Investment Banks of the Future

The availability of capital, high costs of being a public company, and decreases in technology costs have led to disruption in the investment banking industry

Industry Background

Historically, the lack of data transparency has enabled investment banks to capture value and prevent disintermediation between sell-side and buy-side parties. Essentially, companies seeking to raise capital must rely on the banker’s proprietary relationships with institutional investors as well as the banker’s institutional pricing knowledge and experience to ensure successful transactions. These barriers to entry have allowed investment banking firms to protect their business and high margins.

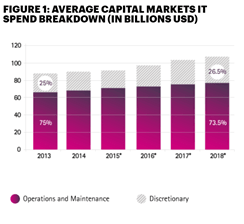

Given incremental regulatory and reporting hurdles and the focus on cost-cutting measures, investment banks have not been able to effectively react to the rapidly changing digital environment. Trying to respond to new reporting requirements, while simultaneously transitioning from legacy IT systems have proven difficult. Banks are compelled to make large investments to support existing systems, which makes it difficult for investment banks to innovate. While IT spend has increased over time, the percentage dedicated to maintenance and operations has stayed relatively stable. With discretionary spending hovering around 27%, investment banks have not invested as much capital in new technologies to protect themselves against non-traditional and more nimble competitors.[1]

Source: Accenture Report: Investment Banking Technology: Jettisoning Legacy Architectures

Challenges

The proliferation of technology has democratized the process of building companies and raising capital. For instance, the cost to launch a tech start-up has declined from $5 million to $5,000.[2] As such, the number of fintech firms launched in New York increased from 33 in 2010 to 85 in 2014. Further, accelerator and incubator programs provide new channels for companies to raise capital and receive invaluable support and expert guidance.[3] These other channels have removed some of the barriers that protected investment banks by increasing transaction transparency.

It is important to note that these competitors are taking away other fee pools as well. Investment banks rely on initial public offerings (“IPOs”) to generate fees. However, companies no longer see the value of raising capital in the public markets. The high regulatory and reporting costs, other sources of capital, and lower technology costs have made it more attractive to stay private. The number of publicly traded companies has decreased. In 1996, there were 7,322 listed companies and today there are now 3,671.[4] Additionally, from 1980 to 2000, on average 300 companies went public and this figure has decreased to ~100 companies per year. Large companies such as Uber and Pinterest have found ways to grow and raise money outside of the traditional investment banking model. Even companies that do go public have found ways to disintermediate bankers. For example, Spotify used a direct listing approach that allows it to bypass bankers by allowing the opening public price to be determined by orders collected.

On the other side of the equation, institutional investors are also developing their own in-house trading capabilities, boosted by the lower cost to build technology-enabled platforms. Consequently, banks such as Goldman Sachs and Morgan Stanley have experienced negative impacts in their institutional client services businesses. For example, Goldman’s Institutional Client revenue declined 18% from 2017 to 2016.[5] These trends have led to disintermediation from both buy-side and sell-side banking clients, ultimately leading to lower transaction volumes and fees.

Opportunities

Investment banks have an opportunity to leverage their global network of historical transaction and pricing data in a digital platform. Investments in innovation will allow them to use the data to provide a more educated view on markets, risks, and opportunities. Banks with this information can better understand its customers.

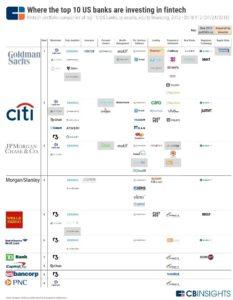

In addition to bolstering their technology and data analysis platforms, banks can also purchase fintech companies. This will allow banks to acquire technology rapidly without having to spend and develop the expertise in-house. In fact, ten U.S. banks have purchased over 81 fin-tech start-ups over the past six years.[6]

Looking Forward

Banks must recognize that their legacy processes will not necessarily be the right ones to guide them through the digital transformation. For example, high margin products such as advisory may continue to be threatened by the prevalence of new capital and the ability for companies to raise funds directly from investors. As such, banks can offset this trend by leveraging digital platforms to provide services in high volumes, spreading out fixed costs.

Further, investment banks can look to technology and data analysis to better understand their clients and find new ways to cross-sell and improve relationship stickiness. By increasing the number of services, investment banks can help clients more efficiently centralize and execute, reducing the inclination to disintermediate. Innovating its services in-house may have its drawbacks. As shown with Moore’s law, given how rapidly technology improves, it would may not be as economical or efficient for investment banks to greenfield these initiatives. As such, banks may see acquisitions as a great strategy to acquire new clients and technology.

Banks can consider fin-tech companies as external sources of innovation and diversification. As Accenture states, “scale and global reach have become de facto commodities, and information and liquidity are no longer constrained. The central investment banking concept is changing and a new digital ecosystem is emerging.”[7]

Potential Internal Roadblocks

The suggestions above are by no means quick fixes for investment banks. These changes must come directly from top management who will champion these initiatives across the organization. Further, given the transformational nature of this strategy, management must be willing to heavily invest upfront and not expect any results in the immediate future given the longer time horizon.

Given the entrenched nature of some of the teams within these banks, management must find ways to bring these individuals on board without alienating them. For example, the advisory business relies heavily on client relationships to garner business and will feel threatened by the acquisition of fintech companies, which may compete with these teams for new business. To help alleviate some of these fears, banks can promote cross-selling of services and products. Instead of positioning the new investments as direct competitors, banks can help facilitate incremental sales and cooperation between teams. This may involve designing new incentive measures to promote cross-selling or use of other team’s services.

Lastly, banks may receive pushback from shareholders who regard investments in IT and acquisitions as a distraction or cannibalization of existing business lines. While companies must continue to invest to support existing infrastructure, they should shift spend towards more innovative technologies and communicate to the market that the benefits have a much longer actualization horizon.

[1] https://www.accenture.com/us-en/insight-investment-bank-challenges-legacy-technology

[2] https://www.accenture.com/us-en/insight-investment-bank-challenges-integrated-digital-ecosystem

[3] Ibid.

[4] https://www.economist.com/news/business/21721153-company-founders-are-reluctant-go-public-and-takeovers-are-soaring-why-decline

[5] http://www.goldmansachs.com/media-relations/press-releases/current/pdfs/2017-q4-results.pdf

[6] https://www.cbinsights.com/research/fintech-investments-top-us-banks/

[7] https://www.accenture.com/us-en/insight-investment-bank-challenges-integrated-digital-ecosystem

Thanks for the post M! It’s interesting to see how technology is disrupting the banking industry. I agree that given the cannibalization risk to existing business lines and the high costs required to change their legacy systems, banks should focus on expanding their services to better serve their client’s needs while outsourcing R&D by investing in fintech startups.

However, banks don’t seem to be pursuing this strategy. The following report from CBinsights shows that Corporate VC investments as a percentage of overall fintech investments have remained flat at approximately 25% since early 2016.

http://lending-times.com/wp-content/uploads/2017/05/CB-Insights_Global-Fintech-Report-Q1-2017.pdf