LiquidSpace and the Platformization of Office Rentals

A door down from WeWork, there is LiquidSpace. Both companies are pursuing a modern approach to the office space marketplace, but LiquidSpace has stayed truer to the rules of platform strategy.

In recent years, concepts of the sharing economy have been extended to various industries as entrepreneurs and investors attempt to create and capture additional value. In line with this trend, shared office space has become an active sub-segment. The biggest name in town: WeWork, the New York-based company, founded in 2010, that recently raised $260 million at a $16.9 billion valuation. WeWork, which offers furnished shared and private office spaces on flexible terms, describes itself as a “platform for creators.” It also appeared on Evans and Schmalensee’s list of the largest startup online platforms. I would argue, however, that WeWork has not fully adapted the platform business model. Instead, I contend that Palo Alto-based LiquidSpace, also founded in 2010, is a much clearer example of the “platformization” of office rentals.

“A platform provides the infrastructure and rules for a marketplace that brings together producers and consumers,” Alstyne, Parker and Choudary wrote in their HBR article Pipelines, Platforms, and the New Rules of Strategy. Traditional “pipeline” businesses transform inputs into outputs through linear processes. Platforms create value by attracting producers and consumers, as well as facilitating the matchmaking process. As a result, while pipeline businesses focus on resource control, internal optimization and customer value, platforms are asset-light, emphasizing resource orchestration, external interaction and ecosystem value.

Let’s use this lens to consider compare WeWork and LiquidSpace. On the one hand, both companies are looking to address the demand for flexible, short-term office space. However, their approaches are quite different. WeWork signs large long-term leases, renovates and furbishes the buildings, and then rents out sections of office space. WeWork may be using mobile apps, cloud computing and other catalysts of the digital platform era to reach consumers, but it is not a multi-sided market place in the purest sense. The fact that the leases are on its books suggests a pipeline business model on the supply side. Paying for large leases, investing in the buildings, and creating high-end offices resembles a linear process of value creation. Like a traditional pipeline business, WeWork benefits from economies of scale (as it carves up larger leases into small allotments).

