Monzo: A digital offering that has traditional UK banks scrambling

Monzo has positioned themselves as a digital-only alternative to traditional consumer banks. Their use of technology has allowed them to offer greater convenience, transparency and service – all at a lower cost. They’re winning, and they’re likely to continue doing so.

Introduction: Big-Bad-Banks

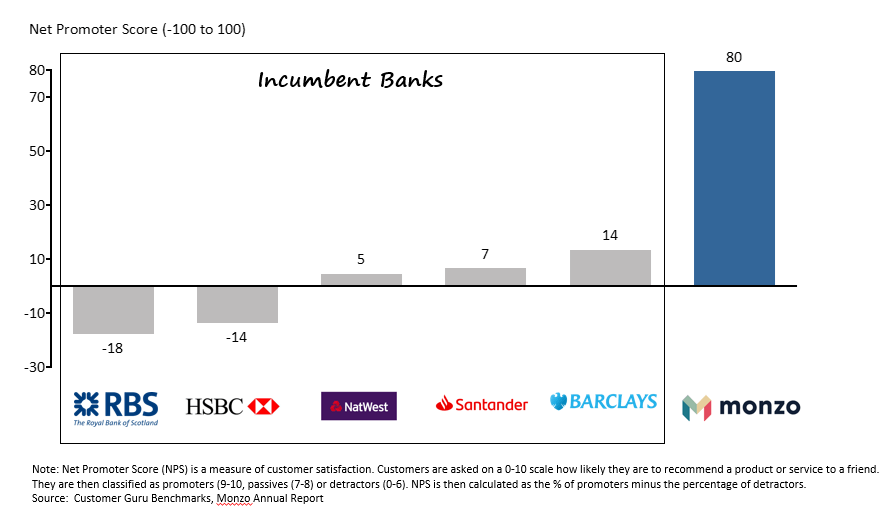

For many years, UK consumers have complained about traditional banks. These incumbents, per Figure A, continuously score negative or near negative customer satisfaction scores (“NPS”). They’re known for charging excessive fees, having outdated in-person branch banking and providing lackluster digital services.

Figure A–Net Promoter Score[1]

Enter Monzo

Monzo is a digital-only bank that was founded in 2015. Unlike incumbents, it doesn’t have any physical branches – and instead invests resources to improving its technology. With Monzo, customers can open an account within minutes, get instant payment notifications, automatically save into ‘savings pots’ and easily split bills with friends. Take a look at Monzo’s first-ever TV ad:

Figure B–Monzo Ad

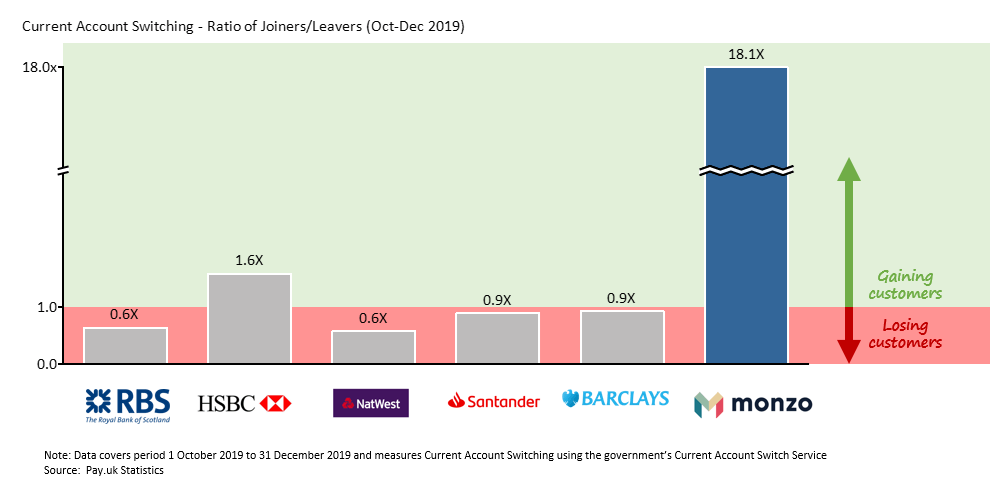

Monzo has caused a splash in the UK banking sector. It now has >3M UK customers, meaning 1 in every 20 adults in the UK now banks with Monzo[2]. A significant portion of these customers have been acquired from incumbent banks – per Figure C: RBS, Natwest, Santander and Barclays all experienced customer contraction in Q4 of 2019, while Monzo grew significantly.

