Amazon | To Go Or Not To Go

Amazon has been one of the clear winners in the digital age, but will it also win in the grocery shopping space? Or will it be forced to share its technology and level the playing field?

We are used to describing Amazon as the ultimate winner in the digital age, to the point where writing an article about them winning (yet again!) seems obvious and unoriginal. But Amazon’s powers extend far beyond 21st century digital businesses such as e-commerce and cloud services. The company is investing billions of dollars in brick-and-mortar, while competitors try to diversify away from the old model by going on an e-commerce shopping spree [1].

This past week, Amazon opened its first Amazon Go store to the public. As I experienced firsthand during the beta test, the concept is simple: Amazon wants to reduce friction for the customer by enabling a grab-and-go system without checkout lines. This model is enabled by massive investments in computer vision and machine learning software [2]. But, why would Amazon invest millions to disrupt the convenience store industry, which has almost negligible margins [3]? One obvious reason is that the labor-saving technology will enable margins to be healthier while attracting more customers due to the time-saving experience. The other, not so obvious reason is that they are uniquely positioned to scale and make these stores ubiquitous in the countries they serve.

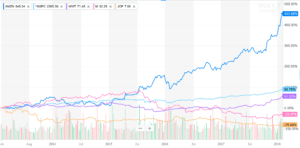

Last June Amazon spent a whopping $13.7bn on acquiring high-end grocery chain Whole Foods [4]. The news of the acquisition (at an approx. 30% premium) sent stocks of other grocery chains tumbling down (see chart 1 below). However, the number of stores acquired may not justify, at least at first sight and in the short term, such a significant investment in the “cashierless” technology.

Chart 1. L5Y performance of Amazon (dark blue), Walmart (purple), Macy’s (pink), JC Penney’s (orange), and SP500 (light blue).

Since Amazon has already incurred these R&D costs, the most logical way to spread these fixed costs is to achieve a bigger scale, i.e. license this technology to any grocery or convenience store chains, which would in turn benefit from saving in labor costs. It is safe to assume that 7-11 would very willingly pay a reasonable fee to avoid manning their stores 24/7, and that they do not have the software capabilities to develop a similar solution in-house.

However, Amazon’s past behavior suggests that they may choose to keep the Go technology in-house. In 2012, Amazon acquired Kiva Systems, a robot manufacturer used in their fulfillment centers [5]. With a price tag of $775m, most observers thought that the purchase would only make financial sense if the existing customer base was maintained. But Amazon renamed Kiva as Amazon Robotics and refocused all production to satisfy its shipping network [6].

Although these kinds of investing decisions might be financially painful in the short term, Amazon’s apparent disregard for quarterly earnings pressure remains supported by its long term financial outlook. Decisions at Amazon are made based on a longer horizon, which helps to explain both the rationale of acquiring Kiva and scaling fulfillment centers to meet its production rather than keep supplying other retailers and distributors and, probably, the rationale of not licensing the Go technology and keeping it in-house. From a strategic perspective, by keeping industry-disruptive technologies in-house, Amazon is building moats to defend itself from potential competitors [7] and avoiding leveling the playing field. This approach is poised to pay off for the Seattle giant in the longer term, and other retailers will be forced to keep up with technological investments or will face going out of business.

There is only one caveat to this strategy, and that’s regulatory scrutiny. Amazon’s business model appears to be disrupting different industries’ business models. So far the company has encountered no significant resistance from antitrust authorities, and that might well be due to its very positive brand image and its customer-obsessed strategy [8]. However, Washington’s views regarding the tech industry have changed considerably in the past year, and with Jeff Bezos as the owner of The Washington Post, plus the potential of Amazon Go making hundreds of thousands of jobs redundant, enhanced regulatory scrutiny seems now closer than ever. If regulators believe that the Go stores, combined with the Whole Foods acquisition, are potential grounds for an antitrust case, the company might need to consider the licensing route as the only viable alternative for its ground-breaking technology.

Sources:

[1] https://techcrunch.com/2017/10/17/walmart-says-it-will-acquire-more-startups/

[2] https://www.nytimes.com/2018/01/21/technology/inside-amazon-go-a-store-of-the-future.html

[3] https://www.convenience.org/YourBusiness/Refresh/Documents/How-Stores-Work.pdf

[5] https://www.wsj.com/articles/SB10001424052702304724404577291903244796214

[6] https://www.therobotreport.com/the-technology-gap-left-by-amazons-acquisition-of-kiva-systems/

[7] https://mailchi.mp/stratechery/amazons-go-and-the-future?e=56178c1b8f

[8] https://www.theverge.com/2017/10/27/16552614/amazon-popularity-user-survey-prime-echo-trust

Great post! Your thesis that Amazon will keep the GO tech in house is interestingly supported by their previous experience with KIVA, however I wonder if your time horizon is long enough — over the 10-15 year horizon it may start to make sense for Amazon to license out GO (and even maybe its warehousing robotics approach). If other companies start to invest in similar tech and there is a reasonable probability that they will independently develop it, then it may be better for Amazon to sell said companies watered-down versions of its products (maybe as a managed services approach) to gain license fees.

