Bumble – More than Just a Dating App

Bumble has transitioned from being a dating app to being a platform that provides a broader set of connections, merchandise, educational pieces, and even their own cafe storefront

Bumble is an online networking and dating company founded in 2014 by Whitney Wolfe Herd1. Started originally as a dating company, Bumble creates value by enabling users to connect with other users to potentially seek a romantic connection with. As more users become active on their platform, the more appealing it is as there is more optionality to find an ideal connection. From 2014 to 2021, Bumble had over 8.6B connections, with millions of users1. The company captures value through users who subscribe to their premium subscription, which unlocks added features that improve the user experience (e.g. increased user visibility within the platform and enhanced matching filters), or make in-app purchases (e.g. extended match times).

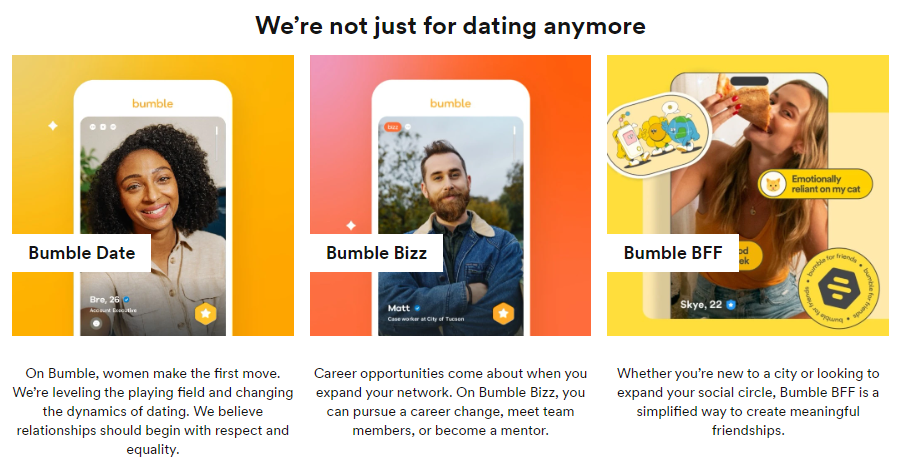

One of the unique attributes of Bumble is it is not only a dating app, but it has over transformed to be an app to allow someone to meet “every type of person you might want in your life”1. This includes a “Bumble BFF” feature and a “Bumble Bizz” feature (note the screenshot of their website below). These features expand the total addressable market for the company, as the platform isn’t strictly for those seeking romantic connections, but also for platonic and professional connections. For instance, under the Bumble Bizz feature, people could find their next job – one testimonial shared on their website discusses about how a single Bumble Bizz coffee date led to someone getting a new job position on the spot3. Thus, the app provides an alternative mechanism for employers and businesses to seek potential candidates.

Screenshot pulled from bumble.com

On their website, Bumble regularly posts how-to guides and articles that not only improve the barrier to entry in those who are learning how to utilize their app, but provide general education on the social connection space even for those who are not app users. Sample article titles include “How to Make New Friends“, “How to Work From Home With Your Mental Health Intact, According to Experts“, and “How to Deal with Dating Burnout”.

Bumble has expanded to be not only accessible through a mobile app, but also through an online website, further reducing barriers to entry as a new user. This also enhances their scalability by capturing additional volume through customer segments who may not have access to a mobile phone (or the reverse). Another expansion for value capture is their online Bumble shop where they sell merchandise targeting a variety of customers through their wedding & celebrations collection (e.g. wedding party favors), capsule collection (Bumble-branded items), and Bumble baby collection (e.g. onesies, towels, toddler clothing).

