UIDAI: Building the AADHAR for Digital India

Streamlining lives of 1.3 Billion people by by building the world's largest electronic database in the worlds most promising emerging economy

Historically, India has been a nation where data has been scarce and unorganized. So, when in 2010 the government mandated UIDAI to launch Aadhar to give a digital identity to every citizen and build a stack of services around it, creating in the process the world’s largest electronic database, it was a watershed moment in Indian history.

Overview

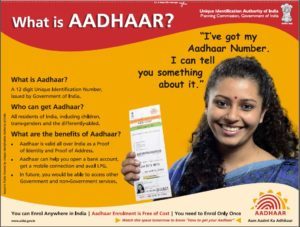

Simply put the Aadhar card is an SSN on some serious steroids. Four things happen whenever an Aadhar card gets issued:

- A 12 digit number (Aadhar Card) is provided and detailed information of the individual including Biometric signatures (fingerprint, iris scan) is captured

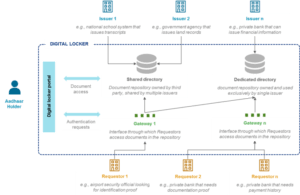

- All information is digitized and stored in a digital locker. This locker can also be used to store other critical information eg. Education transcripts, bank statements etc

- A bank account is simultaneously created for the person concerned

- Going forward, all data related to the individual gets linked to his/her Aadhar number

Further, what makes Aadhar groundbreaking is that it achieves 4 key objectives:

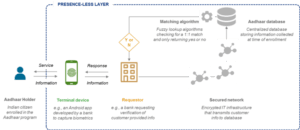

1) On Demand Identity authentication and information sharing

Aadhar sets up a digital signature, a digital locker as well as digital identity for every person. So now, an individual can authenticate his/her identity, share critical information as well as approve any business agreement remotely! All that is needed is a simple fingerprint and iris scanner and sitting at home he/she can share digital biometrics with any individual/organization. They in turn can ‘ping’ the central UIDAI database to verify identity. They can also be granted temporary locker access to verify documents and finally the digital signature can be impressed on any agreement the parties agree to.

2) Seamless financial inclusion and regulation

40% of people in India do not have access to formal banking channels. 90% do not have access to credit. >80% of transactions on Amazon.in are cash on delivery. And there are estimates ranging from 30% to upto 50% of a prevalent shadow economy which operates unaccounted for in cash. Aadhar seeks to solve these problems in a digital way. Everyone gets a bank account when they get an Aadhar card. Moreover, digital authentication paves the way for a Unified Payments Interface (UPI) (think Venmo but linked to identity not a bank). Also, transactions now get linked to a single identifier thereby ensuring better collation of financial data. Finally, all this financial data builds history and ensures access to credit for the smallest of businessmen.

3) Direct Benefits Transfer

India dishes out hundreds of billions of dollars in subsidies every year in food (Public Distribution System), energy(LPG, Petrol, Diesel), electricity(for farmers and industries), industry(tax breaks) and education(scholarships). Managing these for 1.3 Billion people is no ordinary task. Aadhar has enabled the government to roll out what is called Direct Benefits Transfer (DBT). Basically, now the subsidy/benefit can directly be transferred to the Aadhar linked bank account of an individual and accessed by them. This prevents leakage and massively simplifies management overhead.

4) Platform for Digital India

Aadhar builds the platform for digital information sharing. Theoretically any and every transaction can be facilitated through Aadhar. Already innovative use cases are emerging – attendance management, SIM card management, e-governance, administrative feedback, crime records management, electronic voting. Going forward, the possibilities are endless.

Challenges and the road ahead

UIDAI faces several challenges for Aadhar.

- Aadhar has yet to reach 100% coverage. Fundamentally, most of the benefits can be fully realized only at full penetration.

- A recent PIL (Public Interest Litigation) has made Aadhar optional and not mandatory. This is because the Supreme Court ruled that no-one should suffer due to not having the card

- Digital infrastructure is still being set up in most cities in India. Most financial institutions haven’t adopted technology in a big way. India is one of the only countries where a print-out is still required to board a flight. Hospital records aren’t electronic and education data is still offline.

