Unilever China: Using Open Innovation to Become “Fast Fish” in China

The article is about how Unilever China using open innovation to optimize innovation process to match with China Speed.

In Summer Davos, the annual meeting of New Champions 2017, China Premier Li Keqiang talked about “China Speed”: Now is a time for speed moving fish to take slow moving fish, instead of big fish to eat smaller one.[i]

Due to the rapid development of E-commerce, and the penetration of local brands, Unilever, one of the biggest FMCG firm in China started to encounter challenges from smaller competitors. On the annual E-commerce report 2017, the online sales growth are not as significant as local brands. Unilever China started to think a new way to develop their product, to fit with the “China speed”.

- Background: China Retail Market and Unilever in China

China has been the world’s second-largest (after the U.S.A) consumer products goods market since 2014. Total retail sales of consumer goods were around 6 trillion dollars in 2017, with an increase rate of 10% compared with 2016.[ii]

Among all the different channels, online sales growth contributed to 18.1% percent of total Unilever growth, much more than the second channel discount stores (5.6%) and convenience stores (4.7%) (see Exhibit 1) . [iii]

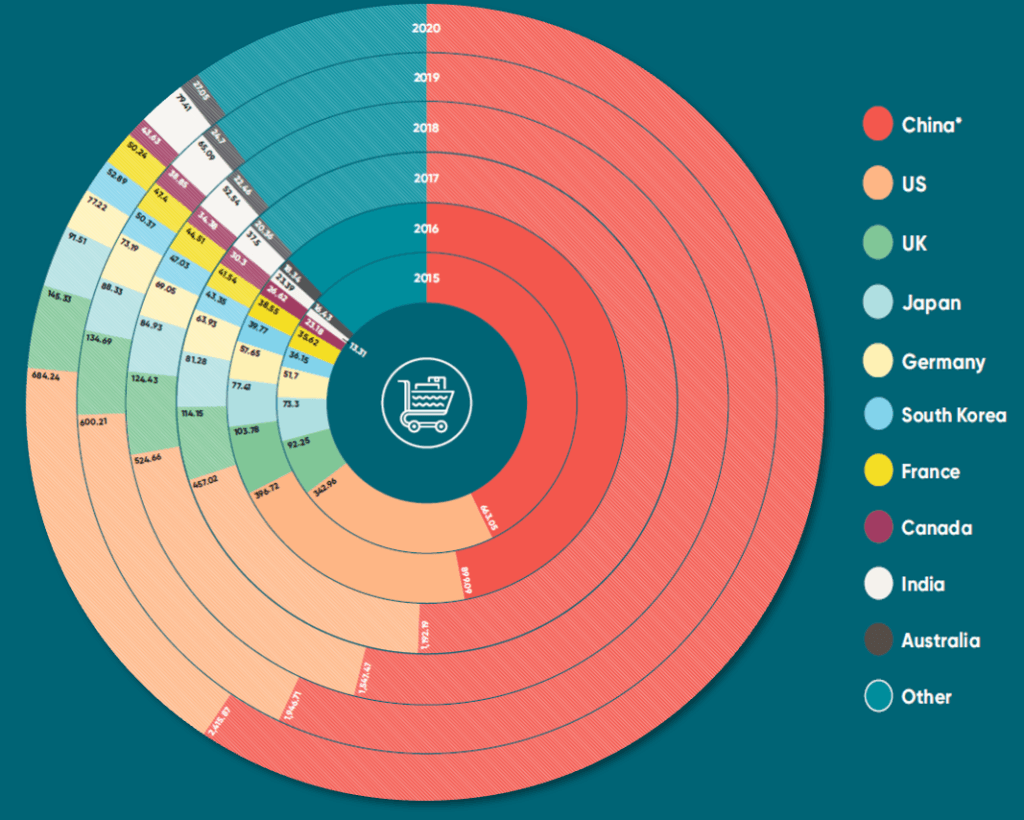

Among all the global online retail sales, China contributed over half of the total sales, with a significant growth from 2015 to 2017, and with a great positive forecast toward 2020 (see Exhibit 2).[iv]

