Amazon Go: The Future of Retail?

In 2018, Amazon launched Amazon Go, a brick-and-mortar store powered by machine learning – with no checkout lines or cashiers. Is this the store of the future?

Since its founding in 1994, Amazon has enjoyed infamy as the ultimate disruptor of traditional retail. However, in January 2018, the e-commerce giant took its first steps toward reinventing the brick-and-mortar shopping experience, launching Amazon Go, a physical “store of the future,” to consumers in Seattle.

As the largest e-commerce player in the U.S., Amazon has leveraged its scale and vast accumulation of data to identify user behaviors and engage in constant optimization, creating a nearly frictionless shopping experience. Amazon Go approximates a physical manifestation of essentially the same concept: sensors in the store recognize a customer upon entering the door, log every item they put in their “virtual basket” (and accounts for those they put back on the shelf), and automatically charge their Amazon Prime account when they walk out, entirely eliminating the need for checkout lines or cashiers. [1]

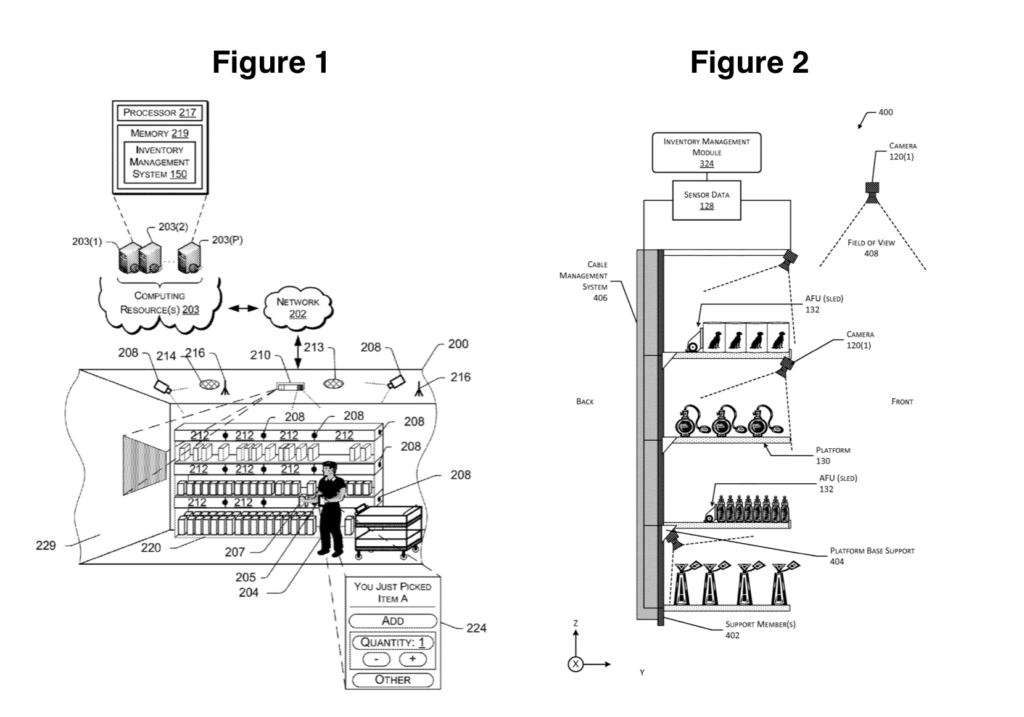

The stores leverage what Amazon has dubbed “Just Walk Out” technology: with the help of computer vision, sensor fusion, and machine learning, customers are able to make purchases without a cashier. [2] Figures 1 and 2 demonstrate how the technology aggregates data from multiple sensors to ensure that it accurately and reliably tracks a specific user’s movements. Sensors also leverage a customer’s past purchase data to confirm that they are correctly identifying the items picked. For example, if the inventory management system is unable to discern whether the customer picked a bottle of ketchup or a bottle of mustard, it will reference that user’s purchase history to determine which of the two is more probable. [3] Similarly, the system will consider the contents of the user’s existing basket to determine likely product adjacencies. [4]

