“Unpacking the Effects of Brexit on one of Europe’s Largest Paper & Packaging Businesses: The Smurfit Kappa Group.”

Brexit’s impact on UK manufacturing is so significant that it is even impacting one of the most basic and commoditized industries; pulp & paper. Learn more about one of the biggest paper & packaging players – the Smurfit Kappa Group – as it grapples with the effects of Brexit on its supply chain and overall business strategy.

The geopolitical tides have dramatically turned, with nations eschewing globalization for the more inward-facing stance of isolationism. The effects of this paradigm shift are far-reaching, touching the supply chains of organizations globally. In examining the magnitude of this impact, there is one organization that is facing an existential crisis induced by Brexit – the Smurfit Kappa Group. More specifically, Brexit is forcing the Smurfit Kappa Group to face some very difficult decisions regarding its supply chain, capital allocation and overall corporate strategy. Yet, management’s current response may not be sufficient long-term when dealing with the global scope and supply chain logistics of the company and a more comprehensive response is indeed merited for the company’s long-term success.

The Smurfit Kappa group is amongst the largest producers of corrugated paper and packaging in the world, with mills throughout Europe and the UK[1]. Because the company sources recovered fiber and containerboard from its mills across Europe, Brexit had the immediate impact of increasing raw materials costs. More specifically, the company saw a nearly 21% drop in Net Income in the first half of 2016, driven almost entirely by a €182MM increase in cost of sales[2]. This profitability decrease was entirely driven by the increase in the price of recovered paper fiber, which is the largest input in the company’s raw material production process. Given the limited supply of European paper mills, which at present time are operating near full capacity[3], and added costs associated with sourcing these raw materials outside Europe, the company faced few alternatives. What is more, on the 2Q2016 earnings call, CEO Tony Smurfit addressed the impact of this increase with surprise, as he had initially argued that “Any effect (of Brexit) on Smurfit Kappa Group will be as a result of the withdrawal having a knock-on impact on UK/European gross domestic product”[4]. While valid, his thesis was largely driven by the observation that the paper and packaging industry tends to track global GDP growth as it is a staple material input in many global businesses[5]. Thus, if UK GDP begins to decline with businesses fleeing, this should impact businesses like Smurfit Kappa that are directly tied to GDP growth. What management failed to anticipate, however, was the additional impact of the raw material costs and currency headwinds.

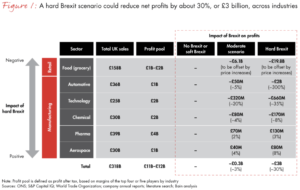

Fortunately, despite this initial miscalculation, management has taken proactive measures to minimize the economic impacts of Brexit on the company’s supply chain and profitability, since the first half of 2016. Due to Smurfit Kappa’s scale and pricing power, the company has been able to offset the impact of rising raw material costs by increasing the prices of their finished goods to end consumers. Indeed, according to a 2016 Bain Report (see figure below) many UK based manufacturers are expected to offset the increased raw material costs with price increases, in a similar strategy[6].

This pricing power was reflected by a nearly €60/tonne increase in recycled containerboard prices (the largest price increase in several years), effective in February of this year. The increase in pricing helped Smurfit Kappa Group return to record profitability, with Net Income rising in the first quarter of this year by nearly 20% despite the increase in Cost of Sales attributed to raw material and input costs. On the earning’s call, CEO Tony Smurfit again stressed the resilience of the business going forward, arguing that further price increases in the next 2-3 years would follow “if and where necessary”[7]. Nonetheless, the company’s absolute reliance on pricing power to offset rising raw materials costs raises some serious questions and concerns about future competitiveness. Particularly in the paper and packaging industry, where gross margins are notoriously low, product differentiation is unperceivable, and consumers are generally very price-sensitive, I am concerned about the long-term (3-10 years and beyond) viability of this strategy as consumers may opt for less-expensive alternatives.

I therefore think the company has to consider several other alternatives going forward to address the potential issues that will arise from its Brexit-induced supply chain disruption. My first recommendation is to invest in lower cost mills throughout Europe (predominantly in the North-West where most corrugated pulp is sourced) and also establish longer-term contracts with its suppliers to lock in lower prices (the typical tenor is 1-2 years). What is more, Smurfit Kappa typically spends around €500MM per year on acquisitions, and it should therefore strategically seek assets that lower its production costs and increase efficiencies in its supply chain.

These recommendations aside, I remain concerned about the long-term competitiveness of Smurfit Kappa in an increasingly commoditized and price-sensitive industry. While their strategy is predicated on price hikes, there is a limit in their end consumer’s flexibility, and I fear this may be coming to a head.

(Word Count: 793 Words)

[1] Smurfit Kappa Group Annual Report, December 2016.

[2]Smurfit Kappa Group 2q2016 Quarterly Earnings Report, June 2016.

[4] Smurfit, Tony. “Bloomberg Morning News: Market Watch.” September 29th, 2017.

[5]“Global Forest, Paper & Packaging Industry Survey: 2016 Edition”. Price Waterhouse Cooper, December 2016.

