Value-Based Healthcare: Game-Changer for Medical Suppliers?

Digitalization and big-data transformations across all channels of delivering healthcare are revolutionizing the medical industry. But, are medical suppliers immune to this change?

Digitalization and big-data transformations across all channels of delivering healthcare are revolutionizing the medical industry.1 But, are medical suppliers immune to this change? Medtronic Inc., one of the largest medical device companies in the world, contributes to the $140B medical technology market in the United States.2 Medtronic’s recent acquisition of Covidien (largest acquisition in this industry), valued at $43B, poses even greater challenges for the company to sustain a strong supply-chain network in this ever-changing environment.3

Hospitals and healthcare networks today have access to innovative technologies to collect large amounts of data through electronic medical records (EMRs), personalized health mobile applications, and other telemedicine platforms. The data collected can comprise of anything from clinician diagnoses, post-op recovery regimens, patient behavior and compliance, to health regulations and more.4 Gathering powerful information such as these examples can allow medical professionals and suppliers to work together to customize patient solutions, reduce healthcare costs and improve supply-chain efficiency.4

Having real-time, customer-driven data dramatically changes demand implications between hospitals and medical suppliers. Hospitals are facing more pressure from insurance providers and administrative committees to purchase intelligently due to the data at their disposal.5 Furthermore, with the introduction of value-based healthcare models, (where costs are appropriately allocated along the care pathway of a patient), hospitals will be billed based on product usage rather than one-time price.4,5 This pivotal change from a fee-for-service model to a value-based healthcare model, where patient outcomes are thoroughly measured, is predicted to considerably reduce healthcare costs. But, will this benefit medical suppliers such as Medtronic?

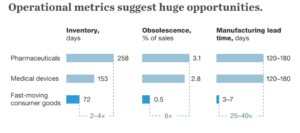

Medical suppliers need a method to modify their products to adapt to the value-based healthcare model. As seen in Figure 1 below, supply and demand can change drastically if suppliers shift their ordering patterns from bulk orders and orders based on history to real-time, need-based, and customized patient treatments.6 To remain sustainable as a business, suppliers have to conform from transaction-based demand planning to data-driven strategies. This allows suppliers to focus on products that improve in value for the patient and reduce costs while optimizing production and supply efficiency.

Figure 1. Supply and demand drivers with the growth of healthcare IT. Source: Delloite 6

Medtronic is one of the few companies in the forefront of adapting to this new environment. For being a pure medical device company, Medtronic is now investing in healthcare IT, data collection, and altering its devices to provide a whole healthcare service platform. These proactive and strategic decisions will allow Medtronic to thrive in value-based healthcare systems. For example, Medtronic’s largest platform is pacemakers, which are implantable devices that are placed in the heart to correct irregular heartbeats. With the growing rate of heart disease and other similar conditions, pacemakers will only increase in demand.7 However, additions to this platform were needed in order to truly account for how value-based healthcare models and data-driven decisions could change the approach clinicians prescribed pacemakers. Recognizing this, Medtronic has invested in remote monitoring systems, where care doesn’t end with an implant. Real-time data is sent to clinicians even once the patient receives the implant.7 This technology helps reduce errors, detect irregular behavior, and overall, reduce costs by avoiding readmissions. By investing in early data collection through their established devices in the cardiac market, Medtronic can help clinicians and institutions recognize heath trends earlier whilst controlling future demand for their devices with those same customers.

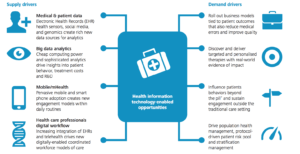

Digitalization within this ecosystem can also help suppliers change their internal production and inventory days.8 Value-based healthcare models provide a better avenue for medical suppliers to adopt characteristics from the consumer goods supply-chain systems (see Figure 2 below). Suppliers can hold smaller levels of inventories driven by the real-time data collected from healthcare institutions. Smaller level of inventories can lead to a significant amount of cost savings across the industry. Today, medical device companies such as Medtronic, spend roughly 40% of revenues on supply-chain costs. This results in an industry wide cost of $122B.8 Typically, in comparison to consumer goods, medical suppliers use a one-size fits all supply-chain model rather than customer or data-driven demand decisions. Digitalization in the healthcare industry and the significant amounts of data can benefit suppliers by allowing them to be more agile in their production and supply-chain processes.5,8

Figure 2. Inventory days differential between medical suppliers and CPG. Source: McKinsey. 8

To suppliers, making company-wide changes at such a large-scale is a daunting task, especially when the benefits might still be unclear. While we know with some certainty that the healthcare industry is moving towards value-based models, will this actually prove to be profitable for medical suppliers? How customized will data-driven demand planning really be? Will digitalization help the healthcare industry completely adopt supply-chain models similar to consumer goods companies? These are the questions companies such as Medtronic face today and need to tackle as this industry takes a drastic turn.

Word Count: 760

Bibliography

[1] Paralkar, Mandar. “From Product to Service: The Changing Role Of Medical Devices.” Digitalist Magazine, Digitalist Magazine, 17 June 2016, www.digitalistmag.com/digital-economy/2016/06/21/from-product-to-service-changing-role-of-medical-devices-04273557.

[2] Delloite, 2015 Global Life Sciences Outlook Report “Adapting in an era of transformation”, https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Life-Sciences-Health-Care/gx-lshc-2015-life-sciences-report.pdf ,accessed November 2017.

