Walmart: It’s my party and I can cry if I want to

Is the party over or can the world's largest retailer reverse the trend?

Nobody knows where my Johnny has gone

Judy left the same time

Why was he holding her hand

When he’s supposed to be mine

— “It’s my party and I can cry if I want to” by Lesley Gore

Introduction

In our digital age of Amazon and Uber, we don’t think of Walmart as operating at the frontier of technological innovation. Walmart, after all, has physical aisles that take an eternity to navigate compared with a one-click checkout. But Walmart was not always a technological laggard. Quite to the contrary, much of Walmart’s success was built on technological innovations of their supply chain that offered an unforeseen combination of value, selection, and availability to its customers. Today, as the world’s largest retailer by revenue, Walmart attempts to maintain its lead by continuing its legacy of technological advancement in a brave new world where cost and convenience are requirements for retail success.

If you can’t measure it, you can’t improve it

Walmart’s supply chain has long been a complex network where inefficiencies are costly. Too little inventory leads to unsatisfied customers and missed sales opportunities, while too much causes costly inefficiencies in storing superfluous goods. The goal of digitizing a supply chain is the accurate and timely measurements of both supply and demand, so you and your collaborators can consistently deliver value to your customers [1]. Recognizing this general principle in 1966, Sam Walton attended an IBM school in upstate NY and committed himself to hire the smartest person in the class to start digitizing his operations in Bentonville, Arkansas [2].

A history of digitalization

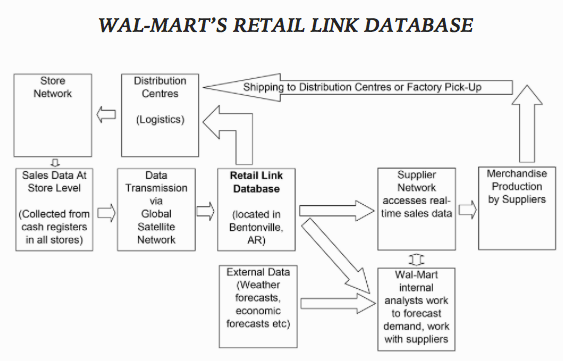

Building a distribution network for the first Walmart stores was a result of necessity rather than choice: suppliers simply weren’t willing to drive their trucks to remote areas of rural Arkansas where the first Walmart stores were located [3]. Since then Walmart has repeatedly introduced new technologies such as RFID, Vendor Managed Inventory, Collaborative Planning Forecasting and Replenishment and Retail Link. Unfortunately, there’s not enough time to explore each one in turn, but let it be said that Retail Link was the largest civilian database in the 90s, it contained data on two decades of every sale made at Walmart and suppliers were given access to historical and real-time data [3].

Continuous innovation paid dividends for Walmart: As recently as 2017 Walmart is still operating at the leading edge of efficiency with an inventory turnover rate of 8.11 compared with Amazon’s rate of 8.66 and Target’s of 5.68 [4].

What tomorrow’s customer needs

Playin’ my records, keep dancin’ all night

Leave me alone for a while

Till Johnny’s dancin’ with me

I’ve got no reason to smile

— “It’s my party and I can cry if I want to” by Lesley Gore

Despite this long history of applying technology to its operations, Walmart was slow to catch on to the e-commerce revolution. The company is now in a challenging position where it’s trying to catch up with Amazon while simultaneously anticipating what the future will demand. In an article written for the World Economic Forum, Walmart’s CEO Doug McMillon mentions how “[t]he historic trade-off between price and service has been altered by technology and customers expect to save time and enjoy the experience while saving money” [5]. This realization represents a fundamental shift in Walmart’s strategy. Historically, their focus was on minimizing cost through efficient supply chains. Today, Walmart needs to think about how their technological innovations can extend beyond the supercenter to conveniently deliver products directly to customers who expect to receive service and convenience in return for low prices.

Walmart has pursued multiple strategies to accelerate their entry into e-commerce. First, they’ve acquired e-commerce companies such as Jet.com and Bonobos (you might have missed the latter as it was same-day news with Amazon’s acquisition of Whole Foods) [6]. Second, they’ve been investing in fulfillment centers designed for e-commerce [7]. Walmart’s traditional distribution centers are designed for palettes of product to be shipped in bulk to stores, but e-commerce calls for warehouses where orders can be composed of individual SKUs that are packaged and shipped directly to a customer’s home. Third, they’ve been leveraging their brick-and-mortar presence to provide online/offline hybrid services such as in-store pickup of online orders and grocery deliveries which require shorter delivery routes to minimize product spoilage [8].

If I were CEO…

“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.”

— Sam Walton

If I were CEO, I’d focus Walmart’s digitization efforts on services that have a palpable impact on the customer’s experience. For years this meant investing in supply chain efficiencies located upstream of the customer’s store visit. Today it means working directly on the interface between the customer and the store. In-store pickup and short-haul delivery of groceries are aligned with this strategy. The challenge I would like to see Walmart face is how it can bring the digital experience to the store in an effort to convert in-store customers to online users. For example, they could build a loyalty program through their app that can also be used for making e-commerce orders. But that’s just my $0.02 and I’d love to hear yours. Can Walmart remain its competitive edge in the digital age?

