USAA – A leader in Financial Services Digitization

USAA has provided the military with digital banking for years, but needs to continue to innovate to stay on the top of the digital banking world.

USAA, originally the “United Services Automobile Association” when it was formed in 1922, is now a diversified financial services group of companies that is among the leading providers of financial planning, insurance, investments and banking products to members of the U.S. military veterans, who have honorably served, and their families, and is committed to delivering excellent service and great guidance.[i]

For a company like USAA to provide top quality service, one would think that it would need to have many retail locations to meet the needs of its customers. However, that’s not the case. Despite serving customers all over the country (and the world), USAA has only 16 physical locations outside of their headquarters in Texas[ii].

This fits well with their moto “Legendary Service and Simple Tools.” Through USAA’s mobile app, members can send money, get proof of insurance, pay bills, deposit checks, and more. And, if any problems arise, USAA is ready to provide customer support over a hotline.

I interviewed two USAA customers to see if USAA is actually able to deliver on its promise of “Legendary Service” to its 11.4 million global customers with very few physical locations:

- Former Navy Lieutenant and USAA customer Tabitha Strobel noted that, “I initially thought it was weird that [USAA] didn’t have any physical locations near me, but they absolutely provide high quality service even without physical locations, which is exactly what you need for military customers, who are all over the world and need high-quality service everywhere”[iii]

- According to former Navy Submarine officer Billy Strobel, also a USAA customer, their service “really is top quality. When you call them they are always there and very helpful.”

USAA has clearly been a forerunner in the digitization of the banking industry. However, in order to stay ahead of the technology curve, USAA needs to digitize even further.

Even though USAA reduces costs by eliminating overhead that many bank spend on their physical branches, USAA, like most financial institutions, still spends a lot on costs that should be eliminated or drastically reduced with further digitization.

- Blockchain will soon drastically reduce closing costs on mortgages and other transactions. As it is now, in many states, USAA pays a closing attorney to witness the mortgagee sign the mortgage and ensure money changes hands properly. Blockchain could perform the same function for a fraction of the price with smart contracts. In the same way, the banking industry often gets into trouble for losing loan documents or inability to show that it had provided a Good Faith Estimate (GFE) as required by law within the proper period of time before the closing. Blockchain could eliminate the worries associated with recordkeeping, as blockchain keeps a permanent record of transactions. This could even help the mortgagee (and everyone else involved in the ecosystem) to keep track of who owns the loan if it’s sold on the secondary market.[iv] According to bankrate.com, the closing fee paid to a real estate attorney in Massachusetts is typically $648.[v] This could be almost completely eliminated using blockchain.

- USAA should partner with other financial institutions to invest in blockchain technology, with the goal of lowering transactions costs, particularly on mortgage loans. Sooner or later USAA’s competitors will, so it behooves USAA to be the first bank to use blockchain in this way, as it will give them a competitive advantage to be one of the first movers.

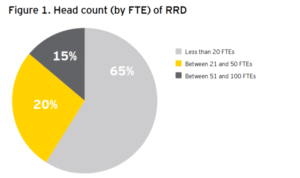

- Digitization of financial and regulatory reporting is also key in the banking industry. An EY regulatory reporting survey found that most large banks have separate department for regulatory reporting in addition to their financial/SEC reporting. This group can be up to 100 FTEs (see the graph

below from the study). [vi]Many of these roles could be eliminated through digitization of the regulatory reporting process, at a significant cost savings to the bank, that could be passed on to its members.

below from the study). [vi]Many of these roles could be eliminated through digitization of the regulatory reporting process, at a significant cost savings to the bank, that could be passed on to its members.

USAA has been a leader in digitalization in the past and needs to continue to be a leader going forward. Blockchain and digitization of its regulatory reporting process are a couple ways it can continue to be a leader in digitization but only the start of a digitization that will continue to profoundly affect the banking industry for decades to come. (708 words)

[i] Welcome to USAA!. 2016. Welcome to USAA!. [ONLINE] Available at: https://www.usaa.com/inet/wc/about_usaa_corporate_overview_main. [Accessed 18 November 2016].

[ii] Welcome to USAA!. 2016. Welcome to USAA!. [ONLINE] Available at: https://www.usaa.com/inet/ent_locationServices/UsaaLocator/?0&wa_ref=pub_globalnav_help_atm_usaalocations. [Accessed 18 November 2016].

[iii] Interview with Billy Strobel and Tabitha Strobel on 11/18/2016. Interview performed by Dave Vitello on the Harvard Business School campus.

[iv] http://www.bankrate.com/finance/mortgages/closing-costs/massachusetts.aspx

[v] Massachusetts Closing Costs | Bankrate.com. 2016. Massachusetts Closing Costs | Bankrate.com. [ONLINE] Available at: http://www.bankrate.com/finance/mortgages/closing-costs/massachusetts.aspx. [Accessed 18 November 2016].