[3] Medtronic Inc., “Medtronic Completes Acquisition of Covidien”, http://newsroom.medtronic.com/phoenix.zhtml?c=251324&p=irol-newsArticle&ID=2010595, accessed November 2017.

[4]McKinsey & Company, “Healthcare’s Digital Future”, https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/healthcares-digital-future, accessed November 2017.

[5] Supply Chain Dive, “J&J: Embrace Change to Transform Healthcare Supply Chain”, https://www.supplychaindive.com/news/JNJ-healthcare-supply-chain-innovation-change-culture/445106/, accessed November 2017.

[6] Delloite, 2015 Global Life Sciences Outlook Report: “Moving Forward with Cautious Optimism”, https://www2.deloitte.com/content/dam/Deloitte/ch/Documents/life-sciences-health-care/ch-en-lshc-2016-life-sciences-outlook.pdf, accessed November 2017.

[7] Medtronic Inc., “Remote Monitoring: Stay Connected. Keep Going.”, http://www.medtronic.com/us-en/patients/treatments-therapies/remote-monitoring.html, accessed November 2017.

[8] ]McKinsey & Company, “Strengthening Healthcare’s Supply Chain: A Five-Step Plan”, https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/strengthening-health-cares-supply-chain-a-five-step-plan, accessed November 2017.

Fascinating take on digitization in the medical device industry and how it can help (or hurt) patients and the bottom line. In an article published in the Journal of American College of Cardiology, a meta-analysis of studies published between 200 and 2008 studying the effect of, “remote patient monitoring (RPM) on the outcome of chronic heart failure (HF) patients,” in which, “a transfer of physiological data using remote access technology via remote external, wearable, or implantable electronic devices.”[1] This is very similar to the situation Medtronic is solving for via digitization of pacemakers, although dated. The study showed that, “[randomized control trials] and cohort studies showed that RPM was associated with a significantly lower number of deaths (RCTs: relative risk [RR]: 0.83, 95% confidence interval [CI]: 0.73 to 0.95, p = 0.006; cohort studies: RR: 0.53, 95% CI: 0.29 to 0.96, p < 0.001) and hospitalizations (RCTs: RR: 0.93, 95% CI: 0.87 to 0.99, p = 0.030; cohort studies: RR: 0.52, 95% CI: 0.28 to 0.96, p < 0.001) I take issue with the reality of the limited time health care providers have to spent on broad sets of patients."

In short, it is not a stretch to say that digitization of medical devices will help patients.

That said, any increase in the time a healthcare provide spends on a patient leads to better outcomes. [2] Perhaps the digitization just makes it more fun, more efficient.

Regarding supply chain cost for Medtronik: I am curious why costs are so high as a percentage of revenue. The 40% figure seems to exceed other industry costs that could also benefit from supply chain digitization. What unique challenges to this space will digitization solve?

[1] Sebastian Winkler, Friedrich Koehler. "A Meta-Analysis of Remote Monitoring of Heart Failure Patients." Journal of the American College of Cardiology, Volume 55, Issue 14, 6 April 2010, Pages 1505-1506

[2] Dugdale, David C, Ronald Epstein, and Steven Z Pantilat. “Time and the Patient–Physician Relationship.” Journal of General Internal Medicine 14.Suppl 1 (1999): S34–S40. PMC. Web. 1 Dec. 2017.

Great article!

I think medical devices companies currently are in a tough time, as hospitals are undergoing significant reduction and wanting to transition to JIT. This may put burden on the inventory cost of these medical device companies, possibly leading to large supply chain cost. On the upside, electronic health records and other hospital systems are on their way to be more consolidated, and it may reduce the cost of Medtronics trying to integrate their supply digital system into the hospital software system.

Really fascinating look at the constantly evolving healthcare market. Digitization is happening across the space and it’s forcing suppliers and hospital systems to rethink their existing relationships. I would think that this trend is good for consumers and the hospital systems as they flush out waste from the system and become more efficient. I wonder what the impact of these technologies would have from the vendor’s perspective: if you have better information on end customers I assume it will result in a smaller bullwhip effect from demand.

Thank you for your post, I really enjoyed reading it.

You have alluded to the emerging Internet of Things (IoT) wave in med-tech and I imagine that this trend is only going to get bigger given the advantages that it offers – the ability for physicians to constantly monitor patient data, the ability to improve patient adherence to therapeutics, and most importantly, the collection of big data on health outcomes that can be then mapped back to the therapeutic care given to the patient. Such changes will allow for measuring the value of care very effectively as we will be able to pinpoint those therapies which yielded better results than others. Micheal Porter has defined value based healthcare as improved outcomes divided by reduction in costs [1] and your argument will definitely allow the numerator to be better measured.

Having said that, I am not sure how whether medical device companies like Medtronic will adapt their supply chains basis this trend in digitization of healthcare. While I agree with you that the overall digitization trend will allow med-tech companies to better plan their inventory and perhaps start engaging in just-in-time inventory manufacturing through better prediction of demand from customers, it may also happen that customers start being more picky about which devices they really want. For example, with patient outcome data available that can be mapped back to the medical device used for the patient, hospitals and doctors may start preferring some devices over others and change their preferences much faster as new technology comes out because they have access to the end outcomes data!

This should be worrying to medical device manufacturers because their emphasis on quality and tech advancement will only increase. However, it will be wonderful for the patients!

1 The Strategy That Will Fix Health Care, Michael Porter, Thomas H Lee, HBR, October 2003