Starbucks: the rise of mobile orders

The rise of mobile ordering is a great opportunity for Starbucks if they can harness the potential.

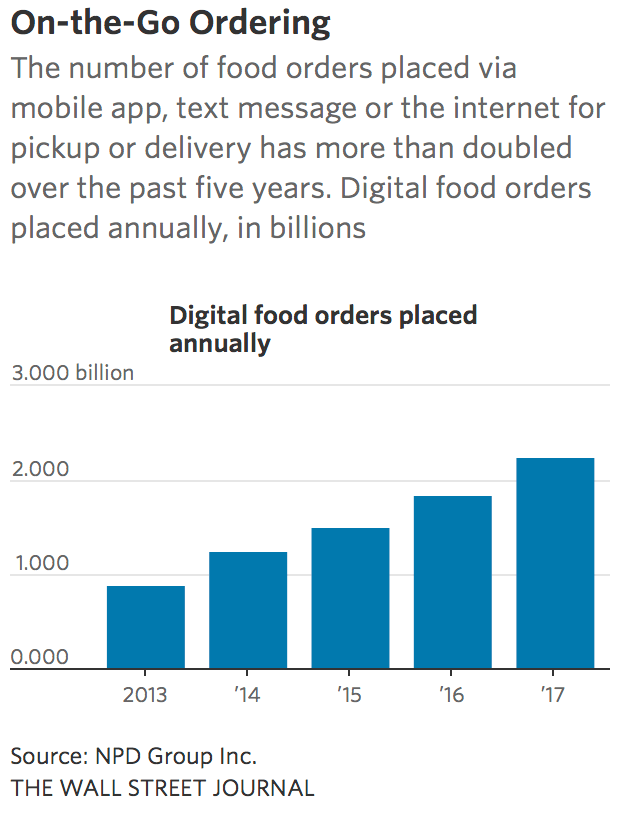

Consumer use of digital technology has risen at a prodigious rate, fundamentally altering how many industries function (fig 1).1 Within the food service industry, Starbucks was an early participant launching Wi-Fi in its stores and partnering with iTunes Music in 2007, adding digital gift card integration in 2012, and accepting mobile orders for pick up in its American stores in 2015. 2, 3 The move towards mobile ordering was met with excitement with Howard Schultz stating that Starbucks was “building an unassailable position“ in the market.2 While filled with opportunity, this effort has not been without challenges both from an operations and from a cultural standpoint.

