Netflix: Reinventing Hollywood with Data

A tech company is upending traditional Hollywood with big data.

This past summer I had the pleasure of working at a company that I’ve admired for a long time – Netflix. In a world that is dominated by “creative” excellence, Netflix is trying to take creative out of the equation and focus on a data-driven approach to decision making in Hollywood. Although everyone in Hollywood claims to be making decisions based on data, no one is doing it to the extent of Netflix.

Netflix’s Data Approach

We all know Netflix as the DVD-by-mail company with the little red envelopes. Visionary Netflix CEO, Reed Hastings, predicted that this business model would be a thing of the past and completely shifted the business model towards online streaming – its primary business today. But how did he do this successfully? The answer of course is data…and lots of it.

After working at Netflix over the summer, the takeaway that stood out to me the most was that Netflix is not a media company…at least in a traditional sense. Netflix is a tech company and their product just happens to be media-related. To be even more specific, Netflix is a big data company. Netflix has nearly 94 million subscribers around the world who currently stream on average 125 million hours of content a day. But they aren’t just focused on simple streaming data. Netflix also collects data on when you watched, where you watched, how you watched, exactly when you stopped watching in the middle of an episode, what you searched for, how you browsed and TONS of other data. In aggregate, this leads to Netflix collecting TRILLIONS of data points! If this isn’t big data, I don’t know what is.

Value Creation Through Data vs. Competitors

Analytics, such as streaming data, gives Netflix insights into their viewers like no other traditional media company can get. Analyzing streaming data creates value for Netflix by letting them know exactly what viewers are watching and how popular certain shows are on the service. This allows them to negotiate effectively and figure out how much they should pay for content. If a particular show is driving a lot of usage on the service, then they know they can dramatically increase the amount they pay for the next season and still get a strong ROI and vice versa.

