PillPack disrupts retail pharmacy with medication to your doorstep

PillPack, a full-service pharmacy, was recently bought by Amazon for $1 billion and is now poised to disrupt the retail pharmacy market.

The disrupter

PillPack was founded in 2013 with one goal in mind, to disrupt the pharmacy industry. The brainchild of TJ Parker and Elliot Cohen, the idea of the company can be traced back to an MIT Hackathon Medicine competition in 2012. Parker is a second generation pharmacist that witnessed firsthand how many chronically-ill patients were struggling to deal with multiple medications that had been prescribed to them by numerous doctors. The idea for PillPack came from his experience and was simple: He wanted to create a technology that would allow for the consolidation of pills into a simple pack to ensure that patients were taking the right dose of their medication and at the right time. Although the idea was simple, as with all innovations in healthcare, Parker and Cohen knew it would be difficult to execute due to the disparate prescription information across the U.S. healthcare system [1].

Today, PillPack is a full-service pharmacy that delivers a better, simpler experience through convenient packaging, modern technology and personalized service [2]. Pillpack currently operates nationwide with hubs in Manchester, NH; Miami,FL; Brooklyn, NY; and Austin, TX. The key elements of the company include a proprietary software that has automated tasks such as coordinating with your doctor and insurance, scheduling your shipment, and packaging your medication by time of day. [3]. The kicker is that customers pay no additional cost for the service, they must only continue to pay their co-pays. In summary, with PillPack, patients are now able to receive their pre-packed prescriptions delivered to their home for free and have their medication pre-sorted.

Current state of retail pharmacy

The retail pharmacy industry has entered a period of intense competition driven in part by new tech startups such as PillPack, the transition to value-based care and M&A transactions. [4]. Retail pharmacy has historically been dominated by traditional retail players such as CVS, Walgreens, and Walmart. CVS alone currently commands 25% of the market through their network of retail stores and mail pharmacy services [5]. But the factors such as a large number of store locations, which in the past has allowed traditional retailers to dominate the market, have started to change. With the rise of e-commerce, consumers are now demanding even more convenience. Amazon has made it possible for consumers to receive pretty much whatever they desire at their door step. Now those consumers are asking, why can’t our medications be directly sent to us pre-packed and pre-sorted?

In addition, with the transition to value-based care, the focus of the industry has shifted to tracking and managing data with the goal of improving healthcare outcomes. [6]. The challenge with retail pharmacy, much like other parts of the healthcare system, is that due to disparate systems that are being utilized across the spectrum, it has been difficult to track medication adherence and drug spend. This challenge has provided an opportunity for new players to enter the market and supply the data that providers and health plans desperately need, such as a consolidated view of medications that have been prescribed to a chronically-ill patient, in order to track healthcare outcomes and make real-time adjustments when needed.

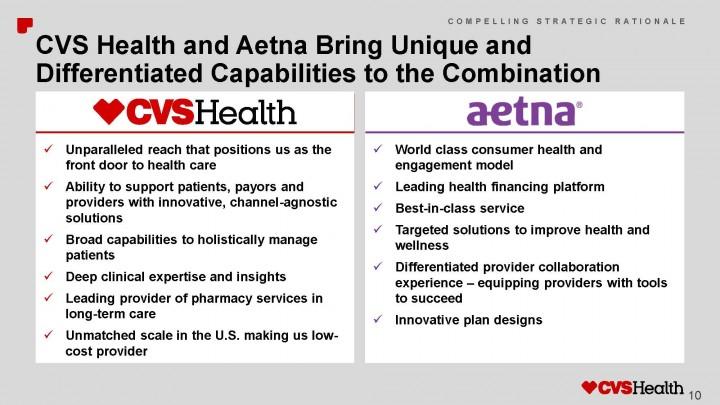

Value Proposition for CVS & Aetna Merger [13]

With the rapid disruption that is currently shaping the retail pharmacy industry, traditional leaders have turned to M&A to further increase their value proposition to consumers, providers, and payers. For example, CVS recently acquired Aetna with the goal of integrating across healthcare services and providing expanded services such as a competitive edge [7]. The transaction would also allow the combined company to simplify the current drug payment and rebate process by bringing everything under one roof. The question remains whether these transactions will be able to hold over new entrants such as PillPack.

Amazon with the help of PillPack disrupts another industry

The current winners of the disruption taking place in retail pharmacy are new technology startups such as PillPack that have focused on improving convenience for consumers, improving data collection for providers and payers and reducing the complexity of the drug supply chain, which stretches from the pharmaceutical company to consumers. This has been reflected in the high valuation that is being placed on said companies. For example, last summer, Amazon acquired PillPack for $1B, outbidding Walmart [8]. With their acquisition, Amazon now has the ability to ship prescriptions across the country and directly to customers, making them also a clear winner in the disruption taking place in the industry. Although the combination of Amazon and PillPack may make them a clear winner as of now, they still have a large number of barriers to overcome, such as the regulated nature of the industry and entrenched players that will likely not play nice.

