Nielsen: Big Data or Bust

Nielsen has been a market leader in the big data an analytics space for decades. Will their enormous scale and historic dominance become a threat in the digital age?

Overview

Nielsen is a global market research data and analytics company, specializing in measurement of what global consumers watch (online, TV, radio, books, magazines, newspapers) and buy (grocery, drugstore, convenience stores, mass retailers).

Nielsen creates value through capturing enormous amounts of data about consumers, and selling this data and analytics to retailers, brands, broadcasters, consultants, financial analysts, and anyone who has a use for the data. In addition to selling data to customers, Nielsen also provides consulting services, and a multitude of products that utilize their data and capabilities (ex: pricing models, innovation consulting and testing, attribution modeling, ad testing).

Challenge 1: Technological Disruption

Nielsen has been in this business since 1923, and has been able to protect their competitive advantage through significant scale. To gather the troves of retail data that Nielsen generates, the company must maintain relationships with a significant portion of national retailers, and provide or leverage technology to capture and process their POS (point of sale) data. Nielsen also must provide technological devices to thousands of households across the US to capture data for the Nielsen ratings, and for the Nielsen household sample. This scale serves as a significant competitive advantage, as customers value the wholeness of the data captured; but, it also is a source of potential threat to their business.

In Nielsen’s annual report, sites potential technological disruption as one of the greatest potential risks to their business. Technology is advancing quickly, and while Nielsen tries to adapt – it is not unreasonable to think that new ways of gathering data could be created that render Nielsen’s methods obsolete. If Nielsen cannot keep up, get ahead of this curve, or acquire a company that can, their going concern is questionable.

Challenge 2: Disintermediation

Nielsen has historically served as the great aggregator of data. Individual retailers create their own data sets and track consumers through loyalty cards, but also provide their data to Nielsen. As data analytics and measurement have risen, there is increasing risk for retailers to skip Nielsen, and go directly to consumers. Many already do (e.g. Kroger, Target), but if retailers stop seeing the benefit in collaboration with Nielsen, they may choose to end the relationship.

Finally, brands like Lay’s are disintermediating Nielsen by going directly to consumers through social media and online platforms that let them speak directly. While this method is not a full replacement for the data that Nielsen gathers, it could be troubling in the future as ability for brands to communicate with consumers grows.

Challenge 3: Moving from Physical to Digital

Digital trends in consumer behavior are moving toward channels that Nielsen doesn’t have as clear visibility – online. Specifically, ecommerce growth (Amazon, Instacart) has changed how consumers buy goods and online programming viewership (Netflix, Hulu, network owned sites) has changed how consumers watch media. Growth in number and size of these platforms has created fragmentation in Nielsen’s view of the world. Some of these sites do not cooperate with Nielsen or share their data. Thus, as trends move in this direction, Nielsen is losing sight of a growing portion of consumption and viewership.

What they’re doing to stay ahead of the trends

Nielsen has tried to stay on top of the digitization trend by forging partnerships with the digital players to gain access to their data, and improve their visibility into the digital market. While these partnerships are important, they add additional risk into Nielsen’s model as inviting another player into your business often does. Historically, partnerships have ended when one side no longer wants to share their proprietary information, and can see value in protecting in vs. collaborating with Nielsen.

Source: Nielsen Annual Report 2017

Source: Nielsen Annual Report 2017

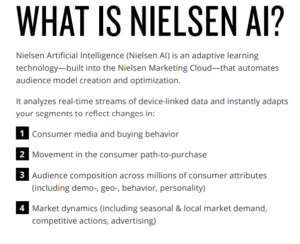

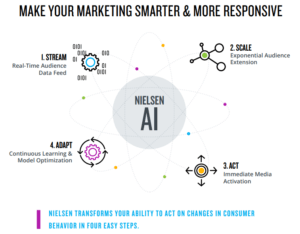

Since 2017, Nielsen has offered AI with their Marketing Cloud product to help customers better optimize advertising investment and customer engagement. This pulls in integrated data across Nielsen’s audience measured platforms and allows marketers and advertising executives to make real time informed decisions about how to optimize spend and where advertising is shown.

Source: Nielsen AI Whitepaper

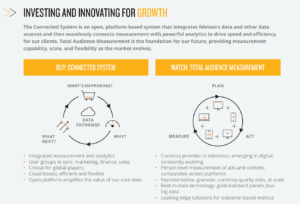

Nielsen is also investing in better connecting their data sources, bringing in outside data sources, and packaging it to better fuel growth for customers. These new systems provide an even clearer picture of exactly what is happening in the marketplace and why, and exact who is watching in the evolving marketplace.

