Macy’s Store Closings, Layoffs a Sign of Struggle in Omnichannel Retail

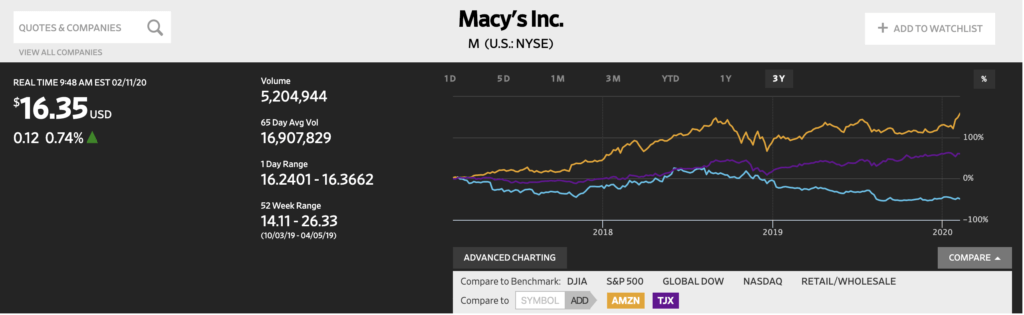

Macys is unable to deliver on competitive pricing, differentiated customer experience, and unique product offering. Its historical competencies leave it ill-equipped to compete in the omnichannel retail market.

In 1858, former sailor Rowland Hussey Macy opened the doors of R.H. Macy & Co., a dry goods store in New York City. That day, he sold just $11.06 worth of merchandise. The first year, however, was more auspicious with Macy earning $85,000 in annual revenue. Macy’s would proceed to grow organically (including a Herald Square flagship – the world’s largest store in 1924) as well as through acquisitions.[1] Today, Macy’s, Inc. is comprised of Macy’s, Bloomingdale’s, and Bluemercury.[2] It is its Macy’s brand, however, that has made recent headlines due to the announcement of the chain closing 125 of its 636 stores (a whopping 20%) as well as “cutting roughly 2,000 corporate jobs, or 10% of corporate and support staff, and closing several offices.”[3] This news is a manifestation of how Macy’s is not on the winning side of the digital revolution.

In the context of brick-and-mortar retail, digital growth has challenged the traditional model. The expansion of broadband access and the normalization of online shopping has squeezed mom and pop and established international chains alike out of the market. One cannot analyze this market without mentioning the behemoth driving and capitalizing upon this digital revolution: Amazon. Amazon’s scope and scale empower it with leverage across the supply chain to deliver low prices (along with its inherent convenience and ease of use). How can Macy’s and other traditional brick-and-mortar incumbents win in this largely upended omnichannel retail industry? I argue there are three major levers of delivering value in this context: price, experience, and product.

Macy’s has long been a stalwart of American shopping malls (which face their own plight, with vacancy rates approaching double digits in 2018).[4] With price points above discounters and below other mall department stores like Nordstrom, Macy’s contends that it “delivers quality fashion at affordable prices.”[5] However, Macy’s “quality” or value for one’s money is being surpassed by the growth of outlets and discounters, and its claim of “affordable prices” are being undercut by Amazon. With SG&A comprising 42.9% of sales,[6] Macy’s is incapable of competing with e-retail on price alone (consider Amazon’s SG&A costs of only 6.7% of net sales).[7] Since Macy’s cannot compete on low price, we look to our second main lever of driving value: experience.

Retailers (both brick and mortar and online) must deliver a valuable experience for shoppers to drive in-store and online traffic. There is no one-size-fits all solution in this respect. Shoppers seek and are attracted to experiences that are highly differentiated and they patronize these varied experiences to suit various needs/wants and occasions. For example, TJX has experienced growth[8] as it delivers on the fun of the hunt, eschewing greeters, personal shoppers, and shoe salespeople, for example. Or, consider the success of Sephora,[9] which delivers a seamless omnichannel retail experience. With in-store experts and services and online reviews, the company facilitates discovery in a supportive environment. Macy’s arguably provides a somewhat vanilla shopping experience, with no unique or stand-out attributes (e.g., it is not white glove service, competitive/fun to hunt, personalized, etc.).

The third major way through which Macy’s can compete in the post-Amazon market is through offering a unique product mix which drives (and responds to) consumer tastes. This is a difficult task, as Amazon aggregates SKUs and hosts branded retail products on its site (and then replicates the most popular designs in-house). The solution: exclusive items.

To illustrate this logic, consider another industry recently upended by digital competition: media. Content aggregator Netflix was able to draw eyeballs away from traditional media in a manner not unlike Amazon drew consumers away from traditional retail. Netflix built out its library (in both depth and breadth), all accessible for a low price point when compared to cable packages. A ‘golden age’ of TV ensued, with more money being pumped into content creation as well as SVOD players extending the lives of existing content through syndication windows. How, then, can one compete in an industry where there is so much new content and in which content hops from platform to platform? Original content. That is, exclusive series that draw viewers onto owned platforms. This, in effect, is why Netflix reportedly spends over $14 billion on originals each year,[10] and why we see competitors like Disney+, Amazon, and Peacock focusing efforts around original programming on owned platforms.

