Unlocking access to medicine in developing countries through digitization

Novartis is a digital pioneer in developed countries, but has struggled to increase patient access in developing countries. How can Novartis use digital technologies as a catalyst to redesign fragmented distribution systems?

The next frontier in pharma: Chronic diseases in developing countries

Three major mid-term shifts urge Novartis to fundamentally rethink its distribution systems:

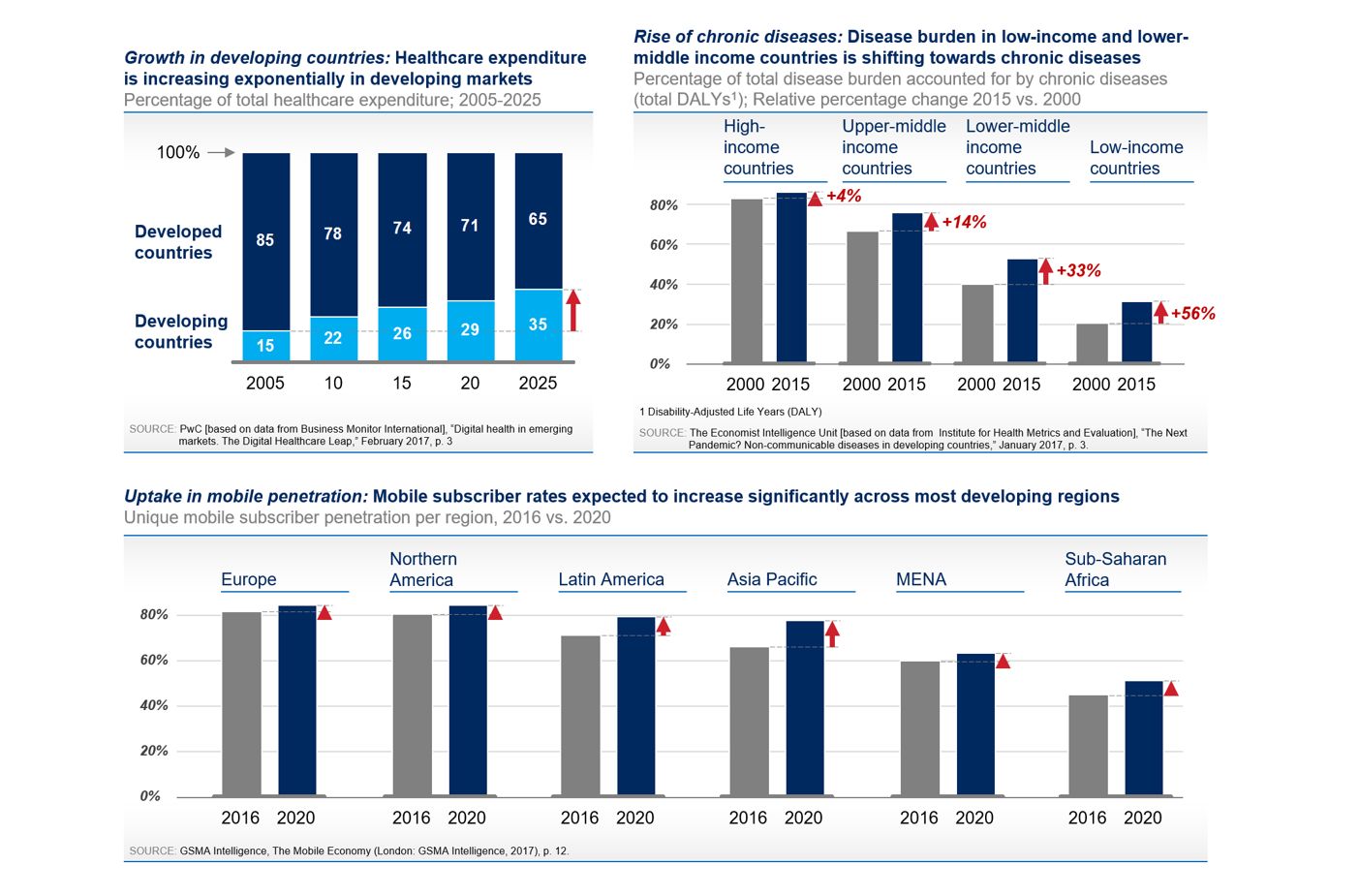

- Growth in developing countries: Healthcare expenditure in developing countries have increased 13.2% annually between 2004 and 2014, compared to 3.5% in developed countries [1]. Developing countries will contribute 35% to global healthcare spending by 2025, up from 15% in 2005 [2].

- Rise of the “next pandemic” [3]: chronic diseases: Driven by urbanization and changing lifestyle habits, chronic diseases such as diabetes or heart illnesses now represent up to half the disease burden in developing countries [4].

