Airbnb vs COVID: The battle for community and connections!

Will COVID take down the community connections that Airbnb built over years? Or will Airbnb strengthen its community to defeat COVID and emerge stronger than ever?

The travel industry is one of the worst-hit because of the COVID-19 pandemic. The lockdowns and shelter-in-place across the world have resulted in record low hotel and travel bookings across the world. Airbnb has not been spared. They had planned to go public in 2020 and are now trying to save their business. They took a $1B expensive loan at a 40% lower valuation, wiping out billions of dollars in gains for Airbnb’s early employees and investors. They also canceled the $800M marketing budget. The hosts and travelers wanted to get refunds for all the bookings committed on the platform.

Airbnb disrupted the hotel industry and increased the availability of bookable rooms worldwide. It is also a young company and has used AI and data analytics to improve the experience for hosts and travelers. Will it be able to innovate its business model and bounce back? Here are some of its responses and lessons from them.

Online Experiences

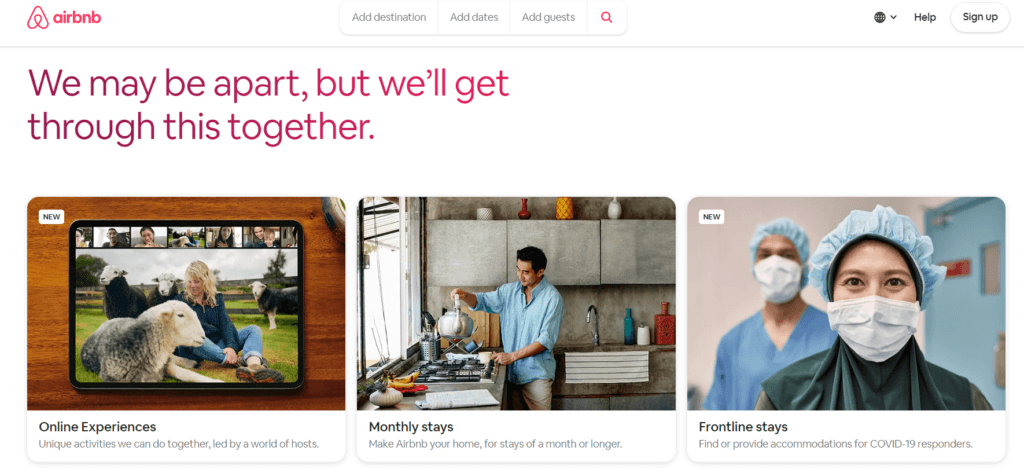

Airbnb launched “Online Experiences” that are led by inspiring hosts from over 30 countries—including Italy, Japan, Morocco, and Mexico—unlocking access to cultures and traditions from around the world. Hosts are already offering Online Experiences—like magic lessons, cooking classes, guided meditations, and more—through Zoom. Airbnb already has nearly 100 hosts offering experiences online and thousands more who have offered to host experiences. Some of the most popular offerings are already sold out.

This is a great example of innovating new solutions while maintaining the core “building connections across the world” philosophy. These online experiences could be an alternate source of revenue for Airbnb and hosts and a nice hedge against major disruptions such as pandemics. However, the market for online experiences has many competitors by industry such as Masterclass. Airbnb has the advantage of many users and hosts already on its platform.

Flexible Cancellations

The success of Airbnb as a platform relies on both sides (hosts and travelers) being satisfied. In the light of the pandemic, Airbnb made two tough decisions: first, refunding guests whose trips were canceled at the personal expense of Airbnb’s hosts. This did not go well with the hosts who lost a lot of expected revenues. Second, Airbnb started a $250M fund to reimburse the hosts partially, with the Superhosts (highest rated hosts on the platform) getting a priority.

While this was a big sacrifice for Airbnb, this might win travelers’ and hosts’ hearts. Airbnb’s long-term success depends on the community, and this will go a long way to showcase how much they care.

