Udaan – Digitizing and Transforming the Indian Trade Industry

Udaan is India’s largest business-to-business e-commerce platform. It has operations across categories including lifestyle, electronics, home & kitchen, staples, fruits and vegetables, FMCG, pharma, toys and general merchandise.

The Indian retail industry has emerged as one of the most dynamic and fast-paced industries and accounts for over 10% of the country’s gross domestic product (GDP) and around 8% of the employment [1]. A report by the India Brand Equity Foundation says that E-commerce in India will reach $ 99 billion by 2024, growing at a 27% CAGR over 2019-24, with grocery and fashion/apparel likely to be the key drivers of incremental growth.

Challenges and Opportunity

Despite being an attractive market, the organized segment of the industry is just about 25%. Outside this segment, millions of small and medium retailers around India are untouched by technology. As a result of this, middlemen were able to shortchange the retailers largely by price and to some extent, quality.

Proliferation of internet on smartphones, growth of e-commerce, tools for digital payments and a uniform taxation system – goods and services tax (GST) are positively disrupting the technological landscape of the Indian retail industry. This led to the opportunity that the Udaan team saw in democratizing the entire retail value chain bringing transparency throughout the process while delivering on efficiency. Udaan enables B2B transactions by bringing the participants – be it the wholesaler, retailer, distributor, and small shop owner – onto a single platform.

Value Creation : Creating a One-Stop Shop Model for Grocery Retail

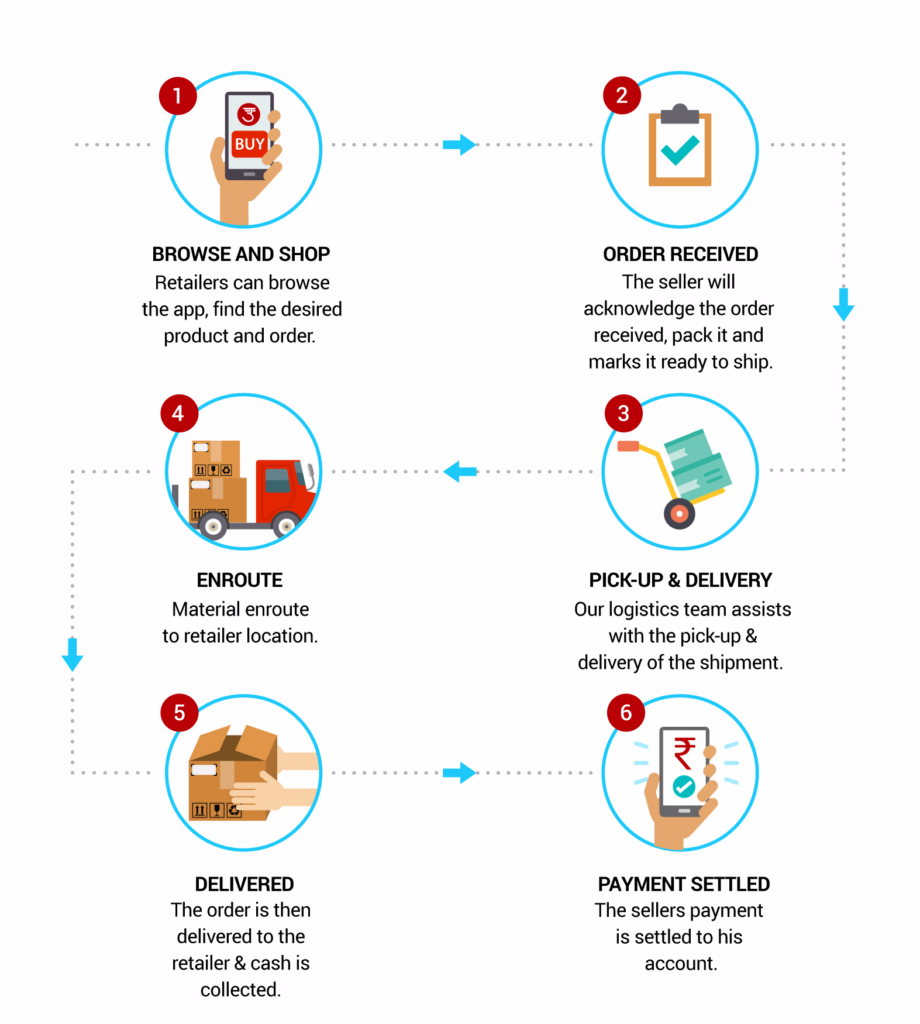

The founders understood that the entire retail industry supply chain was inefficient. They created a platform which enables the buyers (retailers) to select a product, place an order with sellers (wholesalers, brands, and manufacturers) who pack it and dispatch it through ‘UdaanExpress’, go-to logistics service provider platform, ensuring the delivery process is streamlined. The buyer pays on delivery unless it is a credit transaction. Through this model, Udaan creates and delivers value to multiple parties :