Amazon’s use of deep learning algorithms to develop its “Just Walk Out” technology has a number of implications for both product development and process improvement. At a high-level, Amazon is pursuing an omnichannel strategy and developing an entirely new type of shopping experience by reproducing its online competitive advantage – the ability to accumulate and exploit data – in brick-and-mortar retail. As a result, the company has been able to optimize productivity while minimizing traditional operating costs. After conducting an analysis of customer activity at Amazon Go’s flagship store over several days, data analytics firm Brick Meets Click estimates that the store generates $2,700 in annual sales per square foot of selling space, with an average of 50 inventory turns per year. This extremely high sales per square foot metric, matched only by Apple and a few other specialty retailers, demonstrates just how effectively Amazon has maximized customer throughput and sales by removing traditional retail’s most pervasive bottleneck: the checkout line. [7] All the while, Amazon has virtually eliminated the cost of checkout personnel.

In the short term, Amazon plans to build as many as 3,000 cashier-less stores by 2021, targeting dense urban metros with young professional populations. CEO Jeff Bezos has reportedly expressed interest in targeting the fast casual and quick service restaurant space, where long lines at highly-trafficked meal times abound. [9] Many predict that Amazon will also couple the “Just Walk Out” technology used in its own stores with its high-profile acquisition of Whole Foods, potentially leveraging the learnings from Amazon Go to optimize the grocer’s 450+ retail outlets. [10] Moreover, the technology has significant long-term implications on Amazon’s ability to accelerate data capture and more accurately predict user demand, which could ultimately increase the overall efficiency of its supply chain and distribution across all of its channels. [11]

However, despite the operational efficiencies achieved by eliminating checkout lines and cashiers, the cost of opening a single Amazon Go location remains extremely high. Bloomberg reports that the Seattle flagship required a $1 million outlay in hardware alone. [12] In addition, the potential impact on the 3.5 million cashiers employed in the U.S. remains an open question. [13] One key consideration for Amazon is how it can explore job creation in the sector by focusing on new skill development.

The advent of Amazon’s cashier-less stores also raises a fundamental question about the offline shopping experience: are consumers really willing to sacrifice face-to-face interaction in brick-and-mortar retail? In a survey of 1,000 U.S. consumers, 30% of Baby Boomers expressed unwillingness to try Amazon Go, and 20% of respondents felt that they would be “losing out on something” by foregoing a traditional store. Similarly, when asked to identify the biggest deterrent for shopping at Amazon Go, 24% cited the lack of social interaction. [14] As Amazon continues to iterate on its store technology, it should also consider how it can preserve the more social aspects of traditional retail.

Questions

- Do you think that the cost of opening an Amazon Go store will prove prohibitive for scaling the technology?

- Do you think that “Just Walk Out” technology is truly the way of the future? In 10 to 20 years, will all stores operate without cashiers?

(796)

[1] Alan Boyle, “Ready to be tracked at the grocery store? Amazon’s mini-mart raises new questions for digital privacy,” GeekWire, December 7, 2016, https://www.geekwire.com/2016/ready-tracked-grocery-store-amazons-mini-mart-new-frontier-digital-privacy/, accessed November 2018.

[2] Amazon Go Editorial Staff (2017). Amazon Go, https://www.amazon.com/b?node=16008589011.

[3] Amber Autrey Taylor et. al. Electronic Commerce Functionality in Video Overlays. U.S. Patent 20180295424 filed June 11, 2018 and issued October 11, 2018.

[4] Jason Del Rey, “We May Have Just Uncovered Amazon’s Vision for a New Kind of Retail Store,” Recode, March 30, 2015, https://www.recode.net/2015/3/30/11560904/we-may-have-just-uncovered-amazons-vision-for-a-new-kind-of-retail, accessed November 2018.

[5] Dilip Kumar et. al. Detecting Item Interaction and Movement. U.S. Patent 20150019391 filed June 26, 2013 and issued January 15, 2015.

