The Unilever Foundry – bringing innovation to 400 brands, under one roof

Can a 90-year old company learn to behave like a start-up? Slow growth, ever-changing consumer tastes and the rise of digitally native upstarts are threatening the traditional consumer-packaged goods industry. Unilever’s significant investment in open innovation intends to challenge this trend by collaborating with start-ups to infuse new ideas and practices into the company.

The CPG sector is enduring a challenging period especially in the US where “the organic-growth rate…has declined…and shareholder returns have lagged the S&P 500.” [1] Consumer profiles and habits are continuing to rapidly morph depending on life stage, socio-economic status and location, which means a “one size fits all” strategy is destined to fail today more than ever before. [2] The internet has fueled the growth of upstarts that sell direct to consumers and pose a threat to traditional categories. These brands, small and large, are growing at speed: according to Nielsen, the “16 largest CPG manufacturers…saw their collective share of the US brick-and-mortar market decline to 31% whereas 16,000 smaller manufacturers…with combined sales of $145 billion, saw their total share of the market rise to 19% from 17%”. [3] These upstarts are at an advantage due to their agile structures that allow them to develop deeper relationships with consumers. As a result, large CPG companies are starting to partner up with these very entrepreneurs to influence how they do business through the use of open innovation, defined as the process of “relying on outsiders both as a source of ideas and as a means to commercialize them.” [4]

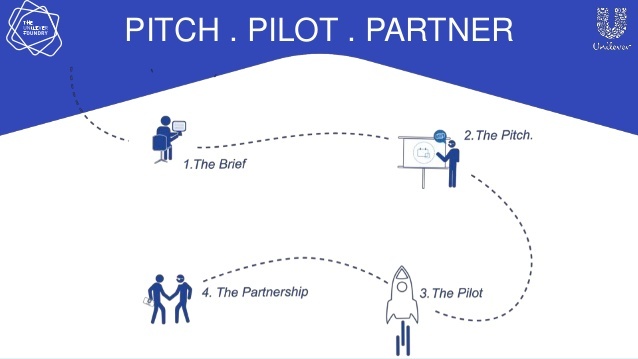

Unilever launched its own innovation system called The Foundry in 2014: a “global platform for partnering with the world’s best startups to accelerate business innovation on a global scale.” [5] Startups are invited to submit ideas across enterprise tech, social & sustainability, marketing & e-commerce and the very products & ingredients that could evolve Unilever’s product portfolio. [6] A select number then enter into a pilot program with one of Unilever’s 400 brands. [7] For startups, it provides the unique opportunity to have access to million-dollar brands and their budgets, along with mentorship from experienced marketers and the opportunity for funding through Unilever Ventures. For Unilever, it allows them to crowdsource ideas to help their brands reach customers in new ways. Projects include inviting customers to personalize their own jars of Marmite via their Facebook page and using AI chats to help them create more meals using Knorr products. [8] Unilever’s focus is now on scaling select projects in other markets. Since launch, The Foundry has accomplished its short-term goal and worked on over 100 pilot projects, scaling 48% of them. [9] A longer-term priority is to ensure that open innovation is integrated in its internal working culture and Unilever has created co-working spaces to physically bring these startups together with its brand managers. [10]

The majority of partnerships to date appear to be marketing-driven with a goal to form deeper connections between Unilever brands and their target audiences. However, true future-focused will need to address Unilever’s core business models; for example, supply chain development and the creation of cutting-edge products and services. The Foundry also has a key role to play in CSR initiatives: Unilever’s Sunlight laundry soap partnered with Altered in developing economies to enable families to conserve up to 98% of water used in everyday activities. [11] Prioritizing these efforts will be key to making sure The Foundry does not remain siloed as a source of gimmicky marketing campaigns. Unilever also needs to focus on longer term partnerships, versus one-off executions, in order to validate external open innovation as a true business advantage. [12] This requires ensuring consistency in how start-ups are evaluated and how their solutions are escalated internally to achieve buy-in given the operational intensity of ideas that are truly disruptive. The ability to successfully scale pilots around the world will also depend on how partnerships are managed and nurtured on an ongoing basis and therefore will rely on the remit of Unilever employees. What is also key is how Unilever will begin to internalize these capabilities and start cultivating entrepreneurialism from within. This will evolve superficial collaborations with entrepreneurs to provoking a fundamental shift in thought and approach at the core of the organisation. For instance, Unilever should amend recruitment practices and hire managers who have had start-up experience as well as consider putting together integrated teams of Unilever employees and startup partners to evolve the internal development processes that govern how ideas go to market.

Is The Foundry really the answer? It begs further questioning. Can external sources truly drive business transformation or should this only be fostered from within? How can Unilever act like a start-up without compromising the consistency and quality that has brought it success?

[788 words]

Sources

[1] McKinsey & Company, “Agility@Scale: Solving the growth challenge in consumer packaged goods” (PDF file), downloaded from McKinsey & Company website, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/agility-at-scale-solving-the-growth-challenge-in-consumer-packaged-goods, accessed November, 2018.

[2] McKinsey & Company, “The consumer sector in 2030: trends and questions to consider,” https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/the-consumer-sector-in-2030-trends-and-questions-to-consider, accessed November, 2018.

