Old Clothes, New Strategies: ThredUP’s Evolution

ThredUP, the self-proclaimed “world’s largest fashion resale marketplace,” began as a pure multi-sided platform, matching sellers with buyers to trade their clothing directly. In an effort to create a better experience and more value for both sides, ThredUP pivoted to a consignment model taking more control over transactions (and, subsequently, more risk). The risk appears to be paying off as its latest “Resale-as-a-Service” launch allows brands and retailers to directly plug into the ThredUP platform to fuel their own businesses.

Introduction

ThredUP originally launched in 2009 as a peer-to-peer marketplace platform that facilitated men’s shirt swapping.[1] Faced with the classic chicken-and-egg problem, the company shifted its focus onto children’s clothing a year later.[2] It was a clever strategic move because it a) convinced hesitant participants because there was less stigma around children’s hand-me-downs and b) was a way to target moms to eventually re-sell their own clothes, thus increasing supply and opening the door to attract more buyers to the site driving indirect network effects. In 2012, ThredUP shifted to a consignment model becoming more vertically integrated allowing it to create additional value for sellers and buyers and increasing its appeal for more people to engage on the platform.[3]

Value Creation for Sellers and Buyers

ThredUP creates value for sellers by:

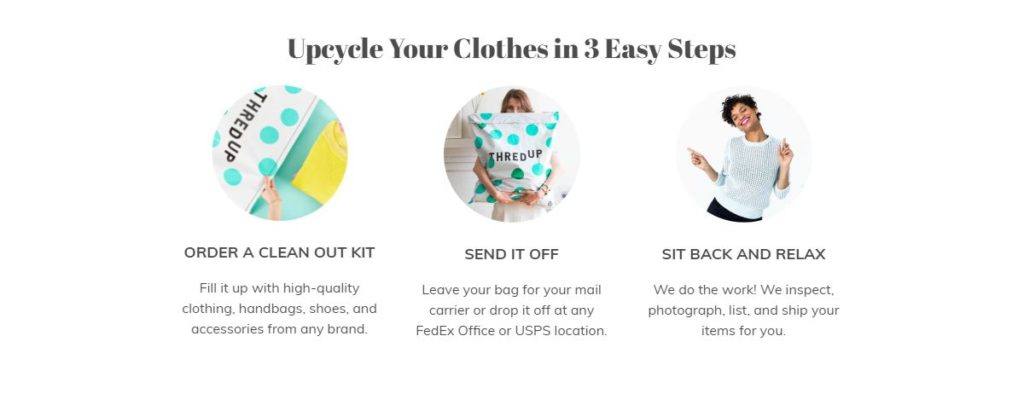

- Offering a convenient way to re-sell/donate/recycle clothing from home. Through the innovative “Clean Out” service, a seller requests a “Clean Out Kit” bag with pre-paid postage or prints a pre-paid label to use on a box they already have, fills it with clothes, then leaves it for the mail carrier to pick-up.

- Saving sellers time by doing the heavy lifting of selling and distribution. ThredUP professionally photographs items, writes copy, packs and ships items, and manages returns. Through its automation capabilities and logistics, ThredUP can do this at scale, processing up to 100,000 garments each day.[4]

- Providing more accurate pricing through data science. It leverages computer vision and AI to instantly determine resale value, factoring in estimated retail price, fair market value, age, quality, style, level of similar inventory already available, and features a dynamic pricing model that accounts for seasonality and high demand.[5] The seller still controls the item’s listing price. ThredUP’s payout calculator allows sellers to estimate the payout on their clothes.

- Payout optionality. Sellers may choose to receive cash, credit, or, instead of receiving a payout, opt for ThredUP to donate $5 per bag to a charity of the seller’s choice.

ThredUP creates value for buyers through:

- Largest online assortment of secondhand clothing. ThredUP carries 35,000 brands across multiple tiers and offers up to 40,000 new items daily. [6]

ThredUP distribution center. Source: forbes.com - Savings of up to 90% off retail prices.

- Reduced risk by ensuring quality and 100% authenticity. With strict quality standards and a 12-point quality check system, buyers can trust that the condition of the items are as described.

