StockX: Bullish on NFTs’ Potential to Transform Resale Marketplace Economics

StockX, the world’s largest resale marketplace, is attempting to leverage Blockchain Technologies and NFTs to overcome operational friction & expenses and improve profitability. Will this innovative approach spur growth and engage customers, or burn bridges with key stakeholders like Nike?

ABOUT STOCKX

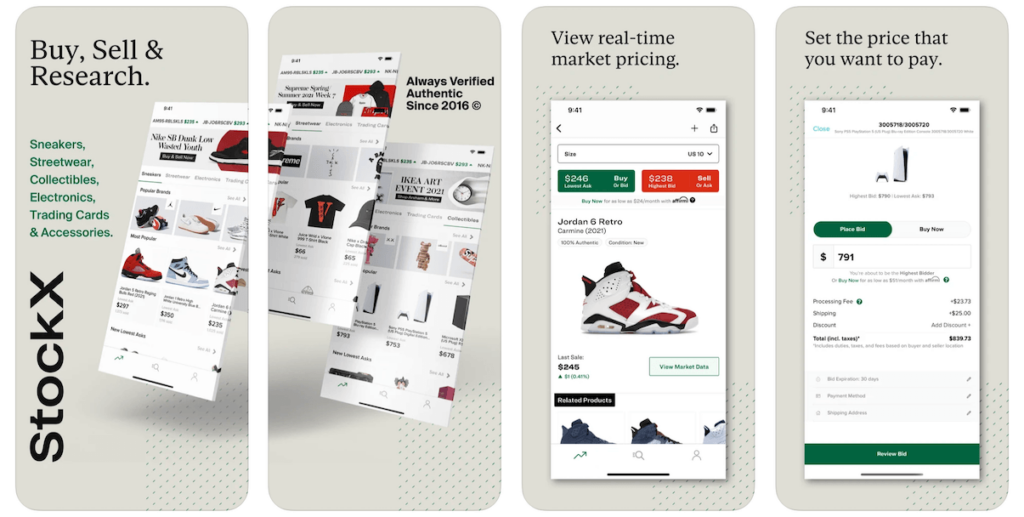

StockX is the world’s largest online resale marketplace, which found its footing by facilitating the trading of authentic sneakers in 2016. StockX later expanded to other items – such as designer clothing and accessories, rare trading cards, and Sony PlayStation 5s. StockX’s authenticity guarantee initially set it apart from incumbents like eBay but increasing competition and pending manufacturer anti-counterfeiting provisions threaten growth. StockX has needed to consider innovative ways to improve its profitability, scalability, and sustainability while maximizing its proven value proposition.

VALUE CREATION

Structure

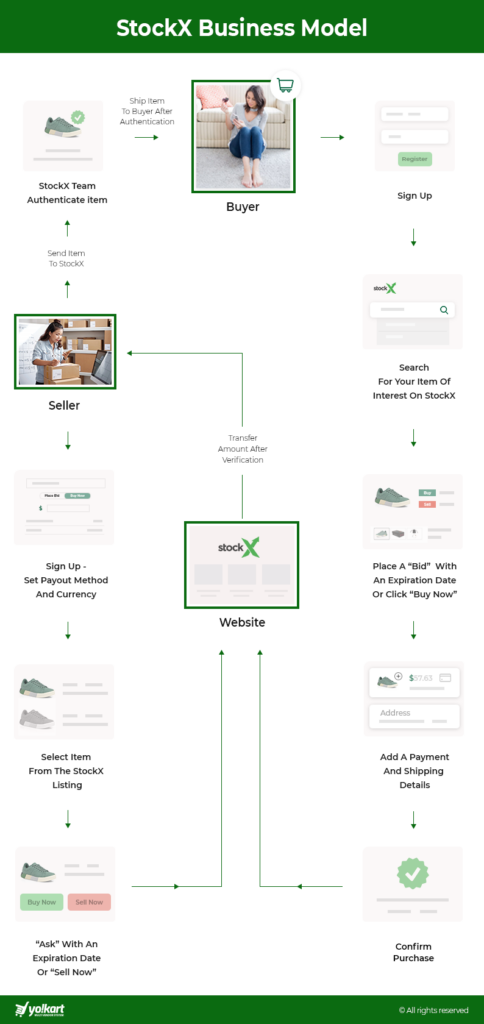

StockX operates like a real-time trading platform by facilitating anonymous (i.e. avoiding disintermediation) trades and transactions between sellers and buyers: sellers list items with “asks” (or “sell now”), and buyers place “bids” (or “buy now”). Transactions are deemed successful when a seller and buyer find a matching price. StockX has also dramatically simplified the resale e-commerce process by enabling sellers to post listings quickly and facilitating all processing, handling, and shipping with an escrow-like model.

Transparency

All the “asks”, “bids” and sales are displayed on each product page to foster transparent pricing. Buyers love this because they can better assess prices based on current demand, thus avoiding overpayment. In some circumstances, buyers can purchase lower-demand items below retail prices thanks to StockX’s real-time market pricing, well-before retail outlets mark down inventory. Sellers also appreciate transparency because market price trends allow them to optimize sales to maximize profits.

Authenticity

Upon a successful transaction, sellers ship their goods to StockX’s facilities, where they implement a proprietary, multi-step authentication process (i.e. which involves human and AI-enhanced inspections) to verify each item’s authenticity, quality, and condition. Counterfeiting was a significant pain point for buyers, and now StockX’s “VERIFIED” tag has become synonymous with authenticity.

