The Procrastinator Gets the Worm: HotelTonight Creates a Win-Win for Hotels and Last-Minute Travelers

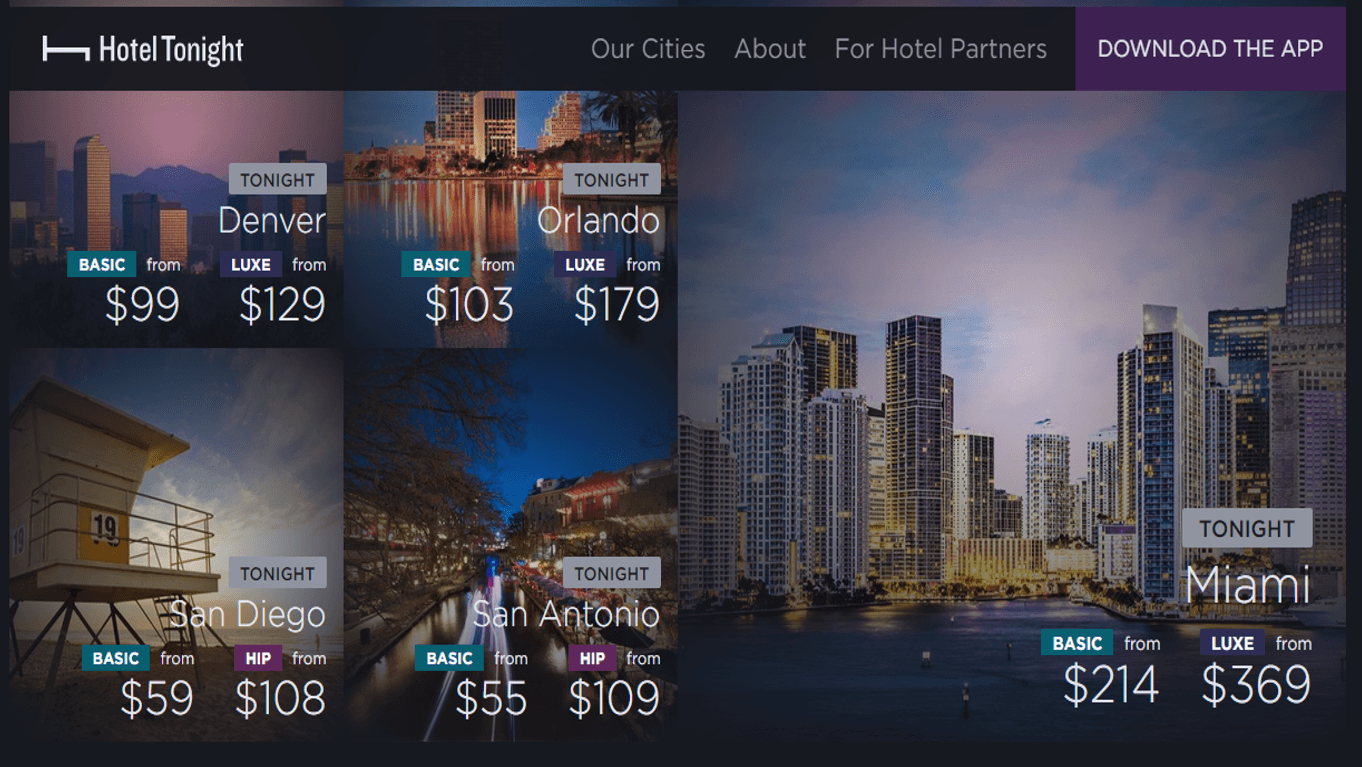

The Platform

Launched in 2010, HotelTonight is a mobile application that connects travelers seeking last-minute hotel accommodations with hotels eager to monetize vacant rooms. Unlike competitors in the travel industry focused on traditional bookings via a web-based platform (i.e. Priceline, Booking.com), HotelTonight strategically chose a mobile-first – in fact, mobile-only – platform to capture the increasingly prominent spontaneous travel market. True to its name, HotelTonight initially offered discounted hotel bookings for the upcoming 24 hours in just three cities. Given the company’s model has powerful indirect network effects, it focused on gaining scale in hotel partnerships, geographies, and users. Today, millions of users can choose from 15,000 hotels in hundreds of cities in 35 countries.[1] Its most recent rumored valuation was greater than $300 million and the company reportedly turned a profit in 2016, a feat countless billion-dollar-valuation platform businesses fail to claim.[2] By building and sustaining a platform that expands the hotel marketplace and createsvalue for both accommodators and travelers, HotelTonight creates a defensible and differentiated role in the industry.