Figure C–Account Switching[3]

Creating Value: Use of Technology

Convenience

Monzo identified customer pain points with traditional branch banking and sought to address them with technology. One pain-point is account opening – where traditional banks cause significant frustration with processes sometimes taking weeks and multiple branch visits. Monzo designed a fully digital process for account opening. Customers download the Monzo app, upload a copy of their ID and then take a selfie-video saying “My name is….”. For these checks, Monzo has partnered with Jumio, which uses artificial intelligence algorithms to detect fraud from the ID copy and selfie-videos[4]. As a result, a Monzo account can be opened within minutes.

Transparency

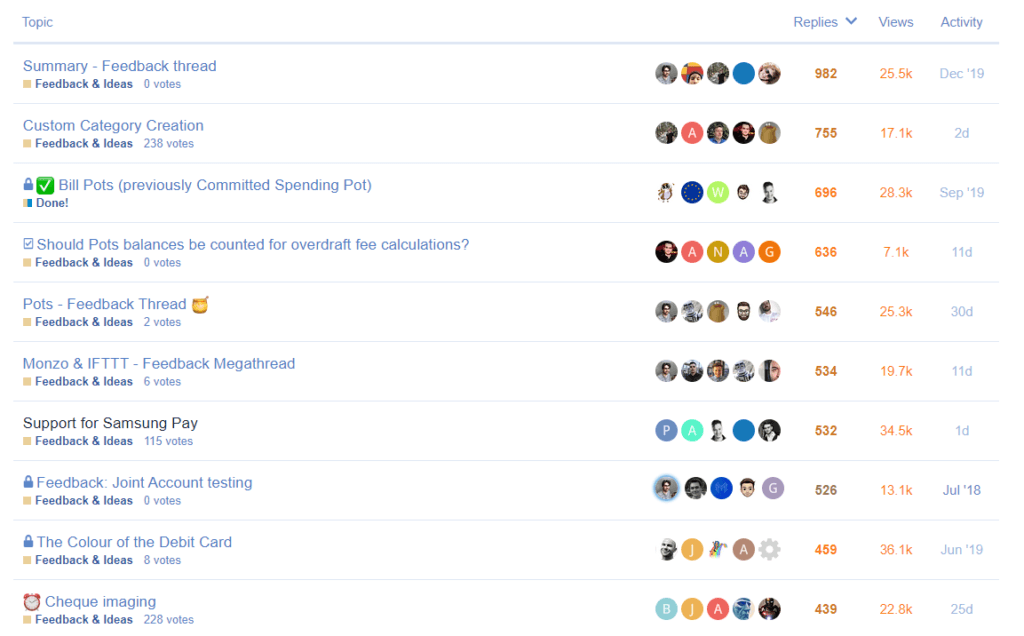

In contrast to the incumbent banks, Monzo emphasizes openness with its customers. It has an active online community forum, with >50,000 participants. Monzo uses the forums to keep customers up-to-date with new developments and to allow customers to socialize. Separately, the forum is also used to collect feedback on new feature ideas – asking customers to ‘vote’ for their favorite ideas (see Figure D). A great example of this transparency was Monzo’s recent US launch: they made their product development roadmap public (see here for Trello board), asking customers for feedback on what features they want to see first.

Figure D–Community Forum, Feedback Section[5]

Customer Service

Monzo has also invested heavily in customer service technology to ensure it delivers a superior experience. They built ‘Monzo Chat’ a bespoke software that allows customers to instantly chat in-app with a representative 24 hours a day, 7 days a week[6]. To support this, Monzo created a Las Vegas office to ensure it could provide out-of-hours support to the UK. This digital customer service is a major driver of Monzo’s higher NPS.

Lower Cost Base

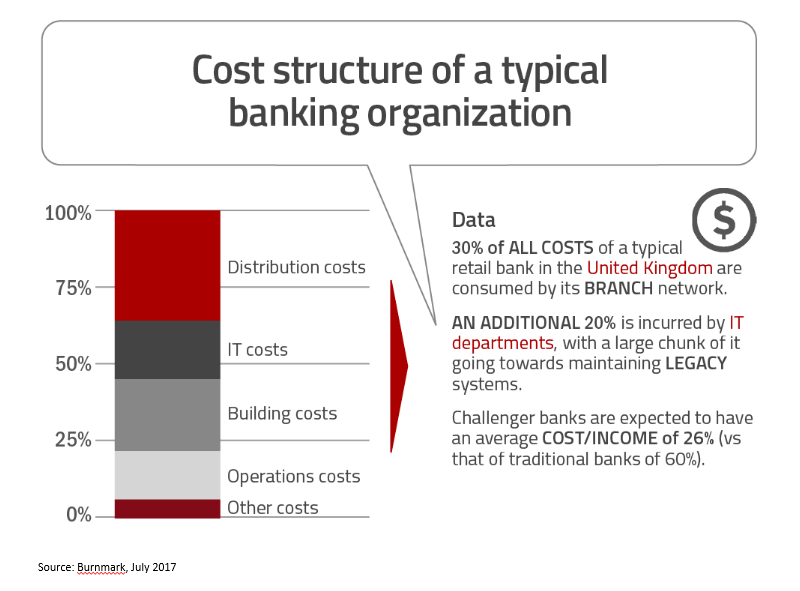

Given its digital-only model, Monzo has a significantly leaner operation vs. traditional banks. Traditional banks’ branch networks account for c.30% of their cost base, with an additional 20% for IT – a large proportion of which is spent on legacy IT systems (see Figure E). Given Monzo has no branches and is not burdened with legacy IT, they can use this cost advantage to further invest in their technology.

