GXB: a blockchain-based decentralized data exchange platform

Gongxinbao (GXB), a start-up in China, provides a trustworthy and consumer-centric marketplace for data exchange by building a blockchain-based decentralized platform. Will this adoption of new technology allow GXB defeat other incumbents in the platform market? Can GXB’s business model solve issues that currently hinder the growth of data exchange market?

Gongxinbao (GXB), a start-up in China, provides a trustworthy and consumer-centric marketplace for data exchange through building a blockchain-based decentralized platform. Will this adoption of new technology allow GXB defeat other incumbents in the platform market? Can GXB’s business model solve issues that currently hinder the growth of data exchange market?

Background

In recent years, as China shifted its strategy to boost growth through consumption, consumer finance market has been booming and is projected to reach $5.75 trillion by 2019[1]. Since consumer finance market relies on data to estimate risk, this new trend results in a huge demand for consumers’ personal information. While China’s credit report system is still in its infancy, this gives rise to data exchange market.

In GXB’s opinion, the main challenges of current data exchange market are:

- personal information leakage. Currently, many consumer lending companies bought data from hackers in black market, and hence consumers are unprotected;

- data exchanged in the current market is normally fraud and outdated;

- companies withdraw from exchanging data on existing platforms because these platforms can resell data that is exchanged on them[2].

These problems can be addressed by blockchain technology.

What is Blockchain?

Blockchain is the underlying technology of Bitcoin. It is a public ledger that records every peer-to-peer transaction in the network, and everyone can have a copy of it. In addition, transactions that have been recorded on the ledger cannot be changed because they are cryptographically protected. Since the ledger is immutable and public, the transaction history of a person in the network can be traced and trusted. Thus, it is also a database that nobody can control but everyone can trust.

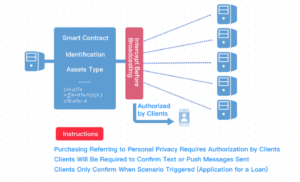

On top of the features described above, the blockchain of GXB platform has another feature: smart contract[3], which allows automated transactions. For example, if a credit lending company, A, wants to issue loans to a new consumer, X. Company A can initiate and broadcast a smart contract on the platform. In the contract, it will specify the type of data it is interested in and the price it wants to offer. Built in the contract is what would trigger the execution of the contract, i.e. the approval from consumer X for ABC to buy this data. If Company B has the data and considers the price fair, but the client has disapproved, the transaction is denied. On the other hand, if the client has approved, then company A will automatically be charged, and company B will send data cryptographically to company A. The whole transaction process will be recorded on the chain, except data[4].

Value creation and value capture

GXB creates value by building trust between buyers and sellers, facilitating transactions, and help consumers manage their personal information. Companies can file complaints after transaction, which directly affect the reputation of sellers. Since the ledge is immutable, new buyers can rely on the history of sellers to make decision. In addition, the whole transaction process is fast and protected. GXB platform cannot take advantage of transactions by obtaining a copy of the data. Lastly, consumers are protected because they can control the flow of their data.

To attract first adopters, GXB offers crawling services: under consumers’ authorization, GXB can scrape data about consumers’ behaviors on targeted platforms, such as lending platforms or e-commerce, such as Alibaba. Since GXB can provide authentic and up-to-date personal information of consumers, it has already attracted 37 consumer finance companies and millions of entries of have been requested. As it grows its user base, GXB expects to draw more companies to exchange data and capture its value by charging a fee for each transaction[5].

Concerns and Challenges

The business model of GXB seems too good to be true. If your main concern is about blockchain and smart contract, I want to assure you that these are as valid technology as machine learning or AI. However, whether these technologies can build a marketplace described by GXB is questionable. Assuming that GXB knows how to code, and the platform runs as it describes, GXB still faces these challenges:

- Consumers are not protected

It is true that hackers now collect consumer information without permission, but GXB makes it even easier for them to access information that was inaccessible before. Once GXB send data crawled from platforms with strong security to credit lending companies, consumers’ information is now in more databases. It has also become more vulnerable to be hacked. If consumers are aware of this risk and avoid using GXB, its business model falls apart.

- The market has high multihoming tendency and high network effect

Just like most of digital products, data can be copied and resold may times. A data vendor can sell its data on different platforms at very low cost. Similarly, buyers can be on multiple platforms to look for data they are interested in. In addition, buyers on GXB platforms can resell their data on other platforms, and the black market is still flourishing due to weak regulation. At the same time, many government backed data exchange platform are emerging. Therefore, GXB will face fierce competition at least for now.

[1] China’s consumer finance expected to be a marketwithout ceiling: http://www.chinadaily.com.cn/bizchina/tech/2016-01/27/content_23269761.htm

[2] GXB Blockchain-based Decentralized Data Exchange Overall Plan for ICO v1.0

[3] Smart contract is a technology brought by the next generation of blockchain, Ethereum.

[4] GXB Blockchain White Paper – http://ico.gxb.io/download/GXB_Exchange_ICO_Program_v1.0_EN.pdf

[5] GXB Blockchain-based Decentralized Data Exchange Overall Plan for ICO v1.0

[6] Graphs: GXB presentation slides

I agree that the profit formula in its current form may not be sustainable. Competing with government sponsored data exchanges would be extremely difficult. But if GXB can but a reliable network of data sources – which do not rely on scrapping – and build a solid analytics platform, then it has great potential for offering subscription services. One approach would be to tie into consumer finance (banks’ own databases), e-commerce, and real estate transaction databases and generate real-time analytics such as credit ratings, expected customer-acquisition-cost per product per age-group by location, demographic maps, etc. Don’t sell the data, but sell the analytics.

Thank you for your comment, Kunal! The only problem is that credit lender wants to build their own models, and hence the painpoint for them is to get good data.