- Uptake in mobile penetration: 4G coverage will reach 70% of the population in developing countries by 2020 [5], while mobile service subscriber penetration will reach 50-75% by 2020 [6].

The confluence of these developments opens unique opportunities for Novartis. Even though emerging markets contributed 25% to sales in 2016 [7], Novartis is struggling to gain traction in chronic diseases. Initiatives such as Novartis’ Access program are very limited in reach [8]. Unlike disaster relief efforts concerning communicable illnesses (e.g., HIV, Malaria), chronic diseases require scalable long-term distribution systems. Why does Novartis hesitate to build distribution models in geographies that bear 80% of today’s deaths in chronic diseases [9]?

A digital silver bullet to crack market access?

Developing countries pose substantial access barriers in awareness, affordability and availability [10,11]. Various hurdles undermine efforts to improve availability through distribution systems:

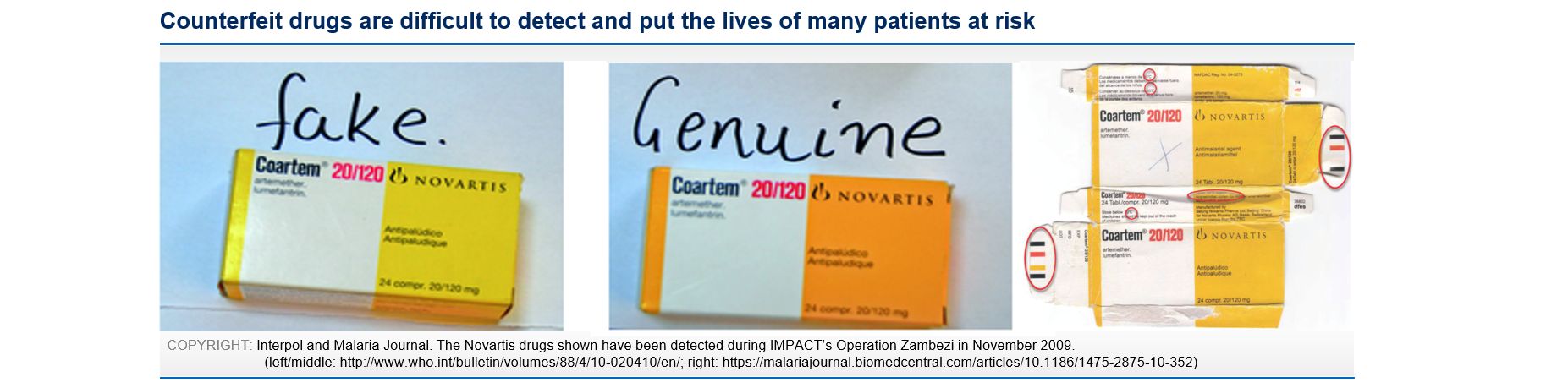

- Permanent threat of substandard (counterfeit) drugs: Up to 30% of medicines in Asia, Africa, and Latin America [12] are substandard, reaching 64% for certain medicines [13].

- Limited stock visibility: Novartis has little information on the stock levels along the distribution chain, resulting in stock-outs or waste.

- Uncontrollable mark-ups: Erratic margins in fragmented distribution chains can quadruple end-customer prices compared to manufacturing selling prices in countries such as Kenya [14].

- Inadequate disease information: Drugs are not ordered because patients and health-care professionals are unaware of treatment needs and options.

Overcoming these hurdles requires better data flow along the supply chain in developing countries. Hence, how is Novartis leveraging the mentioned surge in mobile communication technology [15]?

Cutting-edge in developed markets, but barely scratched the surface in developing markets

Novartis’ outgoing CEO Joseph Jimenez recently appointed a Chief Digital Officer [16] and embraced digitization as a top priority [17] through various initiatives:

- Analytics: Cooperation with IBM Watson Health blending disease knowledge, data analytics, and machine learning to individualize treatment for breast cancer patients [18]

- Connected solutions: Cooperation with Qualcomm to develop a wireless enabled inhaler device (“Breezhaler”) supporting disease management in respiratory conditions [19,20]

- Smart devices: Audacious long-term bet with Google Health to commercialize smart contact lenses with auto-focus capability and blood glucose measurement [21,22]

- Data transparency: Public-private partnership program “SMS for Life” providing Sub-Saharan healthcare facilities with smart phone applications to monitor and manage stock levels [23,24]

- Data sharing: Multisector collaboration with Intel (“Better Hearts Better Cities”) for cardiovascular disease prevention/management in low-income urban communities [25]

Only the last two initiatives could potentially alleviate distribution challenges. A technology leader in developed markets, Novartis has shown little appetite to drive digitization in developing markets.

