Outsourcery: Will Infosys lose its magic?

Outsourcer, Infosys, is under threat from both Trump and Technology.

What wizardry can save the company's future?

Infosys, the second largest outsourcing company in India’s $150bn IT services industry, was built on a simple trick: to make your company’s IT costs disappear! Behind the curtain, these functions reappear at a much lower cost in India; the issue however for western administrations is that IT jobs disappear with them. In the US, this job-disappearing-act has recently drawn ire from both sides of the aisle with Democratic Senator Chuck Schumer calling outsourcing companies “chop shops” and fellow-muggle Donald Trump pushing to levitate the minimum salary for Infosys’ lifeline H1B visas from $60,000 to $130,000 – a move that ward off up to 95% of its would-be outsourcing immigrants [1]. This protectionist restriction would significantly stymie the ability of companies like Infosys to do business in their largest market. Meanwhile in Europe, major Infosys clients appear uneager to embark on transformational IT projects given the uncertainty of Brexit. Like the US, Britain has also raised the minimum salary for visas by 50% while british banks such as RBS have cancelled or postponed large contracts with Infosys in the wake of the referendum.

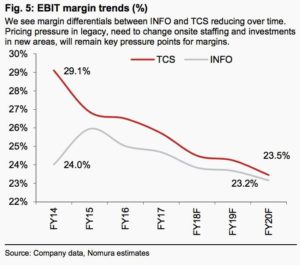

To be clear, the industry was facing secular decline before protectionism was in the cards. Big data analytics, A.I., Apps, Cloud Computing and the internet-of-things have conjured a new wave of tech that is changing the way that Infosys’ customers see their IT requirements. Why maintain data infrastructure in India when the cloud can do that cheaper? Why fork out for expensive tailored software when “there’s probably an app for that”? As Infosys’ ex-CEO Vishal Sikka recently incanted: “We will not survive if we remain in the constricted space of doing as we are told, depending solely on cost arbitrage. If we don’t [shape up] we will be made obsolete by a tidal wave of automation and technology-fuelled transformation that is almost upon us” [2]. There are signs that Infosys is already feeling the pain of commoditisation with recent deals won at ever lower margins. In addition, the company has chronically underinvested in R&D compared to western rivals such as Accenture, investing only 0.5% of revenues vs Accenture’s 2% [3].

Does this all spell disaster?

Perhaps as if under a Trumpian hex, InfoSys announced plans to hire 10,000 American workers over the next two years rather than continuing to solely apparate workers from India. This strategy is unsustainable as it unwinds the entire business model of outsourcing to take advantage of salary arbitrage – for example, the typical IT Indian worker can expect to be paid $5,000 while their US counterparts can expect north of $100,000 [3]. However, long-term, it may be the only way to reverse the company’s bad juju by simultaneously buying plenty of time for the existing business to continue in Trump’s America and searching for the next potion to transform the business for the future. Like Infosys, other global firms such as Siemens and General Electric are ‘localising’ their supply chains, jobs and production. While Infosys’ direct competitors, TCS and Wipro, have handled the threat of protection differently by investing in ‘near-shore centers’ to serve their US clients from countries such as Mexico without visa restrictions.

Another anti-protectionist potion is for the business to become ‘intangible’ and compete directly with the host of new tech entrants. In this vein, Infosys has started a VC-like fund called Infosys Innovation Fund to work on big data, A.I. and cloud computing. Since inception, the fund acquired cloud management firm Cloudyn and drone-maker ideaForge as well as LP interests in several other VC firms [5]. In addition, Sikka brought on acquisition specialist Ritika Suri as well as a Google engineer Sudhir Jha to push Mana (not this author’s pun), the company’s artificial intelligence platform.

Alchemy – how can Infosys turn its business into gold

Infosys has made steps in the right direction both by localising the business and expanding into new tech products, but it is unclear whether the steps taken thus far are simply slight-of-hand. Looking into the crystal ball, the company should now lay out an action plan that uses digitisation, A.I., big data and cloud computing to transmute the old business into the new. These technologies could allow the expensive new US workforce to focus on high value new products and relationships while also creating huge efficiencies in the existing Indian business. The company doesn’t need to be at the vanguard of technological breakthrough but it does need to be able to design and implement new-tech systems to their clients’ delight. This emerging new-tech focused business will be less vulnerable to protectionist policies and will provide a shot at magical growth for years to come.

