Airbnb: Using Technology to Reimagine Travel

Airbnb has transformed global travel using digital technology to connect millions of guests with private hosts. Can the company leverage technological innovations to sustain its competitive edge going forward?

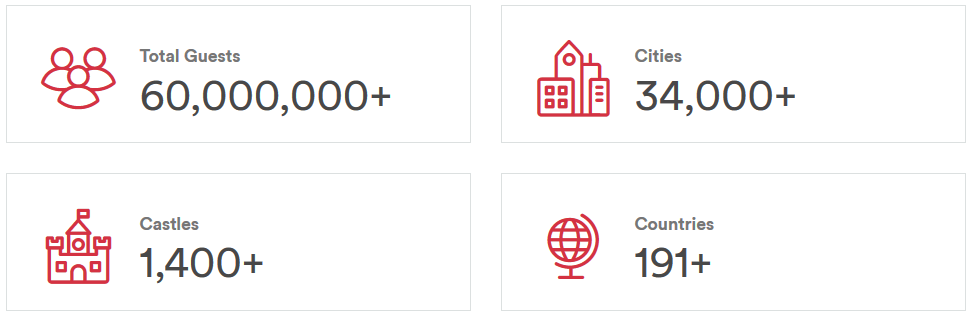

Initially created in 2007 as a short-term solution for founder and CEO Brian Chesky to cover rent in San Francisco, Airbnb has rapidly grown over the past nine years to become the go-to online booking service for peer-to-peer accommodations. The company, now valued at $30 billion[1], has transformed global travel using technology to connect over 60 million guests with hosts in more than 34,000 cities and 191 countries[2]. Yet questions remain about the sustainability of the company’s business model from attracting and retaining hosts to identifying future growth opportunities.