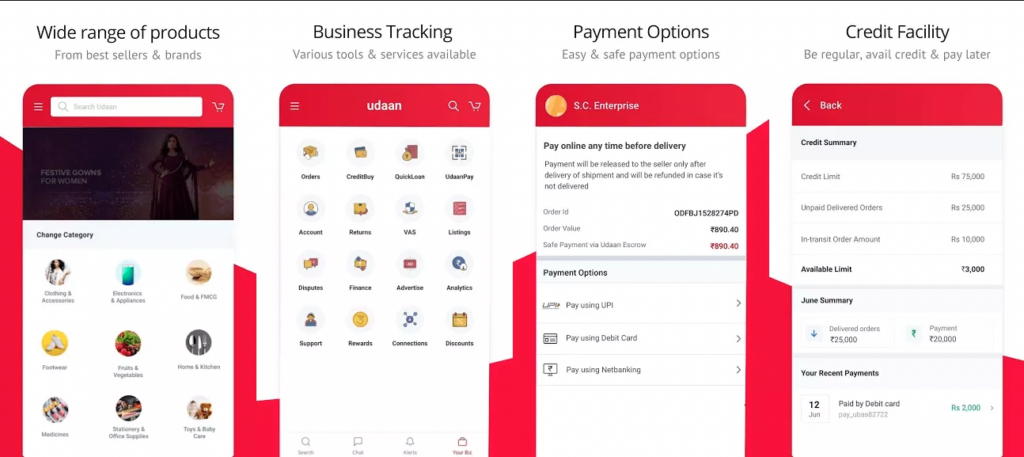

Retailers : Unlike traditional fast-moving consumer goods (FMCG) companies, whose range of products cover a few categories, Udaan has numerous advantages. Firstly, there is a wide choice in terms of goods available on the platform. which gives the buyers a large spectrum of choices to pick from. The platform also offers a host of services to its buyers such as transparent pricing, convenience in selection of goods, tracking and next day delivery, easy payment and return of goods if the recipient is not satisfied. With Udaan Capital, the company also aims to provide the necessary working capital at low interest rates increasing the value proposition to retailers.

Wholesalers and Distributors : On the other hand, Udaan presents an attractive proposition for any seller as they can reach out to a larger set of customers across India [3]. The platform’s SaaS offerings such as analysis of real time marketing feedback through app data analytics enables brands and manufacturers to make well-informed decisions about product launches and testing of new products in different markets. While the app-based pricing system gives better pricing control, the product listing advertisements and in-app advertisements encourages manufacturers and wholesalers to reach their targeted, specific, and ready-to-purchase retailers on the platform [4]

Capturing Value : Udaan captures the value created through the delivery charges it collects from the market participants for picking up goods and delivering them to the buyer. Udaan also provides sellers registered on the platform, storage, and warehousing services to deliver goods faster to the buyers. Sellers are charged a fee for such warehousing services. On top of this, they also offer several other fee-based value-added services to businesses. These include analytics packages, targeted advertising, packaging, and printing labels on products, the printing of invoices, and returns management services.

Scalability and Sustainability

With India’s rising digital footprint and an ecosystem that is poised to grow exponentially over the next decade, Udaan is ideally positioned to capture more users and create value. Udaan currently has 3 million registered users with 25,000-30,000 sellers across 900+ cities in India. The platform currently boasts around 1.7 million retailers, Kirana shops, farmers doing 4.5million transactions per month [4]. With strong cross side network effects, the platform can attract more users by having a plethora of options to choose from for retailers while attracting new customers for wholesalers.

With scale comes complications especially when it’s not a pure play platform anymore and the revenue model is highly dependent on other value add services such as logistics and lending. The company will have to keep providing differentiated services from analytics offerings to end to end services at highly competitive price points to increase the stickiness of the customers, reduce multihoming and increase its share in this growing market.

This is a really cool business! They’re a logistics company, but also way more than a logistics company. They even provide loans to retailers. Reading through this, I can’t help but wonder if they’ll eventually go the way of Amazon and start using their data/analytics, warehouses, and logistics to create their own products to sell on the platform. Great post Karthik!

Thank you, Karthik, for bringing up Udaan! It is by far one of the most amazing Indian unicorn stories; especially for the amount of transparency, selection, and control that it gives to India’s wide retailer base on their sourcing, pricing, and quality of procurement. It would be interesting to see how the value distribution/margins across the supply chain are shifting pre- and post-Udaan. Thanks once again, Karthik.