- While digital penetration is rapidly growing, the country is still far from technologically enabled

- Digitization of data creates security risks of potential leakage

- It is unclear what data can be shared with whom. There are concerns of a Big Brother like situation emerging with the nation’s privacy being compromised

The UIDAI has proven itself to be an organization which can successfully strategize and roll out digital initiatives. It should now be tasked to help create roadmaps for digitization of key institutions in India i.e. hospitals, schools, government offices etc. Aadhar data, if compromised, could be the biggest data leak ever. A protocol for consistent security risk assessment and nullification needs to created. Most importantly, consumer and business awareness of the uses, benefits and potential of Aadhar needs to be created. Only then will we be able to truly leverage Aadhar and achieve the dream of a digital India.

References:

[1] Ministry of Law and Justice, The Aadhar Act http://www.indiacode.nic.in/acts-in-pdf/2016/201618.pdf

[2] “The Bedrock of a Digital India”, Sasi Desai, 2016 https://medium.com/wharton-fintech/the-bedrock-of-a-digital-india-3e96240b3718#.djn94hc44

[3] Open Data Portal, Govt. of India https://data.gov.in/

[4] The trouble with Big Brother’s eye http://www.tehelka.com/2012/08/the-trouble-with-big-brothers-eye/?singlepage=1

[5] How AADHAR can simplify your financial life http://economictimes.indiatimes.com/wealth/plan/how-aadhaar-can-simplify-your-financial-life/ articleshow/51659075.cms

[6] UIDAI uidai.gov.in

[7] The National Identification Authority of India Bill http://www.prsindia.org/billtrack/the-national-identification-authority-of-india-bill-2010-1196/

[8] Review of the Direct Benefit Transfer for LPG, Committee Report http://petroleum.nic.in/docs/dhande.pdf

[9] Aadhar shall remain optional http://www.thehindu.com/news/national/aadhaar-shall-remain-optional-supreme-court/article7525976.ece?homepage=true

[10] Unified Payments Interface http://www.npci.org.in/UPI_Documents.aspx

[11] Reserve Bank of India www.rbi.org.in

Thanks for providing the overview, AVP. First of all, I have been trying to load the UIDAI website for 10 minutes…no luck…this does not bode well. In any case, I think you are right to point out the significant data security concerns stemming from Aadhaar. It seems that the government has put in place some regulations to prevent user fraud, i.e., using someone else’s ID to obtain services or claiming not to have an ID in order to access services multiple times. [1] Similarly, there appears to be awareness that user data must be protected from unwanted breaches. [2] However, I do not believe that regulations have been put in place to prevent government misuse of Aadhaar data, including sharing data with private organizations or using it to profile citizens for the purposes of law enforcement. In the absence of government regulation and oversight in this area, I am worried about the ways in which this data will be used.

[1] http://tech.economictimes.indiatimes.com/news/corporate/india-brings-in-new-regulations-to-address-aadhaar-data-security-privacy-concerns/54340830

[2] http://indianexpress.com/article/technology/social/aadhaar-data-vulnerability-enormity-symantec-ilias-chantzos-3071899/

“Thanks for providing the overview, AVP. First of all, I have been trying to load the UIDAI website for 10 minutes…no luck…this does not bode well.” – Probably an issue on your end. Never faced problems with it.

Your concern on data security is valid. So far there is no concrete data sharing policy and this is something that has been raised at several fora and the govt is actually currently working on.

I am interested to understand how the various organisations involved undertake dispute resolution with respect to various pieces of data. With a bank account, there are established systems of determining whether a bank account is a true record of account, but this may be more complicated with this kind of more extensive database, especially when that data could be copied onto other systems on an on-going basis.

Are they using any digital innovations in this dispute resolution space, given that the existing legal system may not be able to cope with additional cases ceteris paribus? [1]

[1] http://origin-www.bloombergview.com/articles/2014-11-25/speeding-up-indias-courts