Rethinking the Video Game Business Model

Activision Blizzard is one the largest video game publishers in the world and has seen tremendous success over the past 5 years. Moving forward, it must re-evaluate its strategic and operational positioning to adapt to a set of transformational digital trends in the video game industry.

With 2017 revenues of over $7 billion, Activision Blizzard (NASDAQ: ATVI) is one of the largest video game publishers in the world. The company develops and publishes console, PC, and mobile video games including blockbuster titles like Call of Duty, Destiny, World of Warcraft, Overwatch, and Candy Crush. Activision Blizzard (henceforth “ATVI”) was formed primarily through the merger of three separate entities over the past decade: Activision Publishing with Vivendi (Blizzard) in 2008, and King Digital in 2016. Today, those entities remain relatively separate with their own organizational structures, video game titles, and methods of distribution.

Over the past 5 years, successful new hits, increasing in-game transactions, and higher profit margins have led ATVI’s share price to appreciate over 400%. Looking forward, ATVI’s continued success will depend on its ability to navigate through a set of transformational digital trends.

Key Transformational Trends in Video Gaming

For a long time, the video game business model was relatively straightforward – publishers sold physical copies of games (e.g., CDs or cartridges) at retail outlets (e.g., GameStop) and received one-time revenue from those sales. In the last decade, however, a set of digital trends have emerged that introduce both new opportunities and new challenges for this traditional model.

Physical to Digital

The first trend is the movement away from physical media (e.g., CDs, cartridges) to digital game downloads. While over 90% of console game sales were done through physical media 5 years ago, more than 35% are done through direct downloads today. ATVI’s financial upside from this shift is immense, as direct downloads have up to 30% higher margins than physical sales.

However, there are several challenges associated with this trend. First, like in other industries, video game retailers have struggled during this transition and have increasingly pressured publishers for economic concessions. Because the majority of sales still go through traditional retail outlets and because those outlets act as showrooms for games (akin to Best Buy for devices), publishers must commit significant resources to maintain these relationships. Second, this shift to digital has concentrated greater power in the hands of online distributors like Steam. With growing reach and influence on consumer purchasing behavior, these online distributors have augmented their bargaining power and have increasingly put publishers at a disadvantage.