Extended Stays and COVID Frontline Worker Stays

Airbnb’s home page is suddenly very focused on three things — online experiences, monthly stays, and something called “frontline,” which is an area for hosts to offer housing to healthcare staff and first responders. This is a great move by Airbnb and will help win a lot of loyalty points from the community across the world.

One promising travel trend on Airbnb in these times is that searches for longer stays nearby have more than doubled worldwide. People are turning to Airbnb for these types of reservations, which can provide the flexibility they need with the comforts of home. In the U.S., for example, bookings for four to six weeks increased by at least 30%. Airbnb was quick to act on this and has been encouraging hosts to enable the long-term stay option along with flexible cancellation policy to encourage peace-of-mind for bookers. This can be a win-win for both the hosts and Airbnb.

In addition to this, Airbnb launched a program to house 100k COVID-19 frontline responders. Leveraging the power of its community, it encouraged hosts to open homes to collectively help control the virus spread. These homes were either available free or at a reduced cost for the frontline responders. This is better than keeping the places empty as it earns some revenue and helps the pandemic. It also keeps the community engaged – a critical factor for Airbnb’s rebound after the pandemic.

What enabled this transformation?

This transformation has not been easy for Airbnb. When hundreds of employees are working remotely and simultaneously, and complex changes must roll out in 60 different languages, it is hard to do that seamlessly. Airbnb’s incredibly tech-savvy team mapped the process and scope in under three weeks. They made quick and big changes on the website and reached out to the stakeholders. Airbnb removed abstract layers of communication. Instead of using a Google Doc, they used collaborative interface design tools such as Figma to look at all the designs and quickly prototype and screen-share. Their real-time analysis systems monitored the behavior of guests on the platform to new changes. Airbnb used this feedback to quickly iterate and improve the offerings.

Other Opportunities

Airbnb could also invest time in building a sophisticated cancellation, forecasting, booking system now to cater to the surge in demand when things reopen. For instance, the regular business travelers, who have been “tethered” to their domiciles and working from home, will want to travel even more but they will look to small cities and communities as their preferred leisure options. Airbnb can be prepared for these changes to capitalize on future opportunities.

Lessons for Others

Airbnb has shown that rapid transformation to the business model can help raise hopes for a stronger comeback and survival. Despite being in one of the worst-hit industries, Airbnb leveraged its incredibly agile and tech-savvy team to redesign the products and keep the community engaged. It also taught us that speed of implementing changes using remote tools matters greatly in adverse circumstances. Hopefully, the traditional hospitality industry will take note of this and reinvent itself.

Airbnb has gained goodwill from travelers, hosts, and the world for their efforts. However, this has costed them dearly, and they may face a liquidity crisis if the pandemic lasts longer. The rapid response from an agile team might just enable them to bounce back even stronger and eat up competitors’ market share when the world reopens!

References:

https://www.airbnb.com/resources/hosting-homes/t/coronavirus-updates-34

Great post! Thanks for sharing. The move towards online experiences seems a logical extension to their business, especially at this time. However, I was wondering how it will differentiate itself from Masterclass and other similar startups? Price, I am guessing could be one differentiator as Masterclass is based on celebrities bringing their skills to normal people vs. here it is connecting normal people to normal people. The threat though is the quality. Professionals can bring much better quality lessons than AirBnB hosts. Do you think this is a permanent move for AirbnB or just for now to remain engaged with its customers ( hosts and guests) during COVID19?Would love to know your thoughts on this.

Great point, Sneha. I see a couple of differences between Masterclass and the Online Experiences here. As you pointed out, the community connection here could be a big differentiation. Masterclass would be more unidirectional and Airbnb could really strengthen the community through these intimate one-on-one sessions. The quality may not be the best as they are just beginning, but could be improved over time. Secondly, the Masterclass pricing model is subscription based, while Airbnb would want to go for individual or small group live sessions and make them more interactive.