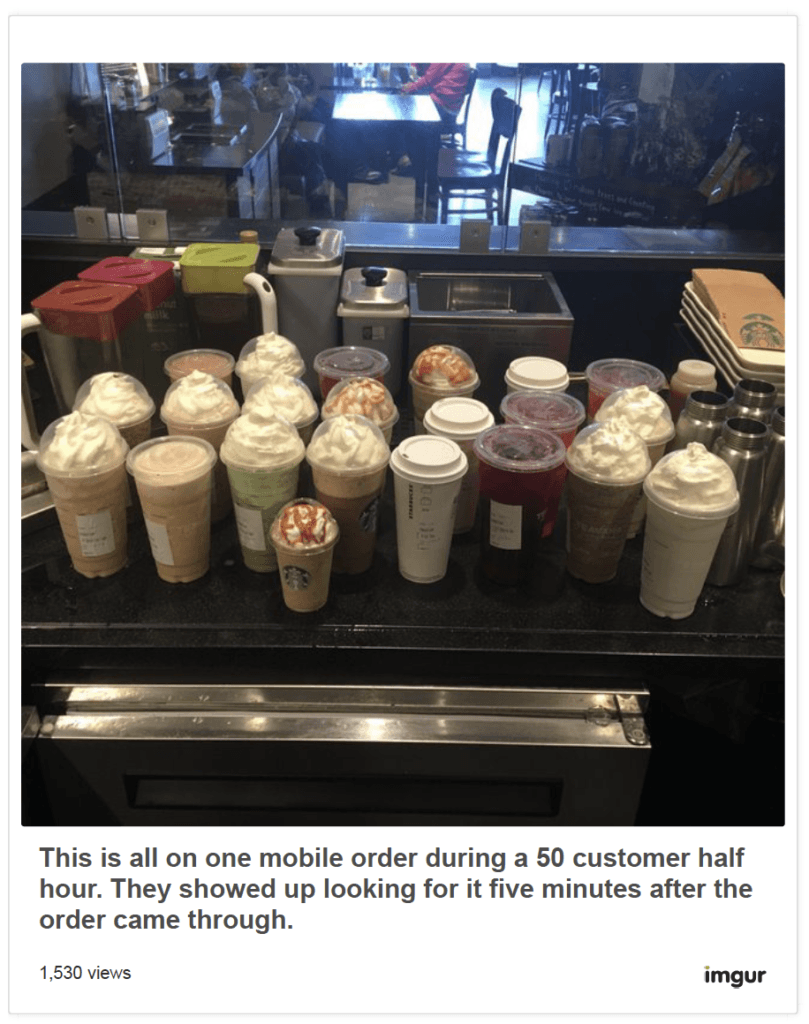

Mobile orders at Starbucks increased to 7% in early 2017, up from 3% the year prior. In the highest volume stores this translates to one out of every four Starbucks orders originating on a mobile device. 4 However, over the same period Starbucks reported a 2% decline in overall transactions and concerning stock price fluctuations.5, 6 Central to this dichotomy, these issues are attributed to difficulties encountered with servicing mobile orders, a new customer stream that has increased wait times by up to ten minutes per person (fig 2).7 Industry experts describe increasing lines as mobile purchasers are reticent to “cut” and congestion in the drink handoff area is worsening, both leading to decreased satisfaction and company sales.5, 8 From a cultural standpoint, the rise of mobile platforms, and digitalization of the coffee ordering process threatens the ethos of the “coffee house”. The Starbucks experience is built on the bedrock of human interaction, as a location for coffee connoisseurs and others to purchase their daily coffee, conduct meetings, engage in phone calls, or spend the day working and studying.9 A shift to mobile ordering risks eroding this “coffee house” culture and changing Starbucks into a frustrating and time consuming stop on the way to another destination.

To combat the increased foot traffic and wait times Starbucks is working to implement creative solutions. They have improved the physical space adding signage to more clearly separate customer groups, developed a text messaging system to inform customers when orders are ready, and they are adding “to go” windows and extra baristas where appropriate (fig 3).8, 10 The company is also rethinking production methodology. For example, stores typically have two espresso machines, only one of which is utilized. Starbucks is experimenting with assigning mobile orders to one machine and in store orders to the other. Innovations such as these have decreased wait times by up to sixty seconds, and increased customer satisfaction.8 Starbucks is also adjusting its digital infrastructure. For example, the rewards system has been updated to provide benefits based on total amount spent rather than total number of purchases, as customers have been incented to enact multiple small transactions, slowing overall throughput time. Additionally, Starbucks updated its mobile platform whereby customers can now retrieve food in locations other than the counter or register, and baristas can track wait times after an order has been placed.8

Looking ahead, Starbucks’ approach must be multi-pronged. While continuing to remedy inefficiencies in the short term, it is imperative to build future sustainability. This will require a thorough analysis to understand the purchasing journey of the mobile purchaser and those coming in off the street. There will be opportunities to gain efficiencies if Starbucks understands the differences between how each class of customer utilizes the stores. This may enable innovations such as exploring small standalone stores located alongside the traditional store. In this example, efficiencies can be gained through separating production lines and customer types. In concert with this, Starbucks should pursue solutions to make the mobile experience as engaging as coming in person an effort that they have prioritized lately. 11 This will be paramount as Starbucks is facing pressure from many sides, electronic sales of coffee and equipment empower the home barista, local shops attract new customers, and non-coffee shop locations dilute the brand experience.12

Starbucks has maintained itself as a specialty coffee brand for the connoisseur, a core mission and vision that Starbucks has cultivated since 1971.9 However it remains unclear whether or not embracing mobile functionality will move it away from this identity and push it in the direction of commoditization. Will Starbucks be the place people come for their beverages because it represents quality in coffee? Or will they come because it represents what is convenient – a commodity?

An industry leader, Starbucks must work to stay at the forefront of changing consumer preferences. It will be imperative for them to identify new challenges and to continue to be first, different and unique.

References:

- Lobaugh K. Navigating The New Digital Divide: Capitalizing on digital in uence in retail. 2015.

- Alba D. Starbucks’ Grande Plan: Selling Coffee Via Apps. Wired, 2015.

- Madhani A. Starbucks launches don’t-wait-for-your-frap app across USA. USA Today, 2015.

- Taylor K. One of Starbucks’ biggest strengths is becoming a huge problem for the chain. Business Insider, Vol. 2017, 2017.