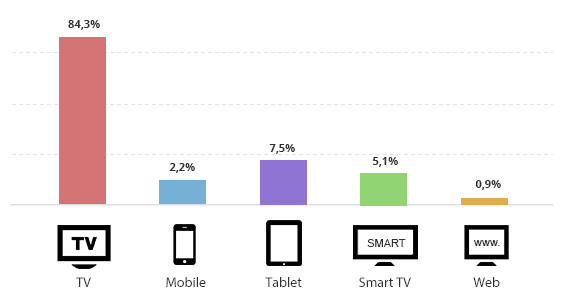

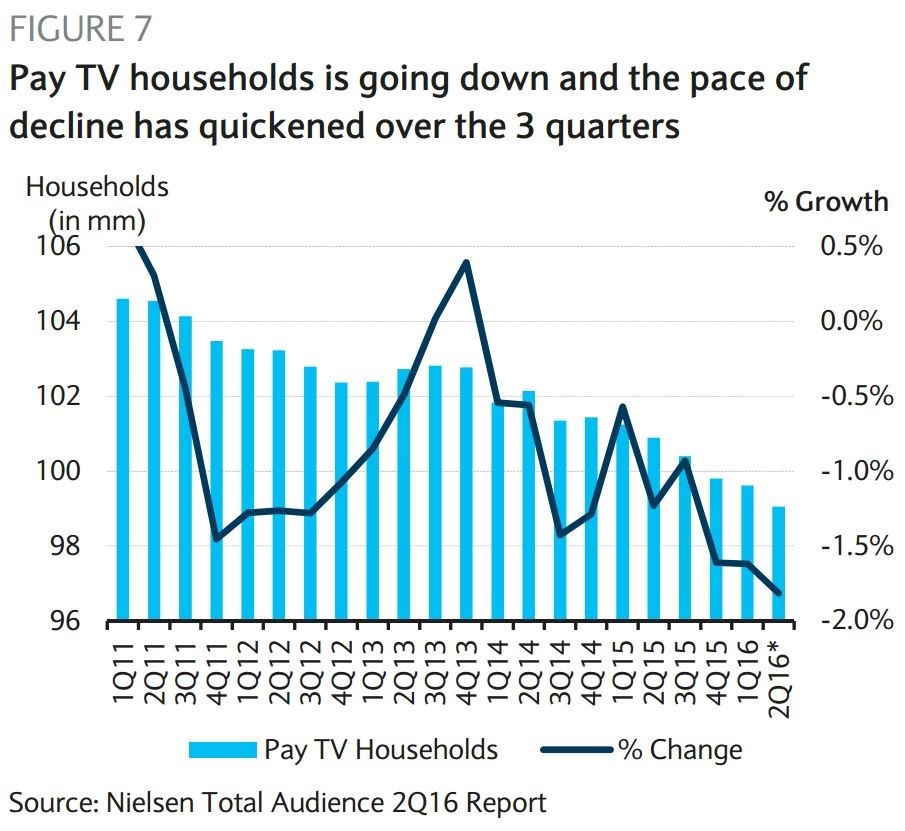

In contrast, cable TV networks have to rely on Nielsen TV ratings to understand how well their shows are performing. The problem with this is that TV ratings are estimates that are calculated using a small portion of the broader population. Of the 100+ million TV households in the US, Nielsen is collecting data on approximately 50,000. That means they’re collecting data on less than 0.1% of the population! And though they consider it to be statistically significant data, wouldn’t you rather know exactly who’s watching what at any given time? That’s the value creation that Netflix has that no TV cable network can match. On top of that, TV viewing is becoming fragmented on non-TV devices and Nielsen is still figuring out how to capture viewership on all other devices effectively.

Content Viewership Becoming Increasingly Fragmented Across Devices

Value Capture vs. Competitors

Netflix’s data not only adds a lot of analytical value, but they are also able to capture it by making better business decisions than their competitors. For example, after collecting data for years on their streaming service, Netflix decided to enter the world of original content – effectively going from content distributor of long-tail content to competing with the biggest TV networks in Hollywood, including HBO. Their first two original series were House of Cards and Orange is the New Black. Both were outstanding hits and this was no coincidence. Netflix’s data told them political dramas were doing well and that users particularly enjoyed content from Kevin Spacey. Thus, they had conviction like no other TV network would in this production. In fact, they were so confident that they commissioned two seasons of House of Cards without even producing a pilot – something completely unheard of in Hollywood! Capturing this blockbuster series required them to outbid both HBO and ABC. This would not have been possible without the precise data they had available to them.

Future Industry Challenges and Opportunities

Due to the lack of similar data for legacy media companies (networks and pay TV providers), we are seeing many of them suffer. Firms such as Viacom are finding it difficult to predict what audiences will want to watch on TV. As a result, their ratings are suffering and they are losing advertising revenue. If a new method of gathering more accurate data is not developed, they will continue to suffer and the beneficiary will be Netflix. Netflix is also extremely secretive of their data because they know how valuable it is and refuse to share it with anyone.

The real opportunity here is for Netflix to give the people what they want. Historically, creatives have held this power in their hands when deciding what shows and movies to greenlight. Netflix is actively trying to cut out creatives in the decision-making process and letting their users decide through their viewing habits. In a sense, every time you watch something on Netflix, you’re helping decide what they will make next.

Sources:

https://www.wired.com/insights/2014/03/big-data-lessons-netflix/

https://blog.kissmetrics.com/how-netflix-uses-analytics/

https://www.linkedin.com/pulse/amazing-ways-netflix-uses-big-data-drive-success-bernard-marr

https://thenextweb.com/insider/2016/03/20/data-inspires-creativity/#.tnw_ppsHYJ1X

http://variety.com/2017/digital/news/netflix-250-million-hours-1202010393/

Nupur – Netflix’s data machine has continued to blow my mind. Your mention of House of Cards and some of their other original content, produced with certainty, is clearly a game-changer for the industry. Do you happen to know if Netflix only uses its own proprietary data to make these assessments? Or is it possible that they also ingest information from rating agencies, coupled with reaction feeds on Facebook and Twitter? I wonder how accurate a single data source is for making these sorts of predictions, but in this case it makes sense.

Furthermore – do you see a world in which Netflix spins out an arm to compete with the likes of Neilsen? Or do you foresee them always holding this data close to their chests? It could be lucrative for them in two ways: 1) for data licensing, but 2) for third-party producers to create content people will like, which in turn can be shown on Netflix, attracting more subscribers.

I imagine Netflix will keep this data close to them for now. However, I do see a world where they would release this data to content producers in a select way. Not provide all data, but selectively the data that is relevant to the show they are working on. Because I agree this data could help producers create better content.

Super interesting, thanks for sharing! I knew that Netflix leveraged a lot of data in their recommendations engines but didn’t appreciate the extent to which they used it to license content from other studios and commit new original content. Amazing how they could commit to two seasons for House of Cards without even having a pilot. I agreed that they have a huge advantage over traditional TV however I do wonder how the market will shape up between Netflix, Amazon Video (which is also incredibly strong in consumer data and analytics, and a reputation for burning cash) and, to a lesser extent, Hulu.