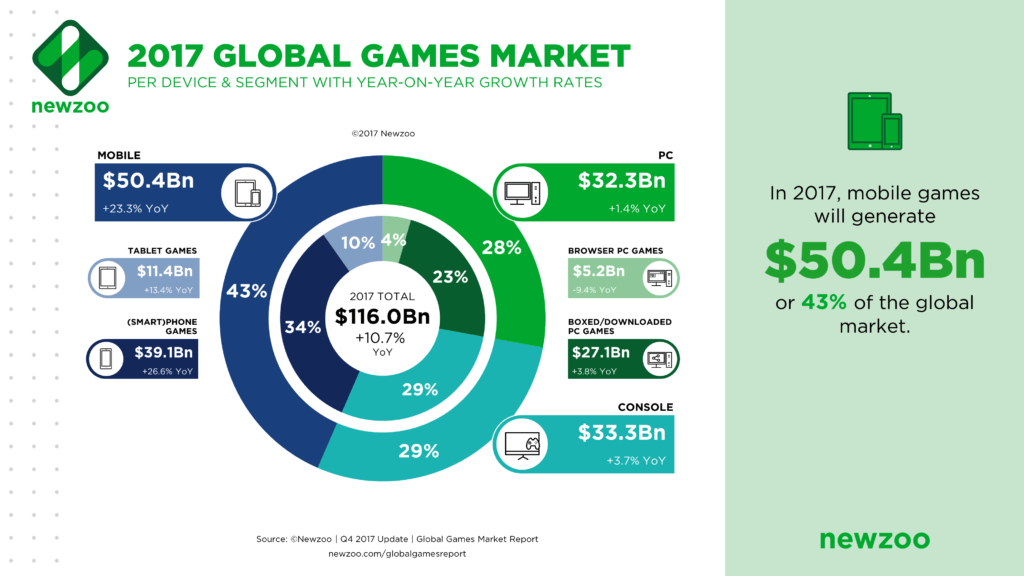

PC / Console to Mobile

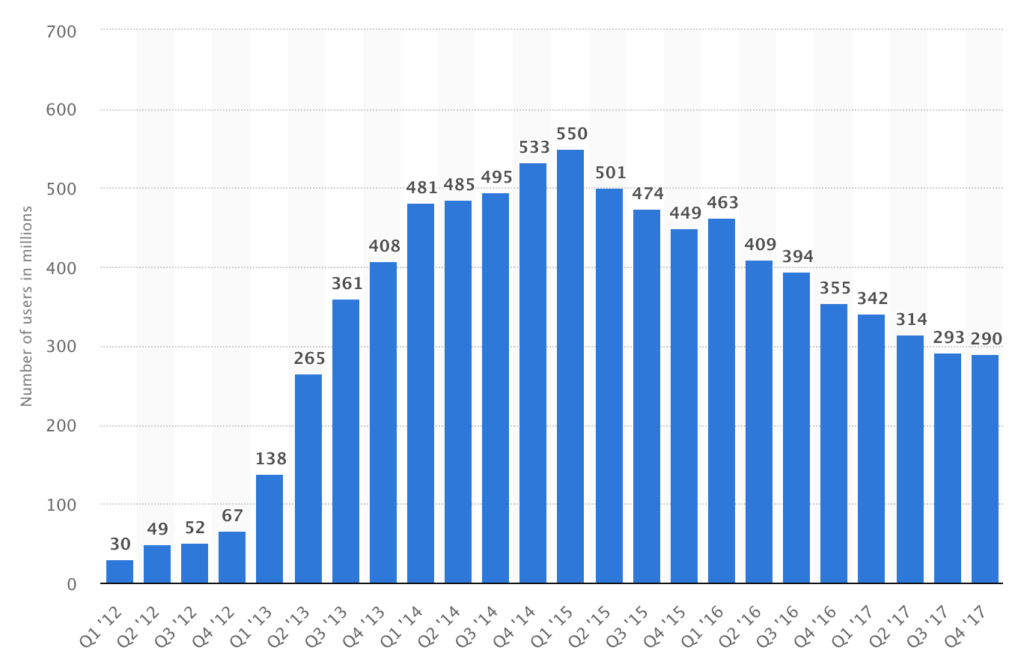

Another trend is the movement away from PC and console gaming toward mobile gaming – while mobile has exploded, PC and console growth has slowed to the low single digits. Though winning in mobile would significantly accelerate growth, ATVI is historically a console and PC business. In fact, prior to the acquisition of King, ATVI’s revenue was almost entirely based on the PC and console gaming markets (post King, mobile is about 25% of revenue). As a result, in order to continue growing like it has in the past, ATVI will have to succeed in a new business that requires a very different set of creative and commercial capabilities. Whereas PC / console success depends on blockbuster games that consumers play for many hours on end, mobile success relies more on casual games that users repeatedly come back to for short amounts of time. In other words, the type of game that flourishes on PC and console, where ATVI has strong competencies, is very different from the type of game that works well on mobile, where ATVI has gaps. Although ATVI’s acquisition of King attempted to address this skills gap, King is still relatively separate from the legacy business and its monthly active user count has dropped nearly 50% from a high of 550 million in 2015 to 290 million in the latest quarter.

Social Gaming

In addition to mobile, another consumer trend has been the movement toward social gaming. 10 years ago, gaming was primarily individual in nature – a consumer would mostly play games by themselves and occasionally with friends nearby. Today, the growth in internet speed and access have allowed massive multiplayer online games to thrive. In fact, the most popular titles today are ones with significant social features embedded. As a result, individuals play specific games for far longer than they used to, and these games now have very strong network effects.