Your favorability ratings data is fascinating — in the midst of techlash it is really interesting to see that bad sentiments are so unevenly spread. I wonder if this is better marketing on Amazon’s part or just fundamental differences in the value created by Amazon relative to peers?

My concern comes from the finance side. The research and design cost of Amazon Go store must be extremely high, and Amazon needs to implement the whole solution (hardware+software) in every new store it opens. And the real cost that is replaced by the technology here is labor cost inside the store. However, if we look at the revenue structure of the convenient stores, the highest margin actually comes from the food/beverages that need to be freshly made by people at the counter, which is hard to be replaced by technology. So I’m so curious about the financial performance of Amazon Go store and see if there’s really a cost efficient statement.

I wonder why Amazon has decided to build out Amazon Go stores given their acquisition of Whole Foods. This “cashier-less” model would be incredibly helpful to Whole Foods given their large perishable offering, which would free up more associates to engage in stocking, customer service, and other roles in the store. It seems as though Whole Foods has a lot to gain from this type of technology.

Great post! To what degree do you think these stores are just ready-made distribution centers for groceries? Are they a stop-gap to some near future where Amazon will be able to deliver all groceries to you (e.g. Amazon Fresh), or is their current incarnation here to stay?

Thanks for sharing your insights, Juan. I, too, tired Go during its Beta this summer. It’s pretty amazing and eerie to experience first-hand. You almost need to force yourself to walk out after collecting your things – it’s a very unnatural feeling not to pay someone! Coincidentally, I was reading an article earlier today that attempted to estimate the number of cashier jobs that technology like Go could impact if rolled out across the U.S. Not surprisingly, the numbers were pretty substantial: 1.3% of the private sector workforce or 2.3 million jobs would be impacted if this tech became ubiquitous. To your point, estimates like this, even if they’re pretty rough, might raise some eyebrows in D.C. It’ll be fascinating to see if this tech sees any action beyond the single store in Seattle!

Thank you for your post. I completely agree that Amazon is definitely winning in many aspects of their business. It would be interesting to see how the shift from pure online to clicks and mortar work out fully for Amazon. Not only that they have Amazon Go they also have the Amazon books and Wholefoods. I’m unsure how the company will actually roll this out fully but it will definitely disrupt the retail industry even further. It will be interesting to see how a cash cow incumbent such as Walmart reacts to the situation.

Great post!! I loved hearing about your experience with Go, as it’s a new product to me. Also appreciated your thoughts on keeping tech in house vs. licensing it. Will be curious to see what happens to Amazon once investors start to demand higher profitability, since as you rightly point out, it is in a very unusual financial position.

I am quite concerned with the regulatory scrutiny you mentioned at the end of the post. I think that some of the major ‘winners’ in the tech space – Amazon, Google, Facebook – might be winning too much! In this case, I wonder if Amazon has other ideas for leveraging the technology other than at a grocery or convenience store. This could just be a ruse for them to master machine vision and then apply their learnings elsewhere.

Great post! While writing my post on Walmart, I was surprised to learn that Walmart and Kroger are also testing cashierless stores, albeit using much less sophisticated technology — via a digital shopping scanner that can be installed on customers’ smartphone or a store-provided handheld device. Kroger expects to have roll it out to ~400 stores this year and Walmart to ~200 stores.

I also think it will be a tough decision for Amazon to decide whether to license out this technology in the longer term. Whole Foods is only 470 stores, compared to Walmart’s 4,700+ US stores and I doubt Amazon will really want to expand into the fixed cost business of brick-and-mortar at the same scale as Walmart and Kroger. However, even if Amazon wants to license the technology, the other retailers may be wary of partnering with a major competitor. If a partnership happens, there will probably be very specific negotiations around what data is shared and who owns what.

Thanks for an interesting read, Juan! I’m also curious about how Amazon Go’s experience would shape or change the overall grocery shopping experience. How to scale the Go store experience quickly is critical and licensing would be the quickest way to achieve that. Though the fixed cost of developing the technology was already incurred by Amazon, I wonder how much it costs to equip a store with all the sensors and cameras and how easy it is to make adaptations on existing retailer stores, since most retailers have already massive footprint and it would make more sense for them to adapt existing stores. I’m concerned that potential licensees would be deterred by the upfront cost. So if going down the licensing route, how to make it financially viable and attractive to potential licensees would also be something Amazon could consider.