(783 words, lyrics and quotes omitted)

References

[1] Christopher, Martin. Logistics & supply chain management. Pearson UK, 2016.

[2] Walton, Sam, and John Huey. Sam Walton, Made in America: My Story. Bantam, 1993.

[3] R. Fraser Johnson, Ken Mark. “Half a Century of Supply Chain Management at Wal-Mart.” Case No. 9b12d010. London, Canada: Ivey Publishing, Richard Ivey School of Business Foundation, 2012.

[4] “Wal-Mart Inventory Turnover Ratio”, https://csimarket.com/stocks/singleEfficiencyit.php?code=WMT, accessed November 2017.

[5] McMillon, Doug, “Investor Resources,” https://www.weforum.org/agenda/2017/01/3-predictions-for-the-future-of-retail-from-the-ceo-of-walmart/, accessed November 2017.

[6] “Amazon vs. Walmart: Which One Will Prevail?”, http://knowledge.wharton.upenn.edu/article/amazon-vs-walmart-one-will-prevail/, accessed November 2017.

[7] Nash, Kim, “Wal-Mart Builds Supply Chain to Meet E-Commerce Demands”, Wall Street Journal (May. 7, 2015)

[8] Ignatius, Adi, “We Need People to Lean into the Future,” Harvard Busines Review (March-April 2017)

Walmart is clearly locked in intense competition with Amazon. Given the extent of their brick-and-mortar presence, it appears that they have the potential to leverage this network and compete effectively in the e-commerce space with reduced delivery times. This might be particularly effective in the future age of drone deliveries – while Amazon has the distribution network, Walmart’s extensive store presence could lend them a competitive advantage. The other option, as you mention, is to make the in-store experience simply superior, such that customers want to shop at physical stores rather than online (e.g. using technology to personalize the shopping experience). Their biggest advantages are convenient brick-and-mortar stores and more recession-proof products and pricing – they should use these to their fullest to compete with Amazon.

I want to build on Chris’s idea about leveraging brick-and-mortar stores as a competitive advantage. This would require integration with a fast delivery platform (which Amazon seems to have mastered with Amazon Prime’s Same-Day Delivery). Perhaps by partnering with a company like Uber to facilitate quick transportation from stores directly to the customer, Walmart can compete with Amazon’s uber-efficient supply chain (excuse the pun) and simultaneously shift customer perception to align with ‘operating at the frontier of technological innovation’.

Expanding on the app idea, another way that Walmart could convert in-store customers to online users is by introducing a ‘Walmart pay’ system whereby people could use a credit card linked to the app to make purchases (similar to Starbucks). This would enable the app to bridge the gap between a customer’s in-store behavior and online purchasing patterns, thereby allowing the app to make more customized recommendations for online activity.

As we discuss the significance of converting in-store customers to online users, I think it is important to consider the potential impact of losing “impulse buys” from in-store traffic. As a consumer, I am definitely guilty of walking into shopping malls, grocery stores, and other retail outlets set on purchasing only what is on my shopping list. Yet, all too often, I walk out of the store with five different items that I bought impulsively because they looked interesting. While this habit is bad for my wallet, it is critical for retailers. How can the retailers make up for lost “impulse buys” by consumers who are no longer wandering the aisles? Is there a way to integrate both online shopping and e-commerce? I’d be curious to know the average “basket size” of an online consumer vs. an in-store consumer.

I agree with the comments above, and also want to highlight how important it is to also build the same brand awareness online as you have in your brick-and-mortar store. Walmart’s acquisition of Jet.com to fight Amazon in e-commerce has proved to be a useful as Walmart’s ecommerce sales have grown 63% and its stock over 10% in the last year. However, Jet.com used to carry a broad array of Costco’s “Kirkland” brand that consumers are familiar with. Walmart is now attempting to phase out these Costco products in favor or its own “Member Mark” brand. Although this makes sense from a Walmart perspective, it is unclear how the consumers will react. Will you lose the customers who are used to buying Kirkland cashews but now can’t find it? Would they switch over to the Walmart brand?

Very interesting to read about the ways Walmart is “going digital” and shifting to accommodate the online customer. Niko has done a great job of outlining three main efforts: (1) acquiring ecommerce players, (2) investing in fulfillment centers that cater to e-commerce vs. B&M fulfillment (they’re different!), and (3) providing online/offline hybrid services. As Walmart makes these investments, it raises the question: will the customer follow? Niko suggests that Walmart should think about ways to convert in-store customers to online users, but will this be enough? I think RoundRobin nails it with her comment on the importance of building brand awareness online as Walmart has done with B&M. It will take more than just shifting customers from B&M to online (especially with the large cannibalization impact) for Walmart to be successful. How will it capture customers from Amazon? And how will it get out ahead of Amazon and capture net new customers who are coming online?

