IKEA: Digitzing supply chains to win on customer experience

IKEA's investment in digital supply chain technology has improved operating efficiency of its furniture/food businesses as well as enhanced omni-channel customer experience.

I will argue that IKEA is a digital winner, specifically due to its investments in digital supply chain management. These investments have not only improved operating efficiency but have made substantive positive impact on omni-channel customer experience. IKEA has proven itself to be “consistently inconsistent” and capable of continuous innovation on its business model.

Rethinking the big blue box

IKEA has been famous for its massive retail footprint and unmistakable blue, boxy megastores. These outlets (serving as hybrid destination showroom spaces and warehouse pick-up centers) were part of IKEA’s initial innovation on the traditional mom-and-pop furniture store. However, the rise of ecommerce in this decade has challenged the business case for the IKEA style of expensive real estate investment. Moreover, the trend towards urban living and away from car ownership adds additional risk to IKEA’s brick-and-mortar customer value proposition.

Leveraging their savvy for customer experience design and a strong digital supply chain platform, IKEA has been able to launch new tech-enabled channels to better meet the changing times.

For example, IKEA was one of the first major retailers to develop a Click-and-Collect program, where shoppers can order in advance and more quickly pick up their purchases in the IKEA parking lot. This required integrating POS systems, ecommerce front-end, and up-to-the-minute inventory tools. While a heavy investment upfront, this service model innovation improved technology available in-store as well, and made their future forays into direct-delivery ecommerce less painful.

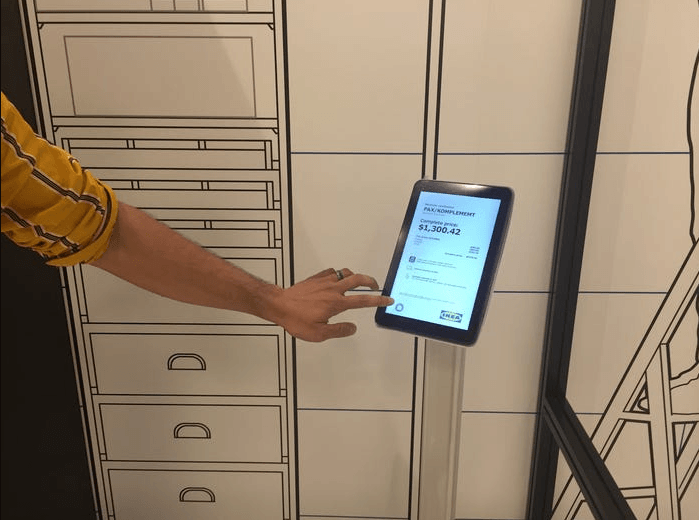

More radically, IKEA is piloting showroom-only microstores for high-rent areas called “IKEA Planning Studios,” where all purchases are fulfilled via direct-to-home delivery rather than carry out. To that end, the showroom is filled with tablets where customers can add items to their virtual “cart”. There are also stations with touchscreens where customers can use IKEA’s 3D imaging tools to “design” their room. For the first time ever, this tech-enabled store format has allowed IKEA to profitably maintain a physical presence in Manhattan, where rent per square foot would otherwise be too expensive to support a traditional store. The traditional Brooklyn-based store serves as a de facto fulfillment center for customer orders generated in the Planning Studio, relying on IKEA’s digital supply chain excellence.

Modernizing meatballs

Another recent IKEA success story is the complete digital overhaul of its food supply chain. Perhaps just as beloved as IKEA’s omnipresent minimalist designs and rock-bottom homeware prices are IKEA’s Swedish meatballs, available as a hot meal for “hangry” IKEA shoppers as well as a packaged, frozen to-go SKU. In fact, food service makes up 5% of IKEA’s retail sales, making IKEA’s sit-down restaurants a $2B+ business in their own right. But when EU food inspectors identified traces of horse meat in one of their Czech Republic meatball products, the company realized how woefully outdated their food supply chain was, relative to the well-oiled machine of their furniture sourcing.

