Walmart’s final stand? The battle for e-commerce revenue through faster delivery

The war for ecommerce continues and Walmart has just entered the fray. The final frontier is speed of delivery. Amazon, once a fledgling startup, is now the incumbent behemoth in online commerce. Can Walmart prevail?

The age of Amazon

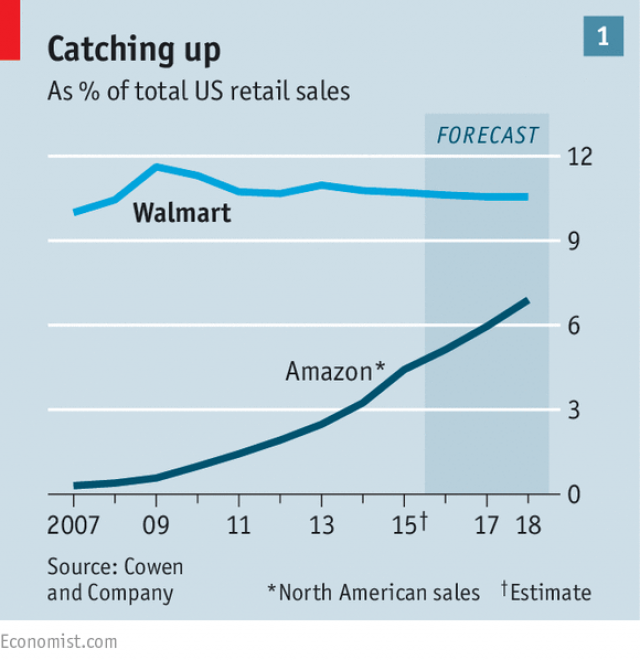

Walmart is in a dire situation. By all estimates, Amazon’s retail sales are soon going to catch-up or at least rival it’s. The answer here is growing its own online revenue and Walmart management agrees. At a recent investor meeting, executives announced a focus on e-commerce to drive growth [1].

However, customer demands have changed. A quote by Stephenie Landry, head of Amazon’s Prime Now program comes to mind: “Ten years ago, people thought two-day shipping seemed really fast; now we think two-hour shipping and one-hour shipping will be the standard” [2]. Also, apps like Uber and Instacart have changed customer expectations in terms of delivery.

Furthermore, online demand is spiky and requires infrastructure built for peak conditions [3]. Traditional retail infrastructure isn’t built to handle these spikes, but rather does well with stable, consistent, demand [Ibid]. The key to the castle here is faster, responsive delivery through digitization of the supply chain – a feat Amazon achieved years ago.

Acquisitions, talent and fulfillment centers

For the mid-term, Walmart is focused on solving deeper problems using a two-pronged strategy: bringing on relevant talent in the digital space and building new distribution centers.

For instance, Marc Lore, a tech executive, is well-known in tech circles for his e-commerce expertise and selling Quidsy (an e-commerce site for diapers) to Amazon in 2011 for $545M [5]. He has been brought under the fold of Walmart and named CEO of eCommerce to spearhead the new digital strategy [Ibid].

Walmart is also investing in distribution centers so as to deliver goods to consumers across the country faster [6]. These new facilities are “more than 1 million square feet and hold at least 500,000 items—much larger than its traditional distribution centers for stores, which hold 30,000 to 50,000 items” [Ibid] to offer a wider selection to consumers [Ibid]. “These new buildings…use both human labor and automation, such as computer-controlled chutes, to move items [Ibid]. The new centers will be part of a network for filling online orders that includes traditional buildings, plus 11 existing smaller e-commerce centers and 83 Wal-Mart Supercenters that have been designated ‘ship-from-store’ locations. [Ibid].”

The goal of these distribution centers is to serve a wider selection across the country quicker [Ibid], thus eventually competing with Amazon’s delivery times. Lastly, Walmart’s goal also involves some experimentation in newer ways of delivery that might be faster in the future i.e. drones. For instance, “a patent application filed by Walmart…proposes an ‘aerial transport and launch system’ for dispatching delivery drones in mid-air.” [7]

Going the extra mile

The goal for Walmart however shouldn’t be band-aids but rather to build an organization that can compete in the short-term by further investing in advanced technology in fulfillment centers and mid-term by creating a culture that rivals Amazon’s culture of experimentation.

