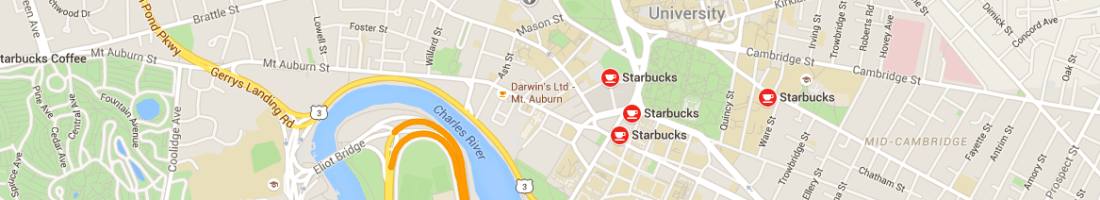

Starbucks: Brewing up a data storm!

Starbucks’ use of data from geographic information systems (GIS) allows the coffee chain to optimize store location, perhaps explaining why it’s feasible to have four Starbucks stores within a 1-mile radius in Harvard Square!

Ever wondered why there are four Starbucks stores within a one-mile radius of each other in Harvard Square? This is certainly not a phenomenon that is unique to Harvard Square. In many locations, from New York City to São Paulo, one will often find Starbucks stores clustered near each other. This seems counterintuitive, as logic would have you think that this strategy might actually lead to cannibalization and therefore negatively impact the profitability of the stores. However, Starbucks has been very smart in its use of data analytics to not only determine optimal store location, but to customize its menu offerings by location and therefore capture significant value.

In order to assess a potential new store location, Starbucks leverages data from Atlas, an in-house mapping and business intelligence platform developed by Esri, a geographic information system (GIS) company. Atlas provides Starbucks with data on consumer demographics, population density, income levels, auto traffic patterns, public transport stops and the types of stores / businesses in the location under evaluation. Through careful analysis of this data, Starbucks is able to project foot traffic and average customer spend of a given location, therefore helping Starbucks to determine the economic viability of opening a store in that spot. This also creates value for customers by providing convenient locations to grab that much-needed cup of java.

Once Starbucks determines the optimal location, Atlas is also useful for helping Starbucks determine tailored menu offerings. For example, Atlas helped Starbucks to determine areas that have the highest alcohol consumption. This information allowed Starbucks to determine stores that would pilot an initiative to serve alcohol as part of a special menu called “Starbucks Evenings”, which was launched in 2010 in Seattle and has since been expanded to a growing number of stores. In another example, Starbucks used Atlas to predict when a heat wave would occur in Memphis and launched a local Frappucino promotion to coincide with the hot weather. These data-driven menu offerings offer additional ways to capture value, beyond just charging a premium on coffee.

Starbucks’ competitors are also using data in a similar way. For example, Dunkin’ Donuts uses software developed by Tango Analytics, to similarly analyze demographics, presence of competitors and traffic trends in order to determine store locations. That said, Starbucks continues to outpace Dunkin’ in terms of number of stores (11,000 stores vs. 8,200 Dunkin’ stores in the US), as well as in terms of store growth (Starbucks is projected to open 600 net new stores in the US by end of 2015, while Dunkin’ is aiming at 440 net new stores).

Starbucks has done extremely well to become such a ubiquitous part of urban living. However, let’s not kid ourselves: Starbucks is overpriced and the quality of Starbucks’ coffee certainly does not warrant its premium price tag. Will the company be able to continue to charge $2.95 for a tall caffe latte? Probably. Objectively, consumers might balk at the relatively higher price but the convenience of Starbucks’ locations means that it will probably remain the go-to coffee chain.

One of the other challenges that Starbucks faces is the emergence of specialty coffee companies such as Stumptown Coffee Roasters and Blue Bottle Coffee. These chains are attracting the more sophisticated coffee drinker that is making a conscious choice to drink something other than the brew offered at the local Starbucks. While this probably will not make a huge dent in Starbucks’ soaring profits ($627M in June 2015), the shift towards coffee chains that are seen as better quality and therefore value for money may negatively affect Starbucks’ positioning as a more premium coffee brand than your local Dunkin’ coffee. Furthermore, as these specialty chains increase their presence, who is to say that Starbucks’ sophisticated use of data to optimize store location will win over consumers’ preferences for more sophisticated coffee?