In order for Amazon and PillPack to continue to disrupt the industry and create value, they must continue to focus on improving the convenience for consumers through a home delivery model that eliminates the need for consumers to regularly visit pharmacy locations to receive the medication they need. The value proposition for chronically-ill patients is especially high due to them having to balance multiple medications with varying doses and needing to make frequent trips to the pharmacy [3]. PillPack is able to generate revenue and capture value through reimbursement paid by health plans for their services and an additional dispensing fee. So by providing a convenience service for consumers, PillPack is able reap the benefits of being reimbursed by the health plans that cover those consumers.

Entrenched players react

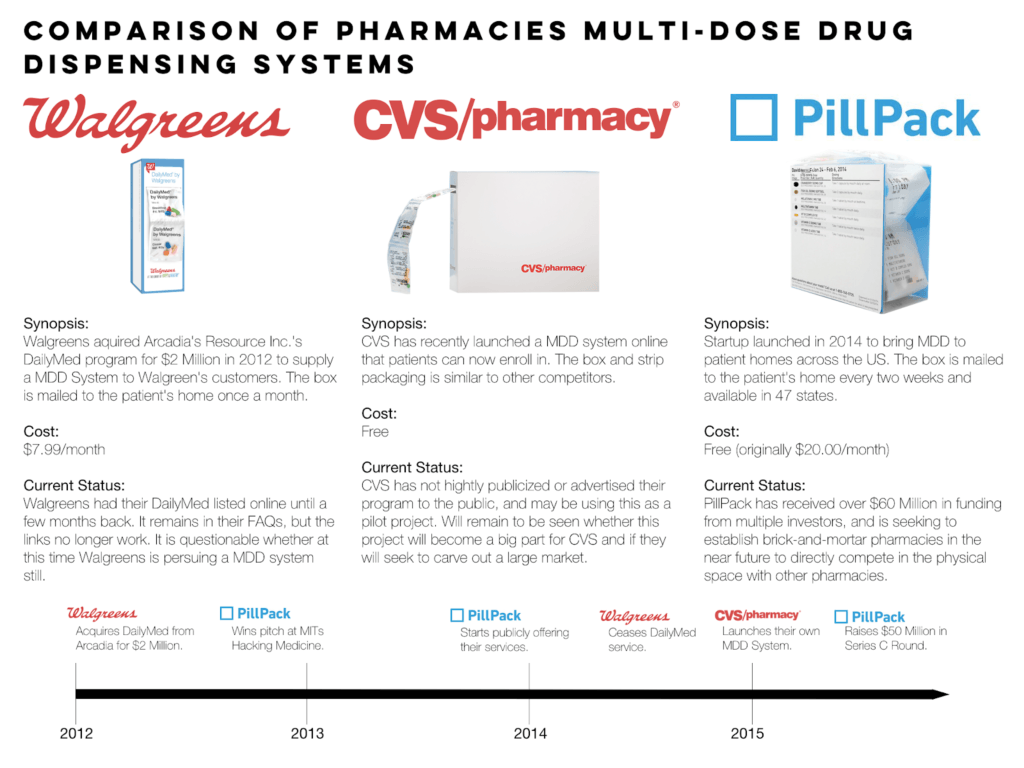

The losers of this digital disruption are entrenched retail pharmacies that currently provide pharmacy services to consumers through brick-and-mortar stores. With the advent of full-service solution providers combined with PillPack and Amazon, traditional retailers must either choose to radically transform or be disrupted. But retail pharmacy leaders don’t seem to be concerned in public. For example, Stefano Pessina, the CEO of Walgreens, said: , “The pharmacy world is much more complex than just delivering certain pills or certain packages” [9]. Despite the efforts of entrenched players such as Walgreens trying to shrug off new entrants such as PillPack and Amazon, Wall Street in particular has not been swayed with Walgreens, CVS, and Rite-Aid losing $11 billion in value after it was announced that Amazon was purchasing PillPack [10]. Retailers have traditionally created value by offering consumers a convenient location to pick-up their medication while handling the necessary coordination needed with providers and payers. They have in return captured value by adding a markup to the price paid to wholesalers, typically varying depending on the drug price [7]. Some entrenched retailers have however responded by replicating parts of the PillPack model. For example, CVS launched new multi-dose packs that are organized into packs and labeled according to the date and time you should take them [11]. As the old saying goes, if you can’t beat them, join them.