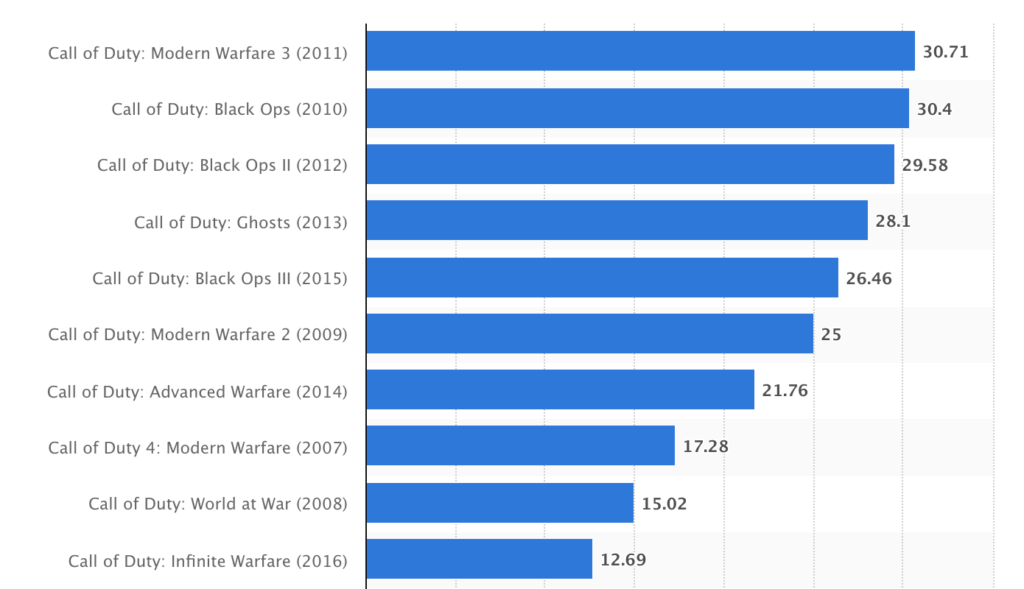

Social gaming creates opportunities for developers to make even more popular titles, but it also challenges the way companies have thought about game development. For one, the old model of refreshing games every year in the hopes of selling more copies may no longer work for every franchise – if an existing edition of a game has a large and devoted enough user base, the network effect may make it too costly to switch to a newer version. One example is the Call of Duty franchise – while monthly active users are today over 40 million compared to 30 million 5 years ago, unit sales of the 2016 version were less than half that of the 2011 version. Consequently, publishers may need to update content for existing editions for a longer period of time instead of just pushing out new editions every year. Second, publishers must acquire social media capabilities to build stronger gamer connections that solidify network effects. This is not a skillset that publishers have historically had, but it is crucial to have today.

Growth in Data

Along with the growth in social and multiplayer online games has been an explosion in user data. Because almost all games today are connected online and require accounts to play, publishers have the opportunity to track individual gamer behaviors, develop better titles and content, and increase user loyalty. This explosion in user data provides ample monetization and optimization opportunities, but in order to capitalize on this wealth of information, publishers need to develop the analytical and scientific capabilities within their organization and may even need to rethink their existing value capture model.

Recommendations

In the face of these transformational digital trends, ATVI needs to rethink its business strategy and organizational composition.

From a distribution standpoint, ATVI should continue to support its valuable existing retail relationships – pushing too hard into third-party digital channels (e.g., Steam) could alienate physical retailers that still comprise the majority of its revenue and play a valuable marketing role. However, ATVI should aggressively develop its own first-party digital distribution technology. Third-party digital distributors, while growing, are still a relatively small portion of ATVI’s business – cultivating in-house capabilities today will ultimately yield a stronger competitive and financial position in a digital future with minimal downside today. ATVI already distributes its Blizzard PC titles via its first-party Battle.net platform – moving forward, it should more aggressively use Battle.net to distribute all of its PC games, including non-Blizzard ones.

To bolster its mobile presence, ATVI should create mobile versions of some of its well-known PC / console titles, many of which could be well-suited to the small screen and already have name recognition. To do this, ATVI will need to address capability gaps within its organization. To start, it should better integrate King’s creative game development staff with its Activision and Blizzard teams, for example by seconding King developers into Activision / Blizzard teams. This mixing of minds should moderate cultural resistance and encourage the open sharing of ideas. For actual game development, ATVI should create separate mobile teams that have the autonomy to pursue a uniquely mobile vision for legacy franchises. At the same time, it should add incentives (e.g., success-based bonuses) for legacy developers to collaborate with the new mobile groups. Finally, ATVI should consider hiring talent from publishers like Tencent that have been able to successfully bridge from console / PC to mobile.