Digitization – more than a silver lining

In light of the far-reaching implications of digital technologies on fragmented distribution systems, Novartis should fundamentally rethink the downstream supply chain in developing markets:

- Verifying authenticity of medicines to fight substandard drugs: Radio-frequency identification (RFID), Quick Response (QR) codes and blockchain technology reduce the risk of counterfeit drugs [26,27,28]. Drug integrity is confirmed through the manufacturer, or through a trusted blockchain network along the supply chain that allows patients to verify medicines with an app [29,30].

- Creating inventory transparency to increase stock visibility: Implementing a digital end-to-end supply management and inventory tracking system empowers members throughout the drug stock chain to report stock levels and react to system-generated reminders. A stock visibility solution developed by Vodacom South Africa has reduced stock-outs by up to 66% [31].

- Lowering price levels to address uncontrollable mark-ups: Verification technologies at the point-of-sales drive affordability. Subsidies or reimbursements can be directly linked to the end-customer price, which reduces incentives for drug retailers to overcharge patients.

- Facilitating information flow to create a downstream pull: Mobile health (mHealth) apps support health-care professionals and patients in better understanding treatment needs and “pulling” the most effective medicines from the upstream supply chain partners.

Unleashing the full power of integrated distribution networks

Digitized distribution systems are necessary, but not sufficient to increase patient access. Novartis needs to build a digital ecosystem that integrates innovative payment schemes (e.g., micro-payment/insurance) and remote diagnostics, monitoring and compliance solutions. In addition, successful implementation requires well-balanced multisector collaboration networks [32]. Despite these complexities, it is high time for Novartis to expand its digital leadership into developing markets.

(798 words)

_______________________

References

[1] GSMA Intelligence, “Scaling digital health in developing markets. Opportunities and recommendations for mobile operators and other stakeholders,” June 2017, p. 9.

[2] PwC, “Digital health in emerging markets. The Digital Healthcare Leap,” February 2017, p. 3.

[3] The Economist Intelligence Unit, “The Next Pandemic? Non-communicable diseases in developing countries,” January 2017, p. 0.

[4] Ibid., p. 3.

[5] GSMA Intelligence, The Mobile Economy (London: GSMA Intelligence, 2017), p. 15.

[6] Ibid., p. 12.

[7] Novartis, Q4 and FY 2016 Condensed Financial Report – Supplementary Data (January 2017), p. 72.

[8] Novartis, Novartis Access 2016 one-year report. Capturing first insights (Basel: Novartis Social Business, 2017).

[9] World Health Organization, “Noncommunicable diseases Fact sheet,” June 2017, [URL], accessed November 2017.

[10] Gill Samuels, “Availability, Accessibility and Affordability, The challenge of diseases of poverty,” 2005, [URL], accessed November 2017.

[11] Anthony Morton-Small, Derek Dieu, Understanding the paradox of Asia’s pharma market to ensure success, Awareness, Access & Affordability Framework, 2012, p. 3.

[12] International Medical Products Anti-Counterfeiting Taskforce (IMPACT), “Counterfeit Medicines: an update on estimates”, November 2006, p. 1, [URL], accessed November 2017.

[13] “Fake pharmaceuticals: bad medicine,” The Economist, October 13, 2012, [URL], accessed November 2017.

[14] IMS Institute for Healthcare Informatics, Understanding the pharmaceutical value chain (Parsippany, NJ: November 2014), p. 8.

[15] Pew Research Center, “Smartphone Ownership and Internet Usage Continues to Climb in Emerging Economies,” February 2016, [URL], accessed November 2017.

[16] “Novartis appoints Bertrand Bodson as Chief Digital Officer,” press release, August 24, 2017, on Novartis website, [URL], accessed November 2017.

[17] Joseph Jimenez, interview by McKinsey & Company, “Novartis on digitizing medicine in an aging world,” June 2015, [URL], accessed November 2017.

[18] “Novartis announces ground-breaking collaboration with IBM Watson Health on outcomes-based care in advanced breast cancer,” press release, June 5, 2017, on Novartis website, [URL], accessed November 2017.

[19] “Novartis Pharmaceuticals collaborates with Qualcomm in digital innovation with the Breezhaler(TM) inhaler device to treat COPD,” press release, January 5, 2016, on Novartis website, [URL], accessed November 2017.

[20] Sarah Neville, “Digital disrupters take big pharma ‘beyond the pill’,” Financial Times, April 24, 2017, [URL], accessed November 2017.

[21] “Novartis backs off from 2016 date for testing Google autofocus lens,” Reuters #Business News, November 18, 2016, [URL], accessed November 2017.

