Blockchain Protocols as Platforms: Lightning Labs and Building the “Layer-Two” for Bitcoin

Can Lightning Labs facilitate an app ecosystem and platform to help Bitcoin achieve greater scalability?

Network Effects for Blockchain “Base-layer” and “Layer-two” Protocols

Inter-chain competition amongst blockchain protocols exhibit many similar characteristics to the competition within personal computing operating systems and mobile app platforms of the 1990s and 2000s. In particular, there is intense focus on leveraging cross-side (or “indirect”) network effects, with the belief that attracting developers that integrate protocols into app development will lead to more users either knowingly or unknowingly using the protocol. One key area of divergence is in how the protocols aim to capture value. The underlying premise for protocol proponents in pushing for more developers and users is that increased developer and user engagement with a protocol will lead to increased demand for the protocol’s native “cryptocurrency,” (e.g. Bitcoin, or ETH, or SOL) which would drive up the price of the protocol’s native crypto asset.

Value creation and capture becomes even more nuanced for for-profit companies that are creating “layer-two” software. “Layer-two” protocols refer to additional protocols built on top of the “base-layer” blockchain that expand the functionality and scalability of the base-layer protocol.

This article highlights one such “layer-two” company, Lightning Labs. Lightning Labs creates a software implementation that facilitates the use and adoption of the Bitcoin Layer-two “Lightning Network.”

How the Lightning Network Works

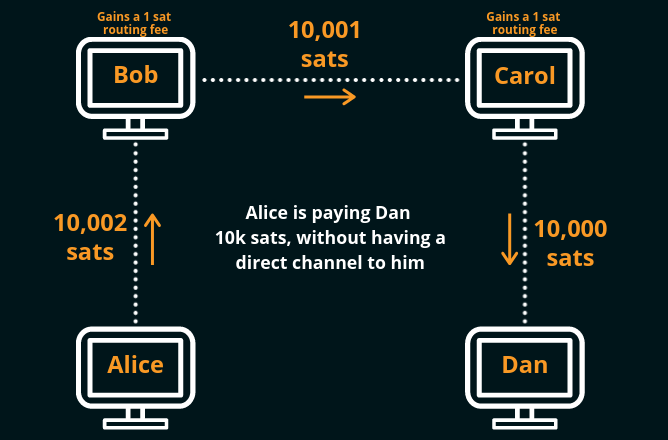

The Lightning Network is a “layer-two” software payment protocol that aims to increase the amount of transactions that Bitcoin can process. At a high-level, the software creates an “open” or “unresolved” transaction between two parties on the Bitcoin base layer that allows two parties to transact with each other without having to commit any of the transactions to the blockchain. The Lightning Network further facilitates additional transaction volume by utilizing “onion routing“: any computer node running Lightning software can transact with any other node in the network, so long as there is a viable path of “channels” between the nodes to pass on the transactions. For instance, if Alice wants to send $100 to Carol, so long as Alice has a channel with Bob, and Bob has a channel with Carol, Alice can route the transaction through Bob (for a minor “routing” fee) to send the value to Carol.

Building the “Lightning Network” and the “Bitcoin” Platform: How Lightning Labs Creates and Captures Value

While the combination of “off-chain channels” and onion routing together have the potential to significantly increase the number of microtransactions facilitated through the Bitcoin protocol, there are several major limitations to scalability. To start, the overall utility of the network is constrained by the number of computer nodes running Lightning software that can route payments. Moreover, the number of Lightning nodes is constrained by the amount of “end-user” demand there is for Lightning transactions in general, and the amount of end-user demand is a function of the availability and usability of “Lightning apps” or applications that incorporate Lightning protocols. The relationships across nodes, users, and app developers comprise a cross-side network effect with three dimensions: the more demand there is for Lightning transactions, the more incentive there is for more computers to start running Lightning software, which in turn increases the utility of the network, which further incentivizes app developers to incorporate the technology, which further increases user demand for transactions, etc.

Lightning Labs helps to cultivate a platform that can generate these network effects by offering solutions for node operators, developers, and end-users. For one, Lightning Labs offers a free software implementation, “LND,” that helps developers run Lightning nodes and process Lightning transactions. LND has over ~85% market share across nodes in the Lightning Network. In addition to creating and distributing the software implementation, Lightning Labs has an engineering and business development team that works with developers to incorporate Lightning protocols into their software applications in order to generate end-user demand. Notable companies that have incorporated LND and Lightning Labs’ software include Twitter, Substack, and Paxful. Last, Lightning Labs offers products (e.g. “Pool“) that allow users to contribute capital or provide liquidity to nodes in the network for a fee in order to increase the network’s payment efficiency. These consumer-facing products both increase user engagement and increase the capacity of the network.

