When the oldest industry collides with the newest trend

Cement, one of the key material used in construction, has gone through serial changes of chemical composition and manufacturing process. Now, with the new era of industry 4.0 and digitization, what will happen to the traditional cement manufacturers?

Can traditional company be digitized?

Construction industry is probably one of the most traditional industry that still exists today. Cement, one of the key material used in construction, has gone through serial changes of chemical composition and manufacturing process. Now, with the new era of industry 4.0 and digitization, what will happen to the traditional cement manufacturers?

The cement industry is Thailand is highly competitive. Top 3 players control most of the market share, and price and service become the key differentiators to win customers. To gain market share, SCG (Number One player in Thai cement market by revenue) and TPI (Number Three player) has both invested heavily on infrastructure, e.g., invest in railway transportation to create multimodal transportation network and gain cost efficiency.

As the second biggest cement manufacturer in Thailand, Siam City Cement (short form “SCCC”) aspires to become the number one in the market. To achieve that, they not only have to provide their customers with better service and lower cost, but also need to work together with their supply partners to drive a more efficient supply chain that benefits both ends of the supply chain. Instead of investing in railway transportation, Mr. Paul Heinz Hugentobler (Chairman of the Board of Directors, HBS ISMP alumni) and Mr Siva Mahasandana (CEO, HBS AMP alumni) decide to embark the cement giant on a transformation journey to digitize their supply chain.

“Digital brings opportunity and change for businesses, enabling their transformation. The use of digital technology can help create new services and business models,” explained Ittaya Sirivasukarn, CEO, INSEE Digital Company Limited, the IT arm of SCCC. (Reed, 2016)[1]

One of SCCC’s biggest goals is getting their products closer to consumers. That means getting closer to the experts and win homeowners’ trust. Instead of focusing on selling only to dealers and sub-dealers, SCCC are building a platform to connect directly to expert contractors and consumers, sharing information, product info and tips. (Reed, 2016) [1] In addition, SCCC implemented F5® BIG-IP® Local Traffic Manager™ (LTM) in its data center to act as a bedrock for the organization to provision, optimize and deliver services. F5 provides both the performance and horizontal scaling required to meet the highest levels of throughput, equipping INSEE with the ability to publish applications quickly within a controlled and secured environment. (INSEE Digital supports Siam City Cement Company’s future needs with app-centric hybrid infrastructure, n.d.) [2] Moreover, SCCC employs SAP Ariba network to automate the entire procurement process, allowing SCCC to better control global spend with flexible management and visibility tools, simplifying commerce by consolidating and managing all key procurement processes. (Ariba, 2017) [3] Lastly, SCCC also creates a truck tracking system that can track the speed and route of each of their trucks real time.

In the future, “We will create the first IOT plant in Thailand,” said Ittaya Sirivasukarn during one of the interviews. (Reed, 2016) [1]

In the future, SCCC want to be able to control our expansion through a single war room, utilizing technologies like sensors, robotics, and drones. They want to get more information and more control. They want to use predictive analytics to ensure that the availability will be at the optimum.

To have digitization as a competitive advantage, is technology alone enough?

