TURO – The collision of AirBNB and Automobiles

TURO – Can AirBNB and Uber combine to eliminate the need to own a vehicle all together?

TURO – The collision of AirBNB and Automobiles

TURO – The collision of AirBNB and Automobiles

Automobile ownership is great. You can hop into your car and drive anywhere you want, whenever you want! However, it’s extremely expensive, and typically carries some overhead like insurance and taxes. The same goes for the other side of the equation. Not owning an automobile is great. You can save a ton of money and call an Uber to pick you up in 5 minutes. But what about that weekend trip to the mountains? Or that shopping trip to IKEA? You find yourself paying for a ride to a car rental lot, where you pay an arm and a leg for any of the 3 or 4 choices – none of which really fit your needs.

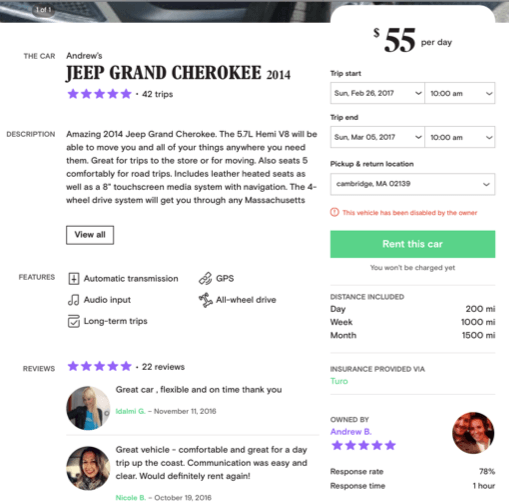

Enter TURO, a car sharing platform that can connect car owners, who would like to make some additional money while not using their vehicle, and car renters, who for one of a hundred reasons isn’t being served by existing car rental agencies. Functioning very much like AirBNB, TURO creates a great deal of value. For owners, it takes about 15 minutes and one picture of your vehicle to create a listing. You can set your own price or allow TURO to use their algorithm to assign a profit-maximizing price. You can also block times on your listing if you know you will need the car.

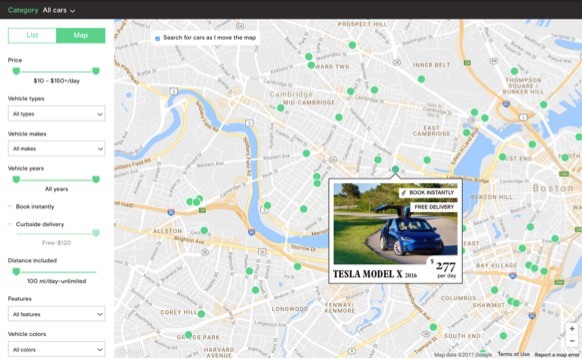

From the renter’s side, value is created in many ways. First and foremost, is the wide range of options available. Simply use their app or website to search for a specific price (there are many vehicles available for less than $30 a day), a specific type (you can search for four-wheel drive for winter weather, trucks for moving, or convertibles for enjoying the sun), or a specific pick-up location (literally scattered throughout the city).

Not only are the options available to the renter far greater than those provided by a rental car company, but the process is extremely different. A car can be booked in minutes, on your phone, and delivered through three different methods. You can either pick up the vehicle from the renter’s location, you can have the vehicle brought to you, or you can have it dropped off to you at an airport, literally as you exit the terminal. No lines, no shuttle busses, no wasted time.

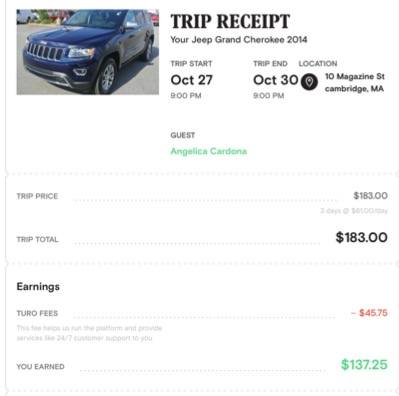

TURO’s value capture model is pretty straightforward. They take 25% of the earnings that an owner would receive for renting out his or her vehicle. This is almost identical to other platforms, like Uber or AirBNB. Because the money earned by owners is being compared to making nothing at all, the 25% is never a deterrent to renting the car. And because prices are so much lower than rental car agencies, the value for the renter is still there.

The TURO platform obviously has network effects, which help drive its value for both sides. These network effects are almost all indirect, as an increase in renters drives value for owners, and vice versa. It is important to note that these effects are almost all local, as an increase in vehicles listed in Los Angeles doesn’t benefit a renter in Boston. There are some slight benefits to non-local expansion, as renting while traveling becomes easier when the same service is available in many cities. You can also envision the pricing algorithm getting stronger as the network grows larger.

Because of the local nature of the network effects associated with a platform like this, scaling can be a difficult and time consuming process. The service was started in Boston, which because of its density, and the fact that its founders were HBS grads, made perfect sense. The platform was then expanded to San Francisco, and other large cities one at a time. A great deal of advertising and marketing was needed to first enter a new city, but then word of mouth spread quickly and the networks grew themselves. TURO is now available in over 4500 cities and 300 airports, and has recently begun operating outside of North America.

In the beginning, very little multi-homing existed for owners, as TURO was the only game in town. Now that some other companies have sprouted up, like Getaround, owners are able to easily list their asset on multiple platforms and take whatever reservations come in. Renters have always been able to shop around, as checking the availability and pricing of TURO vs a traditional car rental agency vs taking a few Uber’s has always been free and relatively easy. With little commitment or switching costs, TURO will struggle to keep both sides of its platform exclusive.

Andrew – great take on the car sharing industry! I think Turo is at a really interesting crossroads at the moment. You rightly point out that the localized indirect network effects make scaling challenging. I’m wondering whether some day, a developer will come in an invent the Kayak (or Hipmunk) for car sharing platforms to help renters find the best deals, and if that will help or hurt Turo in its quest for scale.

Furthermore, I wonder if/how/when regulators will begin to knock on Turo’s door. I don’t know if Turo, Getaround, or any other car-sharing platforms have yet faced these issues, but much like Uber, I imagine that this is something regulators would be interested in streamlining and ensuring fairness. Would they have the desire to combat that head on? It will be interesting to see. I’m rooting for Turo to succeed!