“Darlin’, we need a new couch. And desk. And chairs.”

Wayfair – From Covid-19 loser to winner?

Company overview

Founded in 2002, Wayfair is an online retailer for anything related to a consumers “home” – from outdoor furniture to table lamps and cushion covers, Wayfair promises its costumers that they do not have to visit any physical store in order to furnish their apartments. The company offers more than eight million products across five distinct brands: Wayfair.com, Joss & Main, AllModern, DwellStudio, and Birch Lane. In 2019, Wayfair had about 20 million active customers (vs 8 million in 2015). In 2018, the company fulfilled more than 37 million orders (vs 14 million in 2015), with an average order value of $241 (vs $232 in 2015). Most of its customers stem from the US (85% of revenues in 2019).

Initial Corona fears

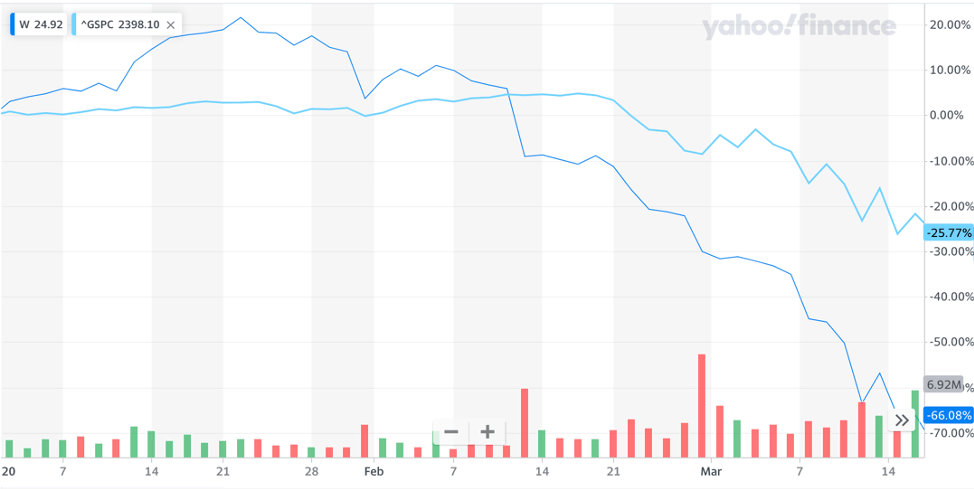

Between January 01st and March 16th 2020, the stock-price of the company fell by more than 66% from its peak mid January at $112 per share to its low in mid-March of barely $33. The massive decline in share price was predominantly driven by investors that feared two scenarios:

- Reduced consumer spending due to uncertainty around the pandemic

- Significant disruptions in the supply chain

Between January 2020 and March 2020, the Chinese country-wide shutdown of factories and businesses due to the outbreak of the pandemic in Wuhan caused significant supply chain disruptions for Wayfair, who source more than 50% of its inventory from China. This fear of continued disruption was further amplified by the increased trade tensions between the US and China leading to higher wholesale prices resulting from the U.S. tariffs on Chinese imports. Along with the risk of reduced consumer spending because of the economic impact of Covid-19, investors lost faith in the stock and sold en masse (see stock-price development between January 1st and March 16th, compared to the SP500 – W: Wayfair, GSPC: SP500).

Corona Boost

However, what most investors did not see coming during these initial months of 2020 was the effect that the country-wide lockdown measures would have on consumer spending in selected categories. People, locked up in the walls of their own homes, spending less on restaurants and outdoor activities, seem to love buying furniture. And Wayfair, with its millions of products and extremely advanced product features such as style-filters, colour-filters, 3D-virtual reality features (e.g. placing a couch virtually in your living room just by clicking a picture of the room) was in the ideal spot to serve these customers well. In a press-release issued by the ecommerce company in April, Wayfair states,

“After entering the month of March with gross revenue growing at slightly below 20% year-over-year, consistent with January and February growth rates, Wayfair saw this rate of growth more than double towards the end of March. This run-rate has continued into early April.”

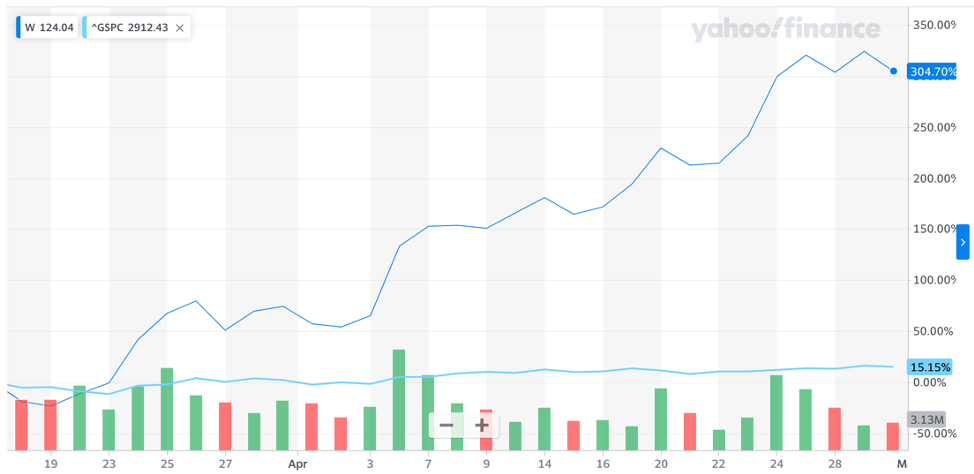

With more and more consumer spending on furnishing and home décor, investor confidence returned and the stock saw a significant growth between March 17th and April 30th of more than 300%, currently standing at +$120. Now, only six weeks after Wayfairs historic stock-price low, The mainstream media often cites Wayfair, along with Amazon as one of the true winners of the Corona pandemic.