Thanks Noops – great read! I’m curious about how Netflix models value capture as it relates to acquisition and usage. I get that knowing data such as political dramas are popular is useful but how does Netflix know that a political drama is powerful enough to drive new subscribers or keep current subs? In other words, the Nielsen equivalent data is extremely useful to cable companies because (as you mention) they sell ads. The math is very linear; more eyeballs = higher price for ads and this informs what they can spend on the content. But Netflix has neither ads nor dynamic pricing (i.e. you don’t pay more for House of Cards), so how does it really know the ROI on any show? Do a user’s subscription dollars get prorated to each program they watch based on time spent? But what if only one show is motivating their subscription and the others are just “nice to have”?

Interesting post, thanks! I think what makes Netflix stand out among all the Hollywood players who claim using big data is that it integrated the approach in content production. I wonder if you know any ‘inside information’ regarding the detailed mechanism. I guess to help pick up leading actor is a low hanging fruit, would be great to hear more about other specific samples for big data tactic application in production.

Hi Napur! Great post. I think what’s curious is that Netflix doesn’t do pilots, but I’m not so sure if that’s a function of its confidence in its data analytics or more due to a company philosophy. As you know, Netflix doesn’t do pilots because its research has shown that pilots are not an accurate indication of whether viewers will like a show; according to Netflix, it can take several episodes into a season before viewers become attached to a series. Thus, Netflix doesn’t do pilots because it believes viewers need access to a show’s entire season, and not necessarily because Netflix strongly believes viewers want to see a show on political drama. Netflix won’t pilot a show regardless of what the data suggests is a popular genre among viewers.

What are your thoughts? You obviously know much more than me!! I’m just basing my thoughts on this article http://www.businessinsider.com/amazon-uses-pilots-to-test-its-original-shows-2016-2.

I also worked at Amazon this past summer and was/am fascinated by Amazon Video, which in contrast to Netflix, believes heavily in pilots. I would postulate (and welcome debate!) that Amazon Video collects similar information to Netflix. Despite this, Amazon Video believes that pilots provide useful data about customer feedback, and that testing and reiterating is a better way to get a strong overall ROI across multiple shows (it seems Netflix is more focused than Amazon on per show ROIs). How did you all view Amazon Video as a competitor? How did you view Amazon Video’s approach to using data? Very curious to hear what you think!

NP – great post (as always). Clearly, Netflix has done an amazing job at leveraging data to create original content for users and differentiate itself from traditional studios. Would love to get your thoughts on the recent announcement that Netflix will soon be leveraging its data to create alternate endings for different users based on their Netflix profile and past viewing preferences. This seems like a pretty fundamental shift away from video-based storytelling as we know it, and a move away from collective content-based experiences that speak to current cultural issues or important shared themes. How do you view this move?

Great post! Thank you for sharing. The use of data in this industry is a very interesting subject. I wonder if Netflix will be able to cut down on the stigma around it amongst creatives. They need to walk a fine line of using data to decrease risk of new projects, while not intervening too much as to scare creative talent away. It’s also still unclear to me how useful the data really is. I mean most in the industry would have agreed/predicted a political thriller with Kevin Spacey and David Fincher attached would be a hit. Also, since they don’t share their data, it’s unclear how big of a hit each of their “hits” really is. Their model is just different so that this doesn’t matter (aka not ad-based). Data usage to improve the platform user experience makes a lot of since (i.e. the recommendation model) – but using data to actually create content is a whole different beast, and I’m not sure the current model is sophisticated enough to create hits significantly better than an smart executive could.

Great post NP! Netflix has indeed managed to build a strong competitive advantage thanks to their data in order to recommend and even produce the right content to the right consumer. Despite their own content production, Netflix is however still dependent on incumbent content producers for the majority of their content – I wonder how these incumbents will retaliate and wether they could use their content leverage to either capture more value from Netflix, or to compete directly through alternative streaming services. Looking forward to see how this competitive dynamic will play out!

Thanks Nupur! What surprises me in these cases is the idea that our preferences “persist”. In other words, the fact that people like political drams and Kevin Spacey means they’ll like the next political drama and Kevin Spacey piece. But wouldn’t one expect that at some point we’ll get tired of political dramas and god forbid, Kevin Spacey? Why is it that we are willing to watch the same sorts of things over and over again instead of seeking newness, and how will Netflix produce truly original content if it relies on our past preferences?