Walmart needs to invest in core technology such as artificial intelligence and robotics, not just better information systems. After Amazon acquired Kiva Robotics (a startup to replace warehouse workers with robots) in 2012, it immediately stopped other retailers from using Kiva’s products and built robotics-driven logistics systems internally [8]. Today, there are better products than Kiva that Walmart can deploy internally to optimize warehouses i.e. Locus Robotics’s fleet of robots to ferry goods across the warehouse or Fetch Robotics’s pick and pack systems to replace human workers [Ibid]. Walmart needs to be able to deploy these types of technologies consistently to build efficient fulfillment centers.

Furthermore, Walmart has been a successful high-volume discount retailer by creating a culture of operational efficiency. However, it noticeably lacks a culture of innovation by experimentation through failure.

A quote by Jeff Bezos comes to mind: “I’ve made billions of dollars of failures at Amazon.com,” he said. “Literally billions. … Companies that don’t embrace failure and continue to experiment eventually get in the desperate position where the only thing they can do is make a Hail Mary bet at the end of their corporate existence.” [9]

These experiments allow Amazon to continue innovating for customers with programs like Prime Now. To answer, Walmart needs to create a culture that does the same.

Open questions that still persist:

- In the rural market — will faster delivery ever matter? Due to Walmart’s strength in small towns, will Amazon lose?

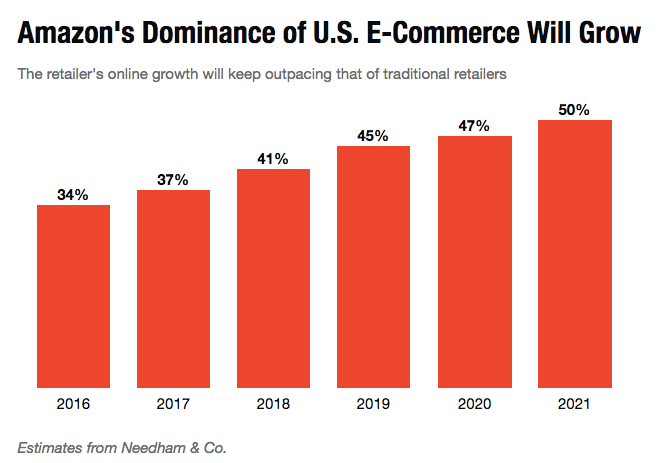

Exhibit 3, Source: [iii] - Projections above show Amazon is poised to win online. Is Walmart’s ecommerce push a Hail Mary?

Word Count: 791

References

Text:

[1] Hufford, A. (2017). Wal-Mart reveals financial goals, e-commerce focus. [online] MarketWatch. Available at: https://www.marketwatch.com/story/wal-mart-reveals-financial-goals-e-commerce-focus-2017-10-10 [Accessed 15 Nov. 2017].

[2] Ivonye, K. (2017). How Walmart, Amazon, Target and others are coming up with new ways of getting more stuff to you faster. [online] Recode. Available at: https://www.recode.net/2017/10/13/16392676/ecommerce-delivery-dominance-amazon-alibaba-last-mile-pickup-kiosk-locker [Accessed 15 Nov. 2017].

[3] McCandless, J. (2016). 3 Ways to Handle Ecommerce Peak Season Demand. [Blog] MultiChannelMerchant. Available at: http://multichannelmerchant.com/blog/3-ways-handle-ecommerce-peak-season-demand/ [Accessed 15 Nov. 2017].

[4] Staff, T. (2017). 6 of Walmart’s Most Recent Acquisitions. [online] TheStreet. Available at: https://www.thestreet.com/video/14048048/5-of-walmart-s-most-recent-acquisitions.html [Accessed 15 Nov. 2017].

[5] Catcher, T. (2017). Marc Lore: The Man, The Myth, The Legend?. [online] Seeking Alpha. Available at: https://seekingalpha.com/article/4085029-marc-lore-man-myth-legend [Accessed 15 Nov. 2017].

[6] Nash, K. (2017). Wal-Mart Builds Supply Chain to Meet E-Commerce Demands. Wall Street Journal. [online] Available at: https://www.wsj.com/articles/wal-mart-builds-supply-chain-to-meet-e-commerce-demands-1431016708 [Accessed 15 Nov. 2017].

[7] Hao, K. (2017). Walmart hopes to patent a floating warehouse to send out drone deliveries from mid-air. [online] Quartz. Available at: https://qz.com/1058907/walmart-following-amazon-filed-for-a-patent-to-send-out-delivery-drones-from-a-distribution-center-in-the-sky-wmt-amzn/ [Accessed 15 Nov. 2017].