Over the course of a year, IKEA (in partnership with JDA Software) established a digital platform for the food division. This system featured better end-to-end sourcing data for all food inputs, scanners to digitize inventory management/receiving functions at the store level, new digital dashboards (with built-in chatbot assistants to make it easier for managers to use), integrated collaboration tools (e.g., to allow a chef to communicate quality standards with the store associate responsible for approving food deliveries), and much more. This transformation also brought the IKEA restaurants and bistros onto the same POS system that IKEA uses for its furniture sales floor, lowering redundant IT expense and enabling a more holistic view of an IKEA shopper’s purchasing habits as they move from store to cafe.

The end result? Cost savings for the company, a better experience for employees, and higher inventory availability / quality assurance for the millions of IKEA shoppers.

What’s next for IKEA?

There is no question that the furniture market in which IKEA operates will continue to face the challenges and opportunities of technological disruption. IKEA still lags behind retailers like Costco and Walmart in terms of proportion of sales made digitally (in-app or on the web), but their global online sales jumped 45% in the last quarter (relative to a modest 5% currency-adjusted growth of sales overall). Whether it is AR/VR-powered interior design tools, 3D printing at scale as a manufacturing model, a rise in consumer demand for smart/robotic-enabled furniture, or some other change yet to be seen – IKEA must stay nimble in order to keep its title as a digital “winner” for the years to come.

Sources

“IKEA’s Meatball Supply Chain Goes Digital,” Wall Street Journal (Jan 31 2020). https://www.wsj.com/articles/ikeas-meatball-supply-chain-goes-digital-11580501597?mod=hp_minor_pos13

“IKEA Retail U.S. shares digital focus, new energy sources in accessibility and sustainability report,” Furniture Daily (Feb 5 2020). https://www.furnituretoday.com/furniture-retailer/ikea-retail-u-s-shares-digital-focus-new-energy-sources-in-accessibility-and-sustainability-report/

“I visited Ikea’s new Manhattan location — and it was like nothing else I’ve seen from the retailer,” Business Insider (Apr 10 2019). https://www.businessinsider.com/ikea-nyc-store-planning-studio-tour-2019-4#the-idea-is-around-creating-greater-convenience-and-realistic-solutions-she-said-36

Really cool, Megan! I saw that IKEA is also testing out a furniture leasing model in 2020 (for as little as $33/month for an apartment’s worth of furniture – crazy). It seems like this would fit nicely in with their new microstore “Planning Studios” for highly urban environments. I agree that their upfront investment in rethinking the user experience and digital supply chain will allow them to be much more agile when continuously innovating in their business.

Thanks for sharing, Megan! I thought it was interesting that you included that IKEA partnered with JDA solutions in order to undergo its technology supply chain upgrade for its food division. As large incumbents, such as IKEA, figure out the best ways to use digital innovation to their advantage, I wonder which between the build, borrow or buy options will prove most valuable for these companies. In this case, IKEA choose to borrow expertise from JDA and it proved fruitful for them.

Megan, this is a very interesting article! I completely agree that rethinking the big blue box has allowed IKEA to increase the efficiency of their processes, reduce costs and improve customer experience. Doing some additional research I found that IKEA’s effort to strengthen the online channel has allowed the company to increase online sales in 43% from September of 2018 to August of 2019 [1]. Although the digitization of the company operations is a key area that will allow IKEA to maintain its leading position in the furniture industry, the management should continue focusing on the development of useful and safe products. The case of the IKEA’s dresser that killed a 2-year-old kid, shows that there is a risk that the company loses focus on the development of products.

[1] Business Insider. “IKEA’s online sales surged.” https://www.businessinsider.com/ikeas-online-sales-surge-43-2019-9. Accessed on February of 2020.

Great Megan, thanks for sharing! I was impressed with the relevance of the food service in IKEA’s revenue. I think the idea of leveraging the supply chain efficiency developed for the furniture business to the food supply chain is brilliant. Integrating IT and business processes for both supply chains makes a lot of sense! Maybe in the near future IKEA can deliver its meatballs to our homes?