Birchbox: Using Customer Data to Set Itself Apart

Despite an oft-copied business model, Birchbox continues to distinguish itself from its competitors by using data-driven customer insights to create value for both its subscribers and brand partners.

Company Overview

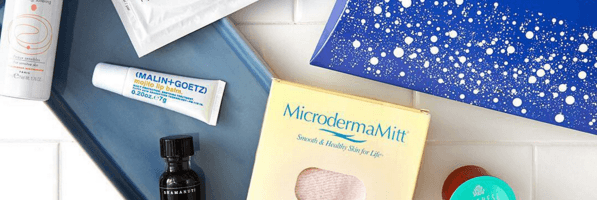

Birchbox is an online monthly subscription service that sends its subscribers a box of four to five samples of high-end cosmetics, fragrance, or skincare products. Founded in September 2010, the company has over a million subscribers and more than 800 brand partners. It has seen tremendous growth—the company has attracted $71.9 million in venture funding and draws revenues of an estimated $170 million a year. [1]

Business Model

A discovery commerce platform: how Birchbox gets people to pay to receive marketing material

Birchbox has championed an innovative business model of serving as a “discovery commerce platform,” which consists of three interwoven businesses that work together to fuel the company’s growth: (1) its subscription service, (2) its online and offline retail operations, and (3) its media operations.

Birchbox generates revenue from subscribers while sourcing its samples for free from more than 800 beauty company partners. Due to network effects, brands are happy to give away company samples of their product in return for having their latest products discovered by a subscriber base of more than a million people. The strategy seems to be working: Currently, 50 percent of subscribers convert to buying full-sized products and 35 percent of the company’s revenues comes from e-commerce sales of full-size products. [2] [3] Essentially, Birchbox has figured out a way to get customers to pay to get marketed to. Its goal is to convert subscribers to purchase full-sized products of the samples they like from the Birchbox website.

This business model works particularly well for the beauty industry, which faces challenges in e-commerce since most women want to be able to touch, smell, and try on cosmetics before purchasing them. [4] Birchbox closes the loop between trial and purchase by allowing customers to try samples of products before committing to making larger purchases on the Birchbox website.

One downside of Birchbox’s business model is that it is easily replicable. Dozens of imitators have popped up with their own subscription-model approach. To combat its competition, Birchbox invests heavily in curating highly customized product offerings and producing editorial content to drive brand loyalty, such as engaging media content to facilitate a community of followers on social media platforms like YouTube, Instagram, and Pinterest.

Operating Model

How Birchbox uses its scale to offer brand partners data driven insights and analytics

As Birchbox scales, its operating model allows it to offer valuable services in experimentation and learning for its brand partners, such as customer data insights, demand forecasting, and A/B test opportunities. Subscribers fill out a detailed questionnaire, providing information on their hair type, skin type, and median household income. They also provide detailed reviews for sampled products on the Birchbox website.

For niche luxury brands, this targeting precision is extremely valuable, as it provides comprehensive demographic and psychographic data about who’s buying their products, as well as sales analytics and qualitative feedback to help them decide what products to keep and what products to drop. “It’s this sort of feedback that can really help vendors grow alongside Birchbox,” says Eric Neher, senior lead merchant of brand partnerships. “We can select data… and help them pick things like packaging, colors, or shades.” For example, custom-perfume company Harvey Prince has grown 400% since partnering with the company in 2010. [5]

“We have an obscene amount of data about our customers,” Katia Beauchamp, Birchbox co-founder, says. “There’s never been a platform that allows you to be a subscription service, have a content CMS, and also have a full e-commerce service, all blended into that with a backend that knows who you are.” [6]

Integrating data into physical retail to enhance customer experience and personalization

In 2014, Birchbox opened a new kind of brick-and-mortar retail store in Manhattan. The physical storefront doesn’t only drive up incremental sales; it combines real time data-driven customization with an offline tactile experience to build customer loyalty. Unlike other beauty stores, the store layout mirrors the company’s website layout: items are organized not by brand but by product category, such as skincare or hair. iPads scattered throughout the store allow customers to provide information about themselves for personalized recommendations. [7] The store’s sales staff are able to pull up user profile data on existing Birchbox subscribers, including the samples they’ve received in past boxes and items they’ve favorited, to help make targeted sales, such as: “I noticed you received this in your box; do you want to see what the full size looks like?” So far, the synergistic strategy seems to be working: Birchbox notes that physical store visits are correlated with a tripling in customer lifetime value. [8]