Figure E–Traditional Bank Cost Structure[7]

Incumbent Reponse: Imitation, the Ultimate Form of Flattery

Incumbents have struggled to combat Monzo’s rise. Many have tried to invest in their own technology, but their size has meant the speed of progress has been slow. Even today, nearly 50% of UK consumers say that they’re dissatisfied with the digital services of their current bank[8]. In an effort to remain cost competitive, incumbents have closed one-third of UK banking branches since 2015, equating to 3,303 closures[9].

Some incumbents have also tried to imitate Monzo’s model. RBS reportedly considered an acquisition of Monzo in 2017, but scoffed at the price tag. Between then and now, RBS has spent £100m to build its own digital-only bank, Bó, which only launched in November 2019 after 2 years of preparation. However, by all accounts, it’s not going very well: 3 months after Bó’s launch, Mark Bailie, the Project Lead, left the business[10].

Conclusion

Monzo is a clear winner over UK incumbents. It has disrupted the traditional branch banking model and used technology to offer a vastly superior experience to customers. I believe that incumbents aren’t well-positioned to catch-up anytime soon, so Monzo is here to stay. As mentioned, Monzo has recently launched in the US – if I were a US incumbent, I’d be very worried.

References:

[1] Customer Guru. “Track Segmented Customer Satisfaction”. Retrieved from: https://customer.guru/

[2] Monzo Website. “3,000,000 people are now using Monzo!”. 16 September 2019. Retrieved from: https://monzo.com/blog/2019/09/16/three-million

[3] Pay.uk. Current Account Switch Service Dashboard. Retrieved from: https://www.wearepay.uk/wp-content/uploads/2020/01/20200123-Current-Account-Switch-Service-Q4-Dashboard-2019.pdf

[4] Jumio. “Jumio, Monzo Partnership Grows to New Heights”. 2 May 2019. Retrieved from: https://www.jumio.com/about/press-releases/jumio-monzo-partnership-grows/

[5] Monzo. “Monzo Community Forum – Feedback & Ideas”. Retrieved from: https://community.monzo.com/c/feedback/35

[6] Monzo. “Introducing Monzo Chat”. 2 November 2018. Retrieved from: https://monzo.com/blog/2018/11/02/monzo-chat

[7] Mohan, Devie. “5 Reasons Why Consolidation of Fintech Ecosystem May Be Inevitable”. 11 July 2017. Retrieved from: https://thefinancialbrand.com/66307/fintech-digital-banking-consolidation-trends/

[8] Tesfaye, Mekebeb. “Banks that fail to deliver high-quality digital experiences risk significant customer attrition”. 11 April 2019. Retrieved from: https://www.businessinsider.com/uk-bank-customers-say-digital-services-key-to-loyalty-2019-4

[9] Gemmell, Katherine. “More than a third of bank branches axed in past four years”. 27 September 2019. Retrieved from: https://www.ft.com/content/c1164d2e-e11c-11e9-b112-9624ec9edc59

[10] Megaw, Nicholas. “Head of RBS’s digital lender Bó to step down”. 21 January 2020. Retrieved from: https://www.ft.com/content/ed00b3d4-3c57-11ea-a01a-bae547046735

I had not heard of Monzo before, but I am going to check them out now — thank you, Colm! I love that Monzo seems to focus on the customer experience with the community forum and feedback section. One of the major pain points for me with traditional big banks is their slow speed of response; I hate being put on hold for an hour in order to talk with a customer service rep who can address my concern in 5 minutes. Bank of America and other banks have tried to address this pain point with smart bots that can help answer basic questions, but having a structured feedback forum is on another level. I do wonder how that might scale once Monzo becomes even bigger though.

I agree with you that incumbents are not well-positioned to catch up with Monzo soon. However, the bigger challenge I see for Monzo is newer players who might be able to copy their model. They do seem to have the first mover advantage in this space, but the barrier of entry also appears quite low for a similar-minded company to take up market share.