Future Scalability and Sustainability

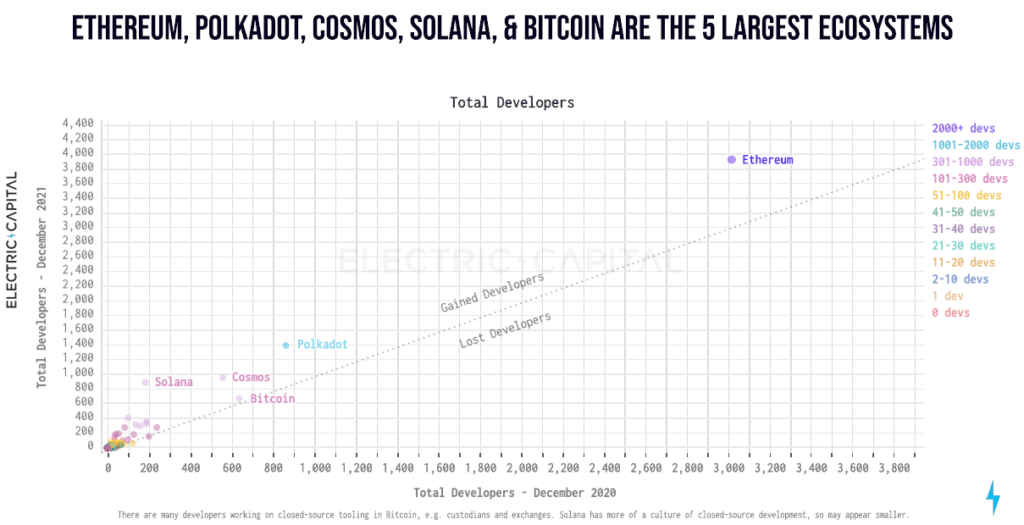

The greatest threat to the long-term viability of the Lightning Network is competition across protocols. More recently developed protocols such as Ethereum, Polkadot, and Solana have similarly sought to attract users and app developers based on different protocol value propositions and the monetary incentive of helping the protocol’s native asset appreciate. Amidst rapid price appreciation of other “cryptocurrencies,” the Bitcoin ecosystem as a whole surely had fewer user and developer engagement.

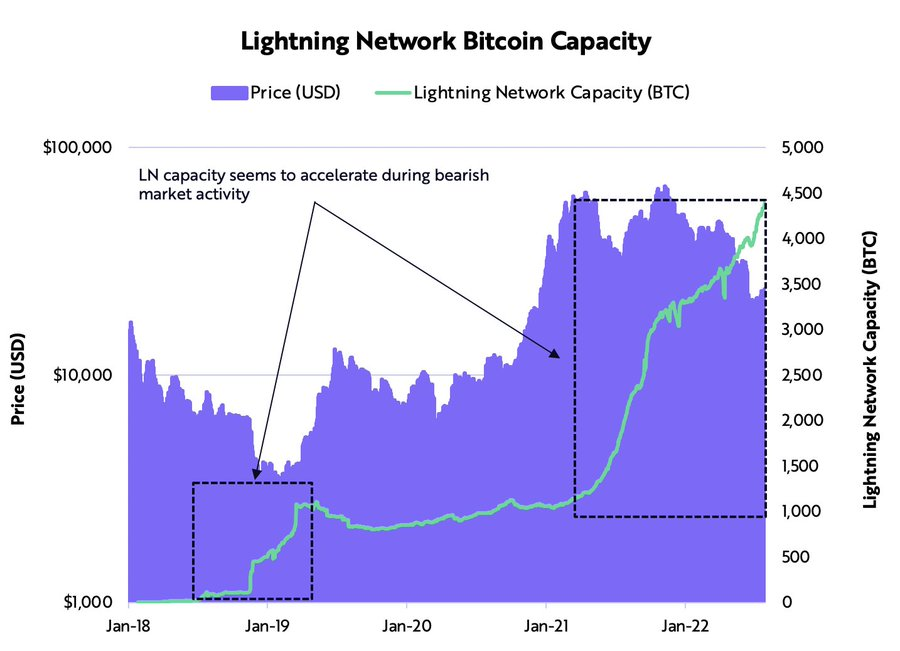

However, the Lightning Network’s capacity and adoption rate have continued to increase rapidly even amidst the recent declines in Bitcoin’s price. These are perhaps early indications that the platform and application ecosystem that Lightning Labs has fostered through its LND implementation and customer-facing liquidity solutions have sufficiently strong network effects to continuously gain broader adoption in the coming months and years, even amidst the intense inter-chain competition and ongoing price volatility of Bitcoin.