[6] Bejamin Jozef Gyori et. al. Shelf with Integrated Electronics. U.S. Patent 010064502 filed June 19, 2015 and issued September 4, 2018.

[7] “AmazonGo’s retail productivity: at least $2700/sq ft selling area & 50 inventory turns/year,” Brick Meets Click, October 29, 2018, https://www.brickmeetsclick.com/amazongo-s-retail-productivity–at-least–2700-sq-ft-selling-area—50-inventory-turns-year, accessed November 2018.

[8] Nick Wingfield, “Inside Amazon Go, a Store of the Future,” New York Times, January 21, 2018, https://www.nytimes.com/2018/01/21/technology/inside-amazon-go-a-store-of-the-future.html, accessed November 2018.

[9] Spencer Soper, “Amazon Will Consider Opening Up to 3,000 Cashierless Stores by 2021,” Bloomberg, September 19, 2018, https://www.bloomberg.com/news/articles/2018-09-19/amazon-is-said-to-plan-up-to-3-000-cashierless-stores-by-2021, accessed November 2018.

[10] Lindsay Dal Porto, “Grocery Game-Changer?” Quality Progress 50, no. 8 (August 2017): 8-10, ABI/INFORM via ProQuest, accessed November 2018.

[11] Soper, “Amazon Will Consider Opening Up to 3,000 Cashierless Stores by 2021.”

[12] Ibid.

[13] Alex Polacco and Kayla Backes, “The Amazon Go Concept: Implications, Applications, and Sustainability,” Journal of Business and Management, 24, no. 1 (March 2018): 79-92, Google Scholar, accessed November 2018.

[14] Russell Redman, “Amazon Go seen as welcome grocery option,” Supermarket News, July 2, 2018, https://www.supermarketnews.com/retail-financial/amazon-go-seen-welcome-grocery-option, accessed November 2018.

Great post and great innovation by Amazon. I am not so much concerned about the lack of face to face interaction in AmazonGo as if anything I think it is a plus for the new grocery. However, customers will need to be confident and comfortable about the accuracy of their receipt upon leaving without worrying that there may be mistake and having to always double check. I wonder, however, if the trend towards online shopping will make this brick-and-mortar store worth the investment. Will brick-and-mortar grocery stores remain a strong hold in the face of online retail or will the wave of online retail take over traditional grocery stores? I am a believer of the former but online time can prove that.

A very hot and interesting topic indeed ! I believe that the cost of opening an Amazon Go is negligible compared to the potential these stores have. Especially so, considering the fact that the costs are fixed and Amazon has significant experience with economies scale. Another important factor to be considered is the speed with which technology is diffused and made affordable – nowadays we are buying flying drones as presents for our kids, which was unthinkable of ten years ago. Hence, technology and costs will not stand in the way of cashier-less shopping experience. However, I do buy the social interaction argument and it still remains to be seen how will human interaction develop in the era of advanced technologies.

I have a lot of questions about the risks to individual stores. How good are these stores at detecting and preventing theft? Does Amazon suffer any losses from shoplifting? During a power outage, is there any way to prevent looting? What about if the wifi in the store goes out? For Amazon, risks like these are probably immaterial in the grand scheme. But from the perspective of expanding this technology, these concerns would be top-of-mind for grocery chains and small businesses.

Hey great essay!

It really makes sense that Amazon bought Whole Foods. Combined with the voice information that Amazon collects through Amazon Echo, Amazon will create an environment where online and offline connect. The progress of the graphic recognition technology is amazing. I used to work with a large tech company that develops facial recognition technology that recognizes 10,000 people’s face in 1 second. Amazon is taking a great initiative.

