Tinder: A Platform After Your Own Heart

Tinder: trying to help you find love despite the rough seas of multihoming and networking effects.

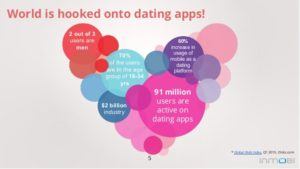

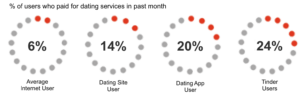

The online dating industry is a big market currently raking in $2B in annual revenue and expanding at an annual rate of 5% from 2010 to 2015.[i] Young adults, age 18-24 years old, have led this surge in usage with 22% having used a mobile dating app, compared to just 5% in 2014.[ii] With users spending an average of 90 minutes a day browsing through dating apps, logging in on average 11 times a day, dating sites have an incredible opportunity to capture value from these users looking to find a connection.[iii]

Source[iv]

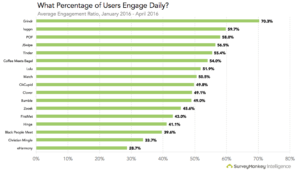

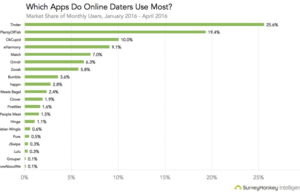

However with over 500 dating apps now on Apple’s App Store[v], it is getting harder and harder for dating apps to create value through scaled growth of network effects and to capture financial value. In this industry ridden with multihoming, the Wall Street Journal found that “the abundance of options means (consumers) are rarely loyal to one dating site.”[vi]

Tinder, the mobile dating app that introduced the concept of “swipe right” and “swipe left” into our daily vocabulary, has found value in being one of the first movers in the mobile app dating space. With 50M users worldwide, Tinder boasts that its user-friendly platform produces 1.2B profile views a day leading to 15M matches![vii] Through using a “freemium” model and developing a less time consuming platform through which users can create enticing profiles, Tinder has maximized the number of users entering the platform looking for a connection. When a female user is looking for a male connection, for example, and vice versa, indirect network effects are at play as each gender receives more value from the platform when additional users of the opposite gender join the app.

To capture value from these users, Tinder has introduced three key elements that continue to drive their revenue up.

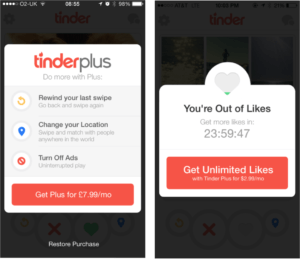

Tinder Plus, Tinder’s subscription model, at $9.99/month[x] let’s the user undo an erred swipe left as well as view and swipe right on users outside of the geographical location of the Tinder Plus user, a constraint of the freemium model. With 284,000 paid users added in Q3 2016, Tinder has reached 1.5M paid users thus capturing financial value from these subscriptions.[xi]

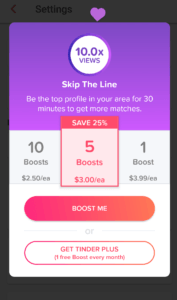

Source[xii]

Tinder has also introduced the concept of Tinder Boost, which Tinder Plus users can activate once per week to increase their view rate for 30 minutes. Freemium users can also access Boost at a $3.99/activation creating a revenue stream from Tinder’s primarily free users.

Lastly, Tinder has partnered with a number of advertisers to place curated profiles into its app to connect with users. In 2015, Domino’s created a Valentine’s Day campaign in which users were matched with Domino’s profile leading to engaging mobile chatting connecting with 234,358 consumers and a PR reach of over 2.2M impressions.[xiii] These creative campaigns allow Tinder to utilize and capture value from its platform for love, by connecting users to products, movies, celebrities etc..

As stated above, the challenge for Tinder remains that as the mobile dating app market continues to grow, users are increasingly downloading multiple dating apps to increase their odds of success. This multihoming effect requires that Tinder continue to develop user engaging features that entice new downloads and entrants to the platform. And the unfortunate irony of the dating app world is that the more successful the app is at matching companions, the quicker those users disappear from the platform following that success.