VALUE CAPTURE

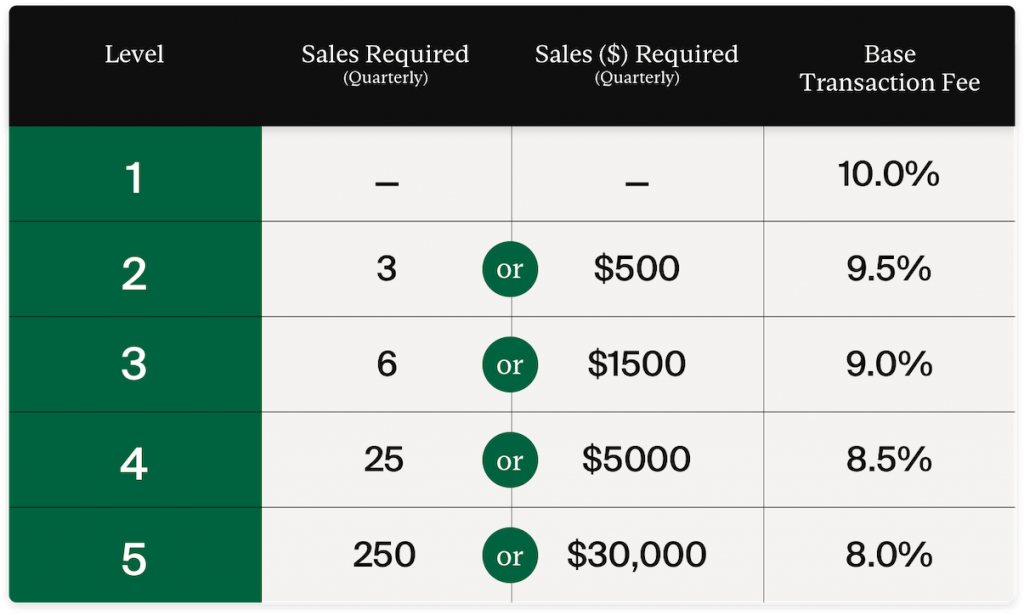

Payment Processing & Transaction Fees

StockX makes revenue by charging processing and transaction fees. Processing fees are fixed at 3%, and transaction fees are tiered based on the seller level – i.e. the more one sells, the lower the transaction fee imposed on future orders. Higher-tiered sellers also receive additional benefits such as bulk shipping, early payouts, VIP account management, bonus discounts, and more advanced tools.

SCALABILITY & SUSTAINABILITY

As of 2021, StockX was valued at ~$3.8 billion and considered profitable after generating $400 million in revenue from $1.8 billion in gross merchandising value (GMV) – a strong sign of growth after accruing $2.5 billion in cumulative GMV between 2016-2020. With targets on international expansion and growth, StockX has physical facilities in North America, Europe, and China, and ships to 200 countries. Unfortunately, StockX needs to physically handle, and authenticate each item every time it’s shipped and re-sold, which creates friction and incurs high operational costs.

Introducing NFTs to improve Scalability & Sustainability

In January 2022, StockX launched a non-fungible token (NFT) offering called the “Vault NFT collection”, where each NFT is tied to a physical item that StockX sells, like how the numbers on a banking application represent actual money.

The launch represents a paradigm shift in the resale marketplace demonstrating how blockchain technology can effectively be used to improve operational efficiency and profitability. StockX claims the Vault NFTs will enable them to “reduce transaction fees, minimize environmental impacts, and create provenance.” A reasonable percentage of resale buyers are also re-sellers themselves who intend on “flipping” items for profits as quickly as possible – a chain that continues until items reach their final buyers. By leveraging NFTs, StockX eliminates the need to handle and ship physical items multiple times, with digital representations being seamlessly traded repeatedly with ownership tracked securely using Ethereum.

Backlash from Nike – Trademark Infringement Lawsuit

Just a month after launch, Nike sued StockX for launching NFTs based on their shoes and trademarks. Nike claims that the NFTs are separate products and not merely digital traceable receipts since the shoes themselves stay in StockX inventory until someone claims them. This case has far-reaching ramifications for NFT “fair use”, trademark and IP policy, and how NFTs may be used to represent physical goods in marketplaces moving forward.

FUTURE OF STOCKX

While Nike and others may be against StockX’s foray into NFTs, some argue that this was a smart strategy for StockX to improve its profitability, scalability, and sustainability while maintaining its core value creation. But will it result in success or not? It will be interesting to observe how things unfold in 2022, and beyond.

APPENDIX: STOCKX BUSINESS MODEL IN DETAIL

SOURCES

https://www.cnbc.com/2021/04/08/sneaker-reseller-stockxs-valuation-jumps-to-3point8-billion-.html

https://www.insider.com/guides/style/how-stockx-works-service-review

https://entrepreneur-360.com/how-does-stockx-make-money-21767

https://stockx.com/help/articles/What-are-StockXs-fees-for-sellers

https://www.complex.com/sneakers/2016/07/stock-is-changing-the-sneaker-resell-market-and-detroit

https://www.theverge.com/2022/6/6/23156515/nike-stockx-nfts-counterfeit-sneakers-lawsuit

https://www.inputmag.com/style/stockx-vault-nfts-sneakers-shoes-nike-off-white-dunk-adidas-bad-bunny

https://www.highsnobiety.com/p/stockx-nft/

https://www.aiobot.com/stockx-nft/

https://www.highsnobiety.com/p/stockx-nft/

https://www.voguebusiness.com/technology/with-rtfkt-acquisition-nike-invests-in-the-metaverse

https://www.yo-kart.com/blog/developing-online-resale-marketplaces-like-stockx/

Thanks for the post Nthato! I had a case over Web3 and Blockchain in VCPE the other day and I left it struggling to figure out what an actual application of blockchain technology would be. It’s interesting to see a really clever example of a company using the technology to actually create value. It’ll be interesting to see how the technology will evolve in the future. Your post also made me finally look into how Ethereum actually, so thank you for that!