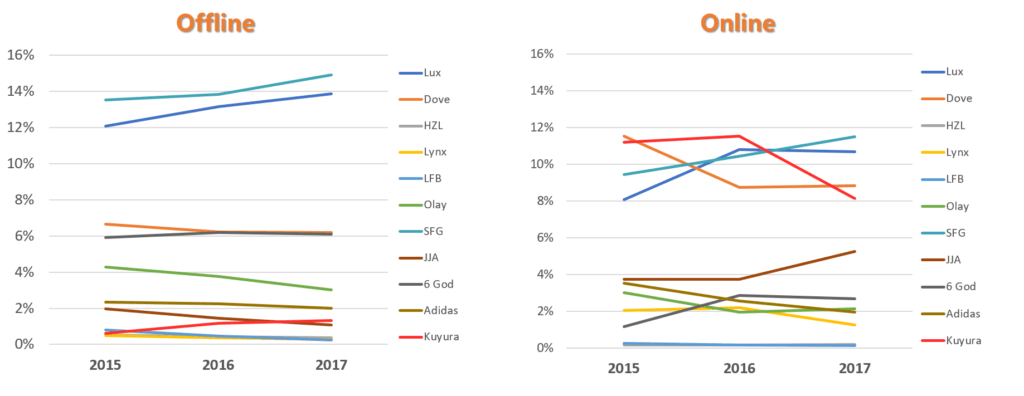

However, Unilever is facing challenges from smaller competitors. The offline top brands are not still top when it moves to online. Lux and SFG sales perfect offline, while Kuyura (a Japan brand) is the top of online sales (see Exhibit 3).[v]

To fit with the fast increasing online sales trend, Unilever must find a way to make itself catch up with the “China Speed”.

- Why does Unilever China need Open Innovation?

The average product launch time of Unilever China is around 6 months for homecare product, such as fabric cleansing product and fabric conditioner, and 1 year for personal care product, such as shampoo and body wash. While the fast product launch time in a local small FMCG company can be at least one month.

There are some reasons behind. First, Unilever, as a big company, has complicated organization framework. Different functions need to align with each other to get a final plan. Second, Unilever, as a global company, needs to get global approval for most local product launch. While due to time difference and regional policy difference, it usually cost a lot of time for international communication. Third, the product launch process is super complicated in Unilever, with 6 difference phases including idea phase, feasibility phase, capability phase, market ready phase, market deployment phase and post launch evaluation phase (see Exhibit 4). The process with 6 phases at least cost half of year, which made the speed lay back compared with local small firms. Unilever need to optimize the product launch process especially for online sales product to match with “China Speed”.

- Open Innovation Used in Unilever China

What Unilever did in China is open innovation with a pioneer team including outside consultants and internal customer market insight team members to form a project team, to develop a new process for China product launch.

The team runs in the following way. First, the pioneer team used brainstorming to list all the possible ways it can use, without thinking of all the potential downsides and risks. Second, the team chose some of the ideas to further select and polish it. Third, the team asked related functions, including marking, R&D, supply chain and sales to go through their idea and get alignment with the new product launch process specific for online products with low regulation challenge.

The final plan, named “China for China”, meaning “do what’s right for China in China”, includes below keep concepts.

China Speed – A C4G in action, we foster an entrepreneurial culture. Speed of decision making and agile action are essential. Inner start-up is one way to go.

Designed in China – to delight consumers with the most relevant, localized products. It’s where our global R&D scale and China-based mix development resources get hand in hand to customize our mixes to local needs.

Portfolio for China – We will build new businesses, both new to China or new to Unilever, as showcased in our initiatives at Air and Water Purification.

Marketing the China Way – We cannot use old ways to innovate or market for the future. The way out is to get comfortable with experimenting more and fast, learning ‘in market’ rather than ‘in test’, and investing in new media channels e.g. Live Stream, Content and e-Commerce, to create brand equity.

Leverage Big Data – Today, data is everything and changes the way of doing marketing. Big data enables campaigns to reach individuals customized to their individual lifestyle, attitude and behaviour. Be the one who masters big data to seamless the path for consumer to purchase.

With the strategic plan in hand, Unilever China decided to use the most simplified product launch process to develop E-commerce product, with a start from a homecare product – Laundry Capsule.

- An Example Product Using Open Innovation: OMO Laundry Capsule

The laundry capsule (see Exhibit 5) belongs to homecare category, with the brand OMO, which is already very popular in China, with the second biggest market share in China. The largest market share owner of laundry product in China is Blue moon (a local brand), and the other biggest player is P&G.

Facing the fast launch pressure, Unilever set a target to launch the laundry capsule within 2 month. With the new strategy “China for China” in hand, the process of launching OMO laundry capsule was simplified in below parts.

First, manufacturing by outsourcing company. The procurement team efficiently searched all the potential factory cooperators and found 3 potential cooperator. With quality team and R&D team, they check the factory hygiene and production standard to make sure they are qualified. And after a bidding system, one of the 3 won the bidding and became Unilever’s outsourcing cooperator.

Second, the negotiation process with international team was simplified from at least 6 meeting in each phase to only 2 key meeting in the whole process.

Third, to make sure the product match with national regulation, and also shorten the application process, the Regulatory team started to apply during the idea phase, which helped to save 1 month in application period.

Fourth, to accelerate distribution, new transportation way including airplane were used after a profit and loss calculation. In addition, among all the potential online distribution channels (see Exhibit 6) , only Taobao and JD were involved in the first period of product launch, to save the negotiation and transportation time with suppliers.

With all the 4 main process optimization solutions above and efficient operation team, the OMO laundry capsule was launched within 2 months, which is a magic speed in Unilever China.