Great post! On your first question I ultimately think that the cost of opening the stores will be insignificant relative to the future revenues that we would expect a store like this to generate. If you do the quick math, at $2,700 sales per square foot and 1,800 square feet, this store is generating approximately $4.9M annually. Furthermore, I’d expect the cost of technology to decrease over time as more stores are built and technology improves. For me, I think Amazon will need to be extremely strategic with its choice of retail space for these stores to work – in a world where I can get food and items delivered for free in the next 2-3 hours, why would I go to a store unless it is extremely convenient?

Such an interesting idea! My concern with the “Amazon go” store concept would be privacy. As large tech companies gather more and more information about their users, the public has started to push back against these companies mining their data. Understanding your purchase history is one thing, but using facial recognition and other technologies to recognize you when you enter a store could cause more controversy for Amazon. How will Amazon ensure that shoppers’ data is secure and not used in the wrong ways?

Fascinating! You couldn’t have described Amazon’s innovation better: “removing traditional retail’s most pervasive bottleneck: the checkout line”. There have been many times when I decide not to buy something in store because the lines are too long (e.g., Sephora, Whole Foods; I’d love to see this applied in Whole Foods).

I truly believe stores of the future depend on knowing each of your customers to serve them better. When I was working at Everlane, we tested having each person sign in upon entering — so that our sales team could better serve them, recommend sizes/styles, etc based off of their online accounts. It ended up being too time consuming and inconvenient so we scratched the test. So tech like Amazon’s is game changing, especially since they know each customer’s purchase habits across many categories.

Interesting read! I would be very interested in learning 1) how this cashier-less store is actually operated, in terms of how they perform inventory management, logistics, account management, etc, and if any parts of the operational process is optimized by the use of machine learning or big data. 2) it will be interesting to see a full cost/benefit analysis on this topic. The change eliminated cashiers, however a lot of the convenient stores utilize self-check out, and the cashiers they employ also help out with logistics, which is still required by cashier-less stores on a daily basis; it also eliminated lines, which are not a huge problem at most of the convenient stores because the checkout throughput time should be quite minimal. Plus the loss of customer experience, I am not sure if this is a worthy transformation but having these technologies tested out will definitely benefit future innovations.

I honestly can’t wait to use one of these stores. To answer your second question, I really think that Just Walk Out technology is the way of the future. Often I don’t want to interact with cashiers, either they’re in a bad mood or chatting too much or I’m in a bad mood and in my own head. The idea of being watched is slightly terrifying, especially if taken to the logical extreme where this technology applied everywhere. That being said I think this technology will be much harder to apply at stores with more square foot i.e. CostCo and Walmart, because the cost of implementing sensors and running analytics on past purchase history. As for your first question, I don’t think Jeff Bezos cares about the short-term cost. Implementing this new business model allows him to have first-mover advantage and expand his Amazonian empire, which is his ultimate goal. He is establishing the paradigm for the next generation of shoppers: quick, anonymous, and driven by data and surveillance.

Great article! I’ve really wanted to experience an Amazon Go store. Regarding your second question, I think walk-out stores will definitely be the way of the future, given the cost-saving opportunities and the consumer desire for convenience. However, I do believe that some types of stores will continue to have a significant number of employees to help with product selection (just not checkout). Especially in clothing stores, I think that consumers will still want the option of human interaction when picking out clothes, but are okay with going human-less for the checkout step.

With sales per square foot of $2,700 Amazon Go’s store is outselling the average Walmart store by over 600%, given Walmart’s average of $437 (https://retail-index.emarketer.com/company/data/5374f24d4d4afd2bb4446614/5374f3094d4afd2bb444a93c/lfy/false/wal-mart-stores-inc-walmart-us).

Albeit this is Walmart’s average across the US in comparison to the Amazon HQ, but the potential for increasing store sales is clearly huge – could Amazon license its technology to Walmart rather than building its own stores?

Very interesting, thank you! I think this idea is a homerun for consumers and is the way of the future. Older generations may not like it as much, but as you mention, they aren’t the target audience and every generation is more comfortable with technology (and less human interaction) than the last. My big question is, how long will it take for competitors to catch up? Amazon’s core marketplace business is extremely difficult to replicate given how extensive their distribution network is, but what is the barrier to entry for “Just Walk Out” technology? I’m sure its challenging to develop, but once Wal-mart or Target do, given that grocery is a very low margin business, how profitable will these Amazon stores actually be if all stores are like this?