- Personalized shopping experience comparable to shopping for new items. ThredUP wants to “make the shopping experience indistinguishable from what it’s like to shop for new things.”[7] Through both the site and app, buyers can set preferences, filter and save searches and “favorites,” and receive recommendations based on history.

Resale-As-A-Service Platform

A most innovative feature of ThredUP is its recent “Resale-As-A-Service” (RaaS) platform that allows brands and retailers to plug into the marketplace through a loyalty program, online collaboration, and in-store pop-ups. [8]

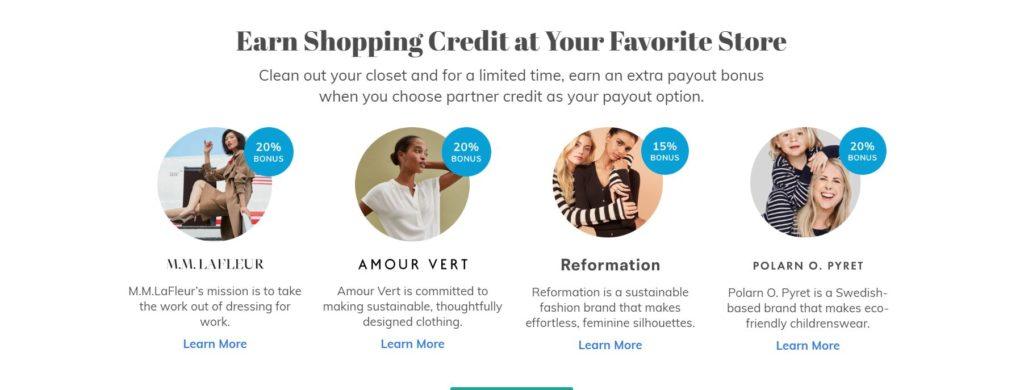

Through the loyalty program, sellers to receive payment in the form of a credit to spend with a brand partner (such as Reformation, a sustainable clothing brand) creating value for the brand partner in the form of customer acquisition and retention and drives brand loyalty. It creates incremental value for sellers when the brand partner offers a bonus (an additional 15%-20% on top of what ThredUP pays).

As an example of collaboration, Madewell, a brand popular among millennials and Gen Z, purchases its own brand’s jeans being resold on ThredUP and refurbishes them to sell in its stores.[9] This unlocks incremental value for Madewell from its own goods beyond the initial purchase. It also creates a way for the brand to offer jeans at a lower price point to consumers (although cannibalization is a risk) and elevates the brand as a supporter of sustainability and the circular economy.

In the pop-up store model, traditional department stores such as Macy’s partner with ThredUP to sell ThredUP goods in-house. The value to retailers is increased foot traffic through a) offering brands that they don’t already carry without inventory risk and b) the “sustainability play” to appeal to environmentally conscious consumers.

ThredUP captures value primarily through commission when an item is sold. However, it is increasing its potential to capture value through the data it aggregates. Data can be mined to guide consumers to purchase new products that are more durable and have the highest ROI, guide brands on the best items to produce with sustainability in mind, and draw insights on seller/buyer behavior that can be segmented in a myriad of ways. In the meantime, ThredUP continues to scale powered by $300M+ in total funding and a valuation of $670M.

[1] ThredUP, “About Us,” https://www.thredup.com/p/about, accessed October 2019.

[2] Cleverism, “Careers at thredUP,” https://www.cleverism.com/company/thredup/, accessed October 2019.

[3] Julia Hanna, “Three-Dimensional Strategy: Winning the Multisided Platform,” HBS Working Knowledge, January 23, 2013, https://hbswk.hbs.edu/item/three-dimensional-strategy-winning-the-multisided-platform, accessed October 2019.

[4] Gabriela Barkho, “Why CEOs of Direct-to-Consumer Brands Are Excited to Open Stores,” Observer, October 4, 2019, https://observer.com/2019/10/brookline-thredup-framebridge-direct-to-consumer-stores/, accessed October 2019.

