“Your Uber Robot Is On the Way”: The Transformation of Uber’s Supply Chain in a Driverless World

The arms race for autonomous vehicle technology has raised fundamental questions about how Uber will deliver ride hailing services in the future.

While there is considerable divergence of opinion around when or how autonomous vehicle (“AV”) technology will manifest in everyday life, preliminary research has emerged attempting to quantify AV’s potentially major economic implications. In a world with driverless technology, few industries will be transformed as significantly and directly as on-demand ride hailing services. Currently, the largest cost component for ride hailing businesses is driver commissions, which are estimated to represent 80% of sales.1 A fully driverless world, however, would render drivers obsolete. As such, ride hailing businesses would need to transform the focal point of their supply chains from sourcing drivers to sourcing autonomous vehicles capable of transporting passengers on-demand.

For Uber – the global ride hailing leader, with a valuation greater than $60 billion and more than 70% U.S. market share – there are opportunities and challenges inherent in this potential supply chain digitization that will likely determine the long-run fate of the company.2,3

The expected benefits of AV make clear the tremendous opportunity on which Uber stands to capitalize through successful AV integration. Recent studies from the OECD and the MIT Artificial Intelligence Laboratory used algorithms to simulate transportation systems providing AV ride delivery. These studies concluded that – in a fully driverless world – the number of cars required to serve public transportation demand in cities could decline by between 70-90%.4,5 Fewer cars on the road would reduce traffic congestion, accidents, and overall transportation costs. Due to more efficient transportation systems and the elimination of driver commissions, experts believe that AV advancements could reduce costs in ride hailing business models by as much as 80%.6

The emergence of AV technology, however, cannot be considered unambiguously positive for Uber. Given AV’s far-reaching effects, the entire automotive value chain has begun competing in an arms race to develop AV technology. Uber’s most direct competitor, Lyft, for example, launched an AV-focused division and forged partnerships with Google, GM, and AV technology startup Nutonomy to accelerate its driverless capabilities.7 These partnerships have borne fruit and put the Lyft cadre squarely in front of the AV race, as just last month Google became the “first to put truly driverless vehicles on to public streets.”8

Perhaps even more concerning for Uber than Lyft’s recent successes are the resources being deployed into the market by large-scale automotive players. GM’s internal AV segment, for example, recently introduced a beta version of a ride hailing application that is servicing customers with semi-driverless vehicles.9 Beyond GM, AV technology development has become a universal element of R&D spend in the automotive industry and, as Figure 1 below demonstrates, the number of cars and companies testing AV in Silicon Valley has increased dramatically in recent years.

Figure 1: Increase in Autonomous Vehicle Testing10

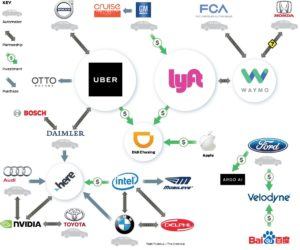

While the competitive environment in the quest for driverless technology has intensified, Uber has created its own internal segment, the Advanced Technology Group, to focus on driverless technology development. To enhance these efforts, in September 2015, Uber announced a partnership with Carnegie Mellon University, whereby the company would collaborate with the Robotics Department on AV technology.11 Moreover, in 2016, Uber acquired startup company Otto – with proven AV technology capabilities – for $600 million.12 And, similar to Lyft’s strategy of creating OEM partnerships, Uber announced an agreement with Daimler and Volvo this year to source their autonomous vehicles for its platform, once they are in-production.13,14 Figure 2 below provides a depiction of how Uber’s AV alliances stack up relative to its key competitors.

Figure 2: Autonomous Vehicle Industry Alliances15

Thus – through internal segmentation, research partnerships, M&A, and supplier partnerships – Uber has taken major steps in working towards an AV solution. It is clear, however, that significant work remains until Uber will be able to offer a commercially viable AV service. Experts believe that software will be the major production bottleneck for fully driverless vehicles. AV Software enables object analysis, decision making-systems, and fail-safe mechanisms, all of which are critical to full driverless-ness.16 Given software’s linchpin nature, Uber should consider partnering more closely with or acquiring businesses that specialize in AV software.