Just as media companies can drive consumer value and product differentiation through original content, so too can retail brands create differentiation and consumer demand via exclusive products and designs. Macy’s is aligned with this strategy, as it hosts 18 proprietary brands.[11] However, it is not sufficient to have exclusive SKUs, they must also drive consumer demand. Without knowing the performance of Macy’s owned brands, it is difficult to opine on the company’s performance in differentiated product offering (although I’d be suspect given Macy’s bland brand statement of being “America’s store for life” – denoting no unique creative point of view).[12]

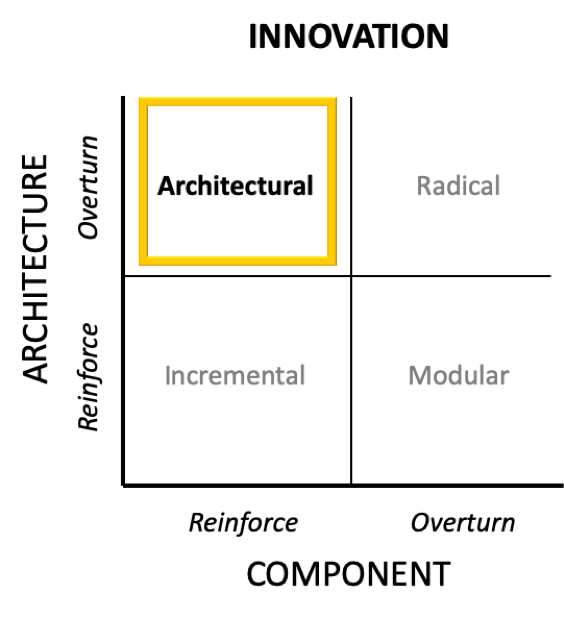

Macy’s latest downsizing news illustrates that its previous competencies in the retail market (store design, merchandising, discounting, real estate development, advertising) are not fit for the evolution of the retail industry. I would further argue that Macy’s faces barriers to change as it is so entrenched in its 160-year history and does not have the capacity or capability to adapt. That is, in order to compete in today’s retail market, Macy’s must undergo an architectural change – one in which the product is not greatly changed, but in which the mechanisms or architecture with which to deliver that product (e.g., supply chain management, sourcing, product development/lifecycle, digital sales and analytics) is radically different.https://www.wsj.com/market-data/quotes/M

[1] https://www.macysinc.com/about/history

[2] https://www.macysinc.com/brands

[3] https://www.wsj.com/articles/macy-s-to-close-125-department-stores-exit-weakest-malls-11580850007?mod=breakingnews

[4] https://www.wsj.com/articles/shopping-mall-vacancies-are-highest-in-seven-years-after-big-box-closings-1538564400

[5] https://www.macysinc.com/brands/macys

[6] https://content-az.equisolve.net/_4b741bec1fe5a20fdbc2173bd7bcb1d8/macysinc/news/2019-11-21_Macy_s_Inc_Reports_Third_Quarter_2019_1594.pdf

[7] https://ir.aboutamazon.com/news-releases/news-release-details/amazoncom-announces-fourth-quarter-sales-21-874-billion

[8] https://www.forbes.com/sites/walterloeb/2019/08/21/tjx-companies-project-robust-growth-during-the-rest-of-2019/#60eee23710b3

[9] https://www.forbes.com/sites/pamdanziger/2018/08/06/sephora-and-ulta-are-on-a-collision-course-then-there-is-amazon-where-is-us-beauty-retail-headed/#2a23d2d355dd

[10] https://www.theverge.com/2019/8/19/20813005/apple-tv-plus-original-video-spending-6-billion-the-morning-show-amazon-netflix-streaming-wars

Great article! I completely agree with the levers you have mentioned and your assessment of each.

Potentially, a lever you had mentioned that they can expand on more is experience. Macy can potentially leverage key digital trends to allow it to improve the customer journey, increase their engagements and reduce costs. These can include digitizing the in-store shopping experience and leveraging data analytics.

For examples on digitizing the in-store shopping experience, Macy can launch shoppable digital windows (similar to Selfridge for example) or increase engagement with smart fitting rooms (similar to Ralph Lauren for example).

Macy can also double down on its data analytics efforts to improve customer acquisition, customer service and customer retention as well as improve its product offerings (e.g. predict taste of customers) and its operations (e.g. inventory management, workforce management), among other things.

Very interesting article, KA!

One thing that it made me think about is based on the combination of two facts you laid out (1) one potential differentiation lever for Macy’s to pull on is experience and (2) Macy’s is an institution at many American shopping malls, which themselves are on the decline. I wonder if there is a way for Macy’s to bolster their in-store experience in a way where the focus is not on the shopping experience but rather the overall experience.

For example, I know Lifetime Fitness is starting to buy up old anchor stores at shopping malls and convert them into living communities that include gyms, apartments, common space, etc. Perhaps Macy’s could make a play similar to that: get people into the malls for other experiential or community-based reasons and then, hey, might as well buy a polo while I’m there?

Great insights into the various levers Macy’s can use! As we evaluate how digital can play a role in bolstering Macy’s into a promising future, I feel experience is the biggest piece that it can influence to beat Amazon. Inspiration can be taken from the beauty and eyewear industry. Investments in AR have pushed these industries ahead in providing virtual trials without having to go to the store. While this might be a technological challenge right now (as was for beauty a few years ago), building features for customers to try out different products on their body types might be a differentiation. Easier alternatives could be more seamless integration on the online and offline platforms. Sephora uses beacons in its stores. These devices emit notifications to customers’ phones informing them about latest offers, products that are available near them. Reminders can also be sent for products that are added to your cart on the app. Opportunities like these would help create delightful experiences for customers and keep the brand top-of-mind.

It seems to me that Macy’s response to the digital threat is to cut costs through store closures and letting go of workers. I agree that it appears they haven’t leveraged the power of digital to compete at scale in the new retail reality.

I like the way you focused on some possible levers to generate value. I wonder if you could have explored the digital opportunities within those levers morel. For instance, Macy’s may not be able to compete on e-retail with price alone but it could explore digital opportunities within pricing to differentiate itself. For example, it could role out dynamic pricing models or targeted advertising to specific customer segments across various price points as a way to better compete in the digital space.