With respect to social gaming, ATVI should shift more resources toward developing additional content for its most popular games, even ones that are 2-3 years old. In addition to keeping users engaged, a constant stream of new content also provides additional opportunities for monetization (e.g., through the sale of expansion map packs). ATVI should also aggressively push into eSports, which would raise the prominence of its major titles and create stickier global communities. ATVI is on the right track, having recently launched its own Overwatch eSports league, and should also think about launching its own Call of Duty and World of Warcraft leagues.

Finally, ATVI should leverage its sizeable set of gamer data to optimize future game content (across all of its games, ATVI has 385 million monthly active users, more than Twitter). To do this, it should hire more data scientists to interpret and evaluate user behavior while more tightly integrating game franchises across its organization to encourage cross-sharing of key learnings. ATVI should also consider monetizing its user data through new revenue streams like advertising – King has been trialing these efforts over the last year for Candy Crush, and ATVI could trial advertisements on its other freemium titles like Hearthstone.

Ultimately, ATVI’s continued success will depend on whether it can formulate the right strategy and assemble the right organization to take advantage of these digital megatrends.

Sources:

- “FY2011-FY2017 Financial Report and Earnings Call Transcripts.” Activision Blizzard, n.d. https://investor.activision.com/investor-relations.

- Hoy, Laura. “GameStop Corp. Is Running Out of Lives in Digital Revolution.” Yahoo Finance. Accessed April 20, 2018. https://finance.yahoo.com/news/gamestop-corp-running-lives-digital-160107148.html.

- “New Gaming Boom: Newzoo Ups Its 2017 Global Games Market Estimate to $116.0Bn Growing to $143.5Bn in 2020.” Newzoo (blog). Accessed April 20, 2018. https://newzoo.com/insights/articles/new-gaming-boom-newzoo-ups-its-2017-global-games-market-estimate-to-116-0bn-growing-to-143-5bn-in-2020/.

- “Not Just Eye Candy – Activision’s Ad Revenue Bet with King Digital.” Reuters, May 6, 2016. https://www.reuters.com/article/us-activision-results-kingdigital/not-just-eye-candy-activisions-ad-revenue-bet-with-king-digital-idUSKCN0XX28S.

- “Statista – The Statistics Portal for Market Data, Market Research and Market Studies.” Accessed April 23, 2018. https://www.statista.com/.

Just a wild thought, how about acquiring/strategic investment in gamer network such as Discord to solidify its connection with gamers and perform massive AI on gamers’ conversation to understand their tastes to build better game?

Reason I think this is because Tencent has such strong social network: QQ for games, Wechat for chatting. To build strong social games, shouldn’t you control some social network to remain competitive?

Interesting idea Peter. Why acquire instead of build? Is there a loyal user base already installed that would be hesitant to switch? My thinking is that if Discord is only adding text / chat functionality, its possible to develop that in house and maybe integrate it into Battlenet.

Great post, James. I agree that the industry shift towards social gaming presents an opportunity for Activision Blizzard. Another area that the Company should explore are games targeted towards Virtual Reality Esports. Intel, Oculus and the Electronic Sporting League recently partnered to create the inaugural VR Challenger League, the world’s first VR Esports League. Currently, Echo Arena and the Unspoken are the two games played in the league. The growth of VR and esports presents a unique opportunity for Activision Blizzard to create new content.

Thanks, James. I think you smartly laid out the three concerns facing most entertainment companies today – shifting from B2B to B2C, being smarter on content creation, and using data to further refine and monetize the whole ecosystem. An interesting challenge will be its ability to balance its retail relationships with any further investment in in-house distribution, especially since the retail dollars will be much bigger for quite some time. ATVI is not the only company going through this, so I wonder if there are learnings from competitors that could help them through this transition. From a content perspective, I really do like how you suggest the company lean on successful IP to date and flow it throughout the rest of the company. This is a safe way to expand and further exploit monetization of known successful properties, de-risking content spend. The data part is interesting, as I have always been skeptical of using data to inform creative choices. Though I recommend the same in my post on NBCU, I think it’s clear that there are limitations to data-based choices, as seen by Netflix’s rise in show cancellations.