Moreover, given uncertainty in when AV will propagate, Uber must prudently allocate resources to AV development while continuing to nurture and grow its existing ride hailing network. Ride hailing accounts for 4% of all miles driven today and is expected to account for 25% of all miles driven by 2030.17 The ride hailing market growth opportunity is massive, and Uber must balance investing for future disruption with maintaining its dominant position in the current paradigm.

While it’s clear the industry has geared itself toward driverless-ness, major open questions remain for Uber’s AV transition. In a driverless world, for instance, Uber will need to consider the business model implications of owning a fleet of AV’s or sourcing them from third parties. Additionally, contending with strong populist crosscurrents, Uber must determine how to rationalize AV’s mass elimination of lower-skilled jobs to communities, governments, and societies more broadly.

Word Count: 800

1 Phillips, Jennifer. “Uber & Ride-Sharing: The $650 Billion Question.” Sharespost.

2 Ibid.

3 Uber’s market share has taken a big hit. Rani Molla. https://www.recode.net/2017/8/31/16227670/uber-lyft-market-share-deleteuber-decline-users

4 Martinez, Luis. “Urban Mobility System Upgrade: How shared self-Driving cars could change city traffic.” OECD International Transport Forum.

5 Alonso-Mora, Javier. “On-Demand high-Capacity ride-Sharing via dynamic trip-Vehicle assignment.” Proceedings of the National Academy of Sciences, vol. 114, no. 3, 22 Nov. 2016

6 The long, winding road for driverless cars. https://www.economist.com/news/science-and-technology/21722628-forget-hype-about-autonomous-vehicles-being-around-cornerreal-driverless-cars-will

7 Lyft launches a new self-driving division and will develop its own autonomous ride-hailing technology. Sarah Buhr. https://techcrunch.com/2017/07/21/lyft-launches-a-new-self-driving-division-called-level-5-will-develop-its-own-self-driving-system

8 Financial Times Google’s Waymo passes milestone in driverless car race. https://www.ft.com/content/dc281ed2-c425-11e7-b2bb-322b2cb39656

9 GM’s Self-Driving Unit Launches Ride-Hailing App. Mike Colias. https://www.wsj.com/articles/gms-self-driving-unit-launches-ride-hailing-app-1502225522

10 Ibid.

11 “Uber and Carnegie Mellon University: A Deeper Partnership.” Travis Kalanick, 9 Sept. 2015, www.uber.com/newsroom/cmupartnership/.

12 From zero to seventy (billion). https://www.economist.com/news/briefing/21706249-accelerated-life-and-times-worlds-most-valuable-startup-zero-seventy

13 Uber, Daimler Strike Partnership for Self-Driving Vehicles. Eric Newcomer. https://www.bloomberg.com/news/articles/2017-01-31/uber-daimler-strike-partnership-for-self-driving-vehicles

14 Volvo is sticking with Uber to win the autonomous driving ‘marathon’. Benjamin Zhang. http://www.businessinsider.com/volvo-us-ceo-interview-autonomous-cars-china-trump-2017-5

15 Mapping the Autonomous Vehicle Industry. David Silver. https://medium.com/self-driving-cars/mapping-the-autonomous-vehicle-industry-4c4b7ac35a24

16 Heineke, Kersten. “Self-driving car technology: When will the robots hit the road?”. McKinsey.

17 IBID.

Super-interesting. It’s definitely a challenging situation to have to invest in a capability that you know will be hugely disruptive one day, but have no idea when the hammer will actually come down. If I’m sitting in Uber’s seat, I’d have a tough time developing complete conviction that an AV fleet is the way to go. A lot of the cost savings potential is driven by expected traffic reduction and I’m not sure I buy that we’ll suddenly need only a 10%-30% of the cars that we used to. I understand AV vehicles have high potential to improve traffic efficiency but AV could also drive an influx of many new zero-passenger cars (used by companies or individuals to run errands when they’re busy) which would increase car parc and keep traffic high. It also may still be better for the business model to retain human drivers instead of transitioning into a fleet manager. The human driver is asset light and shifts much of the operational risk to the driver. Shifting to AV model may make it harder to expand into new cities as rapidly and also end up taking a lot of management bandwith to manage AV vehicle fleet.