Value Creation

In the two-sided hotel marketplace, HotelTonight has to worry about generating both supply and demand in order to increase the value of the platform. On the supply side, the value creation is relatively straightforward: the platform creates a new way for hotels to monetize unsold rooms. Over the past five years, U.S. hotel vacancy rates have averaged 37%.[3] Decreasing this statistic even marginally equates to significant dollars for hotel sales managers. CEO Sam Shank has shared that after convincing a hotel to join the platform, if HotelTonight can show a small incremental bump in bookings and revenue within three months, the hotel will be committed to remaining on the platform.[4] Additionally, as the platform gains scale and travelers become more comfortable with last-minute books, it becomes a competitive disadvantage for hotels to be absent from the marketplace.

Generating demand is slightly more complicated. Using HotelTonight allows users to garner cheaper rates at quality hotels. The app aggregates data of vetted hotels and makes it easy to compare and ultimately book within a very user-friendly, mobile-first interface. The catch is that users must be comfortable with gambling on availability and with not being loyal to a particular chain. To counter these sacrifices, HotelTonight has strengthened its platform with innovations that bolster its value proposition.

- Advanced booking[5]: Since launching, the app has expanded its booking window to one week. This mitigates risk for users concerned about traveling without a confirmed accommodation and potentially broadens the HotelTonight user base beyond th

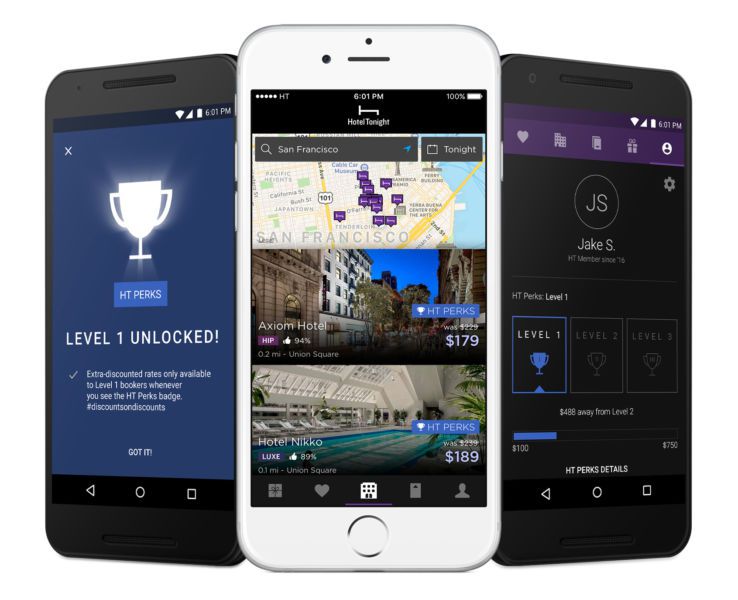

HT Perks User Interface e procrastinators.

- GeoRates[6]: Georates allow hotels to dynamically offer better rates to users likely to convert based upon location. While this obviously creates value for hotels, it also allows users to secure discounts that are not available on other platforms.

- “Loyalty Program”[7]: HT Perks provides users rewards for their transactions on HotelTonight. Launched in 2016, the program retroactively assesses lifetime spend within the app and designates users as level 1, 2, or 3. These statuses never expire and equate to different perks for users, including extra discounted rates, additional travel offers, and a dedicated support phone line. The program decreases the opportunity cost for users that have points with competitors like Starwood and allows them to earn rewards agnostic of hotel brand. HT Perks also solidifies HotelTonight’s role in the ecosystem by increasing switching costs.

- SAP partnership[8]: Business travelers represent a large proportion of last-minute bookers. Through a collaboration with SAP’s Concur, HotelTonight can be easily expensed by 30 million employees at over 20,000 businesses. This seamless integration creates convenience for users and has the potential to drive hotel participation given the broader user exposure.

- Aces Virtual Concierge[9]: Launched in 2015, Aces is a chat-based, in-app concierge service for users booking rooms costing $200+ per night to request anything from a toothbrush to be delivered to their room to local restaurant recommendations. The service saves users time and effort via a simple and convenient interface.

Value Capture

HotelTonight benefits from a very simple value capture equation. Similar to Amazon, the company takes a commission, estimated by analysts to be approximately 15%, from the hotels in each transaction.[10] This is reportedly lower than the rates online competitors charge. A layoff in 2015 along with hyper focus on overhead reduction resulted in the recent profitability of the company.[11] While HotelTonight continues to face competition from large hotel chains, Airbnb, and online platforms, its recent performance proves that it can defend a network-supported niche and gain loyalty in a travel market that is rampant with multi-homing users.

