Criteo: how much personalized retargeting is too much?

Criteo uses AI and Big Data to increase the scope of online advertising by created unique ads for … each individual customer.

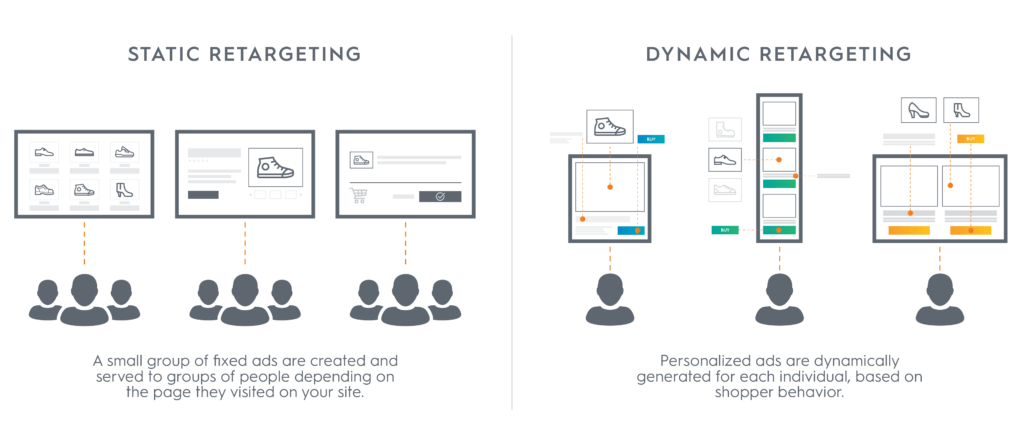

On e-commerce websites, only 2 or 3 percent of the visits lead to a sale. Online advertiser has developed a strategy of retargeting. They would display a product to users, depending on specific webpages they viewed. For example, users would see a banner featuring the exact product they have previously searched.

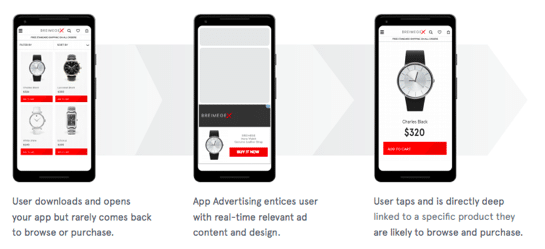

Criteo, founded in France in 2005, is the leader of dynamic retargeting. At that time, static retargeting was the main solution and consisted of targeting people who has previously visited the same website with the same ad. On the contrary, Criteo has developed capabilities to choose 1) the more interesting customers to target, 2) the best time to do so and 3) generate the most appealing ad. Often when a user visit a popular website, a real time bidding occurs to decide which advertising company could display an ad. Criteo has learned to identify users upstream and optimize the biddings given their attributes. If Criteo wins the bid, their algorithms will then generate a customize ad, with for example a specific color, fond and message that would appeal the most to this potential customer.

The company tracks user’s behavior through cookies. This is their main source of data. They can then establish and update profiles of users and products and connect them. They have developed an IT architecture to profit of a huge database and improve their algorithm on real-time. The infrastructure enables to test new machine learning models and compare their performance. Most of these tests are automatically monitored. In 2018, the company conducted around 700 A/B tests and manually intervened on only eight of them.

Value creation and value capture

The customers of Criteo are mainly online retailers and brands. Criteo products give them the opportunity to have access to efficient advertising, customized for each single user. Criteo states on its website that it can help to increase by thirteen times the return on investments on advertising for its customers by increasing the engagement of users on ads.

Criteo started its services as pay-per-click bidding platform, where customers could place bid on targeting campaigns. Now the pricing of its services is much more diverse and complex, as Criteo has extended its services to other type of online advertising.

Competing with the GAFA

Criteo is the leader in dynamic retargeting but it is a small player in the market of online advertising dominated by Google and Facebook. These two companies have accessed to a lot of personal data on users which enable them to draw highly detailed profiles. They have also a direct and privileged access to their own platform. In 2019, Criteo filed a complaint with the French competition authority against Facebook for progressively excluding advertising companies from its platform in the benefits of its own agency.

Criteo not only fears of being excluded from major platforms, but also fears to have its data source drying up. Apple and Google have announced they would begin to decrease and block third parties’ cookies on their browsers to prevent intrusive advertising. These two announcements have caused a major go down of Criteo’s shares. The company has been developing new activities to rely less on cookies.

One of Criteo’s response has been to launch a cooperative in 2017 for e-commerce to share their sales data among each other. The CEO of Criteo explained it would help online retailers to better target their customers and keep up with the giants Amazon and Alibaba. Criteo is educating its customers on the win-win opportunity of sharing data. A sale on a retailer platform can be used to better target users or better recommend products on another platform. Today, the company has gathered data on online transactions worth $800 billions in total from 16,000 different retailers since 2017 (compare to Amazon’s annual transactions of $300 billions) and is at the centre of this initiative by handling the data.

Privacy

The company is currently facing an investigation for violating the European GDPR act (the regulations on data protections) and risk a fine that could go up to 4% of their revenues. The company face a dilemma its activity. The more efficient their algorithms are at customizing ads for every single user, the more obvious an intrusion on privacy appears – even if it is legal – and the more likely it could create a public backlash. The company has also developed schemes to identify ads that could go through or fool ad blockers. I believe it is crucial for the company to set clear boundaries on privacy, on what is ethical and acceptable to do in order to avoid playing too much with fire.

Sources

https://fr.wikipedia.org/wiki/Criteo

https://en.wikipedia.org/wiki/Site_retargeting

https://en.wikipedia.org/wiki/Real-time_bidding

https://www.criteo.com/what-is-retargeting/

https://www.criteo.com/news/press-releases/2019/10/criteo-files-fca-complaint-against-facebook/

Interesting post, especially in a moment where advertising technology is going through a big revolution. On top of Safari ITP and Chrome Privacy Sandbox (both preventing cross-site cookie tracking), there are also regulatory changes (GDPR in Europe, CCPA in the US) that could push out of business many of today’s AdTech companies, whose business is based on cookies. Criteo will need to find (or help build) a new source of data, to be able to re-target and survive in a cookie-less world.

In this very dynamic environment, it will be also important to explore potential partnerships that can deliver innovation to advertisers and retailers. While Criteo has the advantage of having relationships and access to e-retailers’ purchase data, it would be interesting to explore if/how it could partner with other technologies e.g. to help assess how effective advertising was.

Interesting post. I have worked in the digital marketing industry for a long time, and am writing about LiveRamp/Acxiom for this assignment. They managed to benefit from the whole GDPR/data privacy discussion by selling of the data itself and instead becoming a hands-off data matching algorithm. In this new situation, privacy laws actually come to protect them, as new startups will have a hard time managing the complexity and risks.

I’m where Criteo lands on this one – on one hand they’re relatively small, and seem overly reliant on cookie technology, without having a lot of sources to enrich the data. On the other hand, i have seen them pretty strong outside the US, where data quality on users is generally lower (lucky non-US residents…).

I agree that the industry should wake up and hold itself to higher standards before a stronger privacy backlash makes their business impossible