UNIQLO: Digitalization and Supply-Chain Transformation

This is about Uniqlo's supply-chain transformation based on digitalization.

Introduction: Transformation Under Way at Uniqlo

Uniqlo is a main group company of FAST RETAILING CO., LTD., the biggest apparel retailer in Japan with sales of US $16 Billion, placed in the third in the global market, following ZARA and H&M.

In February 2017, Uniqlo opened a brand new 200,000-square-foot headquarters on top of its distribution warehouse in Tokyo. This project was aimed to drive the apparel giant’s new strategy to transform its business model from “Selling what we produced” to “Producing only what we can sell.” As described by Tadashi Yanai, CEO of the company, the strategy represented a shift from “Made for All” to “Made for You” through digital integration of planning, manufacturing, and sales[1]. The new headquarters is designed to foster such integration by placing its 1,000 employees from different divisions in the same workspace—e.g. locating all of the planning, marketing, production, and logistics divisions on the same floor — and connecting them through a common digital platform as well.

[1] https://www.wwdjapan.com/401262 (2017 March 19)

Uniqlo’s Concerns and Efforts for the Supply Chain Transformation

In his press interview[1], Mr. Yanai said, “Digitalization makes demarcation of industries useless. In such a world, data is the most important source of competitiveness. As fashion and apparel products are the data itself, Amazon and Google will have a great power in this industry too. In order to overcome such challenge from these digital giants, we need to transform our supply-chain system by using digital technology”. Thus Uniqlo began to execute supply chain transformation since 2016.

Under the current system, it takes 6 to 12 months for Uniqlo to decide the design, procure material, manufacture products, and deliver them to retail stores, resulting in a mismatch between customers’ needs and the products, with loss of sales opportunities and excessive inventories. However, in 2017, the company has begun to instill RFID (radio frequency identifier) tags to all of their products, and connecting RFID data to its digital platform. With this new system, Uniqlo’s goal is to make accurate daily sales forecasts at each retail store, and to plan and produce its products in real-time.