Can Tinder maintain its lead in number of users thanks to its first mover advantage? Or do you see other players more successfully creating and capturing maximum value in the mobile dating platform?

________________________________________________________________________

[i] http://www.nasdaq.com/article/of-love-and-money-the-rise-of-the-online-dating-industry-cm579616

[ii] http://www.nasdaq.com/article/of-love-and-money-the-rise-of-the-online-dating-industry-cm579616

[iii] http://www.inmobi.com/blog/2015/12/02/decoding-monetization-methods-of-dating-apps

[iv] https://www.slideshare.net/inmobi/decoding-monetization-methods-for-dating-apps/6-6An_average_user_The_New

[v] https://www.wsj.com/articles/the-dating-business-love-on-the-rocks-1433980637

[vi] https://www.wsj.com/articles/the-dating-business-love-on-the-rocks-1433980637

[vii] http://www.investopedia.com/articles/personal-finance/121714/how-tinder-makes-money.asp

[viii] http://www.maxim.com/maxim-man/dating-apps-with-most-women

[ix] https://blog.getsocial.im/dating-apps-mobile-chat-rooms-and-how-you-can-improve-your-app-engagement-rate/

[x] http://mydatinghacks.com/what-is-tinder-plus-and-is-it-worth-it/

[xi] http://www.datingsitesreviews.com/staticpages/index.php?page=Tinder-Statistics-Facts-History

[xii] http://www.inmobi.com/blog/2015/12/02/decoding-monetization-methods-of-dating-apps

[xiii] https://www.sprinklr.com/the-way/7-creative-tinder-marketing-campaigns/

Tinder is an interesting company and is basically driving most of Match.com’s growth right now (they are one of many dating companies owned by Match). In the last earnings call, Match CEO Greg Blatt talked about two projects that he felt were key to Tinder’s continued growth: 1) alternative sign-up to Facebook, in order to expand the top of the funnel and open the platform to more users and 2) the roll-out of a web application.

I see the rationale behind #1 (unlock access to users not using Facebook, or who prefer not to auth with FB), but harder to understand why #2 strengthens the platform in an increasingly mobile world. Thoughts on why this company would invest critical resources into building out a web app, especially when its first 50M active users were captured through a mobile-first largely millennial audience?

Libby – thanks for the comment! I wonder if Tinder is realizing an added value that retailers are now recognizing through omnichannel. That there are consumers who enjoy having multiple outlets through which to access such platforms they believe in and trust. Obviously a web application adds minor additional value to a mobile platform in terms of features – you still aren’t meeting in person for the first connection, but their might be value in providing another outlet for consumers to access Tinder. I think about Groupme vs What’s App. The fact that Groupme has both a web platform as well as a mobile platform is really handy when you are trying to send out longer messages to your friends. I am frustrated by the fact that What’s App requires me to download an application on my laptop to access the platform rather than simply allowing me a quick sign in on the web. There might be value in providing Tinder users with access to their connections on both their portable mobile app as well as the web for when users are multi tasking at home in front of the TV and want the added value of the larger screen to view photos.

Great post! I also wonder if Tinder’s first mover advantage may also have some long-term negative side-effects. As the first pioneer in this space, Tinder had to really shift customer behavior to adopt this ‘swipe right, swipe left’ mentality. As a remnant of this, many people on and off the app still don’t associate Tinder with long-lasting relationships (whether that’s justified or not). Other companies, like Bumble and Hinge, are capitalizing on this shift in customer behavior while not retaining (as much) of the negative association by positioning themselves as more dating-friendly (Hinge as solely friends of friends and Bumble as more women-friendly by their messaging feature). How do you think this will affect Tinder in the long-run or do you think it isn’t something they are worried about (they don’t want to be focused on more serious relationships, its not hurting user growth, etc.)?

Daniella – thank you for your comment. I completely agree that I associate Tinder with the “Hot or Not” swiping culture over the long term dating and serious relationship scene. However as one of our classmates has proven – you can find true love on Tinder!

To think about a response, I did a little research online and found that of the admitted causal connections that took place thanks to a dating app, 1/3 have turned into a long-term relationship. Meaning that even if someone is swiping right on Tinder for the casual encounter, there is always the possibility that a more serious connection could come about.