Thank you for a super post!

As a fourth digital thread to the company, I’d add the emergence of new platforms like AR/VR. I’m curious to hear your thoughts on how Activision should best respond? From BSSE, I guess we learned that it would be best to set up a separate team … but if the strength is in Activision’s strong franchises that it can leverage across platforms (e.g., Call of Duty, World of Warcraft) … I wonder if that is really the best way to leverage the strong set of universes Activision has.

Thanks for a great post! Although it makes sense given market trends to move into more casual mobile gaming, I do wonder what the consequences might be for Activision’s biggest power users. Might they think that Activision is ‘selling out’ or no longer focused on developing in depth console games that have generated so much loyalty to the brand? I am particularly excited about the potential of eSport leagues such as Overwatch League. If Activision can succeed, they can actually create an entirely new industry around jersey sales, live events, etc. However, one question is how to best build this out for a constantly changing landscape of popular games (overwatch today, something else tomorrow). If this is the case, it might be hard for Activision to market ‘Superstars’ because the sport is constantly changing. An analogy being it would be hard for the NBA to market Lebron James if they were constantly switching from Basketball to Hockey to other sports.

Think there would be any interest in them creating supplementary titles for mobile devices that have console-game impact? E.g. mini-games or maintenance games that allow you to boost your level in the regular game? Or are the two gamer populations too separate for that to work?

Great post. Would love to know what you think about some of the most recent trends like Twitch (which allows you to consume games without paying / playing them), Fortnite / PUBG (which are proving the viability of competitive mobile games in the US) and the free-to-play model (which, as you mentioned has been popular for casual games but is growing for competitive games as well and threatens franchises like Destiny & CoD).

“Ultimately, ATVI’s continued success will depend on whether it can formulate the right strategy and assemble the right organization to take advantage of these digital megatrends.”

There is one extremely positive tailwind for ATVI to assemble the “right organization” to achieve a winning position in the digital megatrends: the executive team of ATVI has very low turnover (relative to a typical tech company) and Bobby Kotick is the single longest-serving CEO among S&P500 companies. We should not discount the organizational congruency and time-honored execution power that promise to enable a successful pivot for ATIV.

Amazing post. Diehard Warcraft III and Hearthstone fan here 🙂

Very interesting post! “Over the past 5 years, successful new hits, increasing in-game transactions, and higher profit margins have led ATVI’s share price to appreciate over 400%”. I wonder if there is a concern that in-game transactions lead to shameless “money-grabs” that will led to the cheapening of ATVI’s share price as a result of a classic pay-to-play model which un-evens the playing field?

As a huge game enthusiast, I can’t wait for faster transformation if the industry. I think the opportunities to create better experiences for the gamers through AI, VR and Robotics is well ahead of the current offerings. Game companies should be more aggressive and faster in embracing the change. Otherwise, new companies will disrupt them with more radical innovations.

Thanks for a great post, James!

Like Brittany and ABC, I think you could add exploration of VR/AR to their strategy, especially within their existing franchises.

I feel like Jesse is getting at a really big and interesting question: should ATVI move into new areas (e.g. mobile), or should they double down on their existing business and make it better (“NBA” of gaming). One argument is that this is a classic Christensen disruption situation, and they should invest in the newer, low-end products. This could include developing mobile extensions of their existing franchises as you suggest, and could entail developing whole new products in the mobile space. Both would have dramatic implications for the business. Mobile gaming might increase ads as a share of revenue, and may one day bleed over into their console and PC games as well.

One thing is certain. In addition to hiring data scientists as you recommend, they should definitely hire you to tell them what to do!

Thanks James – I need to learn much more about this part of the Entertainment industry, and this was very helpful! Re: opportunities for growth, one thing that didn’t come right out was international. You talked about increasing internet speed allowing more opportunity for social or multiplayer gaming – as this happens internationally, might the same trends occur? I’m not sure how much of ATVI’s revenues come from abroad, but given the rise of Esports in other countries such as Korea (already fast internet, but just an example), perhaps doubling down on franchises that are successful in international markets could help growth.