- Towards Future – Become a “Fast Fish” in China

It is a privilege to be in China at this dynamic period of time, for me as a previous Unilever employee, and for all the Chinese people. Because there are so many opportunities out there we can tap, so many new things we can try, and so much fun we could have when we standup to the challenge and succeed.

Unilever North Asia head Rohit wrote in his blog that “It is known that China is most advanced in e-commerce and Chinese shoppers are digitized. Our e-Commerce business has made a great leap compared to where we were four years ago. To aim high, we need to learn and move faster in the areas of expanded reach to targeted netizens, better online shopper experience, and uplifting our online business portfolio. My call to action related to Speed is to “Catch the new China’s”.” [vi]

With an eye to the future, Unilever China made a solid move along the journey, and needs to spend more resource on open innovation to upgrade its speed, to catch up with “China Speed”.

Notes: To protect company information, some of the data and information are made up by the author.

Exhibit 1 U Company Sales Growth rate by Channel (2017-2022 Forecast)

Data Source: U company internal report

Data Source: U company internal report

Exhibit 2 U Company Global online retail sales

Data Source: U company internal report

Exhibit 3 China Shower Gel Brand Share

Data Source: Nielsen Retail Index, and Kantar Retail E-Commerce Report

Exhibit 4 U company Product Launch Process

Exhibit 5 Laundry Capsule

Exhibit 6 China E-commerce Platform Distribution

Endnotes

[i] Keqiang Li, Speech at Summer Davos, the annual meeting of New Champions 2017

[ii] China’s General Retail report 2018, Fung Business Intelligence, 2018

[iii] Unilever sales report 2017

[iv] Unilever online sales report 2017

[v] Nielsen Retail Index, and Kantar Retail E-Commerce Report 2017

[vi] Rohit, “China for China” to manage Unilever China, blog 2017

Great essay – thank you. I agree that this is a perfect example of where Open Innovation can make a huge difference: a large, slow-moving organization trying to compete in a rapidly developing market. Unilever should continue to employ these strategies in new markets, as should other large multi-national corporations; otherwise, it’s likely that they will lose market share to nimble start-ups that do not have the same organizational barriers to innovation.

While it seems like Unilever is able to act more quickly to market trends, based on the above, I would be curious as to how it could implement product ideation funnels directly from consumer preferences before competitors launch products that meet those needs. For instance, could there be a community-platform where Unilever supports an entrepreneur who is trying to launch a product that has generated a lot of social media attention?

Great essay Haoran, a perfect example of a multinational firm eliminating organizational bureaucracy to shorten product development cycle significantly. While this process streamlines internal functions, I believe that Unilever can also integrate two other aspects viz ‘consumer centricity’ and ‘partnership’ into its open innovation platform. In my previous organization, a ‘breakthrough insights’ program focusing on having deep interviews with consumers helped us unearth key insights in various segments of the personal care and home care industry. Can such an aspect be added to your open innovation cycle, to bring an external consumer-centric perspective into the entire process. For new technology launches, such insights may eliminate the need for large scale researches thus saving time.

Another area is ‘partnership’. I was inspired by Unilever’s Foundry model, whereby Unilever partnered with hundreds of upcoming startups. This program benefitted both parties. While the startups got a platform and funding to scale their technology and test it out, Unilever got access into latest state-of-the-art technologies from these enterpreneurs, gaining significant competitive edge in areas of supply chain, manufacturing, branding, point-of-sale retail.

I’m amazed by how much Unilever was able to shorten the product launch time to a third, a bit of this time was by streamlining the regulatory process, but I wonder whether the end product is as good (or will be as successful) as the same product which had a few more months of development put into it. I definitely understand the need to be a “fast fish” and keep pace with nimble smaller companies, but at the same time the advantage of being large like Unilever is that you can play the long-game rather than focusing on short-term response. If they have a better product which would hopefully result in a higher long-term market share, then it may make sense to invest in an extra month or two or preparation.

Haoran, this was a very interesting article about Unilever was able to dramatically reduce their product development cycle through open innovation. This was especially eye-opening to me because I had been under the impression that open innovation always came from external consumers – I loved seeing how different parts of the organization and external consultants came together to completely rethink how the process was done. It felt very similar to IDEO where previous notions about what could or could not be done were ignored!

I am curious to know if this approach would work against Unilever in other countries where they are potentially not competing against smaller companies. Does this also work against large companies? And how easy is it for larger companies to repeat this?

Great post!

It’s super inspiring to learn about Unilever’s production development under the “China for China” strategy. I was surprised to learn to shorten the time it takes for products to hit markets, Unilever would use air as transportation to accelerate distribution. After reading the post, I respect Unilever to move at China’s speed as a global conglomerate, and think the four steps taken to bring OMO Laundry Capsule to market show how well the Unilever China team is living up to the strategy.

The new product idea generation process you described sounds a lot like the brainstorming sessions at IDEO. I like the front-to-end integrated solution using Open Innovation. I’d like to learn more about the new products brought to market under the Open Innovation initiative.