However, Tinder’s About Us page states that “Tinder empowers users around the world to create new connections that otherwise might never have been possible.” Juxtapose that with Match that states “Our mission is simple: to help singles find the kind of relationship they’re looking for…. Every month, we hear from hundreds of success couples from all over the world—sharing love stories, sending invitations to weddings and announcing the births of new babies,” and you start to see that these two companies are pushing a very different agenda. In my opinion, I think Tinder is owning its identity and running with it – pushing a high volume of matches and letting the cards fall as the users choose. If a casual encounter turns into a longer term connection, great! If it does not – keep swiping.

https://mic.com/articles/112028/new-data-reveals-some-excellent-news-about-one-night-stands#.jStoM2Uu1

https://www.gotinder.com/press

http://www.match.com/help/aboutus.aspx?lid=4

Megan – awesome post!

As we’ve discussed in the past, I obviously know nothing about dating apps, so take my comments with more than one grain of salt…

My impression is that Tinder’s original advantages – first mover, network effects, etc. – has been significantly eroded by the entrance of competitors that have successfully differentiated their products. I agree with Danielle’s point above that Tinder has a reputation for it’s hot-or-not swiping, ephemeral mentality – that suggests most users to be disinterested in finding true relationships, and more focused on entertaining themselves by evaluating other people’s attractiveness. Other apps that have entered the market that escape this mentality seem more likely to capture people who are actually interested in dating (and ending up in a relationship).

I wonder how well Tinder will be able to monetize its users in the long-term. If it’s monetization schemes target users who are most interested in going on dates and getting into relationships (i.e. through Boost, the subscription, etc.), but these users eventually migrate to other platforms because of their reputations and points of product differentiation – will Tinder see revenues grow or subside over time? Multi-homing further complicates this; how much will any individual user be willing to invest in their online dating platforms? Say it’s a max of $15/month – that doesn’t leave room for subscribing to more than one $10/month platform. Will Tinder be what users to choose to spend their money on?

Sonali – thank you for your comments!

Just to clarify – Boost and Monthly Subscriptions, in my opinion, do not necessarily target those who are looking for a more serious relationship on Tinder but target those who are looking for the added benefit of features like maximizing the number of times your profile is viewed at your specified time of day (boost) and allowing you to see users in other cities in which you may be visiting soon (unlocked geography setting for Tinder Plus).

As I shared above there are only about 1.5M paid subscribers to date of the about 50M active users of Tinder. I completely agree that Tinder needs to further address its means of capturing value from its users. However I do not see its identity as a casual connector app as its main problem. Instead I think the value will come from further developing features for Tinder Plus or added features like Boost that will capture value from users seeking to make the most of their experience with Tinder.

Thanks for your post Megan! In my social circle, it seems like a lot of people who used Tinder early on have switched away to more specific and selective dating apps like The League. Do you think Tinder will ever move to a model that is a little bit less democratic and open to everyone in order to compete? Also, do you think the company will still be around in five years?

Steph – thank you for your comment! Given that Tinder’s model is all about maximizing the number of individuals on its app, I do not see a time where it would limit who was able to access the app. Actually, I am seeing the opposite happening in the online dating space in that other apps are opening up. The League for example is now filled with a number of individuals who have no connection whatsoever to an Ivy League school, the original premise of the app. As it opens up further, the League is diluting what it stood for in the first place and just becoming another dating app with little to no differentiation. Tinder’s ability to minimize the number of users would alienate so many that it could never survive such a PR nightmare.

I do believe Tinder will be around in the next 5 years – however I expect there will be consolidation in the industry as more and more apps come out facing more and more competition for members and participants. We’ll have to wait and see if Tinder is an acquirer or is acquired should such consolidation occur.

Agree with you that they are unlikely to limit users to its app, since swiping/matching is essentially the fuel for their growth engine.

Small thing – they are very unlikely to be acquired, since they are owned by a public company (Match Group), whose majority stakeholder is IAC. They would have to spin off first, then get acquired, which would be hard.

They have and probably will continue to acquire smaller companies. Last year they launched a new fund, Swipe Ventures, to invest in similar and related businesses. They are one of the fastest-growing consumer apps of the last five years, so I think they’ll probably be around in another five.