Venture Capital: Rumors of my death have been greatly exaggerated

Using machine learning to resurrect outdated VC sourcing models

“Venture Capital is Dead.”

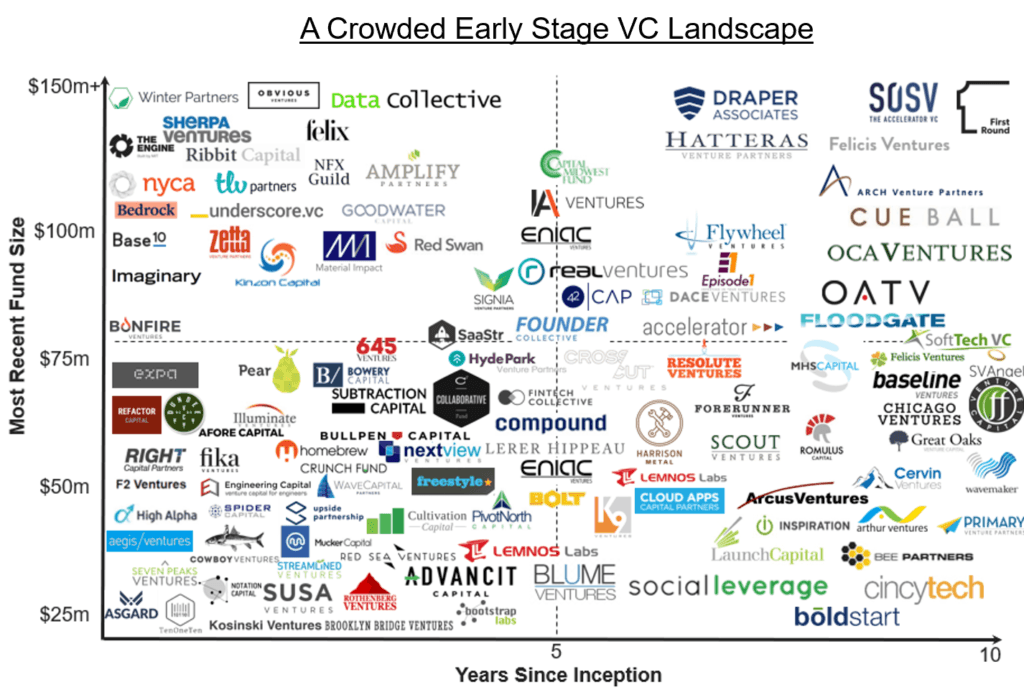

The first line of Mucker Capital co-founder, Erik Rannala’s, 2015 article raised eyebrows and questions regarding the sustainability of traditional venture capital (“VC”). Though hyperbole, Rannala’s statement underscores a recent evolution in VC that is forcing firms to adapt to survive. The pace of VC fundraising reached historic highs over the period 2014-2017, peaking at $41 billion raised in 2016. [1] [2] Most notably, smaller, earlier stage funds have proliferated, with more than 500 sub $200 million funds raised since 2011. [3] An increasingly crowded internal landscape is further complicated by the rise of external competition from crowdfunding, super angels and most recently, ICOs. [4]

To compete effectively, VCs can no longer wait for entrepreneurs to reach out. Instead, they must create a “push” sourcing model to proactively identify, diligence, and win deals at earlier stages.

Veronica Wu, an experienced Motorola, Apple, and Tesla executive, faced this challenge in 2015, when founding Hone Capital (“Hone”), a Silicon Valley based venture fund backed by Chinese private equity firm CSC Global. Wu needed to develop a sourcing strategy that would enable Hone to find and win deals in the world’s most competitive venture market.

To accomplish this goal, Wu turned to machine learning. Hone created a, “machine-learning model from a database of more than 30,000 deals.” [5] Hone used this dataset to examine 400 deal characteristics, eventually identifying 20 that predicted a seed deal’s success (defined as a subsequent Series A). Hone ‘s model evaluates these characteristics, including, “investors’ historical conversion rates, total money raised, the founding team’s background, and the syndicate lead’s area of expertise,” to generate an investment recommendation for each deal.

Although it is early in the firm’s life – VC is an industry that measures success in decades – Hone’s model displays promising early results. Of the seed-stage investments recommended by the model in 2015, 40% have raised follow-on capital within 15 months, nearly 2.5 times the industry average of 16%. Remarkably, this performance was nearly identical to that of Hone’s human investment team. Perhaps most importantly, the model identified successful companies that the investment team originally missed.

Moving forward, Wu and the Hone team intend to refine the model and experiment with the optimum balance between machine learning recommendations and investment team judgement. According to Wu, her team’s analysis of 2015 investment cohort performance, “found that the best [follow-on] performance, nearly 3.5 times the industry average, would result from integrating the recommendations of the humans on our investment team and the machine learning mode.”

