Autonomous Vehicles are leaving mining giant Rio Tinto in the dust

Although Rio Tinto has made some investments in mine automation, it has failed to see the potential impact of full automation and seems unwilling to invest in a digital transformation.

Stuck between a rock and a hard place

2015 was a hard year for the mining industry. The top 40 mining companies in the world posted their first ever collective net loss[1]. This follows on the heels of the 2010-2014 period where the industry had an average annual growth rate of -0.1%[2]. Rio Tinto has not been an exception to that rule as its market capitalization has decreased by 36% since 2010 and it reported a net loss of $866 million USD in 2015[3]. In the face of low commodity prices, a lagging Chinese economy and ballooning debt levels, Rio Tinto is engaged in a struggle for its very existence. Some believe that a digital transformation will be the key to boosting productivity and kick starting growth: welcome to the Mine of the FutureTM.

The way out?

Rio Tinto’s flagship Mine of the FutureTM program has three pillars: autonomous operations, process optimization and data analysis and visualization. In autonomous operations, heavy machinery like large trucks and drilling rigs can be operated remotely by controllers in a local data center. This can increase fuel efficiency, reduce wear and tear on expensive machines, and increase operator safety. Process optimization uses data measurements and analysis to automatically fine tune recovery processes to ensure maximal mineral recovery. Finally, data analysis and visualization is software that integrates all of the data collected from mining operations to produce a 3D model of the mine which enables quick, accurate decision making.

To infinity and beyond

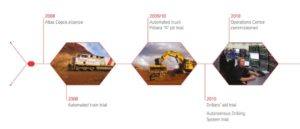

Can the Mine of the FutureTM reverse Rio Tinto’s recent misfortunes and propel it into a new digital age? The answer is a resounding “NO”. Rio Tinto started the program in 2008 (see a timeline in Figure 1 below) and as of today only has pilot projects at its Pilbara iron ore operations in Australia. The rollout of the program has been unbelievably slow with innovation not progressing past the stage of remote operation. An article on mining.com suggests a reason for this: the program was designed to deal with a shortage of workers willing to travel to remote locations[4]. That objective has been achieved in Western Australia with reduced labour needs at the minesites themselves. However, it appears that Rio Tinto did not deem it worthwhile to take the further step of full automation where the real value of increased efficiency could be achieved. It was only in 2015 that fully autonomous trains were trialed in Australia – a full seven years after the first remote control pilot.

Figure 1: Timeline of the deployment of the Mine of the Future TM[5]

Slow moving traffic keep right

Meanwhile the world has raced on. Development of fully autonomous cars has been a priority for every major auto manufacturer for a decade. In 2012, a fully autonomous car from Google passed Nevada’s driving test [6]. Toyota demonstrated a self-driving car in 2013[7]. It’s important to recognize that autonomous driving on highways and urban roads is orders of magnitude more difficult than at a surface mine. Unexpected actions by other road users, traffic controls, and high speed maneuvers don’t exist in the mining world where trucks lumber along at 30km/h in a barren wasteland devoid of any surprises. You couldn’t ask for a better place to implement autonomous vehicles.

Withering into oblivion

Unfortunately, the appetite for capital expenditures has only declined in recent years and the prospect of a fully automated mine is diminishing. The mining industry in general has been caught in a death spiral of cost cutting and reduced productivity as it retreats into the safety of old habits. Meanwhile, the impetus for change has been gradual, mirroring falling commodity prices. Like the metaphor of the frog in boiling water, Rio Tinto may realize its mistake too late to make the necessary capital investments to boost profitability.

Words: 633

1 PWC, “Mine 2016 Slower, lower, weaker… but not defeated”, 2016 [https://www.pwc.com/gx/en/mining/pdf/mine-2016.pdf]

2 “Global Mining Industry Digital Transformation Study 2016-2019 – Research and Markets”. PRNewswire. Nov 9 2016 [http://www.prnewswire.com/news-releases/global-mining-industry-digital-transformation-study-2016-2019—research-and-markets-300359836.html]

3 Rio Tinto, “2015 Annual Report,” March 3 2016 [http://www.riotinto.com/documents/RT_Annual_Report_2015.pdf]

4 Jamasmie, C. “The Mine of the Future Might be a Thing of the Past” Mining.com Jan 1 2010 [http://www.mining.com/the-mine-of-the-future-might-be-a-thing-of-the-past/]

5 Rio Tinto, “Rio Tinto Mine of the Future TM”, 2014 [http://www.riotinto.com/documents/Mine_of_The_Future_Brochure.pdf]

6 Harris, M. “How Google’s Autonomous Car Passed the First U.S. State Self-Driving Test”. IEEE Spectrum. Sep 10 2014 [http://spectrum.ieee.org/transportation/advanced-cars/how-googles-autonomous-car-passed-the-first-us-state-selfdriving-test]

7 “Toyota sneak previews self-drive car ahead of tech show”. BBC. 4 January 2013 [http://www.bbc.com/news/technology-20910769]

Thanks for this post and for bringing light to an industry that has lagged far behind the rest of the world in terms of technological advancement.

There is one aspect of the article that I would like to disagree with regarding the simplicity of converting mining trucks to autonomous operation. One of the most difficult aspects of transportation at mines is the incredibly dynamic conditions; the haul roads that the trucks are driving on are literally changing on a weekly basis, in both the vertical and the horizontal axis’. Another aspect is uneven terrain; GPS & radar are not able to see and identify all of the potholes or abnormalities in these haul roads which could cause significant damage to the equipment if the machines are not slowed down or directed to avoid these hazards. A final complicating aspect of automation is the variability in weather in the remote locations of these mines; many autonomous systems are dependent on visual markers such as road lines or road signs, what if the entire road is covered in snow or mud?

Even with all of these complicating factors I completely agree with you that mining companies need to move to autonomous operation, the cost and safety benefits are incredible, however I believe that it is an even harder environment to master this innovation compared to conventional driving…