In 2014, Birchbox opened a new kind of brick-and-mortar retail store in Manhattan. The physical storefront doesn’t only drive up incremental sales; it combines real time data-driven customization with an offline tactile experience to build customer loyalty. Unlike other beauty stores, the store layout mirrors the company’s website layout: items are organized not by brand but by product category, such as skincare or hair. iPads scattered throughout the store allow customers to provide information about themselves for personalized recommendations. [7] The store’s sales staff are able to pull up user profile data on existing Birchbox subscribers, including the samples they’ve received in past boxes and items they’ve favorited, to help make targeted sales, such as: “I noticed you received this in your box; do you want to see what the full size looks like?” So far, the synergistic strategy seems to be working: Birchbox notes that physical store visits are correlated with a tripling in customer lifetime value. [8]

Looking forward

Birchbox has set up an impressive operating model aligned with three promising businesses that drive each other’s growth. As Birchbox scales and collects more data on its subscriber base, we can only expect it to continue to increase its value to both suppliers and customers via not just network effects but also enhanced supply chain management, demand forecasting, feedback on product experimentation, and analytics insight into consumer purchase behavior.

Sources:

[1] CrunchBase: “Birchbox.” https://www.crunchbase.com/organization/birchbox#/entity

[2] [5] Fast Company: “Opening the (Birch)box”. http://www.fastcompany.com/3044266/innovation-agents/opening-the-box

[3] TechCrunch: “Beauty Product Subscription Service Birchbox Is Opening More Brick-And-Mortar Retail Stores”. http://techcrunch.com/2015/07/13/beauty-product-subscription-service-birchbox-is-opening-more-brick-and-mortar-retail-stores

[4] PandoDaily: “The beauty of Birchbox: it’s not subscription commerce, it’s marketing that women actually pay for”. https://pando.com/2012/10/19/the-beauty-of-birchbox-its-not-subscription-commerce-its-marketing-that-women-actually-pay-for

[6] TechCrunch: “Birchbox Co-Founder Katia Beauchamp: We’re Poised to Grow Way Beyond Beauty”. http://techcrunch.com/2012/04/24/birchbox-katia-beauchamp-interview-video-tctv/

[7] The New York Times. “Birchbox, Seller of Beauty Products, Steps Out From Web With a Store”. http://www.nytimes.com/2014/03/24/business/birchbox-seller-of-beauty-products-steps-out-from-web-with-a-store.html?_r=0

[8] Entrepreneur: “Conceived Online, Birchbox Embraces the Beauty of Brick and Mortar”. http://www.entrepreneur.com/article/248230

Great writeup – they have definitely managed to stay ahead of the pack as so many subscription models have petered out. Do you know if the retail store expansion has hurt Birchbox’s profitability? I know they were actually throwing off cash for a while – impressive for a startup – but I wonder what the retail footprint has done. Secondly, do you see any potential blowback from privacy concerns given all the data that they amass? I assume it’s wiped of any personal identifiers?

Thanks for the great questions!

Regarding your first question: When opening the first store, the Birchbox co-founders explicitly stated that they “are not focused on profitability, [they] are focused on hypergrowth.” At this point, I don’t believe the stores are profitable due to high fixed and startup costs. However, the company has two goals with the new stores: 1) to use new store openings as PR and education around their brand and to drive more people to purchase subscriptions and 2) increase stickiness to their brand. The company found that Birchbox subscribers are more likely to not just buy from Birchbox.com but also from offline beauty stores such as Sephora and Ulta. Therefore, they’re trying to enter the offline retail channel to minimize this leakage. They don’t believe that offline retail is going to disappear from the beauty industry due to the whole social and recreational aspect to it.

As for your second question: I think the privacy issues around Birchbox are less sensitive, since people seem more willing to share information about their skin/cosmetics preferences as long as it means the samples or product recommendations they receive are more customized and tailored to their tastes. Though I don’t have formal data to support this, I doubt Birchbox shares personal identifiers unless it has explicit permission to do. Statistical data on product preferences and A/B test results are still extremely helpful for beauty companies.