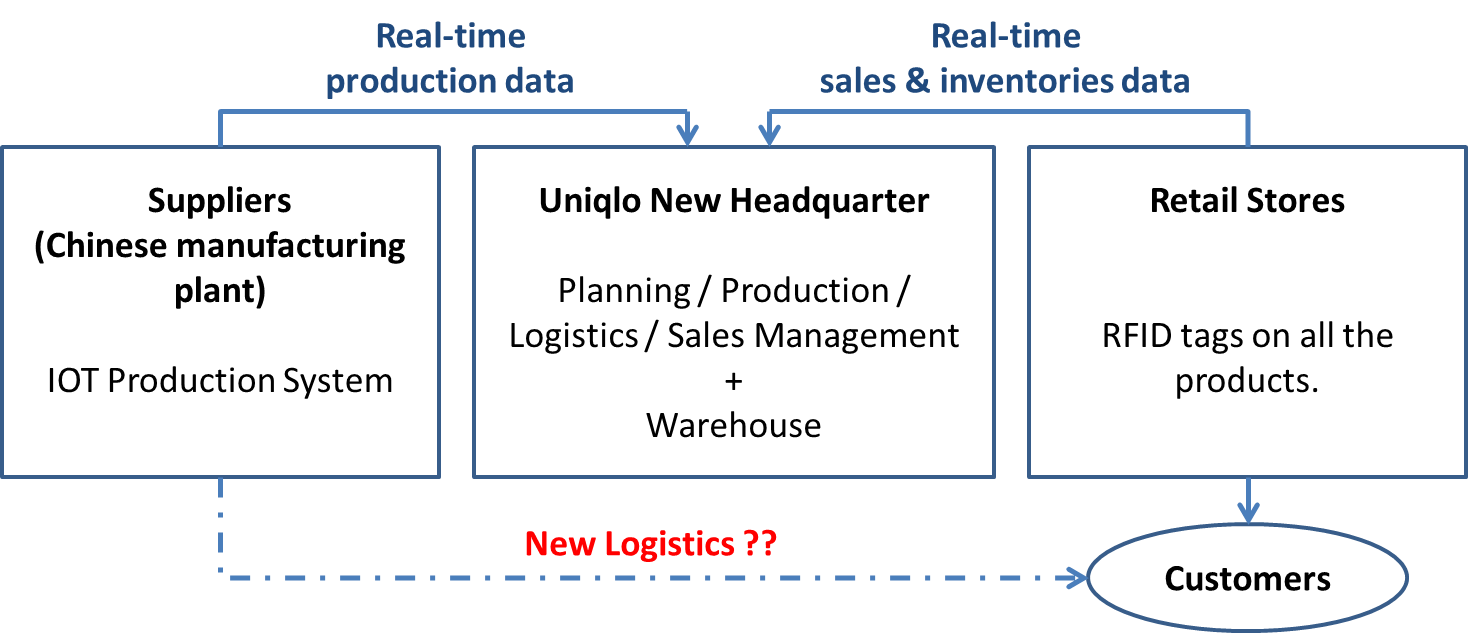

I interviewed my former colleague[2] who is working on IOT digitalization project for a Uniqlo’s manufacturing plant in China, and learned that Uniqlo has requested the plant to introduce new IOT-based automated production system and share the real-time production status with Uniqlo’s headquarters in Tokyo. Once this new system is in place, Uniqlo’s whole supply chain – from production to retail– will be connected to its digital platform.

According to several media sources[3], Uniqlo partners with Accenture for data analyses, and set up a joint venture with Daiwa House Group, a Japanese largest homebuilder, to build a new logistics center for efficient and fast distribution network in Tokyo. Uniqlo also announced that it will increase sales on its own e-commerce platform from the current account of 5% total sales to 30%, and will integrate its real stores with virtual online sales operation. Based on this information, Uniqlo’s new supply-chain system with digital platform can be illustrated as below.

[1] http://business.nikkeibp.co.jp/atcl/opinion/16/092900020/100600009/ (2016 October 7)

[2] Ms. Nana Kato, Textile and Apparel Business Department, Sojitz Corporation

[3] https://www.nikkei.com/article/DGXLZO14184210W7A310C1TI5000/ (2017 March 17)

http://www.logi-today.com/219287 (2016 March 3)

Recommendations and Discussion for the Way Forward

Uniqlo is working hard to establish its new supply-chain system based on digitalization, but its overarching strategy to improve the global distribution networks remains unclear. Now that its global sales consists 45% of its total sales, Uniqlo needs to articulate how to compete with other giant retailers such as Amazon in terms of delivery to customers. Outsourcing its logistics functions to the third parties could be one option.

In order to explore unidentified customers’ needs and innovate its products, it might be important for Uniqlo to collect more data from further downstream of its supply-chain, such as when, where and how consumers use their Uniqlo products, including frequency of washing and cleaning. With such information, Uniqlo can provide more customized service — suggesting new fashion coordination with its product lineup, or advising the timing to replace its clothes.

Open questions for Uniqlo are:

- “What are the downsides of using third party logistics functions in terms of variability and its effects on Uniqlo’s supply chains?”

- “How do they develop long-term strategy in the context of drastic changes of the future consumer lifestyles and new potential players in that landscape? For example, what does Uniqlo do if wearable gadgets expand into the clothes?”

(755 words)

Very interesting piece about the digitalization of Uniqlo’s supply chain in response to the data-driven nature of fast fashion and the company’s growing reliance on international sales. The article reminded me of our case study on Gap in which we debated how much of a role Big Data should play in determining a fashion company’s product mix. Although Uniqlo is not experiencing the same kind of identity crisis as Gap, I believe there is still the possibility of a more data-driven and less coherent approach to erode Uniqlo’s brand and create misalignments with its core customers.

I am also a bit skeptical of the effectiveness of digitalization measures such as RFID chips and enhanced connectivity from manufacturing all the way through retail point-of-sale. I do not know anything about the current prevalence of RFID in the fashion industry but would imagine that such technology will soon become the industry standard and will not give Uniqlo a competitive advantage for very long. I also wonder how cost-effective RFID will be for a relative low-margin retailer like Uniqlo. As RFID supplants traditional bar codes, workers will have to be retrained and scanning technology in every facility will have to be replaced. I can see clear benefits for a higher-margin, more luxury-oriented retailer, but I wonder about how the cost-benefit will play out for Uniqlo.

Improved connectivity throughout the supply chain also seems like it would be limited by the capabilities of independent distributors. I imagine that the information transfer along the supply chain would be broken whenever Uniqlo was required to use a distributor that did not use the same technology as its retailers and manufacturers. It is unlikely that Uniqlo will operate its own distributors in numerous locations throughout the world, and if Uniqlo follows the advice of the author and outsources logistics more frequently, it will be even more difficult to digitally synchronize the entire supply chain.

