Is Alibaba’s Smart Logistic Platform Sufficient?

With increasing demand for logistics in China and fierce competition coming from JD, is Alibaba's asset-light smart platform model positioning itself well for long-term success?

Scale of logistics:

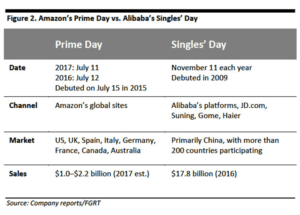

“Singles Day” sale by Alibaba, has become the world’s biggest online shopping day of the year. With a record sale of $25.3 billion [1] within 24 hours on Nov11, it is at least 12 times the Amazon’s Prime Day sales [2]. Behind the $25.3 billion sales are the 810 million parcels generated within 24 hours [3] – almost every 15-65 years old Chinese person will receive a package from Alibaba. Moreover, such scale will soon be a norm. It is expected that the number of parcels in China will surge to 1 billion per day within the next decade [4]. With Alibaba’s 51.3% share of the China’s B2C online sales [5], this is a huge challenge to the company’s logistic operation under the exploding delivery volume.

Although a long-time market leader in the e-commerce space, Alibaba’s logistic has been supported by 3rd party companies to maintain an “asset light” business model. With the growth of the direct logistics approach of JD.com which now has 32.9% of the market share (up from 17.7% in 2014) [5], and its 211 program – same day delivery for orders submitted prior to 11AM and next day delivery for orders submitted before 11PM, Alibaba’s logistics has been a competitive disadvantage for the E-commerce giant in recent years.

“Smart Platform” and asset-light business model

Big Data Platform:

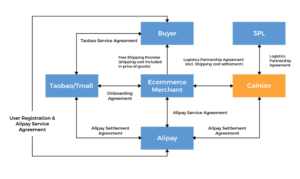

To strengthen its logistic services under its “asset-light” business strategy, Alibaba invested $807 million, to increase its stake in logistics platform firm Cainiao Smart Logistics to 51 in Sep 2017 [6]. Instead of creating a courier service company, Cainiao Smart logistic is a Cloud and Big Data powered platform that connects 3rd party logistic partners with E-commerce Merchant to improve the overall delivery efficiency. Its goal is to fulfill orders on the mainland within 24 hours and within 72 hours globally [6].

By connecting logistic partners and the E-commerce Merchant – Cainiao platform feed real-time information to small merchants to choose the most efficient delivery option within a pool of delivery firms based on its location and type of goods. Cainiao’s smart routing and sorting service also reduce logistics firm’s delivery errors by 40%. In addition, it provides a real-time tracking system to enhance the information synchronization and transparency among logistic partners, Merchants, and Consumers.

https://www.youtube.com/watch?v=bgHfEK34xYk

Warehouse Automation:

In major cities in China, Alibaba set up fulfillment center for merchants to store inventories. This enables Cainiao to leverage its big data and cloud platform to optimize the warehouse design and data flow for more efficient warehouse management.

In addition, Like Amazon’s move with Kiva Robotics, Alibaba opens the largest smart warehouse in China manned by 60 cutting-edge AGV (Automated Guided Vehicle). These AGVs are equipped with Wifi, self-charging capabilities to lift and move the sorting shelves to the workers, who then packed and posted the products to customers around the world. [7]

https://www.youtube.com/watch?v=bvEzDNxj7hA

Robots and Drones deliver the last mile:

In the long term, Cainiao’s E.T. logistic lab is aiming to implement the coolest technology to improve logistics efficiency to the last mile and reduce labor cost as much as possible to cope with increasing demand. The Robot “Xiao G” operates as an autonomous delivery vehicle that interface with transportation management system to optimize delivery route. It uses simultaneous localization and mapping (SLAM) system to assess the local environment and uses the deep learning algorithm to predict the trajectory of moving objects, pedestrians, and vehicles. [8]

Most recently, Cainiao showed off an army of drones that successfully delivered six boxes of passionfruit over a five-kilometer waterway to an island in East China’s Fujian Province. [10]

With Robots, AI and Drones, Alibaba delivered its first Singles day sale package in 12 mins in Shanghai and its first rural package in Guizhou in 69 minutes [11].

Analysis of the actions

Looking at Alibaba’s highly data-driven “platform model” which is decentralized, horizontally integrated. Both the “hardware” perspective of efficiency improvement, cost reduction and the “software” aspect of service quality depend on the implementation of its logistics partners. With fierce competition from JD, which differentiated itself with superior logistic services and increasing middle-class population who demand more services, is “Smart Platform” Enough for Alibaba to catch up its logistics services quality and quality?

Alibaba has to make sure their logistic partners are fully onboard with its vision in its logistic space.