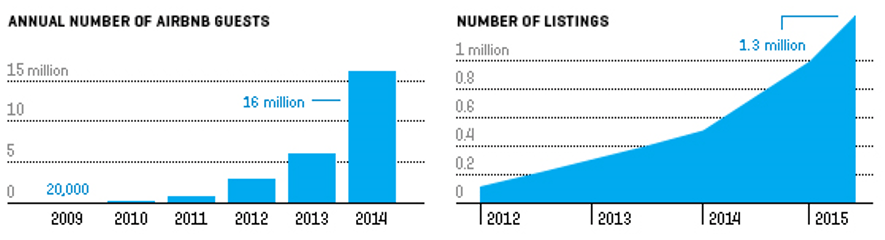

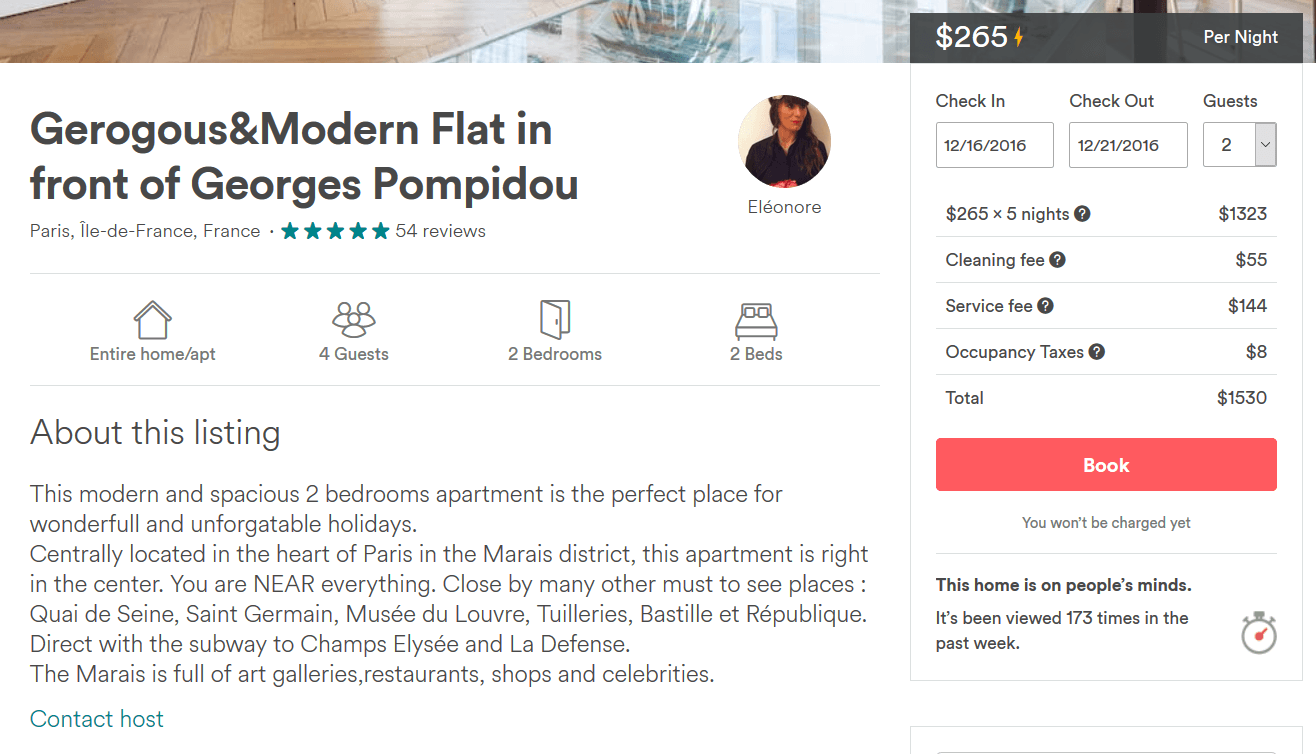

From the outset, Airbnb sought to fill a gap in the lodging market for people seeking unique vacation experiences beyond traditional touristy options. In an interview with Charlie Rose, Chesky notes, “The basic idea is that you could go somewhere and feel like you live in that community[3].” Airbnb delivered on this premise by creating an online marketplace to connect homeowners with guests who pay a nightly rate for their stay. Airbnb handles payment between both parties, charging fees of 3-12% to hosts and 9% to guests[4]. Hosts earn on average $8,000 annually from listing on Airbnb, receiving a source of supplemental income[5]. Guests on the other hand can find nontraditional accommodations to suit their preferences, including longer stays at affordable rates, whole-home rentals and enriched cultural experiences. Over time, Airbnb has expanded the number of listings, growing from approximately 75,000 in 2012 to over 2,000,000 in 2016[6]. This enlarged network has improved the value for hosts and guests by making Airbnb the primary destination for peer-to-peer accommodation bookings. Airbnb has benefited from the growing network since the incremental cost of an additional listing is functionally zero, with revenues flowing directly to their bottom-line[7].

Airbnb facilitates the exchange between hosts and guests through their website and mobile app. The service allows hosts to list their home and describe its features, availability and price. Hosts convey their listing’s quality using pictures, comments and past reviews. Airbnb helps hosts dynamically price their listing with Smart Pricing by leveraging its massive database containing historical rates categorized by seasonality, location and size, thus maximizing revenue for both hosts and Airbnb[8]. Guests are able to find an appropriate match using customizable search tools to specify location, dates, room type, price and other criteria. Guests also receive reviews for past stays to track their reputation on Airbnb. After the guest selects a location, the host reviews the request, communicates with the guest through Airbnb’s messaging service and decides whether or not to transact. Airbnb collects the guest’s electronic credit card payment and distributes the net amount to the host. The remaining logistics are handled directly between the host and guest.

Seems pretty simple, right? Well, not exactly. While Airbnb has generally maintained guest satisfaction through stricter listing requirements, managing the host’s expectations has been more challenging. Airbnb is regularly at the center of negative press, ranging from ransacked apartments to drug-fueled parties[9]. The company reacted by forming a “Trust and Safety Team” and providing tools to screen guests. Yet screening creates other concerns, with increasing complaints of racial bias experienced by guests[10]. Solving the trust issue between hosts and guests is no simple matter, but is critical for Airbnb’s long-term viability. One potential improvement could involve Airbnb partnering with companies like Nest to provide hosts with monitoring devices to remotely check-in on their properties. Should problems arise, hosts could contact Airbnb to resolve the issue. Airbnb could also connect their analytics platform with the monitoring devices to notify hosts and guest if there is suspicious activity. To avoid privacy concerns, monitoring tools should be limited to entryway cameras and decibel meters. Given the significant upfront cost, Airbnb could subsidize these devices at different rates depending on the frequency at which hosts rent their properties and charge higher fees to recoup the expense. Additionally, Airbnb could negotiate with Nest for preferred pricing through bulk purchases and cross-promotions.

Investors will expect Airbnb to deliver new growth avenues given its lofty valuation. To do so, Chesky believes the company “should focus on making sure people have great trips[11].” Airbnb’s latest innovation, Trips, answers that aspiration by offering immersive cultural activities[12]. The company also has plans to add flights and services in the future. While still in early stages, the feature could be improved by combining promotions and discounts with location data to entice guests to visit nearby restaurants and stores. Given the ease of tying outcomes with the app, Airbnb could justify charging fees to advertisers if guests make purchases in their stores. However, Airbnb would need to cautiously navigate the appropriate number of popups with the actual value customers derive from information and promotions. At the very least, Trips opens up an exciting new frontier for Airbnb to engage with its guests and is worth following in the near-term.