I also think this can be a good long-term viable option and a big hedge against disruptions like these. Super low cost, platform-model with already active community are other things that work in Airbnb’s favor.

Interesting article! I wonder for what percentage of hosts Airbnb is their primary source of income, in the end, those are the ones more affected and the funds should be prioritized for them. It’s very difficult to know this, anyone can say it is their primary source and in reality, it may be just a secondary source of income. At the same time, Airbnb is much well positioned that Hospitality companies as they don’t own any of the assets (apartments) and just behave as a platform. If a huge percentage of their host don’t need Airbnb to sustain their lives then I see Airbnb recovering fast. I think a more important issue is how COVID-19 is going to affect demand in the mid/long-term, how many people are going to postpone vacations, holidays, and trips? The crisis may change the behavior of millions of consumers and that means just less business for Airbnb.

Those are all fantastic points, Walter. The fairness question will always be there – Airbnb has put customers first here, and is refunding hosts on case-by-case basis, based on mutual benefits in the past for both parties.

As to your point on changing travel patterns, one positive trend that could emerge is that people prefer to explore local communities as they work remotely versus staying in hotels or the crowded tourist destinations. Airbnb surely has the community edge and capabilities to shine there.

Thanks for sharing, Panda. The online experience sounds very cool and creative. I am wondering whether other hotel companies are doing that. if not, I think Airbnb is quite leading.

Also do you think Airbnb should keep the online experience to engage the community after Covid-19?

I haven’t heard any traditional players such as Marriott / Hilton do an online experiences thing. So yes, completely agree with you on the fact that Airbnb could be leading here.

Yes, it seems to be low investment and high ROI if executed properly, so why not? 🙂

Thanks for the post! It’s great that Airbnb has been able to leverage their strengths pre-COVID to pivot and generate some revenue while also helping out their communities. One concern I have for the travel industry, but particularly Airbnb, is the lasting impact and shift in consumer behavior related to travel once the shelter in place orders are lifted. I am curious if travelers and hosts will feel comfortable letting strangers into their homes or staying in someone else’s home after we have been practicing social distancing and are more aware of germs than ever. Given the good relationship that you mentioned with both hosts and travelers, I think Airbnb can overcome this fear but needs to start working on cleaning protocols and messaging ASAP.

Right on point! Infact, Airbnb just announced a big push for a 24-72 hour waiting period between two occupied dates and has been working on cleaning protocols for peace-of-mind. This is probably not sustainable for business in the long run, but does give peace of mind for travellers.

Super interesting read! I wonder if for Airbnb if beyond innovating digitally, it might be worth to take advantage of what could be depressed real estate assets at a global level, and turn to acquisitions of popular real estate. I feel their incredible amount of data would give them a significant edge into selecting a profitable and effective real estate portfolio and whether they might be leaving money on the table.

Interesting idea, probably a long term goal, but given they have an impending liquidity crisis, may not be the best option in the short term!

Great post! I think airbnb can still allow for experiences in the “world” through other means. Youtube is one option with a video chat “guide” (or either of these as stand alone experiences), but it might be interesting to partner with a VR company or product like minecraft where a virtual version of the existing world has been created. Would this be a viable platform for hosts to provide a cooking class or tour of UNESCO sites for instance? Would this mean that airbnb would be in the rental business for VR sets instead? Not sure if this falls outside airbnb’s scope but perhaps the sets could be insured like shared bikes, where there is a large safety deposit for use that is returned to the user afterwards.

A second aspect which I find very interesting is around buying property and becoming asset heavy. I’m not sure airbnb is best poised to evaluate and purchase properties as their expertise is focused on not just the property but also the service associated with it. That being said, it could provide a new business arm much like Netflix creates its own movies and shows, airbnb can create its own hotel, apartment community, or house.

Thanks DJ, those are both great points.

On the VR partnership and a virtual tour, that could be a great initiative. But I could see this as an extension of the online experiences and making them more real. The VR logistics could be difficult here, but there’s definitely room for creativity here. Thanks for mentioning this.