It should consider joint development with key logistic companies on high tech development to ensure the project feasibility and adaptability. It should also invest or increase its shares in key logistic partners to influence its strategy, making sure the whole logistic system surrounding Alibaba are working towards the same vision.

Questions to consider:

Are data-driven cloud platform and asset-light a winning strategy for Alibaba continue to maintain its market leadership?

Word Count: 790

[1] https://www.wsj.com/articles/chinese-buy-yachts-tvs-online-to-drive-alibaba-singles-day-sales-1510422594

[2] https://www.nytimes.com/2017/11/10/business/alibaba-singles-day.html

[3] https://www.cnbc.com/2017/11/09/alibabas-singles-day-lures-more-global-brands.html

[4] http://www.sohu.com/a/203803331_114760

[6] https://seekingalpha.com/news/3293776-jd-com-gaining-alibabas-chinese-e-commerce-market-share

[10] http://technode.com/2016/12/08/gallery-alibaba-robotics-ai-ar-vr/

[11] http://www.chinadaily.com.cn/bizchina/2017-11/07/content_34230012.htm

[12] http://tech.sina.com.cn/i/2017-11-12/doc-ifynstfh6146024.shtml

[2]

[2]

With a record sales of more than 20 billion within a day, Singles day does pose a significant stretch for Alibaba´s supply chain. I agree with your point that “Alibaba´s has become a competitive disadvantage in recent years”. While I appreciate the “asset light” model and a focus its core business (e-commerce), I wonder if the acquisition of one company “CaiNiao” is sufficient to help it manage the complex supply chain of Alibaba. Firstly, how willing are the logistics supply to integrate to the “central” system? Particular in an era where data equals money. Secondly, given the wide and fragmented delivery network, how much integration needs to be done with the suppliers? Knowing that IT integration is expensive and often goes wrong, I would challenge the capital needed for such integration. Finally, on-time and quality delivery is an key success factor for e-commerce business, the lack of ownership and control might directly impact the customer experience.

To your open question “Are data-driven cloud platform and asset-light a winning strategy for Alibaba continue to maintain its market leadership?”, my personal view will be that this is insufficient. I will recommend Alibaba to strategically look at investment opportunities with delivery companies, or to consider develop 1-2 self-owned warehouse to cater for peak events like Singles day.

Amazon and Alibaba offer an interesting contrast in the trade-offs associated with scale vs. control. Amazon takes consignment of a large proportion of the goods offered on its platform and owns most of its distribution infrastructure. It seems that with Cainiao Alibaba has extended its ownership light strategy to distribution. This will undoubtedly come with trade-offs. Positively it will allow Alibaba to scale its effectively leverageable distribution infrastructure by harnessing the capacity of partners rather than throwing obscene amounts of capital into warehouses. Negatively Alibaba will only be able to ensure service quality and control through the network to the extent that it can direct the actions of its partners.

I agree with Swan that it is inefficient strategy with players like Amazon and JD.com entering the arena. Amazon is not just a retailer; their competitive edge now seems to be coming from numerous companies’ dependence on their distribution network. This is giving them access to data, monopolizing consumers decisions, and setting new standards for online shopping. Luckily, Alibaba has a lot of capital to catch up, and I think they need to aim for a lot more power and influence than they get from being a stakeholder in CaiNiao.

I think that the asset-light model seems to be working, and that it has in many ways enabled Alibaba to pivot without a huge base of assets to hold it back. This is something that I think may prove to be a drag on Amazon in the future – they’re so heavily invested in their warehouses that they may be left in a bad spot if a disruptive technology comes along to radically change the way their logistics are handled. On the flip side, Alibaba will be able to pivot much more easily due to their use of other entities to handle a large part of their logistics.

This approach does have some downsides – namely that competitors can rely on the same approach, and that Alibaba has less control over the process as a result. I would recommend that they look into the possibility of conducting their own internal experiments and then spinning out new entities that exclusive serve them to develop the concepts as one possibility.

Thanks, Lili! Like Swan, I’m concerned about CaiNiao’s capacity with respect to Alibaba’s extremely large volumes. Singles Day generated 810 million orders but, according to the video, CaiNiao’s capacity is only 30 million packages per day. It’s not clear what Alibaba’s delivery capacity is independent of CaiNiao but it’s reasonable to believe there will be a considerable delivery backlog for some time after Singles Day. If daily sales continue to grow as your research suggests, Alibaba will have a difficult time fulfilling orders even with CaiNiao and will probably need to deviate from it’s asset light model to provide more fulfillment centers. Despite these challenges, I think CaiNiao is a novel use of big data analytics and will provide Alibaba a competitive advantage. It’s difficult to imagine JD competing effectively considering the market share and capital Alibaba already has.