Here comes a comment from the electric vehicle enthusiast! As you point out, an autonomous fleet can be used more efficiently and can optimize for time on the road. As utilization per vehicle goes up, the cost/mile per vehicle becomes increasingly important. The cost of ownership of electric vehicles (maintenance, depreciation and energy costs) outcompetes combustion vehicles, and as a result it is very relevant for AV fleets to be electric. I am hopeful that Uber and Lyft’s efforts to spur on AV technology will also lead to an accelerated adoption of electric vehicles.

Really interesting look into the implications of AV on uber’s business model. While I agree that software could be the bottleneck in production, I also believe that post-production obstacles may pose an even bigger threat to a successful go-to-market strategy for Uber + all AV players. Firstly, these companies have to navigate the differing regulatory landscape across states while testing vehicles. Many have flocked to AZ where laws have loosened, but I can expect the battles to continue in other states and at the national level. Then, once regulations catch up, how will infrastructure have to transform to maximize the benefits + safety of AV fleets? How will public transit be challenged? It will be interested to watch as these questions (and many more) unfold in the coming years.

Very interesting article Jordan! One of the questions that concern me the most that you well point out, is the change of business model that Uber will have to consider when AVs become a reality. Will they want to invest in their own fleet and become an asset heavy business, or will they try to outsource this fleet? A big consideration for this question is whether the cost of AVs will be accessible to the masses, or when it will be accessible to the masses. If only the wealthy will be able to afford an autonomous vehicle, will Uber be able to achieve the necessary scale with outsourced vehicles?

This is both interesting and something that will be very relevant very soon. As the exemplary example for ‘industry disruption’, Uber is definitely facing some difficult decisions in regards to their business model and how it will inevitably need to change to keep up with where this industry is headed. I am confident, though, that as an industry disruptor, Uber will continue to make radical decisions. I wonder what the limits to their capabilities are in terms of potentially investing and maintaining their own fleet when AVs do hit the market. In addition, I wonder about their reaction to consumer needs and behaviors – could part of their business potentially turn into a AV leasing company? I do see industry lines blurring as there may no longer be a rideshare, taxi, driver hiring industry anymore in the next few years. Instead, we’ll see Uber competing against the GMs, Teslas, and Googles of the world.

Great article!

I agree that AV is the next – and most critical – step for Uber’s growth. Given its cash burn, high driver costs, employment classification/benefits lawsuits, and price war with competitors, removing significant investment in human capital is key to the company’s long-term profitability. AV fleet management also has significant benefits to consumers, notably optimized allocation of vehicle supply to meet demand, leading to shorter cycle times and cheaper prices for riders.

Critical to AV adoption, however, is wide-spread acceptance by passengers, drivers, and law makers. Uber & other AV partners are still silent on how they plan to achieve this likely costly undertaking. Questions such as “how will cars be tested/permitted/monitored?”, “what risks are exposed with a machine instead of a human controlling the vehicle?”, and perhaps most salient, “who is liable & responsible if there’s an accident?” still need to be vetted and understood before we see AV move toward an operational reality.

Very interesting. One of the most prominent questions that this brings to mind is how quickly new technology will be adopted by consumers. Auto OEMs can control what they offer, but have less control over demand. It may very well be the case that consumers are not comfortable getting into a car that they have no control over. There could also be a difference in speed of adoption between demographics – perhaps younger consumers will be less reluctant to abandon their steering wheels. Finally, will driverless vehicles be more attractive to consumers living in urban/suburban areas, and if so, what percent of the market is truly addressable?

Great article, Jordan.

One thought I would offer is around how mass transit (buses, trams, etc.) will be disrupted by this shift to driverless technology. At the moment the private sector is unwilling to take on mass transit because of high costs and the fact that governments have taken the niche of cross-subsidising these costs as transport, even along unprofitable routes, is a public good.

As driverless technology and big data enables better route planning and more cost-effective vehicles, there would be an opportunity for companies or the government to act as an insurgent by applying these technologies to mass transit. Big data and driverless cars could see perfect synching of demand for travel along most routes with a technology that diffuses cost over more users, challenging the private transport model that is developing in the first generation of driverless vehicles.

Very-well written! As we all discussed in class self-driving vehicles will revolutionize travel for the coming generations. The most interesting aspect to me regarding this topic is to understand who will bare the risk of capital expenditures. I think it is safe to presume it will be car manufacturers. However, I think it poses an interesting option for Uber and other companies to evaluate such an opportunity. First-mover advantage is going to be significant for the company/companies that form a partnership to set the industry norm. It’s hard to imagine what we would do today without Uber or Lyft. Similarly, the future with self-driving vehicles presents increased efficiencies on all aspects of traveling quicker, faster, and more often.