I think this is an interesting project that Uniqlo is undertaking. Their effort to digitize their supply chain from the factory to the consumer will certainly help them to lower their inventory levels and eliminate or reduce the number of items left over at the end of a season. Additionally, it should help them reduce their 6-12 month cycle from design to stores and make them more competitive against other fast fashion retailers such as H&M.

Additionally, I think you have correctly identified that their digitization efforts have not necessarily closed the gap of their distribution. Uniqlo ships products all over the world and depending on their shipment method it may take weeks to months with various levels of tracking accessibility. If Uniqlo wants to further reduce its time from design to consumer, they may need to explore more localized production or different forms of transportation.

To your question of how Uniqlo can detect drastic changes in future consumer preferences I think they are going to need to look outside of their supply chain. Their new digitization data will give them a good idea of what is selling well within their current portfolio and gradual shifts in consumer preferences but does not have the capability of indicating a leap in preferences. For this, I think they need to rely on their design department to be creative and test different products with consumers to find what resonates with them.

I really enjoyed this report. I think digitalization could be a huge game changer in fashion/retail industry, not only by reducing the lead time and costs dramatically, but also by getting wider range of customers’ information that could be used for enhancing production efficiency, setting marketing strategies, and managing brand identity. For me, Uniqlo is a brand somewhere between Muji, a chic lifestyle brand, and Zara, a distributor of fast fashion. Compare to other brands, Uniqlo’s brand image and their vision are somewhat vague. These days, Uniqlo is squeezed by their competitors from everywhere because they are not as much trendy as fast fashion brands and not as much unique as chic lifestyle brands. Also, customers preferences have been changing faster and many customers have been asking Uniqlo something more than price. Digitalization and the customer data from this change could show the way to Uniqlo.

Thank you for raising the use of RFID in retail. This is a hot topic in the space, and one that deserves discussion.

The proliferation of the technology has been predicted for many years now. The technology itself is old, and over time is has gotten less expensive. It is expected that more and more retailers will adopt it, just like Uniqlo has. Other retailers such as Macy’s and Zara already have. For example, according to the Wall Street Journal, in a store where taking inventory used to take 40 hours, with RFID only takes about 5.

The application of the technology throughout the supply chain seem to be endless. Tracking inventory, the way Uniqlo has, is the most obvious one. New, more creative applications of the technology have been in the news recently. For example, Rebecca Minkoff has been using the technology to enable mobile self checkout for consumers in-store. Montcler has been using RFID to combat conterfeit items by tagging the real ones. I can also imagine that RFID could track consumer shopping behavior. For example, it could track how many consumers try on a piece of clothing, and of those, how many buy it. The implications of RFID on big data are huge, and to compete with Amazon, it seems retailers will start to move in that direction.

I commend UNIQLO’s management for having the foresight to work on increasing their COGS in order to digitize their entire operations and gain a deep understanding of their apparels from creation to point of sale. It is crucial for companies to recognize the changing landscapes surrounding them and proactively re-invent themselves.

I am wary how useful this information may be from a design perspective. Wouldn’t these all be lagging indicators in what the consumer thinks of the existing clothesline? How would this shorten design lead times? What are the consequences of having aggregating all of this data in the hopes of forecasting future trends? Would the products begin to converge to a single style aimed at the common denominator, or would it be able to differentiate based off of consumer segments and/or demographics? Being in the fashion industry, something valuable can be lost by this approach: if you’re trying to appease everybody, you are no longer special to anybody.

What I am most impressed with Uniqlo is its innovation. Everything Uniqlo produce serves precisely on customer pain points. HeatTech Technology, for example, provides warmth to wearers during cold days without having to wear think layers of clothes. The deep understanding of customers’ need shows that Uniqlo conducts extensive market research. In addition to enhancing its efficiency, I believe digitization will greatly help Uniqlo process of innovation by enabling customers to connect with Uniqlo directly.

Through its online platform, customers can post comments about the purchased products, giving Uniqlo more insights into potential problems and development it can provide to customers. Uniqlo can also use its online channel to receive customers’ innovation ideas or their current issues related to clothing, creating more ideas for future innovation.

Interesting article, thanks for shedding light on that topic Satoshi! I agree that moving to the digital world is definitely the right move, but Uniqlo’s model is very unique and I believe that they should centralize their digital strategy around their core competencies. Uniqlo is one of the very few brands that penetrate markets with low prices, yet manages to preserve its brand image and does not fall into the “retail discounters” category. I think they should focus on their low prices, high product variety and bulk orders.