Great article Niko! The Jet.com acquisition was definitely a step in the right direction. I’m surprised Walmart didn’t decide to wall off Walmart.com as a separate division and allow it to make the kinds of investment that would make it a better competitor to Amazon. When Amazon makes very large investments (in drone technology or purchasing Whole Foods), equity investors essentially make those investments “risk-free” by rallying behind the stock and allowing Amazon to raise more money at a higher valuation and using that cash to pay for the investments. If Walmart chose to do the same, they could essentially have very cheap capital from their .com division; this would enable them to make investments in companies like Symbiotic (autonomous warehouse), or drone-delivery technology. Walmart’s biggest issue may not be the foresight of its management team, but the limitations of being a non-tech publicly traded company!

I totally agree with CPG Manufacturing Fan. Niko has done a great job of not only outlining Walmart’s action plan to catch up on e-commerce, but also reminding us Walmart’s original position as technological pioneer, introducing disruptive innovations such as RFID or Vendor Inventory Management. But to remain leader in such a competitive industry, innovation must never end. As highlighted by Niko, the challenge is now for Walmart to manage the fact that “historic trade-off between price and service has been altered by technology and customers expect to save time and enjoy the experience while saving money”.

While many perceive Amazon as main competitor, I agree with the fact that Walmart needs to build its competitive advantage in its in-store experience, aspiring to become the “most exciting retailer”. To this end, Walmart could get some inspiration from the disruptive in-store technology introduced by the fashion retailer Zara [1]. Alongside self-checkout systems, Zara introduced other innovative features such as LED screens used as in-store displays to allow shoppers to view products, as well as touch-screens in the dressing rooms to enable customers to request different items and sizes without leaving the comfort of the fitting room. As such, Walmart could improve its in-store experience by introducing LED screens enabling shoppers to view the different products available for each category as well as their store location to make the shopping experience smoother and avoid wasting time researching products across corridors (and buying more instead!).To create a more interactive experience with the customer, Walmart could also install in-store touch screens for each category of product and display recipes according to individuals’ preferences.

To remain industry leader, Walmart will need to complement its “Everyday Low Price” with “Everyday Great Experience”.

[1] https://www.thelocal.es/20151130/zara-looks-to-new-technology-to-give-stores-a-facelift

Great read, thanks Niko!

I fully agree with the comments above that Walmart’s brick & mortar network is a strategic advantage and should be incorporated within, rather than replaced by, their digitization strategy. Given the high cost of last mile delivery (up to ~30% of a product’s total transportation cost [1]) I think their key play should be to incentivize the in-store pick up of online orders by passing on a portion of the transportation cost saving to customers in the form of discounts or loyalty points.

Getting customers to order online should, however, be an integral part of their digitization strategy as it allows Walmart to learn about customer purchasing behavior at an individual level and enables them to provide customized services to build loyalty. For example, once Walmart learns about a customer’s typical purchase routine they could send a reminder email just before the customer’s next forecasted purchase with relevant promotional offers and quick re-order links.

Lastly, this customized service should be replicated in stores using beacon technology, which triangulates a customer’s location within the store and shares it with the Walmart app on the customer’s smartphone, enabling Walmart to push customized promotional coupons to the customer based on their location in a timely manner, with no effort on the part of the customer.

[1] https://www.supplychaindive.com/news/last-mile-spotlight-retail-costs-fulfillment/443094/

Niko, great article! Before reading, I do not think I appreciated the challenge that Walmart is facing today trying to both catch up to Amazon and predict what’s next in consumer preferences with technology. I’m impressed with the three-pronged approach they are taking to modernize through acquisitions, fulfillment center investment and hybrid models.

I agree that the acquisition of Jet.com is crucial as they start to reorient themselves towards a modern supply chain, but believe that the Bonobos and Modcloth acquisitions were more about understanding consumer preferences in e-commerce. I am curious to see where this leads them as the Bonobos and Modcloth as they are both experts in producing items for their target audiences, but they are both more upscale than the traditional Walmart clothing selection. Hopefully, Walmart will leverage the consumer data and client-centricity of these brands to create a better product, but also a more streamlined product development cycle, better forecasting of items and an improved interface for online shopping.

Fascinating read! As Niko mentioned, the acquisition of jet.com and Bonobos was indeed an opportunity to develop Walmart’s ecommerce capabilities. I would also contend that the Bonobos acquisition (in addition to that of ModCloth, Moosejaw, Hayneedle, and ShoeBuy) indicate that Walmart recognizes the importance that brand ownership will play in differentiating ecommerce companies in the future [1]. Walmart’s brick-and-mortar presence today separates it from Amazon in that it provides an opportunity for clientele to shop in-store, where the majority of Americans still prefer to make clothing purchases. Given that Bonobos and Walmart historically attract different clientele, I’m interested to see if Walmart will be able to capitalize on its access to this set of potential new customers.

[1] https://www.nytimes.com/2017/06/16/business/walmart-bonobos-merger.html