Quirky, the Failure of Invention Crowdsourcing

Why Quirky went bankrupt and what they could have done differently.

Powered by internet, social media, and new technology, the crowdsourcing platform has become a popular business model in the past decade. Quirky, founded in 2009 by Ben Kaufman, was developed as an invention platform where inventors could pitch their ideas and have their products developed. Over time Quirky raised $170 million from Norwest Venture Partners LP, RRE Ventures, General Electric Co.’s GE Ventures LLC and Andreessen Horowitz Fund LP [1].

Quirk’s goal was to “make invention accessible”. It created value by bringing together a community of inventors, filtering out the ideas, fine-tuning the design, manufacturing the product, and managing retail partners. It captured value by selling the product to retail partners like Amazon, Museum of Modern Art, Bed Bath & Beyond, Target…etc [2]. Its operating model include the process of filtering out the good ideas with algorithms screening and community voting, its manufacturing capability, and partnerships with the retailers.

Despite the early optimism of investors and media, Quirky filed for bankruptcy in Sep 2015 [5]. It failed because of the following reasons:

- Failing to connect with consumers: Quirky was unable to pick out winning inventions from thousands of crowd sourced ideas, leading to weak sales that could not cover the high development cost. Although the winning ideas were picked by a voting system used by the inventor community, the company failed to realize that the voters are NOT the customers. After all, it’s very different to click on an invention you like than to pay real money for it. Quirky lost its value proposition to since each product has its own target customers. Quirky also didn’t measure whether each product addressed a real consumer need, and if the consumer is willing to pay a certain amount for it. A representative example was a set of wheels that could turn any object into a remote-control car. The company had spent over $800,000 developing the products, which never made it to store shelves [2].

- Unable to attain scale in manufacturing: Due to distribution limit, demand uncertainty, and manufacturing capacity, Quirky was unable to reach scale and save costs in manufacturing. Many of the innovative products were unprofitable due to these high fixed costs.

- Quality control [3]: Quirky could pull off simple consumer gadgets like cross-over iPhone case or cord keepers, but it couldn’t live up to the quality expectations for more complicated products such as household appliances or smart connected products. Reviews on Quirky’s site suggested customers were frustrated that products broke quickly or never worked [7].

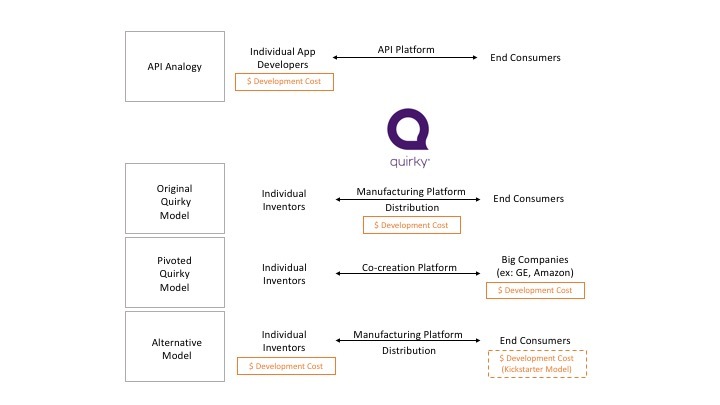

Quirky tried shifting to a corporate partner strategy by signing with large companies such as Mattel, Amazon and GE. This strategy was designed to help Quirky innovate while the partners took on the inventory and working capital risk. Kaufman wanted to take advantage of a new type of innovative process, where companies tap into communities that have expertise and ideas. It’s analogous to how companies build apps today using APIs to access different services from different vendors. In Quirky’s case it was the API [8].

However, the pivoted model would have several problems. It’s unclear how much these big companies REALLY need to “crowd source” ideas. With API and Kickstarter, the crowdfunding model brings the value of variety to the end users, who they are familiar with. These big companies produce complicated machines with specific technology that fits into the company portfolio and core competencies with highly paid talented workers. So how much value can the crowd sourced ideas bring? Second, Quirky used to offer a manufacturing and distribution platform to individual inventors who didn’t have access to these resources, but the big companies have better manufacturing and distribution platforms than Quirky. In that case, Quirky’s value as a co-creation platform, is irrelevant to these large firms.

An alternative that Quirky could consider, would be to go back to their core competencies, the two-sided platform that made invention accessible- offering individual inventors manufacturing and distribution platform. However, like an API, the individual inventors should bear the development cost to make the business model more sustainable. To make manufacturing affordable to individuals, Quirky needs to invest in breakthrough low-cost manufacturing technology such as 3D printing, or modular production, or other future technologies. Secondly, Quirky also needs to have an effective market testing method before going into mass production. Perhaps, another choice is to follow the Kickstarter model where the end consumers bear the production cost, and the demand is forecasted by pre-order before mass production.

Reference

[1] https://www.wsj.com/articles/invention-startup-quirky-files-for-bankruptcy-1442938458

[2] http://www.inc.com/christine-lagorio/what-happened-to-quirky.html

[3] http://www.theverge.com/2015/4/24/8488531/quirky-invention-powered-by-quirky

[6] http://fortune.com/2015/07/15/kaufman-quirky-wink/

[7] http://www.businessinsider.com/quirky-ben-kaufman-2015-4

Your last point makes me wonder if Quirky could become the overarching layer inventors use to track and manage their invention workflows, from initial demand measurement, usability testing to production. Seems like the problem they’re really looking to solve is how to make ideas successful for inventors without lots of resources. Quirkly could become the tool they plug existing point solutions into (ie your usertesting.com results or kickstarter data) to bring these ideas to fruition.

Megan, loved this post! So well thought-out – I really appreciated your analysis. I loved Quirky when it launched, and really wanted it to succeed, but see how the many issues you outlined above led to bankruptcy.

It is so true that online voters are not the same as consumers. I wonder if this is what makes platforms like Kickstarter and Indiegogo ultimately more viable in this arena. While the ideas aren’t being crowdsourced/voted on in the same way, individual ideas do get ‘voted on’ with dollar pledges – a much better way of actually assessing consumer demand. Your post also made me think about Bolt VC (here in Boston), focused on hardware. Since the technical issues were often an obstacle, I wonder if individual idea inventors/owners could have partnered with a hardware startup incubator, and benefited from their expertise. Alternatively, both Bold and Kickstarter/Indiegogo may be more sophisticated and market-robust manifestations of Quirky’s main thesis.