Why Venmo would not succeed in Poland, i.e. “My banks are better than yours”

August 14th 2016 was my first day ever in the US. Together with my wife, we decided to fly in two weeks before classes at HBS were supposed to start to get to know Boston, settle in and, most annoyingly, sort out necessities, such as mobile phone numbers and… bank accounts. The latter resulted in particularly many problems, which prompted me to write this piece.

August 14th 2016 was my first day ever in the US. Together with my wife, we decided to fly in two weeks before classes at HBS were supposed to start to get to know Boston, settle in and, most annoyingly, sort out necessities, such as mobile phone numbers and… bank accounts. The latter resulted in particularly many problems, which prompted me to write this piece.

Born and raised in Eastern Europe, with a brief stint in London, I have always been taught that the West, the US in particular, is way more advanced than Poland, where I come from, in any respect, technology being one of the most obvious areas. In terms of retail banking back home, I only had to visit a branch when it was necessary to set up my bank account (but even then, some banks offered online sign ups). Almost everything I could do either online, or through a mobile app. Same day transfers? No problem, just use your app. “Account maintenance fees”? We don’t really have that. Currency exchange? Online, great rates, no additional fees. I assumed the same would be the case when I move to the US – oh, how wrong I was…

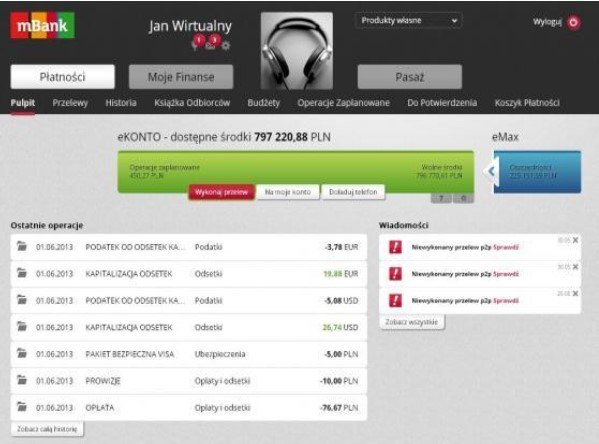

I’m not going to dwell on frequent visits to far away branches, still using paper checks and 3-day transfer clearance periods. Having discovered the magic app Venmno made our lives easier, but made me question whether this sort of solution would have any use where I come from – probably not, every bank has its own Venmo. So, let me tell you a story of mBank, one of Poland’s first online banks, which started a digital revolution in how financial institutions serve their clients in Poland.

It all starts in the year 2000 (only 11 years after Poland regained its independence from Soviet Union), when German Commerzbank-owned BRE Bank launched its new entirely digital retail arm, mBank, in just 100 days. The original business model, championed by Mr Slawomir Lachowski (BRE management board), aimed for mBank to become a “banking Walmart” that would offer customers limited number of high quality products at very attractive prices. The bank’s success was to be driven by rapid technological advancement and innovation, in particular mobile phone use which, at that time was three times as prevalent as use of internet[1].

One of the most important decisions the bank took towards digitization were:

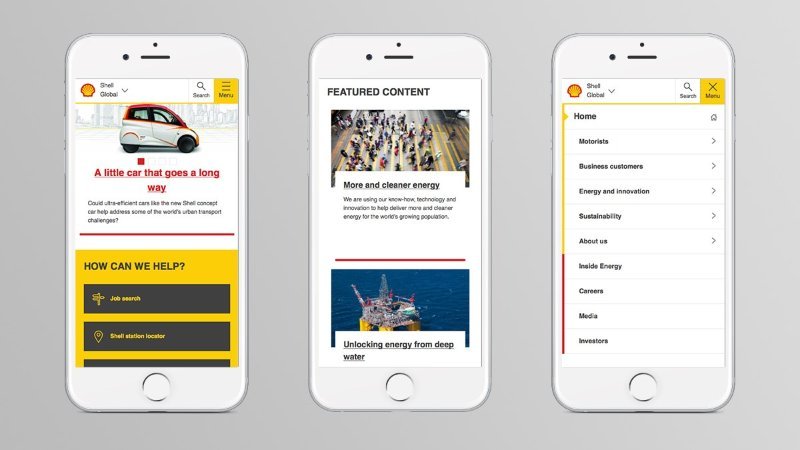

- Gradual product expansion adjusted to user technological sophistication (few simple products to start with, then product expansion). Ultimately mBank also opened up physical branches, they were, however, as innovative as branches get (see the picture below)[2].

- Simple and reliable consumer technology – mobile app and online banking features evolution followed customers’ growing sophistication

- Strategic partnership with Orange Poland, one of the largest telecoms in the country, aimed at enhancing online banking experience for Orange’s customers[3].

- Constant search for innovation opportunities – mBank created mBank Startup Challenge to identify fintech solutions to further disrupt the industry. In 2015 the challenge was won by Koala Metrics, software specialized in enhanced customer profiling based on mobile applications used by account holders.

mBank Startup Challenge

- Introduction of innovative revenue generating solutions, such as mDeals, Europe’s first transnational marketing platform.

mBanks continuous innovation efforts resulted in numerous global awards, including Global Banking Distribution and Marketing Innovation Awards in 2013[4], 2014[5] and 2015[6].