Source: Nielsen Annual Report 2017

Recommendations for Nielsen in the digital age

Nielsen has historically kept up with the pace, or led, digital change in the industry. Either through internal innovation (early days), or constant acquisition of new technologies, Nielsen has managed to maintain their market position. However, with the ever-accelerating pace of digitization, there is much more to do if Nielsen plans to continue forward in this space. A few potential paths forward:

1) Move away from physical technology and shift to mobile application based data collection where possible. One of the largest threats to Nielsen’s business is the large installed technology base used to measure what consumers watch and buy. To protect against this, Nielsen could shift more heavily to mobile technologies (iPhone, Android) for measurement where possible. Application based measurements could replace TV box sets, or online measurement for consumers who give Nielsen permission to measure their viewing habits. In retail, phones could be used to scan receipts, or digitize POS systems to feed data into applications. Though this is an oversimplification of how all of Nielsen’s data is captured, the point stands that Nielsen should be doing everything possible to transition away from physical technologies used to capture data today – which could be rendered obsolete at any point.

2) Continue investing in AI, or partner with firms who have significant capabilities, and expand learnings to the Buy side of the business. Nielsen has enormous troves of data on consumers, and while they’ve begun to venture into this space on the advertising side, much more could be done with the data at their disposal. Learnings around consumer purchasing, patterns of consumption, predictive modeling, could all unlock more valuable learning and data for Nielsen’s customers who do not have these capabilities internally.

3) Or… if Nielsen cannot keep up with digitization, perhaps they can reframe the threat as an opportunity. As Best Buy became the show room that consumers were using them for, Nielsen could double down on raw data collection and generation, and allow other organizations to handle the analytics, AI, packaging. The data, and the relationships required to generate it, are the source of Nielsen’s competitive advantage (at the moment). Nielsen could refocus the organization on creating more and better data and leave the analytics and algorithms to someone else.

Going forward, as a 95-year-old, and very established organization, agility is a concern for implementing change going forward. There are the significant technological challenges discussed, as the large technological base leaves them vulnerable to disruption. There are also operational challenges as significant human capital will be resistant to change that could decrease the need for them (e.g. AI replacing the need for the consulting and analytics arms). Also, there are challenges on the demand side as many of their customers are established brands who will likely be resistant to significant change as it impacts their businesses. Nielsen will have to mitigate these from the top-down with the strategy set at the highest levels, and aligned across the organization. Many of Nielsen’s analytical and lower end consulting capital is outsourced to third parties, thus this limits the human capital risk (for Nielsen at least). Thus, they should continue outsourcing the type of work that could eventually be done by AI, until the point in time that they are ready to switch over. On the demand side, Nielsen should ensure the problems that they’re tackling are the problems that their clients need them to tackle – they should align with the customers’ needs and work on educating them on the digitization trends that these opportunities fit.

Sources

Nielsen Website http://www.nielsen.com/us/en/about-us.html

Nielsen 2017 Annual Report http://s1.q4cdn.com/199638165/files/doc_financials/Annual/2018/04/2017-Annual-Report.pdf

Nielsen History http://sites.nielsen.com/90years/

Nielsen AI Whitepaper http://www.nielsenmarketingcloud.co/hubfs/Nielsen-AI-Marketing-At-Future-Speed_Whitepaper-Digital-3.pdf

Personal Experience working at Nielsen

“Nielsen Dives into AI” https://adexchanger.com/platforms/nielsen-dives-ai/

“Nielsen Marketing Cloud Adds Artificial Intelligence”: https://www.broadcastingcable.com/news/nielsen-marketing-cloud-adds-artificial-intelligence-164614

“Lay’s Joins Growing Trend Of Brands Crowdsourcing Through Facebook” http://www.adweek.com/digital/lays-crowdsourcing-chips/

Andrew Ng, one of the harbingers of machine learning and deep learning, has identified the following 4 attributes that tend to enable a company to survive and thrive as an AI-first (as opposed to product-first or platform-first) company:

(1) Unified data warehouse within the entire company

(2) Strategic data asset acquisition

(3) Pervasive automation

(4) AI-compatible job descriptions and HR practices

Some of the attributes may prove useful for Nielsen to sustain itself as the market leader in the digital era. Please find the video below for your reference (Andrew’s comment on AI company starts at the 17 minute mark):

https://youtu.be/NKpuX_yzdYs?t=16m58s

Very interesting post. “Nielsen has enormous troves of data on consumers, and while they’ve begun to venture into this space on the advertising side, much more could be done with the data at their disposal.” I wonder if the recent focus on Facebook and Cambridge Analytica threats Nielsen’s large position on consumer data and how it can use it going forward?