Polyvore: Consuming Traditional Fashion Retailers

A post analyzing the impact of social commerce site, Polyvore, that has emerged as a digital winner by disrupting traditional e-commerce, the brick-and-mortar department store, and even major fashion publications.

Polyvore, founded in 2007, is a dedicated ‘social commerce’ platform that is disrupting how we discover, purchase, and style clothing and homeware. Polyvore users create collage-like, shoppable “sets” as inspiration for their wardrobes and homes by mixing and matching products from different online stores. All users, even those who do not create their own sets (like me), can browse sets for inspiration and click through to purchase items from the retailers directly from a set.

Polyvore also analyzes metadata so users can also see which sets and specific items are currently trending.

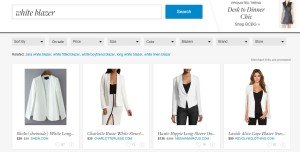

Additionally, Polyvore functions as a multi-brand, searchable catalog of fashion and homeware available for purchase across the web. For instance, after looking at some sets featuring summer fashion trends, I might search for “white blazer” and, after reviewing the search results, I might click through to purchase one from J. Crew.

Polyvore has emerged as a digital winner by disrupting traditional e-commerce, the brick-and-mortar department store, and even major fashion publications. The numbers speak for themselves – Polyvore has over 20 million active monthly users and this global community has created over 150 million shoppable ‘sets’. The company makes money via affiliate revenues and cost-per-click advertising. By seamlessly integrating ads into its site, Polyvore has been able to deliver a 6-to-1 return on ad spend versus 4-to-1 for Google and 2.6 to 1 for social media sites. Polyvore was privately funded by venture capitalists such as Benchmark Capital and Matrix Partners and the company was acquired by Yahoo in mid-2015 for around $200 million.

Polyvore democratizes taste-making, traditionally the domain of luxury fashion brands and magazine editors. It gives ordinary users the power to shape today’s trends and influence purchase decisions. Furthermore, by creating a platform where users can create sets as style inspiration that other users can browse and shop, Polyvore has disrupted the role of personal stylists at stand-a-lone brick-and-mortar stores like J. Crew and at department stores like Nordstrom. It further disrupts these traditional online and offline businesses by curating fashion and homeware in a fun, easily accessible way and on a major scale across the web. Rather than trek to different stores in a mall or bounce from webpage to webpage, you can search “blue and white rug” or “summer sandals” on Polyvore for a much faster, easier browsing and purchasing experience. On the retailer side, not only does Polyvore drive traffic and provide a superior return on advertising, but it allows them to identify and respond to nascent trends and see how consumers use their products alongside other brands by hosting contests for the best set featuring their product via Polyvore’s platform.

Social commerce, including Polyvore, only drives a small share of total online retail sales today but it would be foolish to ignore its growing importance. Social shopping generated $3.3 billion for the top 500 retailers in 2014, up 26% from 2013 according to the Internet Retailer’s Social Media 500. That growth rate is far ahead of the 16% overall rate for U.S. e-commerce. Facebook currently dominates the space but Instagram and Pinterest, which previously only drove brand equity, have realized the power of social commerce and both companies introduced shoppable posts this year. Polyvore, as a dedicated social commerce site with the twin goals of delighting the user and creating an easy-to-use, simple user experience, is still ahead of the curve. A (somewhat dated) blog post by Shopify in 2014 highlighted that while Facebook drove 85% of all orders from social media in 2013, Polyvore generated the highest average order value of all drivers of online traffic ($66.75).

Today, the company has successfully expanded into mobile via its Polyvore and Remix apps – 50% of all sets are created via the Polyvore app, and Remix, launched in April this year, is aimed at enhancing the user experience for those who use the site primarily to browse and shop. While it’s user base is significant and growing, it pales in comparison to major social networking sites. It is unclear how Polyvore will deal with the threat of Pinterest and Instagram – since we use these apps for other purposes daily, there is a significant threat users will migrate their browsing and shopping to these sites. Furthermore, Yahoo recently purchased Polyvore to tap into their expertise with “community-driven experiences and retailer-supported commerce” and it remains to be seen whether Yahoo plans to change Polyvore’s business model in any way and what impact those changes might have on its online community. For now, I’m betting on Polyvore as a digital winner that’s combining design, data, and dollars – what’s not to love?

Online and mobile commerce is definitely the future of retail! Although, it will be interesting to see where Polyvore is a year or two from now under Yahoo leadership. They are planning to manage them separately for now, but I could see the case for integrating with Yahoo Style. I can imagine multiple cases where Polyvore members could be challenged to recreate a look highlighted on Yahoo Style. A front end user could view images on Yahoo Style, click a link to “Get this look on Polyvore”, and then be taken to the Polyvore interface.

Right now Polyvore has a lot of traction in the fashion market. It is interesting to think of the different methods that platforms have used to commercialize curation. For example, Pinterest has just started to make some of their pins ‘shoppable’ in much the same way, where the user can click through and buy what is showcased. The value-add that Polyvore brings of course, is the curation of styles and looks across companies. Now, as more of these curated fashion sites enter the market (competitors that I can think of include BeachMint, The Coveteur, and PopSugar’s ShopStyle) new innovations are going to be required. I wonder what the next value-add offering will be, perhaps a stylist who sends recommendations based on the curated styles that you have liked in the past?

Great post and great company! I totally agree with Grace’s comment above and echo the same sentiment that Polyvore will need some new innovation if it plans to break out from the other competitors in this space; I’m also super curious to see how Polyvore will fare as Instagram and other social media platforms jump into mobile shopping. Although Polyvore certainly has the data available to draw insights from, I wonder if moving into the “personal stylist” genre goes a little too far out of their operational wheelhouse (e.g. managing inventory, delivering on customer experience). I could see the move pushing them into a completely different genre in addition to taking on a whole new set of competitors like StitchFix, a company that seems to be moving more in the direction of private label opportunities over curated third-party vendor styles.

This is a great post! I know that this post is about Polyvore but I’m wondering how you feel about the speed at which Instagram is rolling out their mobile shopping efforts. It seems like they are trying to figure out how to capture value from the opportunity that mobile shopping presents while staying true to the initial value proposition of the platform as a social networking/picture sharing application. This makes me more optimistic about other incumbents gaining a foothold in the space in the meantime.

This is a very interesting topic and post. I actually first became introduced to Polyvore through Pinterest, which are high quality, and have very strong engagement stats – clearly they are doing a fabulous job through this social media channel. Further, Instagram knows what its users want based on prior pins, so it’s a great way of aligning Polyvore’s value proposition with its chosen social media channel. In that, I am skeptical about how the company intends to leverage other social media channels in a way that effectively aligns with its value prop the way Pinterest can. I am also curious about what you think Polyvore should do next to lock in its position as a winner for the long-term.