- Jargon J. Starbucks Tempers Revenue Forecast: The company says popularity of its mobile app creating long lines at pickup counters. The Wall Street Journal, 2017.

- Starbucks Corporation Interactive Stock Chart [database online]. Insert City of Publication Here see notes; 2017.

- Taylor K. We went to Starbucks every day for a week to see if the coffee giant has fixed an annoying problem. Business Insider 2017.

- Jargon J. Mobile-Ordering Apps Create Problems for Restaurants. The Wall Street Journal, 2017.

- Younge Moon JQ. Starbucks: Delivering Customer Service. Harvard Business School: Harvard Business Publishing, 2006.

- HENDERSON P. Starbucks is having trouble keeping up with mobile orders. Business Insider: Reuters, 2017.

- Loten A. Digital Leaders to Laggards: ‘The Journey Never Ends’. The Wall Street Journal 2017.

- Page P. Today’s Top Supply Chain and Logistics News From WSJ [Business: Logistics Report web site]. 2017. Available at: https://www.wsj.com/articles/todays-top-supply-chain-and-logistics-news-from-wsj-1510141986. Accessed 11/15/2017, 2017.

From a ‘Marketing’ lens, your questions at the end are valid. Considering the fact that the original business model of Starbucks is based on the coffee experience, I would actually take it a step further and question the risk Starbucks may face if their drinks become eventually a commodity. I imagine such a scenario may ultimately benefit the competitors who failed to provide the experience element.

Sahel, loved the article and completely relate to the chaos this can cause because I worked above the Rockefeller Center Starbucks in NYC when they were piloting the order ahead feature. For several weeks they had lines out the door and into the subway station. The first thing they tried was creating a separate area for order ahead pick up but anytime there was an error in the drink made the regular line was held up and this was very frustrating for the customers in the “regular” line. I totally agree with your suggestion for them to have small standalone stores that are purely servicing mobile orders. Another technology they could utilize in a purely digital store would be kiosk technology that we see being utilized in a number of QSRs, such as Wendy’s and Shake Shack, right now. However this brings back the issue of who is Starbucks trying to serve: the coffee connoisseurs or the java joes?

Great post, Sahael! To your point, I can envision that Starbucks can play in both the quality experience and commodity space. While they definitely need to create a separate “space” or smaller location to service the online orders (people who value convenience most likely), I wouldn’t be surprised if there is eventually an automated machine that also takes the online orders and automatically makes the drinks (similar to the Coca-Cola freestyle technology without the customer interaction). The only reason you need the baristas is for the customer experience, at least in my opinion. So if you are able to get a machine to services the customers that view Starbucks as a commodity, your baristas can spend more time cultivating the customer relationship and experience in the store.

Thanks for the post Sahael! I strongly agree with the posts above, but I also think the fact that Starbucks is providing the option of mobile orders is pushing the commoditization of their products. As we discussed in the class, not everyone is purely the coffee connoisseurs or the java joes – some people do switch between them due to circumstances, and the option of mobile order will become a huge factor and an incentive for people to shift towards java joes. So, I would be extremely cautious to implementing the mobile orders too quickly, not just in terms of the number of stores, but also in terms of the drink options. Limiting the type of drinks to the simple, standard ones (regular coffee) and excluding ones such as Frappuccino and smoothies may be a good mid-ground solution (at least for now) that would prevent commoditization but at the same time address to the needs of busy working people with the mobile orders.

Great read Sahel! I think your post clearly states the consequences of implementing digital initiatives without considering the broader implications to the supply chain. Just introducing mobile ordering in Starbucks stores proved to be a very inefficient strategy. Companies should look at digitalization not as an add-on to their current business model, but as an integral part of it. In your article, you can see how Starbucks seems to have overlooked the impact of a higher number of orders which produced longer waiting times for traditional customers. On that subject here is an interesting HBR article (https://hbr.org/2017/07/6-digital-strategies-and-why-some-work-better-than-others) that talks about how digital strategies need to be transformational and not just a bundle of cost-cutting initiatives.

Very interesting, Sahael! It looks like Starbucks implemented digitalization without properly evaluating its impact. Now they are trying to find solutions to address the increased number of orders and wait times. One of my concerns is around utilization. Will a higher number of orders require to hire more employees or buy more machines? If that is the case, I would like to see how these increased orders are distributed during the day. I assume that during the morning (before going to work), Starbucks may receive more online orders than any other time of the day. Will the increasing number of orders mislead Startbucks and push the company to make a wrong decision?