Multi-dose drug systems across the retail pharmacy landscape [14]

In conclusion, the combination of PillPack and Amazon has already disrupted the industry and will likely continue into the foreseeable future. However, entrenched players such as CVS and Walgreens are not standing pact and have responded by leveraging their balance sheet to acquire new assets and in some cases have looked to replicate some of the PillPack model. With the disruption taking place, there does seem to be one clear winner: consumers, who now have more convenient methods of obtaining their medication.

References

- Bloomberg.com. (2019). Bloomberg – Amazon PillPack. [online] Available at: https://www.bloomberg.com/news/articles/2018-06-28/amazon-s-pillpack-acquisition-all-started-with-an-mit-hackathon [Accessed 4 Mar. 2019].

- PillPack. (2019). Press – PillPack. [online] Available at: https://www.pillpack.com/press [Accessed 4 Mar. 2019].

- PillPack. (2019). How It Works – PillPack. [online] Available at: https://www.pillpack.com/how-it-works [Accessed 4 Mar. 2019].

- Wolterskluwercdi.com. (2019). Pharmacy Trends for 2018 | Clinical Drug Information. [online] Available at: https://www.wolterskluwercdi.com/blog/pharmacy-trends-2018/ [Accessed 4 Mar. 2019].

- Adam J. Fein, P. (2019). The Top 15 U.S. Pharmacies of 2017: Market Shares and Key Developments For The Biggest Companies. [online] Drugchannels.net. Available at: https://www.drugchannels.net/2018/02/the-top-15-us-pharmacies-of-2017-market.html [Accessed 4 Mar. 2019].

- Pharmacy Times. (2019). 5 Health-System Pharmacy Trends to Watch in 2019. [online] Available at: https://www.pharmacytimes.com/conferences/ashpmidyear2018/5-health-system-pharmacy-trends [Accessed 4 Mar. 2019].

- Toptal Finance Blog. (2019). Everything You Need to Know about the CVS-Aetna Merger. [online] Available at: https://www.toptal.com/finance/mergers-and-acquisitions/cvs-aetna [Accessed 4 Mar. 2019].

- Stevens, S. (2019). Amazon Buys Online Pharmacy PillPack for $1 Billion. [online] WSJ. Available at: https://www.wsj.com/articles/amazon-to-buy-online-pharmacy-pillpack-1530191443 [Accessed 4 Mar. 2019].

- U.S. (2019). Amazon to buy PillPack in potentially disruptive drug retail push. [online] Available at: https://www.reuters.com/article/us-pillpack-m-a-amazon-com/amazon-to-buy-pillpack-in-potentially-disruptive-drug-retail-push-idUSKBN1JO1RU [Accessed 5 Mar. 2019].

- CNBC. (2019). Walgreens, CVS and Rite-Aid lose $11 billion in value after Amazon buys online pharmacy PillPack. [online] Available at: https://www.cnbc.com/2018/06/28/walgreens-cvs-shares-tank-after-amazon-buys-online-pharmacy-pillpack.html [Accessed 4 Mar. 2019].

- Cvs.com. (2019). Multi-Dose Medications. [online] Available at: https://www.cvs.com/content/multidose [Accessed 5 Mar. 2019].

- Medium. (2019). PillPack: Acquired By Amazon for A Billion – Techstars Stories – Medium. [online] Available at: https://medium.com/techstars/pillpack-acquired-by-amazon-for-a-billion-a7a9ad2c87b7 [Accessed 5 Mar. 2019].

- Seeking Alpha. (2019). Where is the love for CVS?. [online] Available at: https://seekingalpha.com/article/4146341-love-cvs [Accessed 5 Mar. 2019].

- Bloomberg.com. (2019). Bloomberg – Amazon PillPack. [online] Available at: https://www.bloomberg.com/news/articles/2018-06-28/amazon-s-pillpack-acquisition-all-started-with-an-mit-hackathon [Accessed 4 Mar. 2019].

Super interesting, Solomon! I agree that consumers are the clear winners so far in this transformation, but do you think this will last? You mentioned that revenue is generated from health plan reimbursements, as this technology becomes more common and is integrated further will PillPack be able to maintain this revenue source? Additionally, could this may be similar to some of Amazon’s other moves where low prices are used to encourage adoption early on before prices are raised to increase profits?

What are the perceived effects on PBMs and drug manufacturers if amazon via pillpack enters Pharma distribution? for instance will PBMs need to pay amazon/pillpack the ‘product payment’ they would otherwise pay retail pharmacy chains? If so, will amazon’s entry lead to more negotiating power on the retail side (or less?), in a way that ultimately effects pricing for the consumer?