[vi] “Setting the pace of change,” 2011 Federal Reserve: Bank regulatory reporting survey, January 2012, http://www.ey.com/Publication/vwLUAssets/Federal_Reserve:_bank_regulatory_reporting_survey/$File/ErnstYoungFRBsurveyreportfinal.pdf

Interesting article Dave. USAA is definitely a front-runner in the Financial Services industry when it comes to embracing the digitalization trend. However, contrary to the general industry trend, in recent years USAA has actually been expanding it physical footprint, opening a set of “Financial Centres” [1] to provide better customer services with regards to complex transactions (and simultaneously achieve improved operational efficiency) [2]. So while I agree that USAA should stay ahead of the herd through focusing on utlizing new digital technologies, I do not agree 100% that it necessarily needs to digitize further – there is value to provide to customers through physical locations and face-to-face interactions.

[1] http://paycheck-chronicles.military.com/2011/05/11/usaa-is-branching-out/

[2] http://www.americanbanker.com/btn/25_7/banking-centers-helpful-for-service-marketing-1050406-1.html

It is fascinating that USAA has managed to be so successful from a customer service perspective, despite the lack of branch locations. As reflected in your interviews with Tabitha and Billy Strobel, USAA gets top marks for customer service. In fact, its Net Promoter Score (NPS) ranking is the highest in the US for: Auto insurance, banking, and home and contents insurance. (1) Let’s take banking for example. A traditional bank spends 40-60% of its operating costs on branches. (2) Despite these high costs, many traditional banks are opening branches every year. In the U.S, the number of physical bank locations rose by 22% between 2000 and 2012. (2)

One reason for this is that people feel safer knowing their money is tied to a physical location. In the early years of online banking, customers may not have felt comfortable completing banking transactions online. In recent years, that sentiment has changed, spurred on by the rise of e-commerce shopping and the electronic filing of tax returns. Armed with a smart phone and an ATM nearby (USAA refunds all ATM fees incurred), customers have very little need for a physical branch location.

I think in coming years, we will see more and more banks shift to this model, thereby saving costs on branches and instead devoting that cost to providing high-touch customer service remotely.

(1) http://www.satmetrix.com/in-the-news/2016-net-promoter-benchmarks-released/

(2) http://www.economist.com/node/21554746

As a 10-year customer of USAA, I can also confirm their unparalleled customer service. Their early, aggressive moves into digital banking radically improved the banking experience for their customers. I have served overseas with the U.S. Air Force for a total of four years on four different continents, and I never once experienced a banking or insurance problem that couldn’t be resolved through their smart phone application or a quick 10-15 minute call on their hotline.

However, I would push back on your claim that USAA should quickly move to utilize the blockchain for smart contracts on mortgages and other products. In its recent reporting on the blockchain and smart contracts, The Economist highlighted two significant outstanding issues with this approach: defective code and the immutable nature of the block chain (1). On average, software comes with between 15 and 50 defects per 1,000 lines of code. This number is expected to be even higher with blockchain code, because the technology is still immature. This makes smart blockchain-based contracts “candy for hackers.” Furthermore, smart contracts based on the blockchain are designed to be immutable, so any attempts to correct the defective code would be considered a breach of contract. For these reasons, I would contend that human-based contract are still superior to blockchain-based smart contracts for the foreseeable future, even if the transaction costs are higher.

(1): http://www.economist.com/news/business/21702758-time-being-least-human-judgment-still-better-bet-cold-hearted

Great article, USAA is awesome! They were one of the first banks to come out with mobile check deposits and that has saved me immense amounts of time in the last few years.

Dave, interesting take on USAA’s digital leadership in the banking world. Great feedback from the Strobels – how did you score such an exclusive interview?!

While I agree with your assessment on blockchain and its ability to lower costs, I think USAA customers are core to the firms ability to stay ahead of digitization. In a recent interview with assistant vice president Prianka Advani, PYMNTS.com reported that the company gets critical feedback from customers and incorporates the feedback into new initiatives. One critical example of this is the use of voice activated assistant Eva. Based on customer reports of the shortfalls of Alexa and Siri with digital banking, USAA created virtual assistant Eva.

http://www.pymnts.com/news/digital-banking/2016/mobile-digital-banking-future/

Thanks for repping my favorite bank, Dave. I agree with your points, and I’ve heard a lot about the how blockchain could revolutionize the legal industry (as you mentioned in your mortgage example). There are some challenges, however, that you might find interesting. First, blockchain sort of knows no boundaries in terms of the law, and jurisdictional differences that blockchain transcends would have to be overcome. Contract law and property law, for example, vary substantially in different US and international jurisdictions. Second, the law itself would have to “catch up” to the cyber world. Not only is cyberlaw still unsettled in many areas, new concepts or applications of concepts (such as the “four corners rule” in contract law) would have to be determined. Since the law tends to lag behind technology and society sometimes, I don’t know that we are there yet, but I’m optimistic that eventually we will be. Here’s an interesting article from the law firm DLA Piper if you’re interested: https://www.dlapiper.com/en/us/insights/publications/2016/07/global-financial-markets-insight-issue-10/can-blockchain-live-up-to-the-hype/