[8] Tobe, F. (2017). The technology gap left by Amazon’s acquisition of Kiva Systems – The Robot Report. [online] The Robot Report. Available at: https://www.therobotreport.com/the-technology-gap-left-by-amazons-acquisition-of-kiva-systems/ [Accessed 15 Nov. 2017].

[9] Griffith, E. (2014). Amazon CEO on Fire phone flop: ‘I’ve made billions of dollars of failures’. [online] Fortune. Available at: http://fortune.com/2014/12/02/amazon-ceo-jeff-bezos-failure/ [Accessed 15 Nov. 2017].

Exhibits:

[i] The Economist (2016). Catching up. [image] Available at: https://cdn.static-economist.com/sites/default/files/imagecache/640-width/images/print-edition/20160604_WBC571.png [Accessed 15 Nov. 2017].

[ii] Yahoo Finance (2017). Walmart online sales growth jumps. [image] Available at: https://s.yimg.com/ny/api/res/1.2/GC3gGdoyvpcWfVwnj0G8pA–/YXBwaWQ9aGlnaGxhbmRlcjtzbT0xO3c9NzQ0O2g9NDE5/http://media.zenfs.com/en/homerun/feed_manager_auto_publish_494/7a706d2047e1ce05cd232cefca11cb83 [Accessed 15 Nov. 2017].

[iii] Fortune and Needham & Co. (2017). Amazon’s Dominance of U.S. E-Commerce Will Grow. [image] Available at: http://fortune.com/2017/04/10/amazon-retail/ [Accessed 15 Nov. 2017].

Header image:

The Infographics Show (2017). Still frame of shipping faster taken from infographic video. [image] Available at: https://www.youtube.com/watch?v=MiQYQQcG1HQ [Accessed 15 Nov. 2017].

I’m reminded of our discussion regarding Uber, Lyft, and Fasten. In the delivery space, it seems to me that network effects are another important consideration. The last mile of delivery is the hardest to get right and potentially the most expensive piece of the puzzle. Until drone or autonomous vehicle delivery, WMT is at a severe disadvantage in the last-mile and will find it hard to compete on price with Amazon. I wonder how many delivery services the market for drivers can support (Amazon, traditional shipping companies, Uber, etc.). WMT certainly can’t cede the space to these competitors, but they may want to consider strategic partnerships with a logistics provider that specializes in last-mile.

I liked the article a lot. I wasn’t aware of Walmart’s investments in such technologies. I see why going the extra mile might be a problem for Walmart vs Amazon. Amazon deliver products in both urban (dense) and rural (less dense) areas. Hence, deliveries in rural areas, which are more expensive (longer distances and lower density), are probably “subsidized” by deliveries in denser areas like big cities. As a result, Walmart faces a problem as they mostly target rural areas. In addition, customers in rural areas probably care just as much as those of urban areas about delivery time.

Walmart has a competitive advantage over Amazon since they can deliver products to their customers from both their warehouses and retail stores. This means that they probably benefit from a better geographical coverage of rural areas than Amazon. Going from there, Walmart could map out the areas for which it makes more sense to serve from their warehouses and areas for which it makes more sense to serve from their retail stores. For these latter, they could incentivize their customers who shop in their physical stores to deliver groceries to their “neighbors” who ordered online (ask the customer at the cash register where they live, check whether there is a pending delivery in their area, and offer to them to take on the delivery for a discount).

Amazon’s retail business strategy is one of centered around an efficient logistics operation. The good news for Walmart is that Walmart has both the scale and purchasing power to match Amazon prices and an existing distribution network. In order to compete against Amazon, Walmart needs to supercharge its distribution system. As consumers shift from in-store purchasing to online purchasing, Walmart should simultaneously shift the orientation of its distribution network. While Walmart is investing in new, larger-format distribution centers, it will also be important to re-tool existing DCs. Not only should Walmart invest in warehouse automation, but it can and should leverage purchasing data to do predictive delivery, a core practice for Amazon. In order to solve the last-mile delivery problem, in the short term Walmart could leverage store associates to make deliveries across the existing brick-and-mortar footprint while relying on third party logistics providers (UPS, DHL, FedEx) for more urban areas outside of the existing footprint. By repurposing its existing assets and investing in new technologies, Walmart should be able to align itself with changing customer demands.