YiGuo 易果生鲜: Fresh Produce to Your Door Step

YiGuo is the first Chinese eCommerce company focused on fresh produce. It owns ExFresh, a specialized cold chain logistics company, to deliver quality produce to Chinese households.

Fresh Produce Market

Digitalization has created great convenience to end consumers when eCommerce platforms connect millions of consumers to hundreds of thousands of individual businesses. However, major players in eCommerce such as Amazon and Newegg have been focused primarily on non-perishable products. With short shelf-life, fresh vegetables and fruits are difficult to be supplied via traditional supply chain. Vegetables and fruits are subject to damage easily and require specific environment to keep fresh. Also, because anyone with internet access can place an order instantly, high fluctuation of demand applies stress to supply chain system especially during bad weather or holiday seasons. However, digitized transaction platforms connect consumers and producers together to form a virtual farmer’s market and pose huge opportunities. While some companies found this type of eCommerce challenging, others saw business potentials.

In China, fresh produce poses a market of 153 billion dollars. Online transactions grows at a 50% annual rate. By 2018, it’s estimated that the online fresh produce market will reach 10 billion dollars.[6] It’s too large of a pie to be ignored. Multiple players in China have already jumped into actions. YiGuo, a company founded in Shanghai in 2005, is one of them.[1] YiGuo is now offering next-day delivery of fresh produce in a kit to metropolitan apartment dwellers. It utilizes digitalization to connect farmers and consumers while optimize its supply chain to deliver quality products to consumers.

YiGuo offers online platform for fresh produce transactions. Source: YiGuo [1]

Current Challenges

In solving problems that comes naturally with fresh produce business and eCommerce, YiGuo’s management is fighting the battle with specially designed supplied chain services and resource allocation strategies.

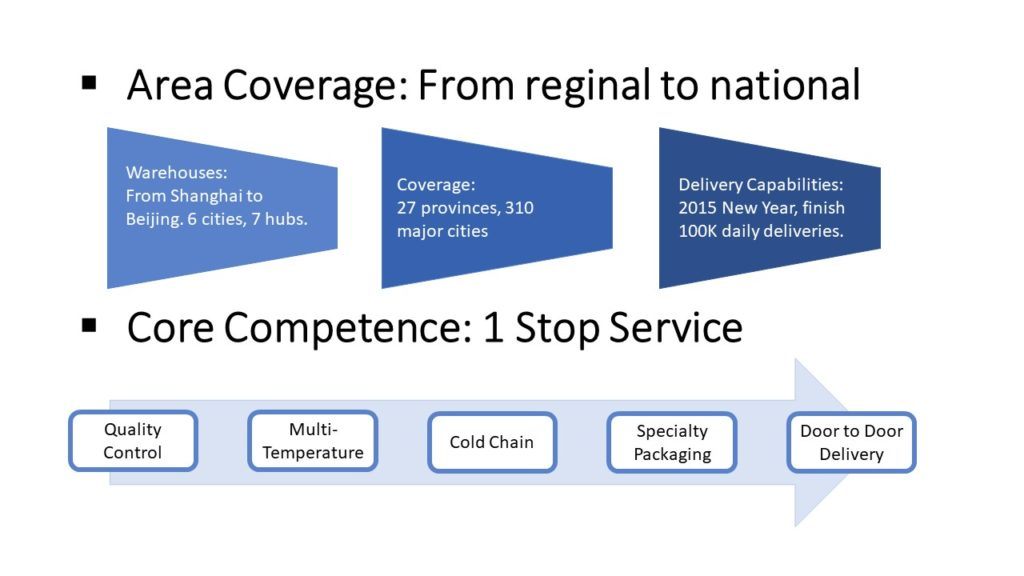

From 2005, YiGuo has developed from offering only a few fruit and vegetable categories to now offering more than 3200 SKU products ranging from grains, water produce, meat, eggs, and etc.[3] A specialized supply chain structure that controls temperature has become the most challenging part of the business. The cold chain structure has developed from a single uniform temperature environment when YiGuo first started to 3 temperature spaces ranging as low as -60 degrees Celsius.[3] However, the full length of the supply chain system has to be upgraded to accommodate this change so that products can stay in its desired environment under every step in transit. In the long run, YiGuo is planning on opening more warehouses to cover in land cities such as Wuhan, Chendu, and Jinan.[3] With more warehouses in major populous hub cities, the cold chain can better serve consumers with assured quality products.

YiGuo’s Cold Chain. Source YiGuo [1]

With digitalization, modern marketplace can minimize inventory holdings. Because demands are filled on per order basis, fresh vegetable or fresh fish don’t have to be harvested until an order is placed. This reduces inventory holding cost for the company and, at the same time, helps to keep produce almost as fresh as the traditional farmer’s market. The company also uses big data to predict near future order quantity.[4] When the system sees potential in rising demand, the company can be proactive early and allocate its cold chain resources to accommodate demand surges.

