Fitbit – leveraging consumers’ obsession with data

In the era of Big Data, companies are obsessed with figuring out how to crunch the numbers and make use of the increased data provided to us by a number of devices. However – companies are not alone in embracing data analytics: As evidenced by Fitbit, there is an increased interest among consumers in measuring, tracking and analyzing data from their own lives.

Fitbits value creation model

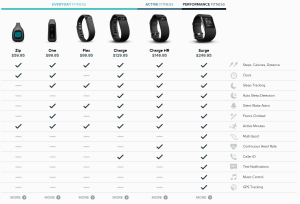

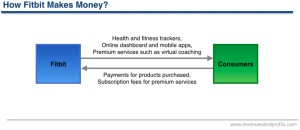

Fitbit is a provider of wearable connected health and fitness trackers, and the company currently enjoys a 77% market share in the full-body activity trackers, according to NPD. Fitbit offers various wrist-based and clippable devices that enables the user to track various activities such as daily steps, calories burned, active minutes and sleep duration. Through real-time information displayed on the device, users can get encouraged to become more active, and users can play around with the data in a number of apps that are connected.

All of the Fitbit devices sync automatically with Fitbit’s online dashboard and mobile apps that provide the users with a wide range of information and analytics, such as charts and graphs of their progress. The platform helps users stay motivated through social features, notifications, challenges, and virtual badges. The users can choose to share some or all of the health and fitness information with friends, family, and other parties with third-party apps. Fitbit enables third-party developers to create health and fitness apps that interact with its platform. Moreover, Fitbit also offers premium services on a subscription basis that include virtual coaching through customized fitness plans and interactive video-based exercise experiences on mobile devices and computers.

Fitbit is leveraging an increasing trend among users to track their daily movements. Increasingly tech-savvy users wish to monitor their exercise, sleep patterns, nutrition and general well-being and are interested in sharing their performance in social media.

Value capture

At present, Fitbit generates nearly all of its revenue from the sale of its connected health and fitness devices and accessories (these range in price from 60-250usd). Fitbit generates a small portion of revenue from the subscription-based premium services, however, there is significant potential to grow this piece of the pie as more third-party developers enter the market. Fitbit generated $745 million of total revenues in 2014, up from $271 million in 2013, growing at 175% yoy. 75% of the revenues came from the US business, and the gross margin was an impressive 48%.

Explained simply, Fitbit makes the majority of its revenue from its hardware, however, its ability to provide advanced data and data analysis is the deciding factor behind any purchase. Its ability to keep offering new data sources and new ways to analyze user data is crucial for success going forward. The importance of the software is supported by the fact that two-thirds of Fitbit’s engineers are in software.

Challenges and competition

Going forward, Fitbit faces huge competition from a number of players, including Jawbone, Nike’s Fuelband and a number of smartphone entrants that can add many of the Fitbit features to its products. However, Fitbit enjoys a strong position in the market and its national-account strategy enabled it to expand distribution fast: Fitbit is now in 30,000 stores in 28 countries.

Fitbit recently did an IPO, and as more data about its users are being made public, questions arise around how they successfully it can convince users to keep using their devices, and perhaps to pay for new features and services. People tend to lose or grow bored with fitness wearables in general, and according to a 2013 survey, one-third of users stopped using theirs within six months. Many industry experts predict that the winner in the space is “not the one that only sells the most devices, it will be the one that persuades the largest number of people to keep coming back”.

_____________

Sources:

http://www.theverge.com/tech/2015/8/6/9110035/fitbit-fitness-tracker-watch-active-users-sales

http://revenuesandprofits.com/how-fitbit-makes-money/

http://www.forbes.com/sites/roberthof/2014/02/04/how-fitbit-survived-as-a-hardware-startup/

Great post and a very interesting topic. To me the key question I would think about if I was Fitbit would be: how can I leverage all the data I have gathered from my customers to make my product sticky in the long term? Maybe there is something to be said about long-term data analytics which span over the initial 6 weeks after which attrition becomes high. Could Fitbit launch a very serious study in long-term benefits of tracking and of physical activity itself? Could they refine their value proposition to promise their customers sound insights out of months, if not years, of data?