Juan,

Great post! I was thinking a bit more about what their long term strategy with Amazon Go would be. I agree with all the points about rolling it out to Whole Foods. In addition, I do think they could really disrupt the traditional convenience store experience. With both the “GO” technology and their ability to predict what goods people need and are looking for, as they already do at their distribution centers, this could massively transform what a “convenience store” really means. Could they use pop-up stores as a mechanism to support their last mile of delivery? It will be really interesting to see what direction they decide to move in.

Great post Juan! Thanks for sharing your first-hand experiences with Amazon Go with us!

I actually hold a different view of licensing technology vs. keeping it in house. I believe Amazon will be in a better position if they license the technology to other retailers. On one hand, the huge retail market (not only grocery, but also apparel store, home appliance store…) will be very interested in such technology, because it can help reduce labor cost and theft, and the retailers cannot do it by themselves. On the other hand, I think Amazon can gain a lot from the partnership, the massive data they can collect to analyze/predict customer behaviors and then leverage it in Amazon.com, and an Amazon payment system they can promote to replace cash and credit cards. I feel the value generated from data and payment system is much more than that generated from grocery business.

Amazon is notorious for testing out concepts and incorporating the learnings from these experiments back into their existing ecosystems or rolling them out at a larger scale if they see promise. It seems like Amazon Go may be another such experiment to observe user behavior patterns and how their buying patterns change given a new paradigm for purchasing physical goods IRL. Should be interesting to see how they learn from this coupled with the additional data they’ll gain from the Whole Foods acquisition.

loved it! Merging of online and offline channels will be one of the most critical game changers. Actually, Walmart is the only company that can respond to this kind of game changers. Amazon Go might be create many new losers. On the other side, Amazon is getting very diverse in terms of portfolio. Managing different business units and competing with many different companies might be the biggest obstacle of Amazon!

Interesting idea around licensing Amazon Go technology which I haven’t considered before!

My concern with that idea is that the technology is now based on the fact that customers who enter the Go store must have an Amazon account., where the shopping amount is deducted from. I wonder if Amazon will agree to license the technology and relax the requirement to have an amazon account, loosing also the immense amount of data coming from it.

I also don’t believe that in the near future the Amazon Go technology will allow to completely remove human assistants from the stores, hence I am not sure of how many retailers will want to re-engineer their store layout and license what is presumably a very expensive hardware (cameras) + software solution.

I keep on struggling with AMZN’s decision to buy Whole Foods. Is this another Bezos move to resemble Musk, first by getting into space exploration and now through this retail high end disruption? Whole Foods is to grocery stores what Tesla is to electric vehicles, and neither seems to make sense for lower income segments. I keep on thinking if a Target acquisition wouldn’t have made much more sense for Amazon.

But let’s deep dive on Amazon getting into groceries. I understand, consumables (repeat purchases) are key for Amazon’s core customers! Got it, now, where exactly has Amazon core capabilities to serve these customers? Not where the company is playing now. Amazon Go aims at transforming the in-store experience, but with limit inventory and high-end products it just loosely stands in between a cool — and overpriced – supermarket store and semi-fancy prepared food delivery model (that is not even an uber eats model). Where in groceries is also Amazon competing? Amazon Fresh, again not yet a proven (profitable) model. Where should Amazon be competing in groceries? Where it excels! As it core Amazon is an operations and technology company. Imaging if it could become your “food” inventory management company? I envision amazon having an app where you can input your family size, your food preferences, your budget, and the recurrence or time of the week in which you would like to receive your food orders. And then, amazon does the rest, and recurrently send you your orders home. Imagine now that the company, because of high household penetration can pool and align the timing of the orders of your entire building… and Voila! Economies of scale.

It may be true that Bezos holds a revolutionary plan for B&M, that I yet not see. For now, it just seems like back to stores feels a little old school and not within AMZN’s competitive advantages.

Great post Juan! Would love to hear more about your own experience in the beta. Did it feel seamless and easy, or were there unexpected hiccups? Did it provide you with real value or feel gimmicky?

Great Post! I am trying to figure out the pattern of all the acquisitions by amazon, I feel they are organic focusing on technology consumer products, grocery etc. and now developing their own sports product line. I am not sure how sustainable is it, are they trying to grow organically in different business model to diversify their investment overtime or they are are enforcing their brand. I guess will see how Amazon Go will develop, and if consumers will adapt quickly with such technology and shopping experience.

Interesting read. Thanks for writing. Given Amazon, alongside most of its Tech peers, are still viewed as “growth” companies, despite their size, they are given more lenience with their quarterly performances (which you point out). This has allowed them to make sizable acquisitions and make meaningful investments and market changing innovations. As the tech space mature, I wonder how this will change Amazon’s culture and ethos. Bezos consistently talks about having a Day 1 mentality in his Annual Letters to Shareholders but what happens when he is scrutinized more heavily on a quarterly basis such as we see with see with incumbents like GE, IBM, Disney, JPMorgan, etc. I wonder if Amazon will be able to maintain its reputation as the innovator we know today.