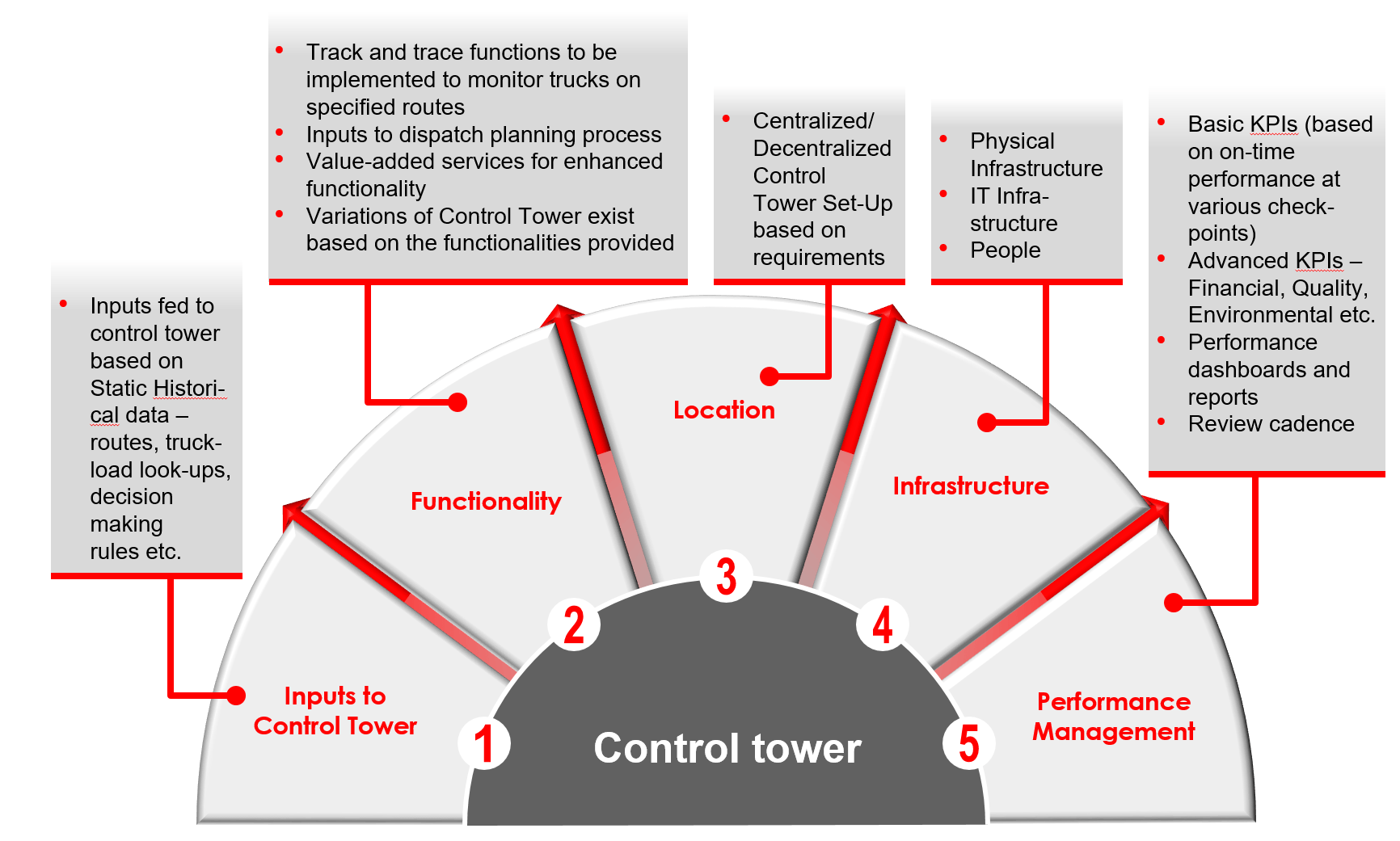

To successfully transform the company’s supply chain, technology and digitization of processes alone is far from enough. The organization that excels in utilize and manage technology well will be the leader in the supply chain 4.0 world. What SCCC needs to do moving forward is to build a efficient supply train team that works with and manages all the new digital resources. SCCC can leverage an existing industry model called “Control Tower”, which encompasses 5 elements: inputs to control tower, functionality, location, infrastructure and performance management. Control tower can effectively integrate the technology with management, provides SCCC an efficient way to integrates their digital capability into decision making and performance enhancement. To successfully run a control tower, a dedicated team with clear roles and responsibility should be deployed to manage the IT infrastructure, design KPIs, consolidate reports and conduct performance reviews. In the early phase, the head of the control tower management team should directly report to CEO, so as to keep CEO informed on all the process and seek guidance whenever needed. Once the operation moves into steady state, the head can then reports to COO or VP of operation and fully integrate the team into the organization.

Your thoughts?

What might be the risk for SCCC to digitize their supply chain? Besides the control center model, is there anything else they need to do to full leverage the power of digitization?

References

[1] Reed, J. (2016, May 20). Siam City Cement on digital change versus stagnation, and how S/4HANA fits in. Retrieved from Diginomica: https://diginomica.com/2016/05/20/siam-city-cement-on-digital-change-versus-stagnation-and-how-s4hana-fits-in/

[2] INSEE Digital supports Siam City Cement Company’s future needs with app-centric hybrid infrastructure. (n.d.). Retrieved from F5 company website: https://f5.com/solutions/customer-stories/insee-digital-supports-siam-city-cement-companys-future-needs-with-app-centric-hybrid-infrastructure-19859

[3] Ariba, S. (2017, August 23 ). Siam City Cement at #SAPAribaLive Sydney. Retrieved from Youtube: https://www.youtube.com/watch?v=1_w15iofgww

WORD COUNT : 773

Vincent, I agree that businesses like SCCC need to embrace digitalization fully and rapidly, so that they can be at the forefront of infrastructure growth in emerging markets. However, I am concerned about the timing and direction of the digitalization trend for SCCC. Recent measures seem expensive and geared towards bringing modern innovation to the supply chain. However, the pressing need is to find solutions that reduce supply chain costs in the short term. According the SCCC’s most recent financial reports (7th Nov. 2017, https://www.siamcitycement.com/stocks/media/00134b.pdf), profit margins have fallen from 12% to 4%, largely due to slowing demand in Thailand, lower prices due to increased competition, and higher expenses related to electricity and coal. Therefore, SCCC may want to reconsider prioritising the “Control Tower” initiative, and instead find solutions to improve profitability now.

I see digitalization as a key operating differentiator, and I think that SCCC will need to push forward with it regardless of the risks. But I think a major risk is that they implement the wrong system, or poorly design their implementation without working with the operators to co-create a solution that helps everybody. It will be key to involve everyone in the design process, with lots of design research done up front before investing heavily in new systems.