In terms of future steps – why change something that works well? mBank was the spark that ignited a revolution in Polish retail banking. It goes without saying that competition has picked up the gauntlet for innovation leadership with interesting concepts, such as Idea Bank’s “mobile pay-in cars”, which business can request to securely deposit their day earnings[7]. mBank will have to continue innovating to stay ahead of the curve.

[1] http://www.e-mentor.edu.pl/artykul/index/numer/3/id/26

[2] http://www.echodnia.eu/strefa-biznesu/wiadomosci/a/supernowoczesna-placowka-mbanku-ryszyla-w-galerii-echo-w-kielcach,10178532/

[3] http://gsmonline.pl/artykuly/orange-mbank-umowa

[4] http://www.businesswire.com/news/home/20131016006502/en/Efma-Accenture-Announce-Winners-Global-Banking-Distribution

[5] http://fsblog.accenture.com/banking/announcing-the-winners-of-the-distribution-and-marketing-innovation-awards-2014/

[6] https://newsroom.accenture.com/news/new-breed-of-banks-sweeps-efma-and-accenture-2015-global-banking-innovation-awards.htm

[7] https://www.ideabank.pl/mobilny-wplatomat

Picture links:

- https://d-pt.ppstatic.pl/kadry/k/r/1/19/04/576bd836e0d07_o,size,969×565,q,71,h,6ab24d.jpg

- http://samcik.blox.pl/resource/stary_mBank.jpg

- https://www.google.com/url?sa=i&rct=j&q=&esrc=s&source=imgres&cd=&cad=rja&uact=8&ved=0ahUKEwjIzs3ylLPQAhVq7YMKHbfxAskQjRwIBw&url=http%3A%2F%2Fraportroczny2013.mbank.pl%2Fen%2Freport%2Fmanagement-board-report%2Fyear_2013_key_highlights_of_mbank_group%2Fkey_projects_of_mbank_group_in_2013.html&psig=AFQjCNHljnl4SPkp_flMBrAFPmTF7epHdg&ust=1479587982100743

- https://zdjecia.pl.sftcdn.net/pl/scrn/69661000/69661881/mbank-pl-09-306×535.jpg

- http://pulsinnowacji.pb.pl/foto/4398863,17120,148750,495613

It’s great to see that Europe is in a similar position to Australia when it comes to banking. I too was very surprised by the poor customer service and lack of digitisation in the US banking system and have been wondering what is behind this. Is the reason based on a lack of demand for these services from customers? I think that is unlikely. Could it be due to the US banks using older and incompatible IT systems which make the costs prohibitive? It’s possible. However, I suspect what is the main driver is the lack of regulatory interference from the US government to force the banks to work together and allow basic functionalities without excessive fees.

Great post on mobile banking options in Poland! I can imagine that it would be quite stressful to set up banking options and then have to set up Venmo in addition to that! Are consumers in Poland quite loyal to one specific bank? Or do they have multiple bank accounts like many Americans do? Does Poland support any cross bank payment platforms? I imagine you would need one bank to be ubiquitous across consumers so that they could transfer money across those payment rails. I know Chase Quick Pay option struggled with that.

Very interesting case! I was also quite impressed by the inefficient banking system when I moved to Boston – I couldn’t believe I needed an appointment to get a credit card? Not long ago, we had the CEO of the largest bank in Peru (Banco de Credito del Peru) come to the HBS Latin America Conference and talk about the digitalization project that they had gone through. They were very successful! Some initiatives seem similar to the ones you described, but what I found really interesting is that they found a mid-way between physical branches and internet services. Since in Peru internet penetration is still low, what they did was offer online services AT the bank. So for example you could go to a branch to open a bank account and be directed to an area with iPads where this service was available. This was also useful to get customers to start creating online profiles and “lose fear” of online banking. What I find very interesting about your article is that the bank partnered with a telecom company, I see how this can work by increasing reach and providing a tailored experience to customers!

Great read ! As you point out, it is quite interesting that countries that were beginning to build out their modern than banking infrastructure in the 2000s did a much better job at digitizing financial services early on, compared to the incumbents in more sophisticated markets – I read this HBR article a few years ago that speaks to it: https://hbr.org/2012/04/innovations-in-mobile-banking.

Infact, this is one of the only industries where a majority of the innovation comes from developing countries. One obvious reason that is often cited is that it is easier to build from scratch (as in Poland) as opposed to reinvent an existing banking system. However, the role that regulation plays cannot be ignored either ! In the US, a big pain point has also been the lack of trust in traditional banks, and the concern of privacy when it comes to financial services. I would be curious to know if these are concerns in Poland at all, and if so, how mBank overcame them.

Excellent post! The chilean banking systems, just like the Peruvian, anticipated the entrance of “Venmo’s” that could extract from them part of the value that was being created and as a response made electronic transfers free of charge. By doing this they removed all the incentives to enter the market because there was no reason for consumers to switch to a new technology or adpot a new app. I would be curious about the response of banks and if they are able to get back that part of the market my adopting new commercial apporachs and more efficient technologies.