[5] ThredUP, “Community Update Payout System,” https://www.thredup.com/bg/p/community-update-payout-system, accessed October 2019.

[6] Walter Loeb, “ThredUP Partnerships Show Macy’s And J.C. Penney Want to Capitalize on Secondhand Fashion Trend,” Forbes, August 19, 2019, https://www.forbes.com/sites/walterloeb/2019/08/19/macys-and-jcpenney-sells-used-clothing-from-threadup/#561bb673225c, accessed October 2019.

[7] Evan Clark, “Digital Forum: ThredUP Goes for Big-Time Growth,” WWD, September 26, 2019, via Factiva, accessed October 2019.

[8] Glenda Toma, “ThredUp Unveils New Platform And $175 Million In Funding As Resale Trend Accelerates,” Forbes, August 21, 2019, https://www.forbes.com/sites/glendatoma/2019/08/21/thredup-resale-175-million-funding/#ff3ae7abeb7d, accessed October 2019.

[9] Daphne Howland, “Madewell teams with ThredUp to sell secondhand jeans,” Retail Dive, October 15, 2019, https://www.retaildive.com/news/madewell-teams-with-thredup-to-sell-secondhand-jeans/565039/, accessed October 2019.

A very interesting article. There are similar companies trying to pierce into resale fashion and Thred-up seems to do a good job at it. I particularly find the payout as a percentage of listing price to be a brilliant idea. Thank you for sharing!

Thanks for this interesting piece. I think this platform provides also an indirect value for citizens, reducing the fashion environmental impact – or it does its share in this direction at least.

What is not clear to me here is how the volume of stock will evolve, since ratio inbound/outbound seems very low, isn’t it? If ThreadUP collects garments before they have been sold, I’m inclined to believe the stock continuously grows. Is this increasing the complexity of the matching system? How many clothes need to be dismissed to safeguard platform’s operations? Is this a limit to scale?

This is an interesting post!

I recently visited my cousin’s house in NY. She had just ordered a new box of clothes for my one-year-old nephew, as he no longer fits into his clothes. She told me about the number of times she had to buy new clothes while the previous one was still in a really good state. I can see why this platform focused on children’s clothing. I can definitely see it being popular with new parents.

Despite the modern view of ever moving towards shopping online, most people still prefer buying clothes at a brick-and-motor store. I really liked their model of using a departmental store like Macy’s to showcase their goods at a store. It will be interesting to see how this model works as they continue to scale up.

Great post! I like this business model – particularly that ThredUP has found creative ways to partner with other retailers. I think consumers are becoming increasingly aware of the environmental impact of fast fashion, and retailers need solutions that signal they also care about the environment. ThredUP seems well positioned to help retailers in this regard, whether that means selling some of the clothing they have collected back to retailers, or simply selling retailers their data.

This is a very interesting platform to remedy the disconnect between buyers and sellers. The value is evident on both sides. Buyers who normally would struggle to find channels for sale are now able to conduct sophisticated operations. On the other hand, buyers who want to buy refurbished clothing for price or environmental reasons have a secure way of doing so. I’m curious to see how ThredUp will compare to Rent the Runway which also aligns with a value proposition of low pricing and environmentalism. Moreover, how does ThredUp currently market themselves? Their success seems to be quite dependent on the trustworthiness and engagement of both buyers and sellers. Moreover, how they market themselves and cultivate the right culture is of crucial importance.

This is really cool to read about; thanks for sharing! I love Thredup’s strategy to overcome the chicken-or-egg problem by first targeting children’s clothing. That makes perfect sense.

Awesome write-up on how Thredup is providing value to buyers, sellers, and retailers. The pricing structure is really interesting to see – I can see how Thredup hopes to capture more value in return for doing most of the heavy-lifting for sellers, while incentivizing them to sell high-quality clothing through the platform still. How has that been working for them in practice? Do you see a lot of low-quality/outdated clothing on sale on the platform, or is there a good mix? Is there a certain perception of what kind of products are most often found/sold on Thredup?

Also, I would love to use Thredup’s ML algorithm the next time I go thrifting…