Short-Term or Long-term

However, the biggest question is whether the company will be able to sustain this trend and emerge from this crisis as a true leader in the furnishing retail space. There are arguments for both sides. On the one hand, one can argue that the pandemic and the increase in users will change consumer behavior in the long run. Customers, who had never shopped furniture online may now consider purchasing a new home office chair or desk on Wayfair.com. Those customers may enjoy the consumer experience and continue to shop online in a post-covid world. However, on the other hand, one can easily argue that the current spike in revenues is due to an increased customer demand for specific furnishing goods e.g. a home-gym, a new desk, a new office chair, that are not necessarily recurring. While people are willing to spend on furnishing right now, because they spend most of their free time at home, this pattern may change again once the economy opens up, people do not work in their home office and spend their share of wallet on other consumer goods again (e.g. Restaurant visits, fashion etc.), leaving less of the pie for furniture.

Opportunities to sustain growth

If Wayfair wants to sustain this momentum and continue benefiting from the current covid boost, it has to do three things well:

- Deliver an excellent customer experience: Due to the current restrictions on offline retail, many customers are entering e-retail for the first time in their lives. Those “fencers”, who refused to shop furniture online before because they were skeptical, may now choose to use an online platform for the first time. It is extremely critical for those users that Wayfair delivers an excellent shopping experience without any hick-ups so that they become return users in the future, once the offline retail curfew is lifted.

- De-risk supply chain: With increasing trade tension between China and the US and countries closing their boarders, Wayfair needs to create alternative ways to source its products, potentially through vertically integrating the best-selling products into a proprietary, private label supply chain that allows the company to fulfill customer demands through manufacturing within the US or at least within North America.

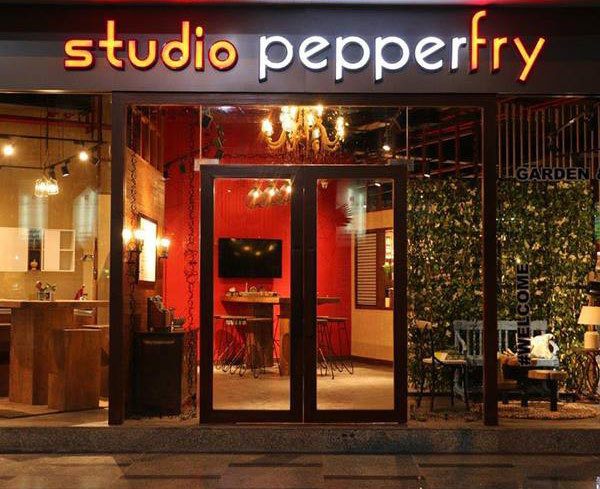

- Seek hybrid opportunities: With a significant amount of bankruptcies in offline retail expected over the next 24 months, Wayfair could take the opportunity to diversify its channels and open showrooms in offline real estate. Those showrooms could attract an entirely new segment of customers, who prefer to shop for decoration and furnishing items offline. With commercial real estate opening up, those opportunities may become more affordable for Wayfair. In India, furniture e-retailers such as pepperfry have done the move into hybrid and seen strong growth through these offline showrooms (see below an image of a pepperfry studio/ showroom)

Overall, while the market initially penalized Wayfair for its dependency on the Chinese supply chain and potentially falling consumer demand, the Covid pandemic has brought immense momentum into the industry and with Wayfair being perfectly placed to benefit from these tailwind trends, I believe the company will emerge from this crisis as a clear winner if they make sure to sustain and retain the new customers in the system.

Sources:

CapitalIQ

Yahoo Finance

CFRA Equity Research

https://www.cnbc.com/2020/04/06/wayfair-shares-surge-37percent-as-coronavirus-drives-sales-of-office-furniture.html

https://fortune.com/2020/04/06/coronavirus-chewy-wayfair-sales-retail-industry-revenue/

https://chainstoreage.com/wayfair-other-retailers-adjust-online-operations-deal-covid-19

An anecdote to back up your claim: I recently reached out to Crate & Barrel and Pottery Barn about furniture orders, and their (U.S.-based) supply chains are backed up for 3-4 months and counting. There are some things we’re willing to wait for, but some that as a result of these delays, we are ordering some things from Wayfair. It’ll be interesting to see what they try to do to hold onto customers once supply chains become a less critical differentiator between retailers.

My biggest concern about this Wayfair growth is that it is only a short term pop. Specifically, I almost see it as a move of revenue from a year out to just right now. In terms of buying furniture and home goods, there are longer life cycles on those items and so if you purchase so much now, then you likely won’t have to buy as much of it especially in the next year (especially if unemployment holds up and we potentially go into a recession / people have less disposable income). I also wonder if a potential recession will spike up the furniture resale market (especially since there are more platforms for these types of businesses now) and if that will lead to even more struggles for Wayfair after the pandemic.

Thanks for sharing Marius! Great article!!

Wayfair’s digital business model helped it survive and do well in this pandemic. In fact, it was interesting to see how they adapted their delivery model to meet the crisis (usually customers had to sign, but they stopped that for now to avoid contact). They are also continuously monitoring their delivery personnel to check for symptoms (e.g. checking their temperature).

But I agree with your recommendations for them to keep their momentum going. I also believe the company should work on reducing its customer acquisition costs (advertising is a huge part of their spending). Hopefully they will be able to leverage this deluge of data to develop better targeting algorithms.