Super interesting read!. It’s interesting and, at the same time, challenging to be thinking about the future of services such as Uber and Lyft, as we touched on a little bit in the TOM case. The article clearly indicated that Uber has taken a big move to respond to the AV trend (M&A, partnerships, development and so on). One question that came up in my mind is whether or not the AV will be self-owned and privately used or be it that people will not own vehicles anymore but rather reply more on autonomous transportation services. I believe the answer to this question will have a significant implication on the extent to which Uber and Lyft are being threatened by the advent of AVs.

Great article! The dynamic of companies from such diverse industries competing for their share of future market for autonomous driving speaks to the great potential of such a market. It is interesting to note the political and regulatory challenges that lie ahead on questions of the safety of autonomous driving. As safety concerns are paramount in consumers’ reluctance to embrace autonomous transportation, the alliance of companies that can implement the safest form of autonomous driving stand the best chance of winning this great market. The automotive industry will be dominated by the company with the best IT implementation, and features such as automotive design and gas-mileage will become of lesser importance. As such, I believe companies like Google, rather than GM, are poised for future success in this market.

Thanks, Jordan. Some interesting questions ahead for Uber and the other contenders in the driverless race as well. In an interesting update since the time of your post, in a $1.4 billion deal, Uber has agreed to purchase 24,000 autonomous XC90 SUVs from Volvo between 2019 and 2021. Thus, in response to the question posed at the end of your piece, it looks like Uber is taking the route of owning its own fleet, although the 24,000 number has been described by Uber as a “general framework” rather than a confirmed number of vehicles to be purchased.[1] Under this scenario, is Uber best to manage a potentially massive, global vehicle fleet? Uber has a number of strong core competencies, such as its software development capacity and a muscular (some say overly-aggressive) lobbying arm. Can it also become a national or global logistics company, on par with FedEx or Amazon? Or a leading fleet operator like Enterprise or Wal-Mart? We’ll have to stay tuned!

[1] “Uber orders up to 24,000 Volvo XC90s for driverless fleet,” Tech Crunch, Nov 20, 2017 (https://techcrunch.com/2017/11/20/uber-orders-24000-volvo-xc90s-for-driverless-fleet/)

Great synopsis of the AV issue at hand for Uber and Lyft. It is exciting to watch science fiction spring to life and gain traction in a relevant and advancing market. However, I am skeptical of the optimism surrounding the implementation of AV and the associated capital expenditures required to achieve marginal gains. Some technological innovations, like the iPhone, immediately transform the mediums by which we interact. Yet other innovations, such as the internet, take decades to demonstrate their full potential. To me, AV adaptation resembles the latter. It will take decades for AV transportation systems to fully integrate into urban areas since the complexities surrounding transportation number in the hundreds, if not thousands. Urban driving requires hundreds sensory inputs coupled with other variables, all compounding into thousands of ‘what if’ scenarios. Thus, what is the net benefit of this development to Uber and Lyft and are the costs justifiable? How much is each willing to spend for seemingly marginal gain? While AV is exciting, I hesitate to see the correlation between AV’s long-term potential benefits and the large costs required to achieve those benefits.

Very interesting article! It reminds me of the Fasten case. It is no doubt that if Uber enters the AV industries first, it will have significant advantages over its competitors, such as Lyft and Fasten. At the same time, AV completely breaks the two-side sharing platform that Uber creates to connect drivers with riders. Maintaining AVs will also change Uber from a software company to a operations company. To avoid these challenges, in my opinion, Uber should contract with AV manufacturers, such as GM. Instead of owning and operating the AVs, Uber treats these AVs as autonomous drivers owned by GM. In this way, Uber will be able to keep its operating model very similar to its model today.

Interesting article! I also agree that autonomous driving is going to be the future direction. And as the leader in the ridesharing market, Uber has to make enough resource to secure a leading seat. However, this would force Uber to face some business model transition challenges. If the cost for using an autonomous car goes so low that a customer wouldn’t own a car any more, then the asset will sit on Uber’s side. With such heavy asset, Uber has to excel at operation, not only technology. Also, part of customer experiences would still need human facing. How Uber come up with solution to this would also become critical.