On your second point, given they have a liquidity crises in the current situation, making the business asset heavy may not be the best option, but definitely some analytics intelligence services to the real estate players could be a viable option!

Thanks for the post! It is interesting to see how Airbnb quickly responded to COVID-19 with innovative solutions. I believe this will strength the network and the brand image. I personally had very bad experiences with Airbnb specially with cancelations with short notice, I think that if the company takes this opportunity to strengthen its customer engagement and service it will be worth the effort. Regarding the initiative “building connection over the world” I found fascinating and that can really be a game changer as far as they are able to convert connections into transactions. I would certainly be interested in connecting with hosts in places where I usually visit, this will improve the trust in the system!

Great post! I agree that Airbnb should leverage the longer stays segment of travelers both now and in the medium term. As leisure short-term vacations may wind down in the foreseeable future, the rise of the home office trend that will surely come from Covid might encourage people to decide to work remotely from different locations and move around more often, instead of being located constantly in the same place. This is something that Airbnb could accommodate given the vast array of properties they have amassed.

I can’t think of any other company that can provide the value that Airbnb can with such a global footprint, so hopefully they can leverage their skills to stay afloat.

Thanks for sharing, Miguel – super interesting! Thinking about leveraging Airbnb properties for remote work could be an great market to tap into for sure.

Very interesting read! Seems like AirBnB have adapted very well to this crisis. I thought they would be crushed by it. Based on what you’ve written, I think the organisation is now well positioned to grow at an even faster pace when the crisis eventually ends. I believe travel will boom once the borders open up with people ready to get out again. Honestly, if AirBnB have found a way to survive this, then I think the company will be here for many years to come.

Great post – I think you’re point around Airbnb really enhancing its brand as a big value add going forward. I had experience with Airbnb vs. VRBO and the service and ease Airbnb showed in allowing cancellations / reimbursing was impressive. Although there is obviously the short term cash hit, I think the brand value added by this is huge – I would definitely choose Airbnb in the future over others because of that. Even more, I think they can do other things to differentiate themselves in a post COVID world – e.g. demonstrate what they are doing to ensure cleanliness and safety for users. If they can also do a better job on that than others, I think they can become the travel stay of choice for many users.

Great post! Very interesting topic. I got a chance to see first-hand how Airbnb has dealt with cancellations when I sought a refund through the platform for spring break travel bookings. It seemed to me that the company was overwhelmed with cancellation requests and that their messaging took a while to get right and consistent, but that they were able to make quick changes and announcements because of their digital-first strategy. Also, they were able to scale refunds with clear platform logic to reduce the load on human service center employees, which much have helped with the spike of call volume in the early days of the cancellation wave.

The pivot to online experiences is also intriguing. Airbnb has gone from room bookings to Airbnb experiences and now digital offerings. I’m curious what the demand will look like for this service feature when travel resumes. Of course, the reintroduction of travel may pose as many challenges for their strategy and policies as the shut down did. Some countries opening while others remain closed, and risk exposure of virus transmission through hosts and guests will pose a significant obstacle for Airbnb to return full steam.

The decision to create a fund to support hosts is also interesting. $250 million is a very sizable commitment. Comparing this to other gig economy companies, it seems that Airbnb has been proactive and significantly more generous in finding new ways for hosts to earn money and get relief, though I’m not sure as many hosts depend on Airbnb as primary sources of income relative to Uber an Lyft drivers where the relief programs have been a bit more limited and fraught will implementation challenges.

It seems Airbnb’s ability to rapidly prototype and test ideas has been a major benefit for the company in weathering the storm. Will be interesting to see how hotels and more traditional travel / housing companies deal with the reopening of travel as there are many more touchpoints in their properties (higher concentration of travelers in one building) than Airbnb’s distributed model which may also encourage more business traveler use of Airbnb’s platform.