(780 words)

[1] https://www.economist.com/blogs/graphicdetail/2017/04/daily-chart-12

[2] https://economictimes.indiatimes.com/tech/ites/road-ahead-not-easy-infosys-ceo-sikka-tells-employees/articleshow/56297615.cms

[3] https://www.economist.com/news/business/21714994-it-firms-need-upgrade-face-technological-and-political-shifts-indian-outsourcing

[4] https://qz.com/1121363/no-bitcoins-for-payments-and-settlements-says-the-reserve-bank-of-india/

[5] https://qz.com/901292/indian-it-firms-like-wipro-tcs-and-infosys-have-been-preparing-for-changes-in-h1b-visa-laws-and-donald-trumps-america-for-several-years/

I completely agree with you that both protectionism and technology advancements are hurting once successful businesses like Infosys. However, I struggle with your recommendations that accept the government dictating who companies can hire. It is most likely good business for Infosys to start focusing on their business mostly being run by big data and digitization. However, I worry that just accepting the government’s pressure of who to hire is a slippery slope. As a business founded on outsourcing skills, it seems like they and others like that would be right to defend their business model.

Interesting essay, it touches on both the topic of isolationism and challenge of digitization, and truly poses an “Innovator’s Dilemma” for the company – how to innovate and build new disruptive products while maintaining a strong core business. This challenge reminded me of the IBM case and the company’s aspiration to regain relevance in the high technology sector through investments in AI and digitization. While I applaud Infosys’s efforts on starting a VC-like fund, I think the challenge with this approach is that these investments will likely take longer to provide meaningful returns to the parent company.

In the near term, there might be potential to explore building a stronger base in markets less prone to isolationism soundbites like Australia, Canada, and Mexico, or focus on developing and quickly growing markets of India and China. While Infosys will likely have to settle for thinner margins in developing markets, this strategy will allow them to better weather the storm in the near term and provide meaningful work to their employees, bridging the gap between today and the promise of AI & big data payoffs in the future.

Great essay highlighting the impact isolationist trade policies are having on an industry that has arguably driven India’s GDP growth over the last decade. I firmly believe that Infosys has no one to blame but themselves for the mess they find themselves in. As Sikka points out, for too long the company has stagnated as salary arbitrage allowed it to build a profitable business without investing in core product development, long term strategy or R&D. I am also unsure as to how ‘near-shore’ centers can allow IT companies to get around the local hiring requirements the new administration has imposed. While the move towards digitization, AI and cloud is welcome I am afraid it comes too late. In this new market paradigm, Infosys will have to do what Microsoft does better than Microsoft. I am not sure they can.

It’s certainly not an easy business to play in today. On one hand, you have the pressing need to constantly innovate and provide low-cost but effective products to your customers. On the other hand, you have to balance fluctuating labor costs and regulatory pressure from governments all across the globe.

I don’t know enough to get into the moral dilemma of paying someone in India significantly less than in the US, but from a consumer’s perspective, if I can get the same service for a much lower price, I’d take it every single time, especially if I’m a business that relies heavily on IT (which is pretty much every business now). We call ourselves a global economy, but the recent push towards protectionism, especially in the current administration, goes against so much of how businesses have been built in the US for the past few decades. I’d echo Alona’s comment that Infosys should enter into emerging markets; however, this feels too little, too late – what stops those emerging nations from doing it themselves for even lower prices?

An excellent post – effectively brings out the massive challenge faced by India’s outsourcing industry and one of it’s iconic firms. I agree with Peter’s diagnosis that the way out for Infosys has to be building up modern technology expertise, rather than relying on cheap human capital. I’m not as bearish as Ninad on the intrinsic prospects of doing so – there are segments (which are not being focused on currently by the Microsofts’) in which Infosys can use India’s strong engineering talent to build good products.

However, the bigger challenge is something Alona mentioned – the difficulty in changing the direction of a huge company. The ex-CEO mentioned in the post, Vishal Sikka, who had been trying to take the company in this new direction resigned earlier this year – in reality, he had no choice but to go, due to major criticism and resistance by shareholders, including Infosys’s respected founders. There are different views on whether he was right or wrong, but there is no question that it will take something incredible to fundamentally change Infosys’s operating model and customer promise.

On a lighter note, there is an upside for HBS students from India – the protectionism by the current administration may mean that the new visa criteria would narrow the eligibility pool, instead of following the current process of a lottery from a huge pool of applicants across different salary ranges. So more HBS’ers could actually stay on in the US if they wish to, without having to put their fate in a lottery with 40% acceptance rate!