Uncertainty at Infosys

Can Indian Technology Services companies weather the storm in this digital age? What can they do to revive growth?

“Churn at Infy continues: 2 more top execs resign [1], Infosys cuts revenue forecast for 2017-18 [2], Infosys releases 11,000 employees due to automation [3]”

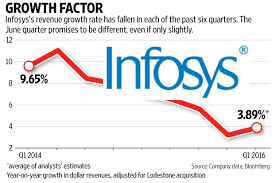

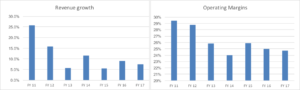

Once the poster child of the Indian IT services Industry, Infosys has witnessed a decline in both revenue growth and operating margins over the last few years [4]. The company has been unable to capitalize on the rise of digital technologies, popularly known as “SMAC” (social, mobile, analytics and cloud”), leading to increased pressures on its existing business.

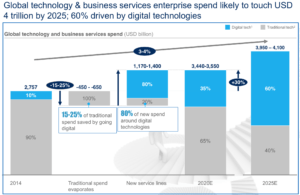

De-growth resulting from decline in traditional IT spending

Traditional service lines, such application development and maintenance are declining by at 2-5% annually as clients shift their budgets towards digital projects. Hence, there is increased competition for lesser spend, resulting in both volume and pricing pressure across the industry. This means that firms will either have to find new ways of operating more efficiently or find a way to migrate to offering high value digital services.

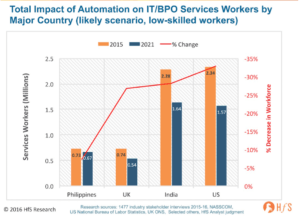

Until now, IT companies have operated as a “people factories,” where they employees thousands of people with the singular aim of billing as many people as possible on a variety of projects. However, pricing pressures coupled with improvements in automation technology have forced firms to execute with same volume of work with 20-30% fewer resources. Hence, several research firms estimate that a significant chunk of software engineering jobs across both US and India will become obsolete by 2021.

Traditional IT projects are linear, have longer timescales and have a large number of India-based resources supporting few US-based resources at the client site. The focus here is to increase the number of India-based resources (higher margin) as a % of the total employee base. However, digital projects are more complex with a shorter timescale. This requires projects to be more agile and deploy more US-based resources that can work in close collaboration with the client. This requires a change in mindset, capabilities and training of the employees.

Resources becoming more expensive due to isolationist policies

With talk of changing the H-1B policies and increasing the minimum salary threshold, IT companies can no longer rely on their strategy of brining low-cost labor from India to the US. Given digital projects require a higher proportion of onsite resources, Indian IT companies are having to source they labor locally which is in short supply and extremely expensive.

All the above factors have compounded the problems at Infosys. Overall, weak performance coupled with pressure from the board has led to several high-profile exits, with the CEO himself resigning this October. The company has recently been trying to take various actions in order to combat this uncertainty.

First, Infosys has recently hired a new Chairman of the Board, Nandan Nilekani. He is the former founder of Infosys and one of the most respected executives in India. He has been asked to return to Infosys to help turnaround the company and find a new CEO who can restore company performance.

Second, the company has outlined a 3-pronged strategy for the company going forward [6]:

- Renew the core business: For the traditional business, try and do “more with less,” i.e. focus efforts on productivity improvements. Employees need to reimagine existing services lines to find new cost-effective implementation methodologies.

- Innovate the digital business: Train resources in Design Thinking and build partnerships with clients to co-create new ideas.

- Re-skilling of employees: Build a culture of education and collaboration by creating the world’s largest corporate university via a multitude of learning platforms

There are several other areas where I feel the company should focus its efforts in order to combat these industry headwinds.

- Create centers of excellence: The digital landscape is massive with competition from several smaller Industry-specific players. In order to compete, Infosys firms will have to pick specific areas and build deep capabilities and cross sell these solutions across their large client-base.

- Partner with smaller, more nimble organizations: Infosys should create an incubator which finds and funds startups which have the potential to develop next-gen technologies to help Infosys move up the value chain and offer more high end services.

- Train resources in communication and creative skills: While Indian engineers are great at coding, they lack the ability to interact effectively with the client. Infosys needs to create a training platform that not only builds technical expertise but also focuses on soft skills, which are becoming increasingly critical.

Few open questions that Infosys needs to answer going forward:

- Given US-based organizations are at high outsourcing levels, does Infosys focus more on Europe where companies are more nascent in the outsourcing journey, but harder to convince?

- Should Infosys focus on existing digital technologies like SMAC or turn its attention to future areas like Robotics, Artificial Intelligence and Augmented Reality?

References

[1] https://timesofindia.indiatimes.com/business/india-business/churn-at-infy-continues-2-more-top-execs-resign/articleshow/61076204.cms

[2] http://www.livemint.com/Companies/XQlNJnQUQeNiUTIQQNv2kL/Infosys-Q2-profit-rises-about-33-to-Rs3726-crore.html

[3] https://economictimes.indiatimes.com/markets/stocks/news/infy-lost-11000-jobs-due-to-automation-key-takeaways-from-board-meet/articleshow/59298660.cms

[4] Company investor fact sheet

[5] McKinsey analysis

[6] Company investor presentation

[7] HFS research

A very interesting and relevant discussion of what some might characterize as existential threats affecting the ~$150-billion Indian IT industry as a whole. To your point, there are numerous business (margin compression from shrinking labor-cost arbitrage) as well as social implications (large-scale elimination of jobs traditionally viewed by millions of Indians as stable and aspirational) of this digital storm, making the questions you raised all the more complicated.

Despite all the complexities, however, I do believe that Infosys must absolutely focus on building strong robotics, AI, AR, and other futuristic capabilities or risk being left behind. I agree that given the pace at which these technologies are disrupting traditional business models globally, Infosys might be better served partnering with or acquiring firms already specializing in these areas. It seems as though the former CEO was making progress in this direction, but the speed at which he was departing from the traditional “people-factory”-led model might have rankled some powerful feathers. Thus, with the return of Mr. Nilekani and the continuing influence bordering on interference of the “old guard”, I question whether Infosys has the organizational will and disruptive mentality required to not incrementally but radically transform itself and quickly move away from traditional ideas that might have helped it achieve success so far, but are becoming increasingly less relevant and financially sustainable going forward.