Great article! As we learned for Havas case, the innovation can happen much faster and smoother on the clean slate rather than the existing platform. In that sense, the incumbents will have some difficult time to come up with solutions which might match up with Monzo’s. I strongly agree with customer experience improvement that led Monzo’s success. Every organization says “customer-centric” strategy, but, in reality, rarely executes it.

One concern for Monzo would be the scale. Because it leverages technology and mobile, Monzo might struggle to expand its customer base through older (and richer) generation who might not savvy enough and have little credibility on mobile-solution. (I don’t have data, but) On top of that, Monzo might not have advantages in loan service, which is important revenue source for banks, given the scale. As long as incumbents hold strong positions in the mortgage market, Monzo’s growth in the US market will be limited.

Good point on adoption with older generations!

I believe Monzo can tailor their digital solution to suit some of these people, while still maintaining their digital model. As an example, I read that Monzo are partnering with ‘PayPoint’, which has locations in convenience stores across the UK, to provide cash depositing services (article below). This offering would be helpful for older generations that would typically go to bank branches to deposit cash. However, it’s true that some older people will still never trust a digital bank!

Article: https://monzo.com/blog/2018/11/21/deposit-cash

Colm, this is a fantastic post. I’m glad that you’ve highlighted the meteoric rise of Monzo in the UK. I set up Monzo a couple of years ago while in the UK, and the best part of the platform for me is the budgeting tool. Monzo’s analytics tell me what I spend my money on and I am able to easily set aside money into the “Pot” so I save instead of spend. I think Monzo could be huge in the US since I feel there is nothing quite like it.

I do think one of the things Monzo is lacking, however, is international money transfer. In this respect, I feel the platform faces stiff competition from Revolut and Transferwise. Granted, the purpose of Monzo is different, but with its transatlantic presence now, I feel this could be a great opportunity.

While the lack of physical branches may be a cost-saving advantage for Monzo, I feel some older generations may feel put off from this approach, since the comfort of knowing you can walk into your bank branch with an issue gives you a more personalized experience. However, that may just be me being old fashioned.

Totally agree on the international transfers. I would love a future where I could transfer money between my UK Monzo account and my US Monzo account without friction (and getting the best possible rate on conversion). I wonder would they be willing to that though given the FX risk. The other alternative is to partner with someone like Transferwise.

Would love to talk about Monzo more!

Monzo seems to be extremely customer-centric and that is clearly attracting retail customers to the product. I wonder what Monzo’s product expansion strategy looks like. By this I mean, in addition to acquiring more retail customers in the UK, USA, and potentially in other countries, I wonder if they are looking to expand to corporate banking. Their technology advantage has clearly helped them disrupt the retail banking sector and provide a more cost-effective and user-friendly service and I am curious if they can sustain that technology advantage to serve corporate clients. Of course, the needs of corporate clients would be drastically different but after demonstrating that it was able to make inroads in one segment of an industry controlled by traditional institutions I am curious if they are at all looking towards that direction.

Great article! The financial services industry has been ripe for disruption for many years but yet we have seen limited disruption in that space. It is interesting to see that in the UK, Monzo, appears to be successful. I wonder why its business model has been more successful than other fintech companies in other markets. Do you think the regulatory environment has been an enabling factor? How was Monzo able to build trust among customers to redirect their deposit to its platform?

I think the regulatory environment plays a huge role! The UK has had increasingly attractive regulatory environment for FinTechs – as the UK government is trying to promote competition via initiatives like Open Banking, where banks need to share data with any new entrants. In contrast, the US regulatory system for financial services is far stricter: if I want to start a bank I need to get 50 state-banking licences, which takes a lot of time and resources. This is why Monzo had to find a partner bank for its US launch (see article below)!

Article: https://www.theverge.com/2019/6/13/18677298/monzo-bank-us-launch-date-availability

Great post – like a few of the others, I wonder about their ability to scale, but they might also be able to do well as a smaller, more cost efficient player. The large banks have so many resources and so much money to invest, it doesn’t seem like a big stretch for them to be able to copy many of the things Monzo does (maybe not quite as well on existing platforms though). But given the overall switching costs of changing banks, which might be more mental than actually difficult, it seems hard for me to imagine Monzo becoming the “winner” of banks, even just in the UK. Banks also offer so many other services that might make it difficult for Monzo to replicate themselves and make it harder to fully disrupt the industry. Definitely seems they are doing great though in the areas they focus on!

Fascinating article. After the class discussion, I felt that Monzo would benefit in launching itself in emerging markets and serve underbanked as compared to moving to the USA. In US, the incumbent banks would catch up with the digital innovation and Monzo would have a hard time to compete against big pockets of these banks. However, in emerging markets, Monzo can bring underbanked and underserved people into banking system.

Great writeup and details on Monzo. Loved it.