[22] Nick Paul Taylor, “Novartis chairman: Google smart lens is a high-risk project,” FierceBiotech, March 2, 2017, [URL], accessed November 2017.

[23] “Novartis launches SMS for Life 2.0 in Nigeria to help improve access to essential medicines,” press release, December 12, 2016, on Novartis website, [URL], accessed November 2017.

[24] “SMS for Life uses mobile and digital technology to increase quality of care in developing countries”, Novartis Social Business SMS for Life Fact Sheet (April 2017), [URL], accessed November 2017.

[25] “Novartis Foundation and partners launch initiative to tackle hypertension and its root causes in low-income urban communities,” press release, May 17, 2017, on Novartis website, [URL], accessed November 2017.

[26] Don Gunasekera, “Counterfeit drugs: Fight fake reagents with digital tools”, Nature 546 (2017): 474.

[27] Guillaume Chapron, “The environment needs cryptogovernance”, Nature 545 (2017): 403-405.

[28] Jennifer Kite-Powell, “PharmaSecure Uses Mobile Device And ID Codes To Take On Counterfeit Drug Problem”, Forbes, February 16, 2012, [URL], accessed November 2017.

[29] Chris Lo, “Blockchain in pharma: opportunities in the supply chain”, Pharmaceutical Technology (October 31, 2017), [URL], accessed November 2017.

[30] Manuela M. Schöner, Dimitris Kourouklis, Philipp Sandner, Erick Gonzalez, Jonas Förster, “Blockchain Technology in the Pharmaceutical Industry”, Frankfurt School Blockchain Center Working Paper (Frankfurt am Main: July 2017).

[31] GSMA Intelligence, “Scaling digital health in developing markets. Opportunities and recommendations for mobile operators and other stakeholders,” June 2017, p. 32 & 63-66.

[32] Ibid., p. 22.

I found this piece extremely interesting and think that digitalization at Novartis for the developing world could radically change the healthcare delivery process and positively effect millions of people. I agree that chronic diseases are the next frontier for pharmaceutical companies and offer a great platform for Novartis to make an impact. I disagree, however, that these new technologies will be directly implemented into the current supply chain – rather technology will enable a different supplier network to be built.

The new supplier network will incorporate the data transparency and availability mentioned in the article, but AI and tele-health capabilities will enable both providers and pharmaceutical companies to understand the patient on an entirely different level [1]. The ability to transfer encrypted data securely and utilize the existing smartphone network will allow companies like Novartis to predict demand more precisely than it has in the past [1]. Instead of needing to interact directly with patients or doctors Novartis may be able to directly participate during the diagnosis and prescription process to predict the needs of the patients. Ideally this would help them lower inventory costs for raw materials, batch production based on region-specific demand, and move to a just-in-time production schedule for drugs it knows it will need in developing markets – in much the same way that neglected infectious diseases could’ve been targeted using Pharmacogenomics [2].

Novartis has the capability to redefine the supply network in the pharmaceutical industry through digitalization of demand forecasting and distribution networks while simultaneously bringing treatments to many of the patients who need it most.

[1] Adebayo Alonge, “How AI Can Help Africa Get Universal Healthcare Before America,” Newsweek, October 30, 2017.

[2] Pang, T. Am J Pharmacogenomics (2003) 3: 393. https://doi.org/10.2165/00129785-200303060-00006

A thought-provoking piece about an important topic! While I agree that chronic disease will become increasingly important in both developed and developing countries, I am skeptical about the use of technology and digitization as a ‘silver bullet’ to improve access to care and health outcomes. Based on the reasons you cited, I do not doubt that digitization will improve supply chain efficiency. Beyond the ‘how’ of delivering drugs lies a bigger strategic imperative for Novartis to work out a scalable business model for serving the chronic conditions segment in the developing world. So far it seems that Novartis is selling these drugs in bundles to governments who then distribute to their constituents. It may be hard to increase demand among governments, who have to manage the double burden of infectious disease and chronic disease [1] and may prioritize the former due to its immediate impacts. If Novartis were to sell directly to physicians or clinics, they would have to strengthen healthcare system capabilities (e.g., primary care) in these countries in terms of chronic disease awareness, diagnosis and treatment, a task they have not had to take on to the same degree in developed countries. While their mobile health apps might help, they cannot build the initial relationships and trust that are needed. These additional supports might create pressures on costs and prices of drugs, as well as profitability for Novartis. In conclusion, for Novartis to succeed in this new segment, it will have to wrestle with some of these strategic questions in addition to increasing digitization.

[1] Novartis Access 1-year report 2016. https://www.novartis.com/sites/www.novartis.com/files/novartis-access-report-2016.pdf