Sources:

- http://www.itworldcanada.com/slideshow/airbnb-starbucks-provide-big-data-secrets-to-enterprise-biz

- http://video.esri.com/watch/3654/starbucks-coffee-and-it

- http://www.esri.com/esri-news/arcwatch/0814/going-big-with-gis

- http://www.fastcompany.com/3034792/how-fast-food-chains-pick-their-next-location

- http://www.nytimes.com/2014/12/05/business/in-the-capital-of-coffee-enthusiasm-for-starbucks-upmarket-chain.html?_r=0

- https://news.starbucks.com/news/starbucks-evenings-stores

- http://data-informed.com/data-driven-location-choices-drive-latest-starbucks-surge/

- http://www.reuters.com/article/2015/10/01/us-dunkin-brnds-storeclosures-idUSKCN0RV4UU20151001

- http://investor.dunkinbrands.com/releasedetail.cfm?releaseid=923440

- http://www.chainstoreage.com/article/food-helps-drive-strong-q2-starbucks-1650-net-new-stores-planned

- https://www.bostonglobe.com/business/2013/08/28/retailers-tap-software-programs-select-ideal-locations-for-new-stores/f6hsWesAX2NwrPXRPeUu4O/story.html

I think you bring up a great point about the relative importance of quality, price, and convenience for coffee customers. I’m sure there is a segment of Starbucks customers (myself included) who would jump ship and choose Stumptown if the two stores were side by side. But they aren’t always side by side, and the location analysis certainly seems to be effectively putting Starbucks stores right in front of me, wherever I go. However, I think Starbucks’ real success comes from making strong, interrelated decisions that affect quality, price, and convenience simultaneously. Because they’ve made it easier for me to buy stuff through the loyalty card, they’ve also made it easier to track my preferences and price sensitivities, and they know where I make most of my purchases. Doing all of those things at once is tougher for a small competitor to pull off.

This was really insightful! I’ve always been curious as to why Starbucks had so many coffee shops close to one another. It’s clear the Atlas algorithm is providing a strategic and financial model that some might consider counter-intuitive, and given that Starbucks continues to follow this strategy of densely-present Starbucks “hot spots,” Atlas must be working.

You brought up an interesting point about Starbucks coffee not being as great as perhaps some other competitors, and I agree that although their product may not be better than some competitors, consumers immensely value convenience. If I think about the average customer, it’s someone on his or her way to work and someone who needs solid coffee without ridiculously huge lines, so having multiple locations nearby certainly helps alleviate that. In doing so, they also continue to increase their brand awareness, which helps them continue to capture market share, at the expense of, perhaps better tasting, competitors who can’t compete with the scale.

With increasing data metrics (e.g., number of customers in store per hour), I wonder if they can find ways to make the purchasing timeline even shorter. Even with 4 Starbucks locations in a single block, some shops are still more packed than others. It could be interesting if they find a formula to say something along the lines of, “the Starbucks at location X has a line 10 minutes shorter than that in location Y.” This may continue to further increase Starbucks’ sales, as they don’t lose those who decide to skip going to the shop due to the long lines. I’m sure, however, they’ll need to focus on finding ways to incentivize franchise owners to continue down this route, since some relatively “prime” locations will certainly lose revenues.

I agree with your points challenging the value proposition of Starbucks, but I really think the ritualistic nature of the experience and the community are what drive people to become loyal patrons. So Starbucks is always packed because they use the right data tools and analytics to provide the maximum value for a specific subset of consumers–not because Starbucks is the hottest thing since sliced bread :p. It still baffles me why there are 3 Starbucks in Harvard Square so close to each other–despite less foot traffic at the smaller locations, the bigger one is always PACKED. So it leads me to believe that people don’t just go there for the coffee itself–they go for the experience, to be seen, to see, to feel. I am not a coffee drinker (shocking, I know), but I’ll often find myself at Starbucks to meet people and to do work over mediocre tea–a testament that it isn’t the coffee itself that’s driving repeat business, but the ambience and convenient, high-quality experience.