(Word count: 800)

_____________________________________________________________________________________________________

[1] Maureen Farrell and Greg Bensinger, “Airbnb’s Funding Round Led by Google Capital,” The Wall Street Journal, September 22, 2016, http://www.wsj.com/articles/airbnb-raises-850-million-at-30-billion-valuation-1474569670

[2] Airbnb Company Website, https://www.airbnb.com/about/about-us

[3] Charlie Rose, “Brian Chesky, AirBnb co-founder and C.E.O., on the success of his lodging rental website,” March 04, 2016, https://charlierose.com/videos/25522

[4] Andy Kessler, “Brian Chesky: The ‘Sharing Economy’ and Its Enemies,” The Wall Street Journal, January 17, 2014, http://www.wsj.com/articles/SB10001424052702304049704579321001856708992

[5] Rose, “Brian Chesky.”

[6] Airbnb Company Website, https://www.airbnb.com/about/about-us

[7] Barry LibertYoram (Jerry) WindMegan Beck, “What Airbnb, Uber, and Alibaba Have in Common,” Harvard Business Review, November 20, 2014, https://hbr.org/2014/11/what-airbnb-uber-and-alibaba-have-in-common

[8] Harriet Taylor, “Airbnb launches ‘Smart Pricing’ for hosts,” CNBC, November 12, 2015, http://www.cnbc.com/2015/11/12/airbnb-launches-smart-pricing-for-hosts.html

[9] Harry Bradford, “Most Airbnb Rentals Go Perfectly. Then There Are These Horror Stories,” The Huffington Post, July 29, 2014, http://www.huffingtonpost.com/2014/07/29/airbnb-horror-stories_n_5614452.html

[10] Heather Somerville, “Discrimination is biggest challenge for Airbnb, CEO says,” Reuters, July 12, 2016, http://www.reuters.com/article/us-airbnb-discrimination-idUSKCN0ZT02M

[11] Rose, “Brian Chesky.”

[12] Airbnb Press Release, “Airbnb Expands Beyond the Home with the Launch of Trips,” November 17, 2016, https://press.atairbnb.com/airbnb-expands-beyond-the-home-with-the-launch-of-trips/

Do you believe Airbnb’s expansion into “Trips” will be successful? While it seems like a natural segue to veritcally integrate into the travel services industry, it’s important to remember that it does require a different operating model and set of operating experiences than Airbnb initially started with. As you mentioned, Airbnb began as an online marketplace for peer-to-peer rentals, which means they fundamentally started as a internet software company. Their competitive advantage was the network effect due to their first mover advantage in this sharing economy. But as they move into additional service offerings, I would be interested to see how labor staffing change with these Trips. My assumption would be that it requires additional headcount, driving away at the high margins of an internet software company. I wonder if there’s a way to continue to grow revenue and CLV without having to change its operational model. For instance, if Airbnb created another marketplace on its platform to allow “hosts” to serve as authentic local tour guides, this could represent another high margin business while enhancing the overall customer experience.

Great post, Sam! I never considered how hosts priced their homes, and found Airbnb’s Smart Pricing feature quite interesting. It essentially helps hosts do what Uber does with surge pricing – effectively matching supply with demand and thus maximizing revenue. This feature allows Airbnb to leverage big data to make strategic pricing decisions. It was also interesting to learn about this tool in the context of the pricing cases we’ve had recently in Marketing, as most companies do not strategically price their products, and usually follow a simple formula of cost plus markup, matching competitors, or adding a certain percentage to last year’s price.

Thanks for the fun read! I find it absolutely remarkable that AirBnB has managed to grow at such an astounding rate, given the amount of trust required between the AirBnB hosts and guests (similar to Uber). Presumably, as AirBnB’s popularity grows and certain properties emerge as the “hot spots” in each city, the barriers to entry for new hosts will become more difficult to surpass over time; I’m sure others book differently, but I tend to book properties with a high review count (and, obviously, high ratings), and completely gloss over hosts who haven’t yet been reviewed.

I like your idea of increasing host comfort through non-invasive monitoring, but I could see such an implementation becoming a PR fiasco, regardless of how much you limit the extent of the monitoring. People tend to overreact to anything involving gathering information about their private life. In the end, even if AirBnB is facilitating the transaction, hosts will have to be comfortable with a certain level of risk; hotels have to deal with the same issues.

Thanks again!