You’ll Be Lost Without it: The Rise, Fall and Rise of Garmin

Garmin invented GPS powered navigation in 1989, however, the introduction of the smart phone allowed competitors to offer better nav products for cheaper. Can Garmin find a way to survive in this new world?

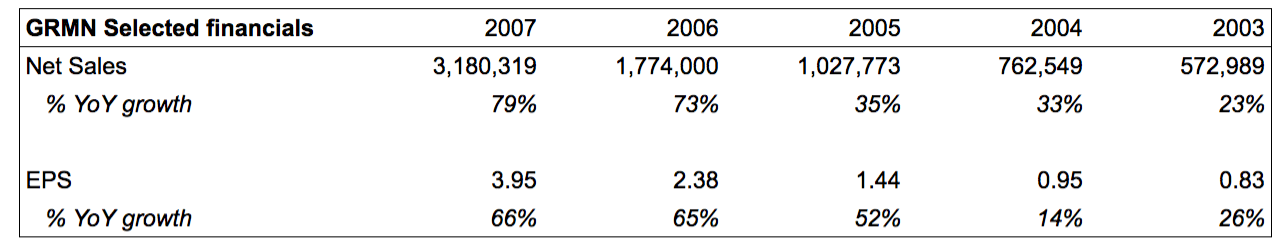

2007: Garmin hits $3B in revenue, growing 80% YoY

By 2007, Garmin had grown from a start-up experimenting with Global Positioning System (GPS) technology into an industry leader with $3.1 Billion in annual revenue growing at 80% YoY [1][2]! As Garmin’s tag line, “You’ll be lost without,” suggests, their customer promise was to provide customers with reliable on-the-go directions to their destination. Garmin’s business model was selling GPS powered navigational devices with turn-by-turn directions for drivers, boat captains and pilots. The devices varied in price from $200 to $600+ depending on functionality.

A changing context: The iPhone & the mobile revolution

In response to the Google announcement, shares of Garmin plummeted 16% [4]. According to Dominique Bonte, an analyst with ABI Research, “With a free alternative that is just as good, I don’t see much positive growth for … Garmin … why would you pay for something you can get for free?” [4]. The analysts were right, the smart phone had replaced the need for specific navigational hardware making most of Garmin’s product line obsolete. By 2010, Garmin’s 80% YoY sales growth had slowed to -9%, EPS growth was reduced to -15% [2].

Developing a new business model

Competitors had found a way to deliver on Garmin’s customer promise in a cheaper, more effective way. In response, Garmin embarked on two approaches: first, to develop a superior product to Google Maps, and second, to develop another consumer application of their proprietary GPS technology.

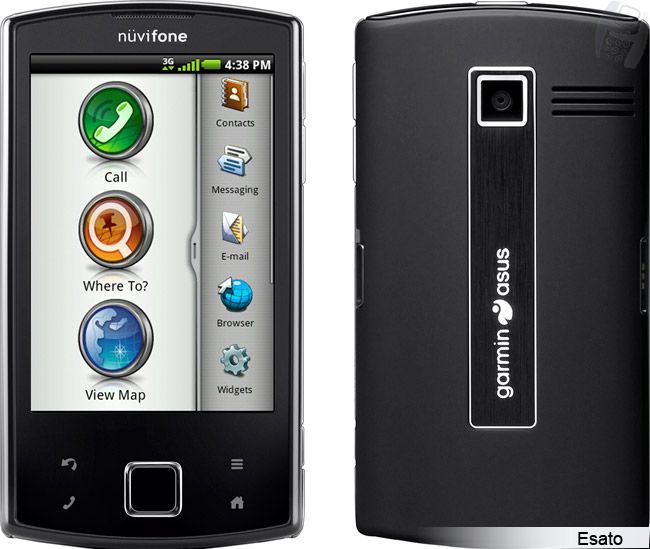

Garmin fights to retake mobile

Beginning in 2008 Garmin produced a slew of innovative new products aimed at re-taking their leadership position in GPS powered navigation. Garmin’s big bet in this space was Nuvifone – a hybrid mobile phone that incorporated their GPS handset functionality. Unfortunately the Nuviphone was a massive failure. According to Julien Blin, principal analyst at JBB Research, Garmin’s phone was a “desperate move.” He explained, “The Nuvifone is around $300, and you can get an iPhone for a comparable amount that can now do the same thing.”[4].

After failing to successfully create their own mobile platform, Garmin’s shifted it’s focus to build software for the Apple and Android platforms. Although Garmin did have a mobile app, priced at $50, it had little adoption. In 2014 Garmin launched a new mobile app called Viago for $0.99 with premium features available via in-app purchases. The premium features and lower price points were not enough to overtake Google, and in 2015, in a sign of defeat, Viago was removed from the app store [6].

The rise of quantified self and internet of things (IOT)

In an effort to find other applications of their proprietary GPS technology, Garmin sought to build a line of wearable devices to capitalize on the trend of wearable computing. The wearables market, comprised of smartwatches, fitness trackers and cameras, is projected to grow more than 18% in 2016 to $28 billion [1].