[3] “Five Challenges for the CPG Sector in 2018”, E-marketer, https://retail.emarketer.com/article/five-challenges-cpg-sector-2018/5a4537eeebd40008a852a266, accessed November, 2018

[4] K. Boudreau and K. Lakhani. “How to manage outside innovation.” MIT Sloan Management Review 50, no. 4 (Summer 2009): 68-76

[5] The Unilever Foundry, “About Us,” https://foundry.unilever.com/about-us, accessed November, 2018

[6] The Unilever Foundry, “Opportunities,” https://foundry.unilever.com/opportunities, accessed November, 2018

[7] The Unilever Foundry, “Opportunities,” https://foundry.unilever.com/case-studies, accessed November, 2018

[8] The Unilever Foundry, “Opportunities,” https://foundry.unilever.com/case-studies, accessed November, 2018

[9] The Unilever Foundry, “The State of Innovation” (PDF file), downloaded from The Unilever Foundry website, https://foundry.unilever.com/documents/12788/92070/The+State+of+Innovation/7c946425-8316-4323-8ed3-8011f9d3dfef accessed November, 2018.

[10] “Unilever launches its first co-working space to encourage collaboration with startups,” The Drum, https://www.thedrum.com/news/2017/02/14/unilever-launches-its-first-co-working-space-encourage-collaboration-with-startups accessed November 2018

[11] The Unilever Foundry, “Articles,” https://foundry.unilever.com/blog/-/blogs/innovation-in-water-multiple-solutions-for-multiple-challenges accessed November, 2018

[12] “Bringing David and Goliath together: Inside Unilever’s startup incubator,” Digiday, https://digiday.com/marketing/bringing-david-goliath-together-inside-unilevers-incubator-foundry/ accessed November, 2018

[Cover image] “Unilever Foundry Seeking 50 New Stellar Marketing Tech Startups,” Google Images, https://goo.gl/images/rvfSoa, accessed November, 2018

Hi M. Interesting article. I’m fascinated with the topic of how established companies are dealing with the tech revolution, and I think this is a good example (or at least starting point) on how to embrace change within an organization.

My biggest concern, as you mention, is how real is this change? Would Unilever be OK with scaling a direct to consumer soap brand that poses a real challenge to Dove? If the answer is that they would, or that they would at least acquire the startup and incorporate its management to Dove’s executive team I’d be bullish on Unilever’s future. If they only focus on pushing companies that don’t disrupt their business then they’ll have a problem… because someone else will come and disrupt it!

This is a well-written piece that illustrates the tension a company struggles with when it tries to break old habits in order to adapt and stay competitive. I worked at a start-up that was acquired by a large corporation, and the impact to our culture was incredibly palpable. Despite its attempts to adopt the practices of a nimble start-up, our parent company was slowed down by its many layers of bureaucracy and legacy business practices. It was akin to trying to steer the Titanic. While I give Unilever a lot of credit for experimenting with methods of innovative product development, I think this grassroots approach will have little impact. I agree with your recommendation that, in order for this strategy to have real legs, Unilever must make some bold, top-down organization changes like changing up their core business models.

I appreciate the perspective you have shared here. I am fascinated by how quickly the consumer goods space is evolving. Behemoths in the space like Unilever and Procter & Gamble have been faced with new brands attacking from all angles – its a true test of agility and poise to see how these companies are reacting to these threats.

I find The Foundry to be a great concept. It seems that Unilever has created a program that has benefits for both sides of the platform – which, as we have learned in TOM, is critical for sustainability! Given this, I find the program itself to be positive. Given that, I do think your follow-up question is very important: Can external sources truly drive business transformation or should this only be fostered from within? It seems to me that unless Unilever finds a way to “infuse” the spirit and freshness of the start-ups deeply into their own innovation processes, it may be hard for them to garner any tangible competitive advantage that can’t just be copied by competitors.

The Foundry seems like an interesting solution to a problem that is plaguing the CPG industry. I wonder whether this will be the long term solution to Unilever’s problems with market decline or if this is just a band-aid solution that is delaying the inevitable. I agree with your assessment on making long term partnerships to help them stay innovative, as opposed to one off projects. As a large consumer goods company, I would be primarily concerned with how to stay innovative long term either from an aquisition of a innovative small company or by changing the culture within. If they do not make any changes, I could see a well-funded creative and innovative company stealing more market share in the future.

This is an attempt for Unilever to keep up with nimble consumer goods startups especially in the direct to consumer space. Unless these initiatives become significantly commercially viable, the open innovation effort remains similar to a marketing or PR stunt. Another question I would ask would be how Unilever can absorb an entrepreneurial culture via the Foundry. The current efforts all seem like Unilever providing one way assistance to budding entrepreneurs, but not necessarily absorbing learnings on how to make its own end to end business processes more agile. I would question whether learning how to innovate further in a company like Unilever is better done by the Foundry or by the Ben & Jerrys or Dollar Shave Club acquisitions.

I think there are a lot of opportunities to be captured from the Foundry. Through the program, Unilever can benefit from ideas that may not have been obvious to them. I agree with you that Unilever needs to ensure they develop long term partnerships with start-ups to ensure that the ideas have a long-lasting impact on Unilever’s top-line. Based on the marketing class we did yesterday, I also think that there could be an opportunity for brand builders in different regions to source ideas from start-ups in their local markets, collaborate with them and present the ideas to brand managers at the head office as those ideas may be applicable to other markets that Unilever operates in as well.

Very interesting article M! I wonder how attractive this model is for startups though. I understand that Unilever provides guidance and potentially an actual budget if it approves the idea, but how does this model compete with VCs that actually invest in these projects. Also given that entrepreneurs are usually very attached to their ideas and prefer to be autonomous when running their company, I am not sure how interested they will be in participating in this program. Could Unilever possibly offer something else? Perhaps this program could lead to partnerships as opposed to actual integration of the startup’s idea with Unilever’s brands?