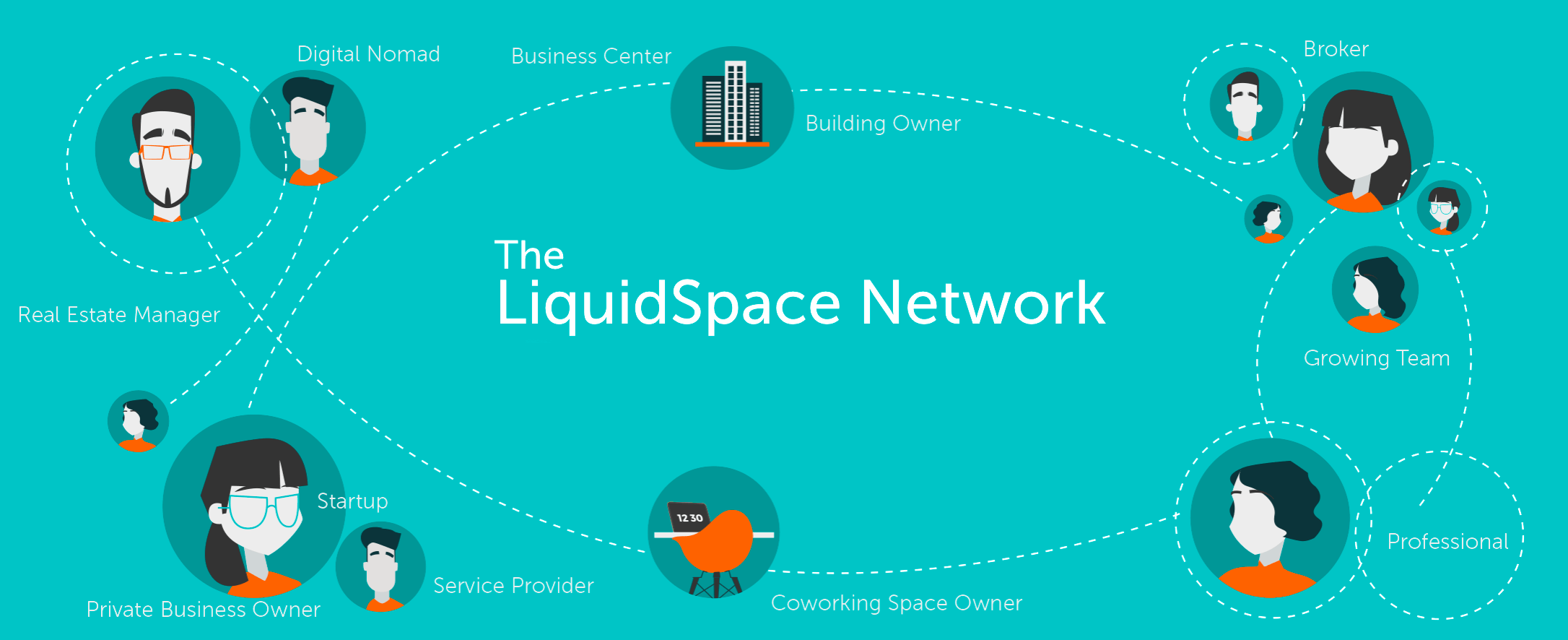

LiquidSpace, by contrast, acts as a multi-sided platform for all parties in the commercial real estate landscape. Their idea is to create a market place where occupiers, asset owners, brokers and even office service providers come together to create flexible office solutions. At first, this simply meant that owners or brokers could create listings of their unused desks and offices for other companies to rent. To compete with the one-stop-shop appeal of WeWork, they added furnishers and office service providers that could integrate their offering into transactions. While they help bring together stakeholders, LiquidSpace itself holds limited assets. As the company scales, every party will benefit from the network effects that enable a better matching process.

So LiquidSpace may be a better example of “platformization” in office rentals. However, this raises another question: if LiquidSpace is better positioned to harness the oft-cited benefits of the platform business model, why is WeWork the biggest name in town? The companies are both about 7 years old, but LiquidSpace has cumulatively raised only $26m to WeWork’s $1.69 billion. Why are investors backing the asset-heavy model over its purist platform counterpart? There are surely numerous factors at play, but a prominent one may the challenge in jump-starting the flywheel of a multi-sided marketplace. WeWork’s hands-on modus operandi on the supply side may enable it to have a better offering and capture greater market share. It will be interesting to see how a future downturn in commercial real estate prices tests the resiliency of this approach. Perhaps LiquidSpace will get another chance to show its own strengths.

***

Sources:

[1] wsj.com/articles/wework-raises-260-million-capping-off-690-million-funding-round-1476284233

[2] hbr.org/2016/09/the-businesses-that-platforms-are-actually-disrupting&ab=Article-Links-End_of_Page_Recirculation

[3] hbr.org/2016/04/pipelines-platforms-and-the-new-rules-of-strategy?utm_campaign=harvardbiz&utm_source=twitter&utm_medium=social#

[4] hbr.org/2013/01/three-elements-of-a-successful-platform

[5] hbr.org/2016/08/the-best-platforms-are-more-than-matchmakers

[6] ebusiness.mit.edu/platform/agenda/slides/5%20Platforms%20Transitions.pdf

[7] cloudcomputing-news.net/news/2016/mar/31/xaap-platform-business-model/

[8] forbes.com/sites/forbestechcouncil/2016/06/22/how-to-succeed-with-a-platform-business-model/#57973160405b

[9] forbes.com/sites/alfresco/2016/11/29/the-platform-business-model-why-it-works-and-how-to-get-there-an-interview-with-sangeet-paul-choudary/#24b4244d17c3

[10] wired.com/insights/2013/10/why-business-models-fail-pipes-vs-platforms/

[11] fastcompany.com/3058351/as-wework-rises-so-does-the-airbnb-of-office-space

[12] medium.com/daphni-chronicles/uberization-nope-platformization-c33f8a15c829#.lynt3v3zr

[13] entrepreneur.com/article/235529

[14] businessinsider.com/wework-business-model-2015-7

[15] Factiva press search on LiquidSpace and WeWork

Such an interesting company, and I’ve never heard of it before. Will both of them win, just in different market segments?

Also – Do you think WeWork can eventually move to a pure-play platform? I’m thinking the current approach allows WeWork to learn a great deal about commercial spaces and leasing. But I am not sure if this expertise would count for anything in a move to platform.