[6] “Is Your Supply Chain Ready?”. Bain Capital Briefing. February 6th, 2017.

[7] Smurfit Kappa Group 1Q2017 Quarterly Earnings Report, February 8th, 2017.

Darius, I enjoyed reading about your take on this Brexit-induced supply chain problem facing the Smurfit Kappa Group. You raise good points; I’m also concerned about the viability of their acute response to raise prices in order to offset an increased cost of sales and its impact on the bottom line. As you stated, paper is becoming increasingly commoditized and consumers are price-sensitive. Therefore this reliance on a pricing “lever” alone to offset rising raw materials costs is concerning.

To that end, I wonder what political levers Smurfit Kappa Group could pull. Would it be worthwhile to invest in lobbying efforts to perhaps persuade the passage of laws in their favor, such as those that could reduce import taxes on recovered paper fiber? Although lofty, this could result in a more viable, long-term solution. I agree with your point on locking-in contracts with raw materials suppliers to minimize these cost increases in the short term, or to bite the bullet and invest considerable capital today in mills that will guarantee low cost raw materials in the future. Given how quickly political winds may shift, I wonder what is the best route.

Great article Darius! I would add that a major concern for manufacturing companies operating in the UK is how to hire and retain its labour force in the context of stricter changes to immigration policy and border controls. It’s still unknown the impact that Brexit will have on EU migrants working in the UK, but additional visa requirements could lead to hire administrative costs squeezing the already low margins of paper manufacturers.

I agree with you that relocating the manufacturing operations to lower cost countries might be a good play, particularly since some EU countries might compete to attract companies fleeing from the UK (we have already witnessed this competition between Dublin, Madrid and Paris to attract some banking positions leaving London). Nonetheless, I am not sure if it’s not a bit too early to commit to such a radical move in light of the uncertainty surrounding how Brexit will play out.

Darius, thank you for this very interesting post and for choosing Smurfit Kappa! Smurfit Kappa was a potential client when I was working in Business Development in Mexico. In addition, during my time as strategy consultant I worked on a procurement optimization project focusing on paper supply.

I strongly agree with the concerns you raised about increased costs of raw material supplies that will ultimately result in higher sales prices. However, I do not think Smurfit Kappa’s competitiveness is at risk since the pulp & paper industry is a highly local industry when it comes to distribution. Paper mills in the UK supply primarily customers within the UK. Thus, a price increase in the UK will not only affect Smurfit Kappa but also its competitors in the UK. In the end, the British end customer will be the one most affected since he will end paying a higher price for products manufactured in the UK that use paper as input.

Great piece! Interesting to see how real and how fast the effects of Brexit are being felt. I agree that increasing prices is not a sustainable strategy in the long run. Firms like Smurfit Kappa will have clearer outlook as soon as the Brexit talks are finalized and new trade agreements are signed – in the mean time the end consumer is going to continue absorbing the costs.

Nice work, Darius. It was an especially interesting read for me given my lack of knowledge about the industry or the company in particular. This is a fascinating case to illustrate the quick effect of Brexit on domestic businesses.

I am still struggling to understand one of management’s comments — the one about further price increases over the next 2-3 years. If I’m understanding correctly, the effect of Brexit was to increase the cost of raw materials imported from other parts of Europe, but isn’t this a one-time increase? And hasn’t management already compensated for this increase if they’ve achieved record profitability? I understand the impetus to pass these cost through to consumers but it doesn’t seem like further increases in future years are warranted.

Darius, you’ve clearly explained this problem and the current solution Smurfit Kappa Group has implemented on pricing. It sounds to me like a very tough position for Smurfit Kappa Group to be in, and the solution requires a lot of effort.

A few thoughts, however: Firstly, since Brexit was not isolated to the Smurfit Kappa Group, is there a reason they would be more heavily affected than their competitors? I’m running under the assumption that they’re competitors have a similarly geographically distributed supply chain structure. But basically, I wonder if the playing field is levelled across the industry, or if there are several players who are say more UK-based, and hence will make it difficult for Smurfit Kappa Group financially.

Second, you mention that you’re concerned about their competitiveness in a commoditized and price-sensitive industry. I agree this is a concern if there is competition which can undercut their prices, but if not, the consumers will have to accept the higher prices. However, now that Smurfit Kappa has been put in this position, it might make sense for them to think through how they could (1) differentiate themselves from competition to the end-consumer, and (2) really improve upon their cost structures in order to outcompete others. To this end, a couple of ideas are broadening their portfolio to include other value-added paper/packaging products, and to go through a full re-thinking of their supply chain (there may be opportunities for them to improve, just as we saw a gap between United and Asahi today).

Smurfit Kappa provides a tangible example of the effects of Brexit, and you’ve raised some serious concerns about the long-term viability of their business model in the latest geopolitical landscape. I would argue against Miguel’s suggestion of a wait-and-see strategy. My intuition suggests that the risks associated increased costs and a developing regulatory environment are burdensome. Locating mills closer to the raw material supply in a more stable regulatory environment appears to be a slam dunk.