Overall, Bumble has continued to rapidly scale to capture value, especially with its launch into different categories as a core strategy (merchandise, education in their how-to articles, Bumble Bizz, and Bumble BFF). The company continues to pursue further diversification through plans to open their own Bumble-themed cafe shops1. The first such location, “Bumble Brew”, opened in 2021 in New York, which was built with 80-seats for dining areas and meant for genuine connections2:

Pulled from YouTube / ABC 4 News

Bumble’s total revenue in 2022 increased 19% to 904M, with total paying users increasing 15%4. While Bumble has a successful track record when it comes to scalability, sustainability may be questioned given their broad range of diversification outside of their dating platform, and entry into higher fixed cost investments (e.g. merchandise and its associated inventory cost, lease costs for their physical café storefront). While Bumble makes a bet on diversification of their platform, there is an increase in competition, as even companies like X (formerly known as Twitter) begin to consider adding dating features5. Another risk is that as users find what they need out of the platform (e.g. their target connection), they may no longer become an active user and the overall user growth may slow down in the future. For a company that depends on high user volumes to enable them to find their ideal match, this can be a challenge, although one Bumble’s competitors will also face. Additional challenges that impact Bumble’s potential for sustainability include maintaining safety and reducing online harassment as 49% of Americans mention dating sites and apps are not safe at all, or not too safe6. Furthermore, 52% of online dating users think they have encountered a scammer while using them6, therefore impacting brand credibility and trust.

Sources:

1. https://time.com/5947727/whitney-wolfe-herd-bumble/

3. https://bumble.com/es/the-buzz/bumblebizzcareer

Bumble logo pulled from logowik.com

Nice blog post! I’m curious, do you think the expanded services like Bumble Bizz and Bumble BFF are designed to retain users that were already using the app for Bumble Date so that way they don’t churn once they’ve found a match or do you think they are more focused on bringing new people onto the platform that weren’t interested in the dating app?

Interesting post! As a Bumble user, I’ve always wondered about the potential conflict of interest – if Bumble do their job, users should use the app for a few months and then never again. To what degree do you think Bumble limits its functionality to drive scale and vice versa?

Great post, Bumble is indeed an interesting case to examine. The concept of disintermediation is particularly intriguing when applied to dating apps. Traditionally, a common friend might set up blind dates, serving as the intermediary. However, Bumble and similar platforms remove this intermediary role, directly connecting individuals. Bumble’s competitive advantage would then be to offer a variety of options without involving itself in the meeting process. This is quite the opposite of platforms like Airbnb or eBay, which have implemented safety and insurance strategies to prevent disintermediation.

This hands-off approach could lead users to feel a greater sense of autonomy and personal responsibility in their interactions. Yet, it also places the onus on them to ensure their own safety and vetting, which can be both empowering and challenging. It raises the question of how Bumble can support user safety without re-introducing intermediation in the traditional sense. Maybe profile reviews? Haha, that might be awkward but useful.

Super interesting read. As someone who hasn’t been on this app before- thanks for breaking it down! Two qq- 1) I jut saw yesterday that the founder is stepping down; how (if at all) do you think this will impact their future strategy and growth plans? 2) Do you believe that Bumble is diversifying to new physical ventures in order to drive more people to use their app (and become paying users) or is this in and of itself meant to be a sustainable revenue stream?

Thanks for sharing! Bumble’s evolution from a dating app to a multi-faceted platform for various types of connections is truly impressive.

I’m also wondering: to what extent does Bumble prioritize perfect matches to keep users engaged? What are Bumble’s strategies to strike a balance between providing meaningful connections and ensuring user retention? Are there features or mechanisms in place that encourage users to stay active on the platform despite finding what they’re looking for?

Great post! I think Bumble has done a great job in experimenting with ways to leverage their existing network (and I’m sure part of their intent is also to “cross-sell” their networks on the additional relationship types). Do you know if there’s a breakdown of their volumes of engagement across these 3 product types? In my mind, each of these relationship types (romance, professional, and personal) are fundamentally different, and I’m not sure if they are easily conflated into a single superapp. I think one of the tricky things here is that by scaling up the user base, Bumble is inherently diluting the quality of candidates across their app, and in a scenario where they don’t have a material way to vet/ ensure quality control, growth seems to go in direct opposition to quality. While there might be user growth in the short-medium term, eventually, the decreased quality catches up, the most fervent users leave, and the app suffers.

Great post! I’m curious about Bumble’s decision to pursue different verticals that have a similar “looking to meet X” function vs expanding into and integrating other functions within dating. While they already have the baseline infrastructure to support Meeting individuals, I wonder if their strong branding around relationships deters users from the business or friends verticals. Additionally, is the process of connecting with an individual for work actually similar to meeting someone you want to date or is that assumption Bumble is making here not true?