Hone has only scratched the surface of machine learning’s potential impact on VC sourcing.

According to Roberto Bonanzinga, co-founder of InReach Ventures, in a traditional inbound sourcing model, promising companies fall under the radar because they are not actively looking for money, not based in a tech hub such as Silicon Valley, or not led by well-connected founders. [6] In fact, VC has systematically underrepresented large founder populations – female entrepreneurs, for example, receive only 2% of venture dollars. [7] Machine learning is a powerful tool for addressing this problem. [8] For example, Alice, an AI platform, provides underrepresented entrepreneurs with benchmark performance figures and personalized recommendations for their startups. [9]

Hone can similarly harness the power of its model to proactively target high potential companies in underrepresented groups. Not only will this strategy positively impact entrepreneurs, it will also provide Hone with unique deal flow. Chris Farmer, founder of SignalFire, lauds machine learning for its ability to identify “companies that we never would have seen otherwise.” [10]

Although successfully raising a Series A is an important step for a seed investment, it is only the first stop on a startup’s journey to generating a strong end-of-day return for an investor. The true power of Hone’s machine learning model lies not in its ability to predict a Series A raise, but its potential to predict ultimate return. As Hone gathers data from maturing cohorts, it will be able to build upon its model, assess a startup’s return potential in real-time, deliver valuable feedback to its portfolio companies on critical success factors, and utilize this data to make smarter initial investment and follow-on decisions.

Machine learning’s impact on VC is still in its infancy and outstanding questions remain. Will machine learning accurately capture rapidly changing investor preferences? Can it generate a comprehensive blueprint for startup success at each lifecycle stage?

Perhaps most importantly, will it fundamentally change the requisite VC skillset – deemphasizing broad personal networks in favor of the ability to exercise investment judgment?

Wu thinks so.

At Hone, “We’re betting on a paradigm shift in venture capital where new platforms provide greater access to deal flow, and investment decision making is driven by integrating human insight with machine-learning-based models.” [11]

(797 words)

[1] “2Q 2018 Pitchbook NVCA Venture Monitor.” Pitchbook, 2018, files.pitchbook.com/website/files/pdf/2Q_2018_PitchBook_NVCA_Venture_Monitor.pdf.

[2] “Pitchbook 2017 Annual PE VC Fundraising Report.” Pitchbook, 2018, files.pitchbook.com/website/files/pdf/PitchBook_2017_Annual_PE_VC_Fundraising_Report.pdf.

[3] Lemkin, Jason. “How Will the Proliferation of Micro Funds Led by First-Time Investors Change the Early-Stage Funding Landscape?” SaaStr, 5 June 2018, www.saastr.com/will-proliferation-micro-funds-led-first-time-investors-change-early-stage-funding-landscape/.

[4] Rannala, Erik. “Venture Capital Is Dead. Long Live Venture Capital.” Recode, Recode, 23 July 2015, www.recode.net/2015/7/23/11614964/venture-capital-is-dead-long-live-venture-capital.

[5] “A Machine Learning Approach to Venture Capital.” McKinsey Quarterly, McKinsey & Co, June 2017.

[6] Palmer, Maija. “Artificial Intelligence Is Guiding Venture Capital to Start-Ups.” Financial Times, Financial Times, 12 Dec. 2017, www.ft.com/content/dd7fa798-bfcd-11e7-823b-ed31693349d3.

[7] Zarya, Valentina. “Female Founders Got 2% of Venture Capital Dollars in 2017.” Fortune, Fortune, 2018, fortune.com/2018/01/31/female-founders-venture-capital-2017/.

[8] Rahnama, Hossein. “Here’s How AI Is Changing VC Funding.” Entrepreneur, Entrepreneur, 23 Feb. 2018, www.entrepreneur.com/article/309198.

[9] Dishman, Lydia. “AI Platform Alice Aims To Help 4 Million Underrepresented Entrepreneurs.” Fast Company, Fast Company, 26 Jan. 2018, www.fastcompany.com/40522097/ai-platform-alice-aims-to-help-4-million-underrepresented-entrepreneurs.

[10] Palmer. “Artificial Intelligence…”

[11] “A Machine Learning Approach to Venture Capital.” McKinsey Quarterly.

I have found the dynamic of gut vs. data in venture capital always fascinating. For example, there are top VC firms like Sequoia and Benchmark which both have a knack for identifying top startups and there are also firms like Hone who are using an algorithm to better make decisions on which startups to invest in. I think the answer lies somewhere in the middle, but there is always going to be a human judgment aspect. At the end of the day, ML and AI are replicating human learning and intelligence on a more consistent and larger scale but there seem to always be factors that will just be beyond a machine’s reach for now (before we reach singularity). A machine and algorithm will not be able to pick up certain quirks that a founder demonstrates during a pitch that a seasoned Venture Capitalist could immediately identify and use as a factor to decide whether or not to invest. A saying that I think will resonate well here is that numbers never lie, but they also never tell the full story. AI and ML will augment venture capitalists in the future by serving as a useful tool, but I don’t think AI and ML will replace VC’s in the near future.