Thank you for the post. While I knew that Fitbit was doing quite well, I did not realize the massive scale they gained over the past 1 year and the growth they have demonstrated! The product has been able to capture the fascination of many. However, my belief in the product in its current form in not very high. One of the challenges you mentioned about user stickiness beyond 6 months is a cause of concern and brings a lot of credit to the question around “Is Fitbit a Fad”. Another concern for me is the lack of any real barriers in the product. While it does serve its purpose in a unique way at this point of time, it is unclear whether the adoption will be to the same extent if watch makers or phone makes incorporate the feature into their products. May be a small fraction of the users who want really accurate data might continue using it, the vast majority might not. Fitbit or for that matter most wearable technology have made great advances in telling us what we’re doing, but there’s yet to be a breakthrough related to what’s going on inside our bodies and that might be the differentiation needed.

Great post! I bought a Fitbit a couple years ago, and to your point, I stopped using it after a couple months. Unfortunately, during that time, I also gained some extra weight. About a month ago, I decided to pull the Fitbit out from my cabinet, and I’ve been in love with it all over again. The device has definitely forced me to make sure I’ve set my specific goals, and with the ability to integrate with MyFitnessPal (allowing me to track calorie burn and calories eaten), I’ve already begun losing a lot of the weight I gained. Fitbit works partially because of the “guilt factor” (i.e., I haven’t reached my very reachable goal for the day, so I need to make sure I walk around instead of watching TV on the couch) and the “competitor factor” (i.e., my friend has walked 25,000 steps; I want to get close to that!).

With the increasing data and API integration with other platforms, I’ve found myself following a much healthier lifestyle by forcing myself to exercise and eat healthy.

There are a couple things Fitbit could possibly consider. First of all, I think if they could invest in a more “presentable”/”luxury” watch/tracker for those going to formal events, that could certainly be an interesting opportunity. Perhaps the market is much smaller in this case, but I sometimes do feel embarrassed when I go to a wedding and see everyone with their nice watches, while I rock my Fitbit (yes, I could use another watch of mine, though I prefer to track the calorie burn from the dancing ). Another consideration is rewarding “power users.” Another company called Switch2Health (now, unfortunately bankrupt because they couldn’t sell enough bands) used to provide rewards (e.g., Xbox 360, Nintendo Wii) for those who reached specific goals. I think Fitbit could possibly integrate with other companies to offer discounts for reaching specific milestones (e.g., Sports Authority discounts, Lululemon gift cards, etc.). Although the reward of tracking health and (in my case) losing weight is great, some people are even more motivated by financial rewards, and I don’t believe it’d be that difficult to sell the idea to major retailers, since they’ll capture value as well).

It seems like the barriers for entry are very low, which makes me surprised to see how strong Fitbit’s brand is and learn about their huge market share.

People have always liked to see data and numbers about things that are important to them (e.g. their health) and I can see how it would also play as a social trend where you can “compete” against your friends.

Fitbit’s push to get such wide adoption comes back to where its ultimate value capture model will be – in the large and ongoing/real-time biometric database it can potentially create, assuming it can solve customer retention issues, and beat out competitors. The consumer facing value creation and hardware value capture piece is just a drop in the ocean compared to what the potential value creation/capture could be with a large biometric dataset. As you point out, many others are interested in building up this kind of dataset, from smartphones, to the Apple watch, etc. Apple has even filed for patents around “mood-based advertising” (http://techcrunch.com/2014/01/23/apple-patent-explores-mood-based-ad-targeting/), giving us a preview of just one of the types of ways (scary or not – up to you to decide, but I certainly find that something about “mood-based advertising” doesn’t sit well with me) in which companies with large biometric datasets will look to capture value from advertisers.

The pending questions about Fitbit’s future, for the time being, come back to stickiness and beating competitors, as you discuss.