[1] https://itunes.apple.com/us/app/hoteltonight-great-deals-on-last-minute-hotels/id407690035?mt=8

[2] https://www.bloomberg.com/news/articles/2016-08-23/how-hoteltonight-went-from-burning-millions-to-planning-an-ipo

[3] https://www.statista.com/statistics/200161/us-annual-accomodation-and-lodging-occupancy-rate/

[4] https://www.battery.com/powered/video-sam-shank-on-high-supply-marketplaces-and-the-power-of-three/

[5] https://itunes.apple.com/us/app/hoteltonight-great-deals-on-last-minute-hotels/id407690035?mt=8

[6] https://www.hoteltonight.com/2015/06/introducing-ht-escape-georates/

[7] https://techcrunch.com/2016/09/29/hotel-tonight-launches-ht-perks-their-version-of-a-hotel-loyalty-program/

[8] https://techcrunch.com/2015/07/27/hoteltonight-and-lyft-can-now-be-expensed-by-25m-employees-via-concur/

[9] https://techcrunch.com/2016/04/21/hoteltonight-expands-its-in-app-concierge-service-aces-to-30-cities/

[10] https://www.bloomberg.com/news/articles/2016-08-23/how-hoteltonight-went-from-burning-millions-to-planning-an-ipo

[11] https://www.bloomberg.com/news/articles/2016-08-23/how-hoteltonight-went-from-burning-millions-to-planning-an-ipo

As a very strong ‘J’ in the Myers-Briggs test, the idea of travelling anywhere without a hotel booked terrifies me. Nonetheless, I like the idea of something like HotelTonight for people willing and able to face that fear. But, hang on, now they’re letting users create advanced bookings? Doesn’t this make Hotel Tonight the same as Expedia, Trivago, Hotels.com, Hipmunk, TripAdvisor, Kayak, Booking.com, Priceline, Hotwire, Orbitz, Agoda…Travelocity… …Hotels Combined… … …Booking Buddy… … …Hotelwiz… … … … … …

Thanks, Meili! Great question. I read a few articles that shared your same skepticism. While it certainly is a valid concern, my view is that week-out bookings still maintain a focus on spontaneous travel but broaden their market beyond the hyper-procrastinators (I, too, would be nervous to arrive in a city without a booking). Additionally, it’s up to the hotels whether they choose to offer week-out rates or not so clearly these players don’t feel adequately served by the current online sites. Finally, I think the players you mentioned don’t have a focus in terms of types of hotel (they offer everything from a motel to huge branded chains like Hilton). I think HotelTonight has shrewdly conveyed that they vet their hotel list to ensure quality and reliability which further differentiates from the other players and saves you the time of having to research each hotel (core to HotelTonight’s initial value proposition).

Christy, great post! I myself am a huge fan of HotelTonight and have used it on numerous occasions while traveling abroad (not sure what that says about my time management skills…). The team has definitely found a huge area of opportunity given the US hotel vacancy rates that you mentioned in your post. I would also add that the simple and streamlined UX is a huge strength of the platform, as it is very easy for users who are new to the platform and are booking a room immediately after downloading the app (also me!). A couple of questions came to mind after reading your post. First, turning Meili’s question on its head, what is to stop more traditional online travel sites from moving into the “last minute” booking space? Is this part of the reason for the launch of the Aces Virtual Concierge? Do you think it would be palatable if HT offered a lower commission on the hotel side in order to gain exclusivity of the “night of” booking window? Second, as HT continues to grow, how does it avoid over-saturation in existing markets? It seems like at some point, it could begin to cannibalize the core benefit that it provides to existing partners.

Thanks Ian- it’s great to get some feedback from a HotelTonight user! Here’s my take. Your intuition was right that online competitors may offer last minute rates to compete in the space. That has already happened and is certainly a threat for HotelTonight. I think this is slightly ameliorated by the pre-vetting that I mentioned in my response to Meili. Similarly, as you mentioned, HotelTonight is optimized for mobile, on-the-go researching and booking which further differentiates it from the online-first competitors. Finally, I do believe that Aces and, more importantly, HT Perks are designed to increase switching costs for current users. However, I think they will have to potentially forego some commission percentage if they want to maintain the best last minute deals. As HotelTonight is obviously not the only game in town, it probably cannot pull an Amazon and apologetically maintain commission rates.

I don’t have a great answer for your second question. While I would argue they HT still has ample room to scale before oversaturation, there is a risk that the app is training users to wait for discounts (similar to problems some retailers have). Still, innovations like the app’s dynamic, geo-based pricing can potentially address this. I guess only time will tell!