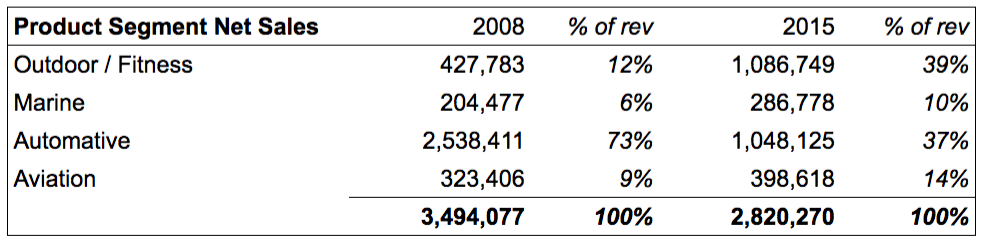

Garmin entered the fitness space in earnest when they acquired Dynastream Innovations in 2006, a Canadian company specializing in the field of personal monitoring technology and wireless connectivity solutions. By 2008 the fitness segment had reached over $400M in sales and contributed 12% of sales [2]. Fast forward to 2016 and Garmin is the hottest name in fitness wearables driven by consistent product innovation and sleek design. Their Vivo smart watch won the Fitness Tracker of the Year at the Wareable Tech Awards 2016. According to wearable.com, “the review broke the record for an all-time high score for fitness trackers and for good reason: it’s all singing, all dancing and packed with tech. [7]” In 2015, Garmin’s fitness segment had grown to over $1B in sales [2]. Garmin’s stock has not recovered to its 2007 high, but the stock has appreciated over 40% year-to-date to $52.

Operationalizing innovation

Garmin has successfully pivoted it’s business model, reducing it’s reliance on traditional GPS powered navigation devices and into consumer wearable products. While the business transition was the most difficult part – the path forward is even more treacherous. Apple, Jawbone, Fitbit and others are all in the market – competition is fierce. In order for Garmin to compete successfully in this segment they will need to adjust their operating model to productionize innovation. In particular this means institutionalizing a human-centered approach to design- moving through an exploratory phase, ideation phase, and then rapid prototyping to test. (792 words).

[1] Min Kao , Corporate Biography. garmin.com.

[2] Garmin, 2015 10-k. sec.gov.

[3] Trends: Why Garmin Stock is Crushing Apple Right Now. investmentu.com. Tuesday, November 8, 2016

[4] Hurting Rivals, Google Unveils Free Phone GPS. nytimes.com. Oct 28, 2009.

[5] Garmin Viago Navigation App Takes on Google Maps. techtimes.com. Jun 19, 2014.

[6] Garmin Killed It’s Viago App. androidpolice.com. May 15, 205.

[7] 2016 Best Fitness Trackers. wareable.com. Nov 14, 2016.

Note: All market information sourced from Google Finance

This was really interesting since I had thought Garmin had already become extinct following the introduction of smart phone maps. I was surprised to see that Garmin was able to make some headway in the wearable case. Do you think they can continue carving out a niche in this area given that the space is very tight? Would the wearable devices from Google and Apple just come around with their location services and eat Garmin’s lunch again? I’m wondering if there are other industries where Garmin’s GPS technology would be able to find better product market fit. For example, perhaps they could partner with drone companies (or related companies like Amazon) where more precise location tracking in a larger geography would be more beneficial.

Jordan, thanks for this cool piece. Though I have definitely noticed the Vivo wearables line, I had no idea that Garmin’s revenues fell as dramatically as they did after mobile navigation was released.

As Philip pointed out, I am not confident that Garmin will be able to continue to capitalize on its leading position in wearables. A major disadvantage that they are facing continues to be the advancement of mobile tech. Corporate partnerships with major mobile developers, like Nike and Apple, has led to the development of software products like Nike+, and now even hardware products like the Apple Watch Nike+: http://www.apple.com/newsroom/2016/09/apple-nike-launch-apple-watch-nike.html. As GPS tech continues to advance and mobile data costs fall, I could see a lot of users transition to the software option, as it’s one less piece of hardware you have to carry on a run or bike. And although Garmin can compete on price (Vivo sells for as low as $99 vs. $399 for Apple Watch Nike+), there are cheaper and arguably similar quality wearable products out there.

If I were working with Garmin’s management, I would want to propose exploring corporate partnerships like Nike has done. It may be too late for Apple, but there may still be opportunities with other mobile providers. I believe the future will continue to be mobile, and so I can’t imagine Garmin’s current model being sustainable in the long run.

This article actually reminded me that I have an old Garmin GPS unit rattling around in the center console of my car. I had all but forgotten about it since navigation on my iPhone is so seamless–no wonder Garmin found its business on the rocks in the late oughts and early teens.

Philip and David have already brought up good points regarding the long-term viability of their wearable tech strategy to compete in an already crowded market. I’m not one to usually suggest firms just throwing in the towel, but I can’t help but wonder if a relevant strategy for Garmin now may be to just be bought out by one of their bigger competitors with more a sustainable competitive advantage. If the market is already so crowded with not much meaningful differentiation between the competitors I have to imagine other firms would be interested in increasing their market share through acquisition.

Very good post Jordan. I share the pessimism that Garmin may not be able to play catch up to more superior companies like Apple or Google. Now, navigation is big business when it comes to flights and space exploration. What better place to focus than those industries from Garmin’s perspective. Boeing and Airbus, among other major aircraft manufacturers will be happy to partner in order to provide best-in-class navigational aids for pilots and ground personnel alike. Aerospace companies can also partake in these partnerships in order to push the frontier. Since projects in these industries are typically very well funded, Garmin could potentially find a niche space to play.