A machine learning sourcing model can potentially be helpful in outbound sourcing but I don’t think it changes the venture capital skillset or is a source of sustainable competitive advantage in the industry. The machine learning sourcing can be incrementally beneficial to reducing large lists of companies to slightly smaller lists but ultimately, capital is a commodity in the VC industry (as you mentioned with how much money has been raised in so many different formats). In most good deals, investment firms need to compete. For the best companies, founders can chose their source of capital and care about the signaling effect provided by the investment firm, the value-add that the investor can bring, and the potential relationship with (and trust in) the investor that might have been built over a long period of time. For example, Sequoia and Benchmark commonly win the best deals (and the home runs are the only deals that really matter in the VC portfolio model). It’s also exceptionally rare for there to be home-run caliber top-of-the-funnel opportunities that no one else has seen. Thus, ultimately, even for Hone Capital, I think the source of competitive advantage is not algorithmic sourcing but maybe relying on potential strategic synergies with their anchor LP CSC, which is a large and influential private equity firm in China, to “win” competitive deals.

Using AI to hack VC is obviously a very impressive advancement. However, I wonder if VC is the best market for it? VC is actually where I think you need the highest level of subjective searching, and where past performance may not predict future performance. Aren’t Unicorns titled as such because they are drastically different than anything to come before them, and therefore can disrupt the industry?

I wonder if using AI would be even more fruitful in Private Equity or more mature growth capital, where the companies have longer track records of financial metrics that machine learning can use to train the algorythyms, and where the industry is look for good, stable companies rather than riskier, industry changers.

Very interesting and informative article. The fact female entrepreneurs only receive 2% of VC money is shocking.

I would make the hypothesis that before AI hacks VC, it will hack active investors in public traded companies, i.e. hedge funds and mutual funds. It will be a long shot for AI to invade the Private Equity industry, given how many deal-making terms need to be negotiated among human counterparts. In PE’s case AI will also be a deal sourcing tool, pulling in suitable investment targets that fit the mandate and criteria of various funds. Therefore I would be more concerned about the “death” of active public market investors, and feel quite comfortable about the enhancement to my deal-sourcing ability from AI.

I believe machine learning will certainly change how VCs currently do sourcing. In my perspective,the importance of big networks will be less relevant, and the information and capabilities to assess good deals will become more accessible. Fewer funds will have an edge to source better deals, there will be more competition for deals and therefore the value created for investor in this funds tend to become lower. However, funds not only invest in ideas but also in people. For the later, machine-learning might be helpful to eliminate biases, as mentioned in the article, but I believe funds will still have to use perception/gut as an factor to have an edge in this business and remain competitive.

Thank you for this extremely interesting article on the potential of ML to disrupt such a high-skill profession. I love the potential of the use of ML for VCs, although with three caveats:

1. As more VCs adopt the model, their algorithms will mostly be based on the same historical data from Pitchbook, Crunchbase etc, which gives these VCs similar recommendations on what to back, then the question is what do you believe differently based on the same data provided to all VCs to gain an edge;

2. Although ML is more inclusive in considering startups from all demographics/backgrounds, the bias will still be inevitably baked into the algorithm because in your training data, past male-founded startups still raised more subsequent rounds at better valuations and had better exit return opportunities, which will flow into your future projections.

3. At the end of the day, making judgement is the easier part of a VC’s job, and a successful VC needs to focus on building the relationships with founders to win their trust and the ability to help portfolio companies to hire and get partnerships. Thus, to answer the last question, I think the benefits of the ML tools will give VCs a helpful reference to speed up initial decision process but wouldn’t necessarily change the core skill set required of the profession.

Thanks for this amazing article on how Machine Learning disrupt the VC industry. ML definitely could assist the venture capitalists with massive amount of business plans submitted to them, especially while identifying the pre-A deals. However, based on my own prior experience in VC, I think the VC industry is strongly network driven, and people driven.

ML might use the algorithm to identify the potential investment and increase their deal, but sometimes, the interaction with the founder’s team, getting to know who exactly the founders are, their personality, their chrism, their people skills, which might not be able to be identified by ML, might lost their chance of getting the money.

Meanwhile, the current situation is, there are lack of good deals. Once every firm use the same algorithm to find the deals, every VC will fight for the same deal, the competitive issue is still unsolved in how to getting money into those startups.