Great stuff, Sahael. Your post and some of the comments above touch on the way that mobile ordering removes some of the traditional coffee house experience and potentially alienates some of the coffee connoisseur customers. I agree with this but rather than seeing it as problematic, I think it’s something Starbucks should lean into. I believe the value proposition of a Starbucks is different in certain cities, such as New York, than in other cities, and that the operational choices should reflect this. No one I know goes to Starbucks in New York for a true coffee house experience (there are ample substitutes for that elsewhere in the city); rather, its value prop there is about convenience, and caters to busy workers. I would do everything I can to encourage customers to get onto the mobile app in order to minimize wait times and improve their experience, and would minimize the typical barista chat, so we can get more customers through the door. However, in other cities where customers still come to Starbucks for a traditional cofee house experience and wait times are not as high, I wouldn’t offer mobile at all.

Terrific post Sahael. I have witnessed firsthand the inefficiencies and disruption of this new mobile ordering platform, as the demand becomes less predictable and drinks build up. This being said, I have also benefitted from the online ordering platform, and find it a convenient way to bypass the ordinary lines that are expected around peak times.

Beyond these two anecdotal points, I share your concern with the blanket strategy of implementing a digital platform without thoroughly considering the implications. This being said, I also see the digital platform as a great asset, particularly as it is a source of very valuable data. I wonder if Starbucks will seek to monetize this data more accurately going forward as they likely can predict when and what specifically a particular customer wants. For example, they may be able to employ predictive analytics to better cross sell items and promotions at Starbucks and more optimally route customers to the store at less busy times.

This is great, Sahael. What I find most intriguing about your post is the effect that digitalization is having on the more analog portions of the business. While Starbucks is continuing to use and improve its digital platform, there are parts of the business that cannot be replaced or modified by this (e.g., espresso machine usage) and Starbucks has to adapt current manual processes to fit its digital strategy. Technological solutions aren’t going to replace all of the processes in a coffeehouse just yet, and the issues that are arising in this augmented approach are applicable for all customer-facing services and retailers.

To your last questions, I think the digitalization of ordering has a net-zero impact on the quality debate. I believe this is a smart play towards the customers looking for the most convenient and reliable acquisition, but I don’t think its existence is a huge deterrent for coffee connoisseurs. Becoming the most popular place for quality coffee is a fight they have to wage in the marketing department and product development, not as much in the business operations realm.

Hi Sahael!

Thanks for your insightful article. I used to be a frequent user the Starbucks app to pre-order drinks but stopped using the service in response to some of the issues you noted. It was nice to see some statistics around the topic as I had begun to wonder if I was the only Starbucks customer having repeat issues with the efficiency and accuracy of their online ordering service. As more customers become active within the mobile app ordering space within the food & beverage industry, I believe that the new convenience metric mentioned in your article is going to become a competitive differentiator as well as deterrents from use of a particular service or vendor. Hopefully Starbucks will be able to adapt to better meet customer expectations sooner rather than later.

Sahael – this was a great post & one that reminded me of very frustrating times waiting for drinks at Starbucks counters! I especially like your question around quality because I think this might be at risk with this model. I think that digitization does offer a unique opportunity for Starbucks but they are currently falling in the same trap many of our case protagonists have: thinking their existing operating model is going to work for a new type of product or process. In my opinion, mobile orders and in-store orders are creating different products because customers might need different things for their different circumstances. This can be seen more clearly in the restaurant industry as restaurant struggle to optimize their process and products for different channels – to go vs. dine in vs. takeout [1]. In Starbucks for example, an in store order can take a bit longer as individuals are presumably in less of a rush than ordering online and will be picked up immediately when it is called making the component requirements (e.g., blending, temperature, separation of ingredients) function differently. Conversely, an online order might need to be made differently to still taste like its high-quality in-person counterpart when picked up at a later time. This combined with the wait time you described might require a different set of processes for online orders including orders with ingredients that separate less, drinks with a lower cycle time, or maybe even limiting online orders to a few key drinks and then specializing baristas for each of these drinks. Although provocative to consider today & inevitably subject to some consumer pushback, these changes may be necessary to meet the required tact time of online drink orders and maintain the customer quality and experience Starbucks strive for.

[1] http://fortune.com/2017/06/09/order-online-food-delivery-starbucks-mcdonalds/