Very interesting article! I do think this technology that will replace cashiers is the way to the future. I wonder how this will impact the Amazon online sales of groceries, since the target market of both can overlap: namely people that prioritize speed when buying their groceries. However, I do think there is the market for people that actually want to see and touch the products, and have the fast shopping experience too. It will be very interesting to see how this technology expands in the future.

Thank you for sharing! I believe AmazonGO has a place in the market for lower-service, high velocity goods that require less human interaction. The concept is very compatible with the shopping habits of millennials who welcome technological change. However, I still believe on-demand delivery is the way of the future. Given Amazon Prime, I think stores in general will become less as less relevant, so the goal of opening 3,000+ Go stores is questionable. Why would Amazon want to compete with itself? At best, I think the Go stores are relevant in larger cities with high visibility and foot traffic, to help promote the Amazon brand (and further remind us that Amazon is taking over the world)!

Incredible! So fascinating. Makes me want to go check out the closest Amazon Go store!

In response to your questions…

1) As Moore’s law surmises, the cost of technology falls at en exponential rate. Clearly, Amazon is the disruptor and early early adopter of this technology. Just thinking about how the first ever iphone was only released in 2007 and the sheer proliferation of smartphones and the internet ecosystem over the past decade, I am reminded by the speed at which new technology is diffused and adopted by especially our millennial generation.

2) Given my belief that this technology will become cheap enough soon, I do believe that this “Just Walk Out” technology will be the next phenomenon that takes over brick and mortar establishments that currently sell products which do not require technical sales support, e.g. clothing and apparel, shoes, fast food, etc.

I’m glad you mentioned the open question of what will happen to the 3.5m store clerks currently employed in the U.S. I worry that there is an extreme version of the future where this technology is rolled out rapidly and with multiple retailers (especially lower-service, higher-velocity retailers which we often see in lower-income communities), and suddenly a large chunk of your community is un/underemployed and therefore reduce their spending with local retailer – in which case we have a bunch of people without jobs and a bunch of stores that are having a hard time staying open because they aren’t generating income.

Thank you the interesting read! A coupe of questions to consider:

1. Given AWS is Amazon’s biggest profit driver, should Amazon be using this technology to build new stores or innovate the technology such that they can sell the technology as a service and collect the data to then leverage for analytics and insights sales?

2. While the current sales per square foot are impressive, how much of that is due to the novelty of the stores vs sustainable, category growth? Said differently, if this technology was widely available like credit card readers, then would the stores see the same sort of sales per square feet results?

Interesting topic that you brought up. I think the cashier-less and self-help model will be the next trend for retail business because it’s effective in cost cutting and margin improvement. However, I went to a few cashier-less stores this year and the customer experience was not very good. For a “lazy” customer like me, I just feel it will be far more convenient if someone can get what I want and provide service like chatting and promoting. So in terms of the future of cashier less business, I am more worried about the tradeoff between operational efficiency and customer satisfaction.

I like how Amazon is leveraging so much of their existing data on users to make the cashless system work. Using users’ previous purchasing data to inform edge-cases is pretty intelligent. However, as we have discussed in class regarding some ML systems I do wonder if this exposes the company to people gaming the system.

To answer one of your questions, I do foresee some version of the this cashless system becoming the industry standard. Automated “self-checkout” seems to already be a widely adopted technology, and I see this as the natural progression in user experience.

I do not think the cost of an Amazon Go store would prohibit the technology. The first store may be very cost intensive but over time as the technology improves and network effects are realized as more customers utilize them, the costs will level and stores become profitable. This is the strategy of Amazon long term for many of its other product segments – provide exceptional service independent of financial performance and slowly build both user base and customer patterns to the point where competition simply can not compete.