Future Challenges

The construction and upgrade of cold chain is an ongoing challenge to companies in fresh produce business like YiGuo. A complete set of cold chain delivery standards has not been established. The cold chain system is mostly invisible to end consumers.[2] With low visibility on the process, barrier to entry is low. Businesses and competitors with disconnected cold chain could steal market share from established companies.[2] To improve YiGuo’s competitiveness, it can first publish its standards on cold chain delivery and join-force with regulatory agencies to legalize related standards. This reinforces YiGuo’s own cold chain dominance and competitive advantage but also keeps barrier to entry high since high quality cold chain tends to be capital investment intensive. YiGuo itself could utilized cloud-based data analytics to monitor, in real time, how well each step of its cold chain equipment is fulfilling its own function.

Another challenge in the future is on the “last mile” delivery. Currently, company uses self-pickup lockers, partnering with retailers, and door-to-door delivery.[4] However, this landscape will likely change as initial investment and operating costs associated with each is quite different. In the long run, I would recommend the company to explore new ways of delivery by investing in drone deliveries, smart home lock systems, and peer delivery systems. With daily delivery quantity exceeding 100,000 orders, there is significant cost saving and efficiency improvements to be made. [1]

Other Thoughts

Consumer demands on delivery has become more stringent and demanding. They desire delivery at specific time of the day.[5] How should YiGuo address this?

Word Count: 799

References:

- YiGuo, “Company Overview,” http://www.yiguo.com/help/introduction.html, accessed November, 2017.

- Wulian Shared Storage, “What is ExFresh,” https://www.50yc.com/information/hangye-wuliu/8702, accessed November, 2017.

- Wulian Shared Storage, “ExFresh focuses on lean cold chain,” https://www.50yc.com/information/hangye-wuliu/5178, accessed November, 2017.

- Ebrun, “Four traits of fresh produce supply chain,” http://www.ebrun.com/20160315/168961.shtml, accessed November, 2017.

- ExFresh, “Company Overview,” http://www.exfresh.com.cn/index.html, accessed November, 2017.

- Xiaopei Zhu, “Ecommerce battle on fresh produce retail,” Business and Life, September 29, 2017, http://news.pedaily.cn/201709/420682.shtml, accessed November 2017.

Minghao, thanks for introducing me to this Chinese company. YiGuo’s digitization focuses on farmers and direct producers, but digitization can also apply to intermediaries like farmers’ markets and supermarkets. If consumers demand a certain product at a certain time, YiGuo may be able to source it closer to the consumer and provide delivery. I wonder if this intermediate digitization fits with YiGuo’s customer promise.

You do not focus on YiGuo’s mapping and delivery optimization, but hopefully the company is able to batch orders by pockets of farmers and pockets of consumers. In a way, the company is returning to old days, where milk would be delivered to each home in the morning. Farmers should have greater point-of-sale data about consumer needs for future growing seasons from this company too.

Minghao, it is a very interesting company doing great things in China.

One of the challenge that most people face in this industry is the profitability. Fresh fruit are normally heavy and less costly, and this make the e-commerce industry very hard to make profit. I could not find the income statement of Yiguo, but I guess it might be still losing money.

There are a couple of ways for them to turn profitable in the long run, but none of them is easy.

1. Achieve economy of scale, so that one last-mile point-to-point delivery can deliver multiple order, and the cost/order can be reduced.

2. Use big data to predict order, but since the fruits are perishable, and thus will impose a great challenge to the forecasting capability

3. Limit service level, and give more days between order dropping and order delivery. This can help them to aggregate orders and achieve economy of scales

But there are huge business opportunities if they can address the profitability qand other challenges

Minghao – thank you for introducing me to Yiguo! I agree that last-mile delivery is a key cost Yiguo will have to optimize going forward. I also think the infrastructure of the supply chain warehouse –> customer will look significantly different in 1-2 decades. For Yiguo, I think they should consider taking advantage of the “gig” economy that is becoming increasingly important. Companies like postmates or UberEats create two-sided efficiencies – drivers who might otherwise drive passengers in an uber can work with Yiguo as well during times when demand for a car ride is lower. Yiguo will reduce some of its delivery demand and Uber drivers will maximize their profitability of time spent in a car. I also think drivers carrying goods from Yiguo’s inner-city warehouses to customers should have some buffer on-hand to meet demand that might arise (i.e., for perishable goods with highest demand, seasonal fruits or vegetables that Yiguo knows will have high demand) so drivers can monitor new orders that come in over the course of the day and sell/deliver the buffer goods they have on hand to immediately address changes in customer demand. Super interesting read though and can’t wait to see how a lot of supplier –> warehouse –> customer delivery companies address this challenge in the next few decades!

Minghao, what an interesting topic! I thought your point about managing the complexities in the cold supply chain were very interesting – I had not considered the need to regulate temperatures based on the product you’re transporting. I wonder why Amazon has been reluctant to enter the fresh produce space until recently – perhaps there aren’t many synergies between ambient and cold supply chains?

While I understand your point that the barriers to entry in a supply chain may be low due to a lack of ‘visibility’, I’m not convinced that this is a strong competitive threat to a reputable operator – particularly in the food and beverage space where trust is crucial. I understand that for many consumers in China, they are skeptical of the food quality that is delivered by traditional retailers, due to a number of recent scandals. As a result, consumers often purchase through independent intermediaries (‘Diagous’) that they trust. I wonder how Yiguo has been able to build trust with its customers, to quell any fears about the quality and authenticity of their products?